Matchless Tips About Trial Balance Is Prepared To Check Accuracy Of

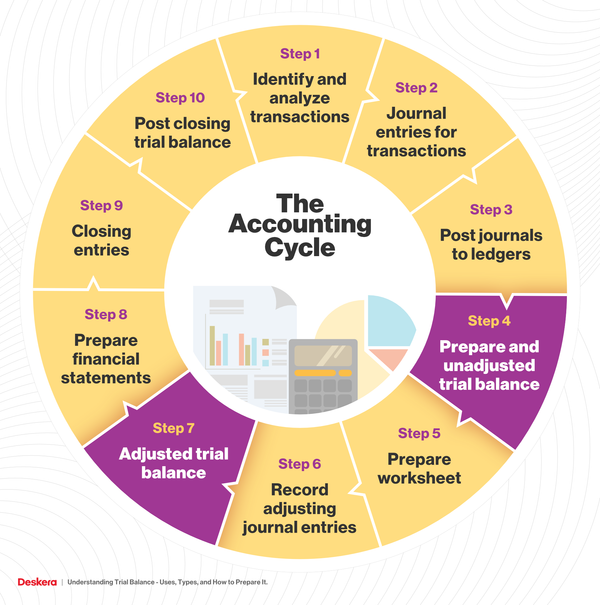

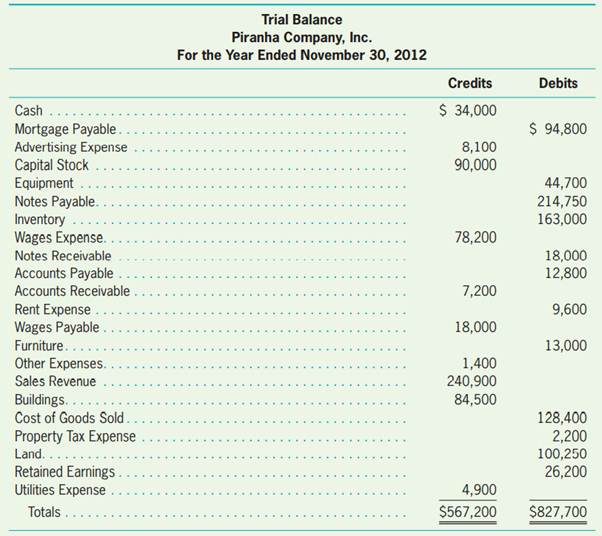

Preparing an unadjusted trial balance is the fourth step in the accounting cycle.

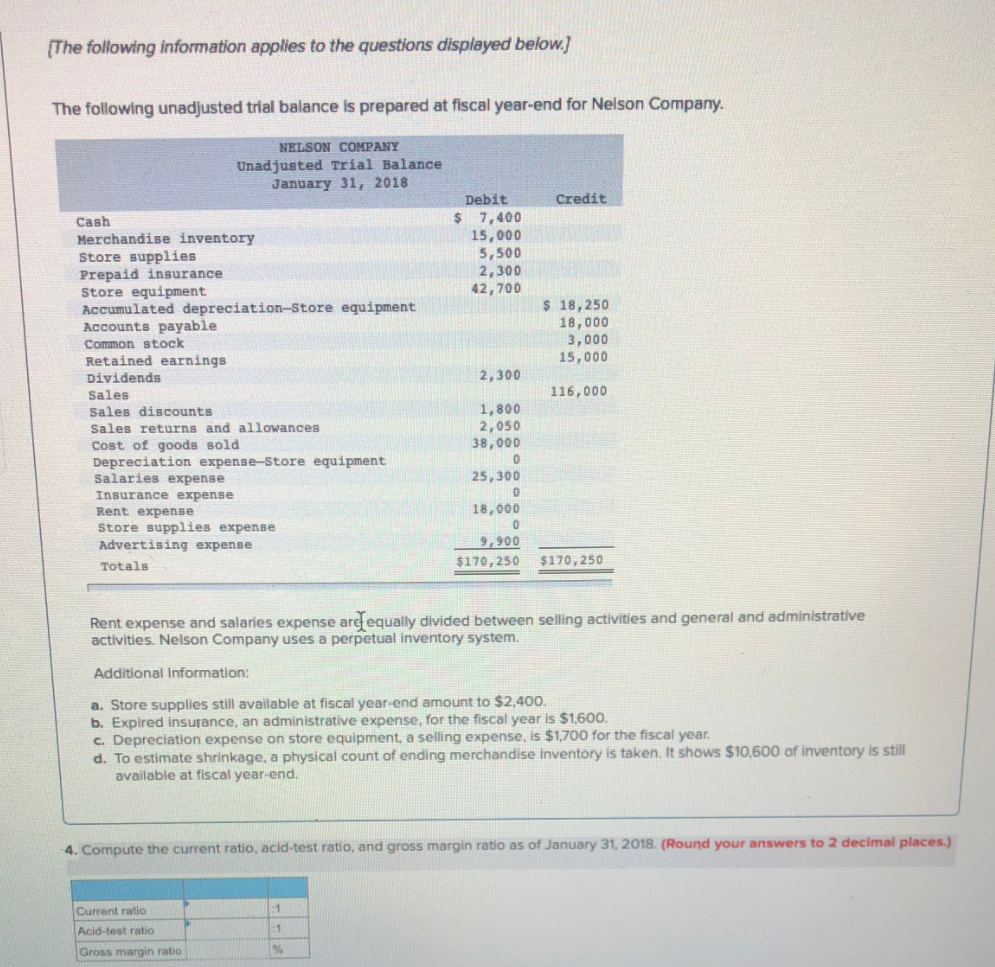

Trial balance is prepared to check accuracy of. However, trial balance is generally prepared at quarterly interval in practice to check the arithmetic accuracy of accounts. The main objective of a trial balance is. Trial balance is used to check the accuracy of a) balance sheet balances b) ledger accounts balances c) cash flow statement balances d) income statement balances.

To prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts. Trial balance is prepared before the. This statement is prepared at the end of the.

A trial balance is a list of all accounts in the general ledger that have nonzero balances. Accordingly, trial balance is prepared to check the accuracy of the various transactions that are posted into the ledger accounts. If the accurate trial balance is not prepared, then the final accounts.

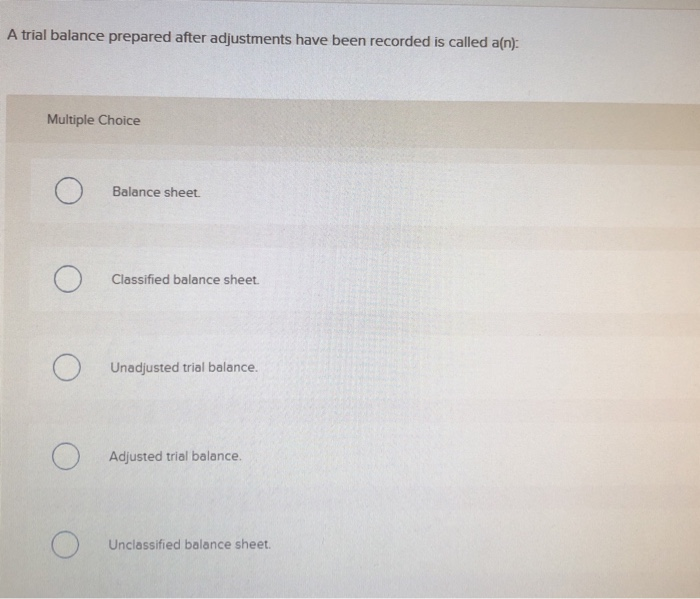

Due to this reason, it is said that trial balance is not conclusive proof of the books of account accuracy. A trial balance is a bookkeeping worksheet in which the balances of all ledgersare compiled into debit and credit account column totals that are equal. Trial balance is a statement prepared with the debit and credit balances of ledger accounts to verify the arithmetical accuracy of the book.

The trial balance checks the. A trial balance lists the balances of all general ledger accounts, categorized into debit and credit columns. It can be prepared at any time—whenever it is desired—to check the arithmetical accuracy of the books of accounts.

It is prepared in the form of a statement. Definition a trial balance is a bookkeeping tool that consolidates all the ledger accounts of a business into one report, showing the debits and credits made to each account. A company prepares a trial balance periodically, usually at the end of every reporting period.

After the preliminary unadjusted trial balance, also known. The general purpose of producing a trial balance is to ensure that. A trial balance is prepared to check the accuracy of accounting records, ensure that total debits equal total credits, and provide a foundation for the preparation of financial.

A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process. However, trial balances are mostly. Trial balance is a statement of ledger balances at a.

The trial balance is prepared after the subsidiary journals and journal entries have been posted to the general ledger. It is certainly one of the important. Trial balance is a financial statement summarising the debit and credit balance of the ledger accounts to verify arithmetical accuracy of financial books.

It is a list of the various ledger account balances whether debit or credit. Preparation of trial balance allows a firm to check for mathematical accuracy of the general ledger balances.