Top Notch Tips About Operating Cash Flow Direct Method

An entity’s cash flows from operating activities can be derived and reported by either the direct method or the indirect method.

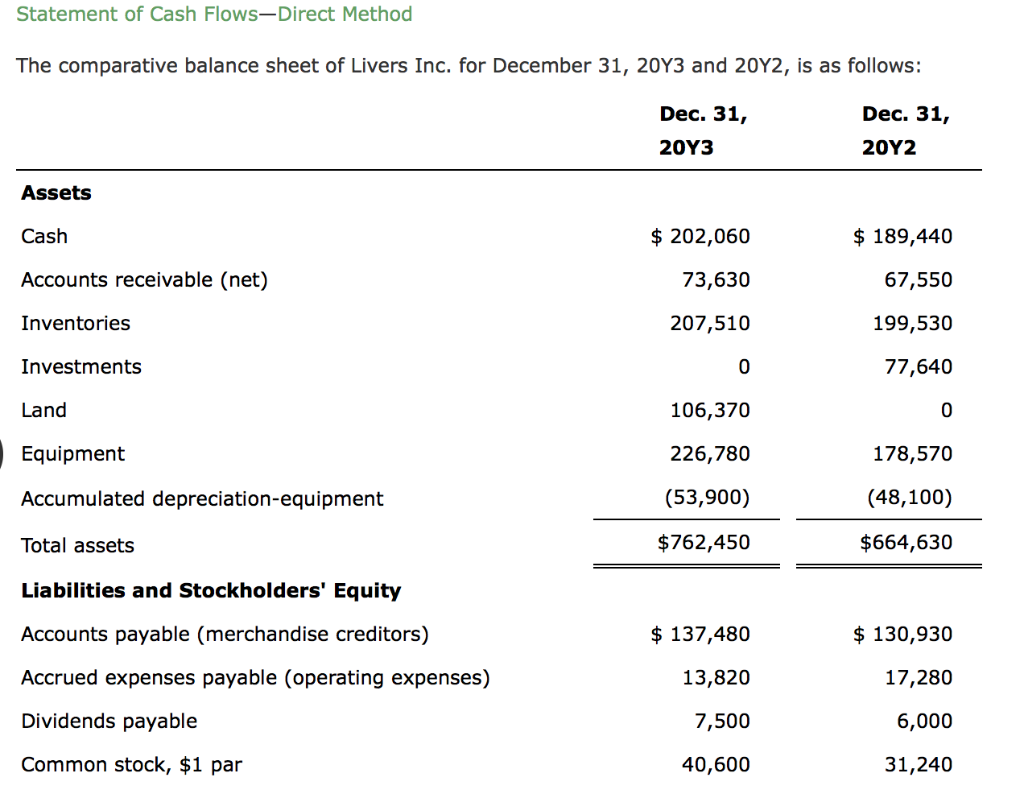

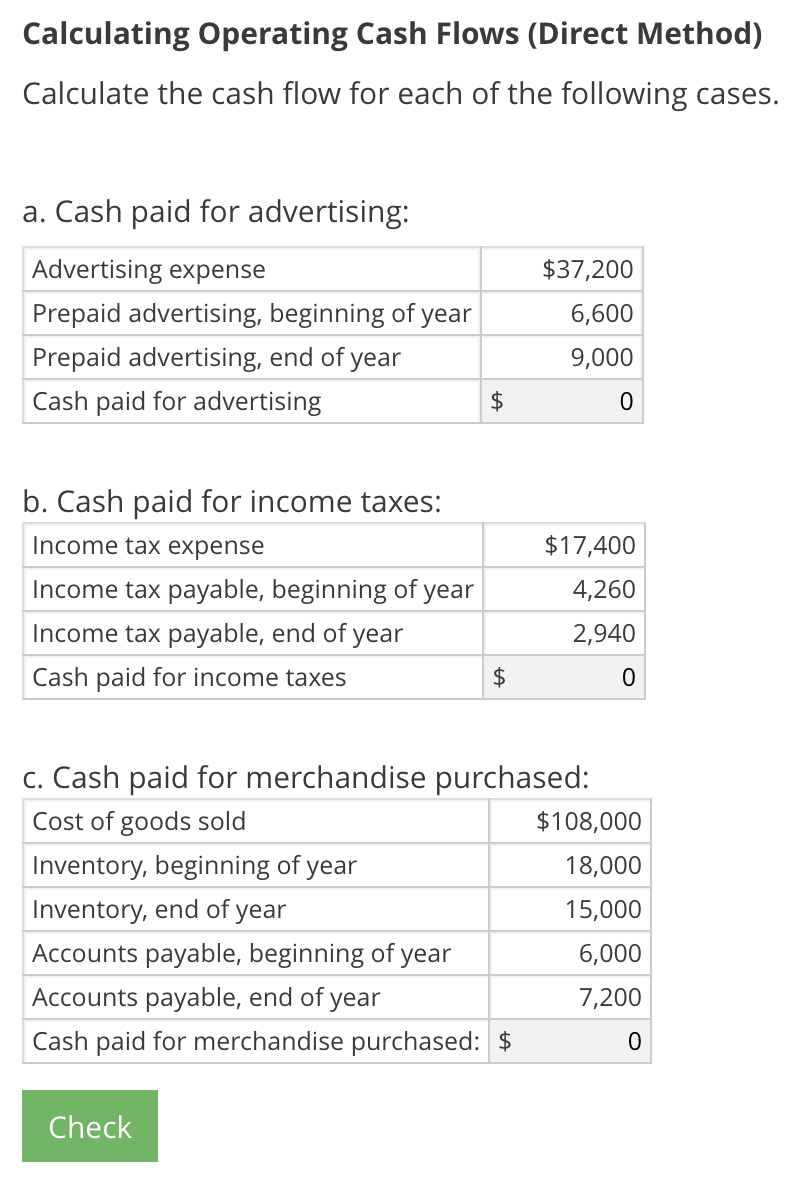

Operating cash flow direct method. Direct method and indirect method. Using the direct method the cash flow from operating activities is calculated using cash receipts from sales, interest and dividends, and cash payments for expenses, interest and. The direct method of presenting the statement of cash flows presents the specific cash.

The direct method is sometimes called the income statement method. The direct method under the direct method, the major classes of operating cash receipts and disbursements are reported separately in the operating activities section. Cash flow survey, july 2009).

Operating cash flow formula (direct method) the less prevalent approach to calculating ocf. Calculate cash flows from operating activities by the direct method the direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow. There are two ways to prepare the cash flow statements.

Cash collected from customers interest and dividends received cash paid to employees cash paid to suppliers Fasb expressed preference for the direct method but the indirect method is used by most businesses in the united states. It also identifies changes in cash payments and company activity receipts.

It builds the operating section of the cash flow statement directly using each of the cash inflows and outflows from a business’s operations during a given period. A cash flow direct method formula is used to calculate cash inflows and cash outflows when preparing a cash flow statement using the direct method. Unlike the indirect method, it directly reports each major cash inflow and outflow, offering a detailed view of cash flows from.

The formula for each company will be a little different, but the basic structure always consists of the three same elements: Investopedia / daniel fishel understanding. The cash flow statement direct method shows all the cash transactions a business completes.

Items that typically do so include: An entity’s cash flows from operating activities can be derived and reported by either the direct method or the indirect method. 20.3 statement of cash flows:

A company can choose the. The direct method of cash flow statement format presents a clear picture of a company’s cash flow. Fasb expressed preference for the direct method but the indirect method is used by most businesses in the united states.

Direct method of operating activities cash flows is one of the two main techniques that may be used to calculate the net cash flow from operating activities in a cash flow. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally presented on a gross basis. The operating activities, investing activities and financing activities.

Businesses can calculate the net cash flow from operating activities (cfo) using: Explained a cash flow statement contains three sections; This method shows a company’s total operating, financing, and investing cash flow over a set period.

/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-68758d3fa7644130a0b7e6a2383545a0.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)