First Class Tips About Step By Balance Sheet

The three components of the equation will now be described in further detail in the following sections.

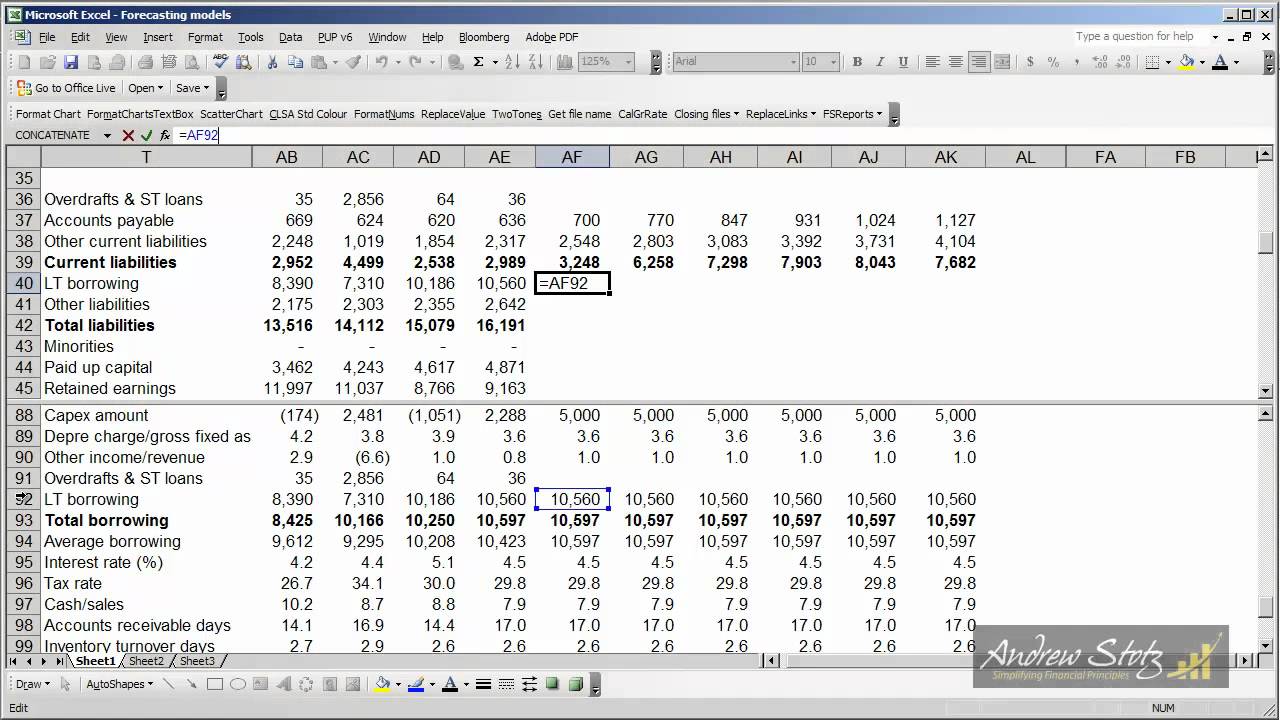

Step by step balance sheet. Version control with git step 5: Most balance sheets span a financial quarter, but you can choose any period you need. Getting all your financial documents ensures you have accurate information.

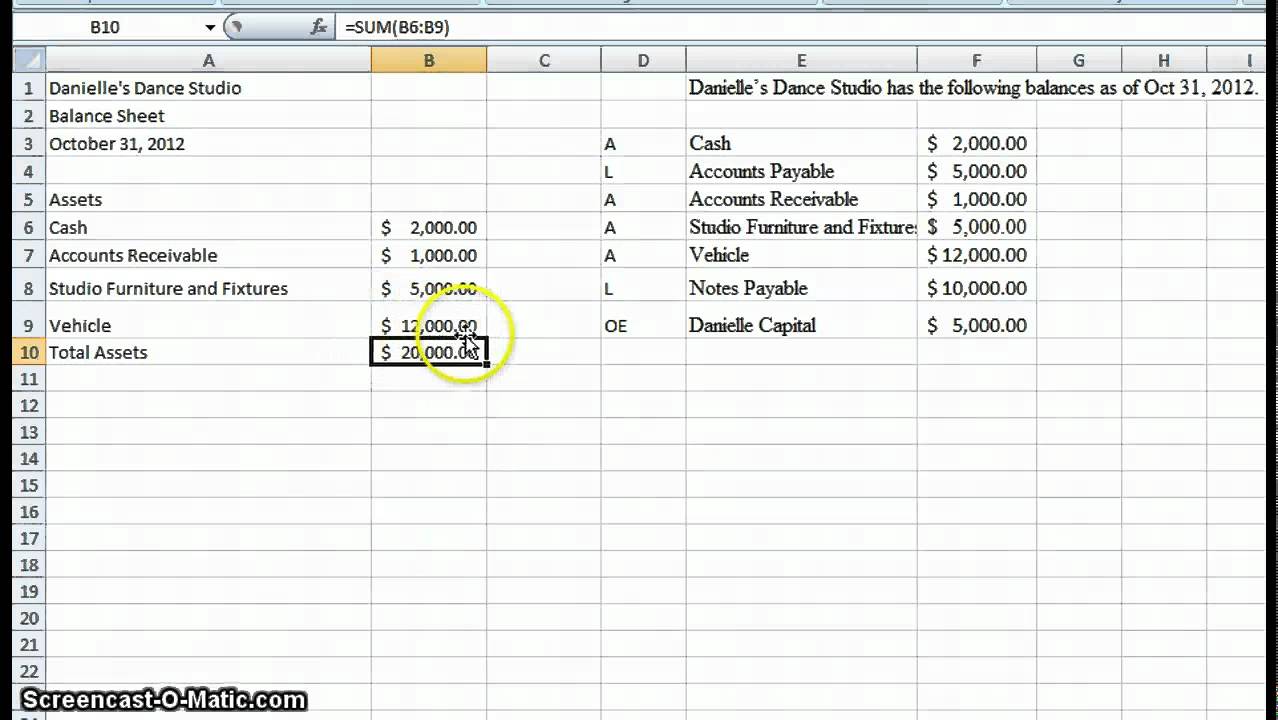

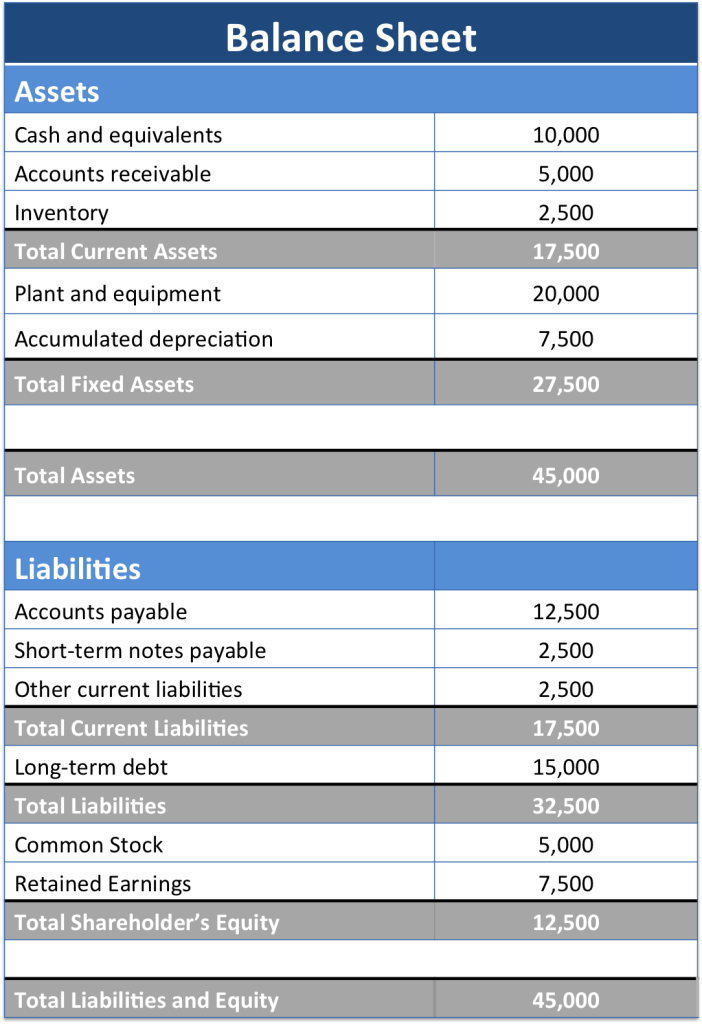

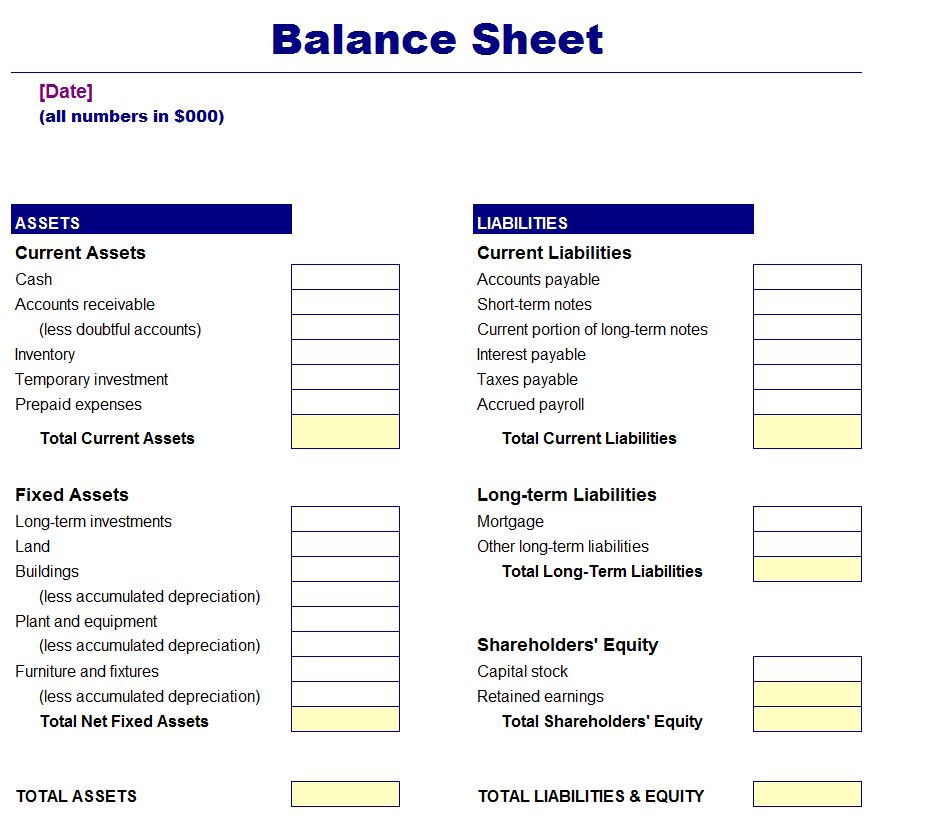

Step 1) prepare a spreadsheet or table step 2) total up your business’ assets step 3) add up your business’ liabilities step 4) calculate your owner’s equity step 5) put the information into your sheet the balance sheet explained a common report for small businesses that checks their financial health is a balance sheet. This guide equips financial wizards with the power to wield balance sheets effortlessly, unveiling the secrets to conquer complexities and enhance financial prowess. Balance sheets serve two very different purposes depending on the audience reviewing them.

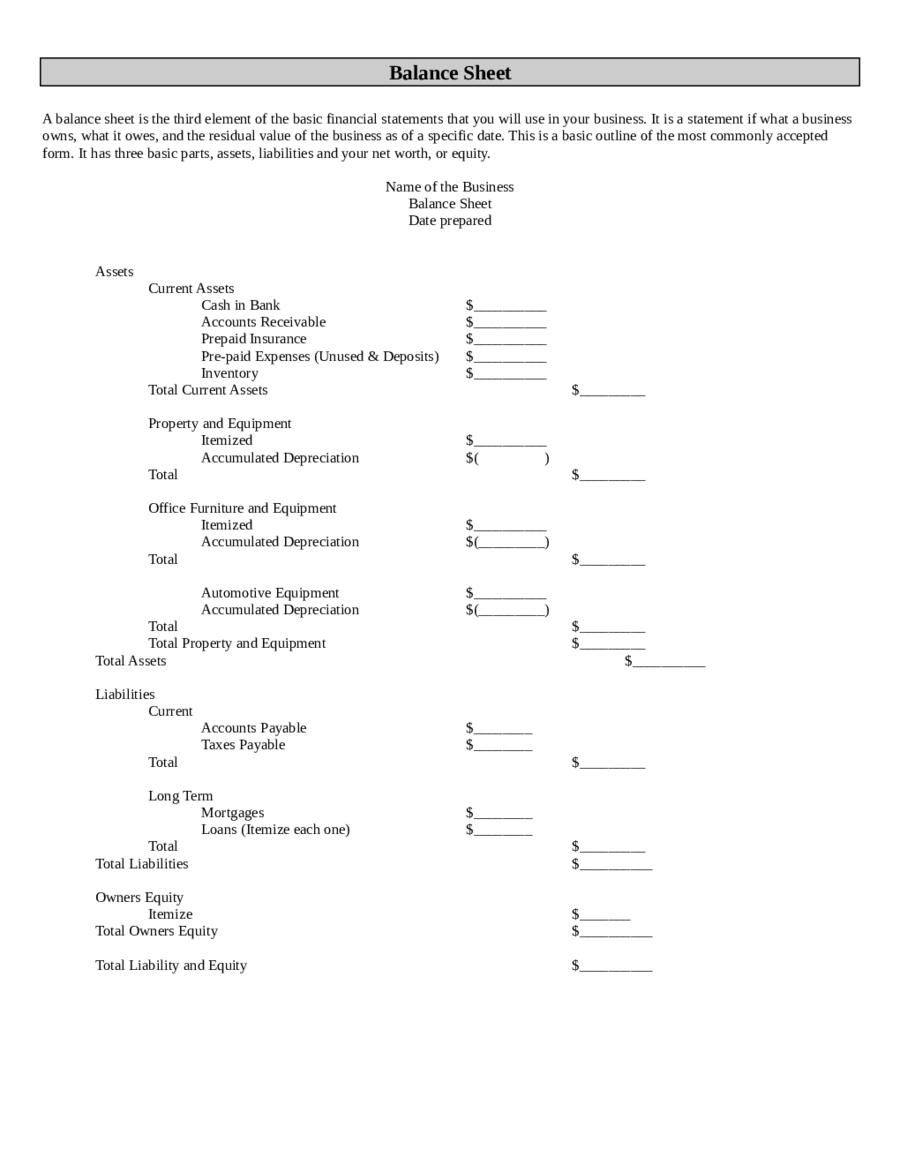

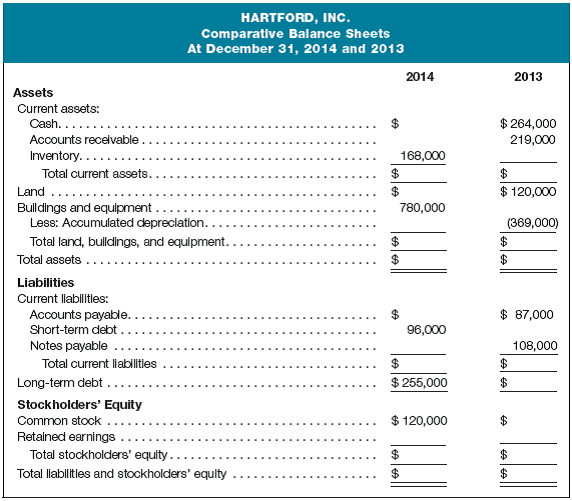

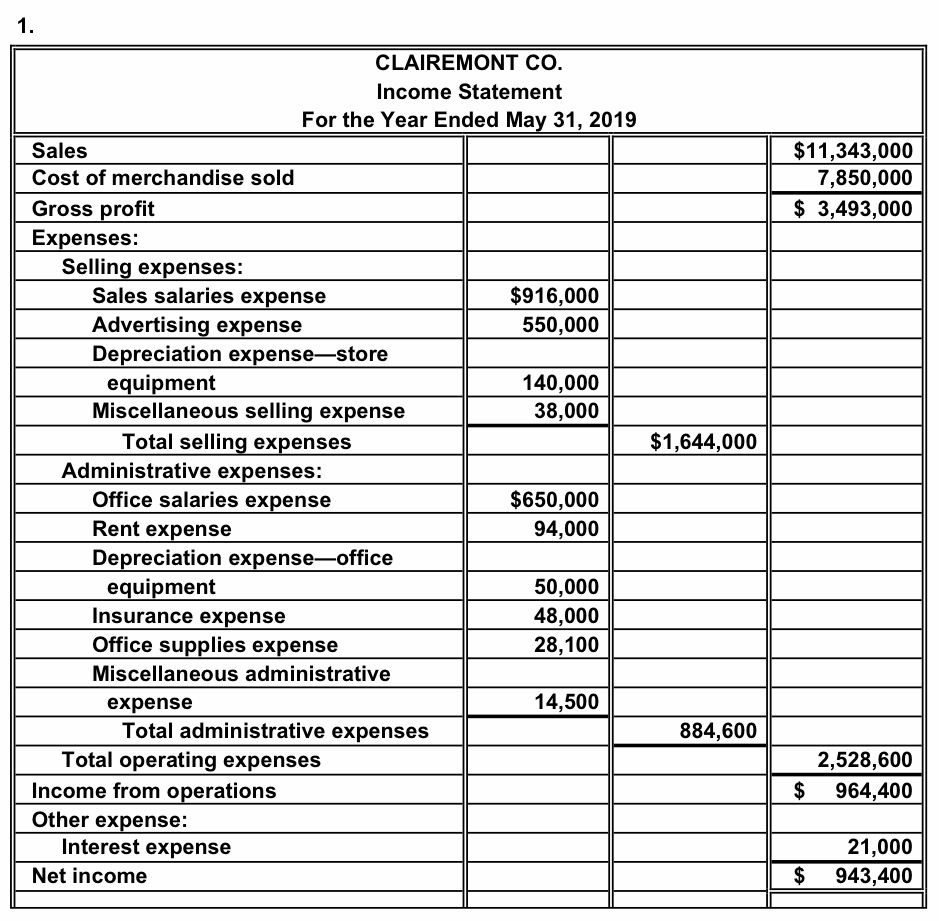

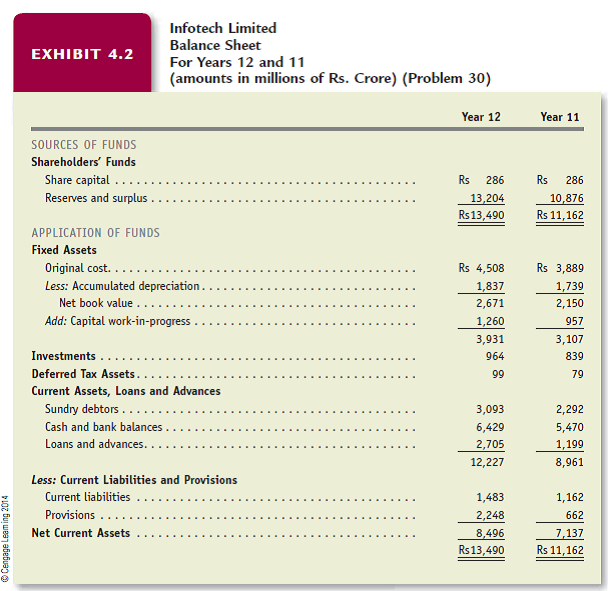

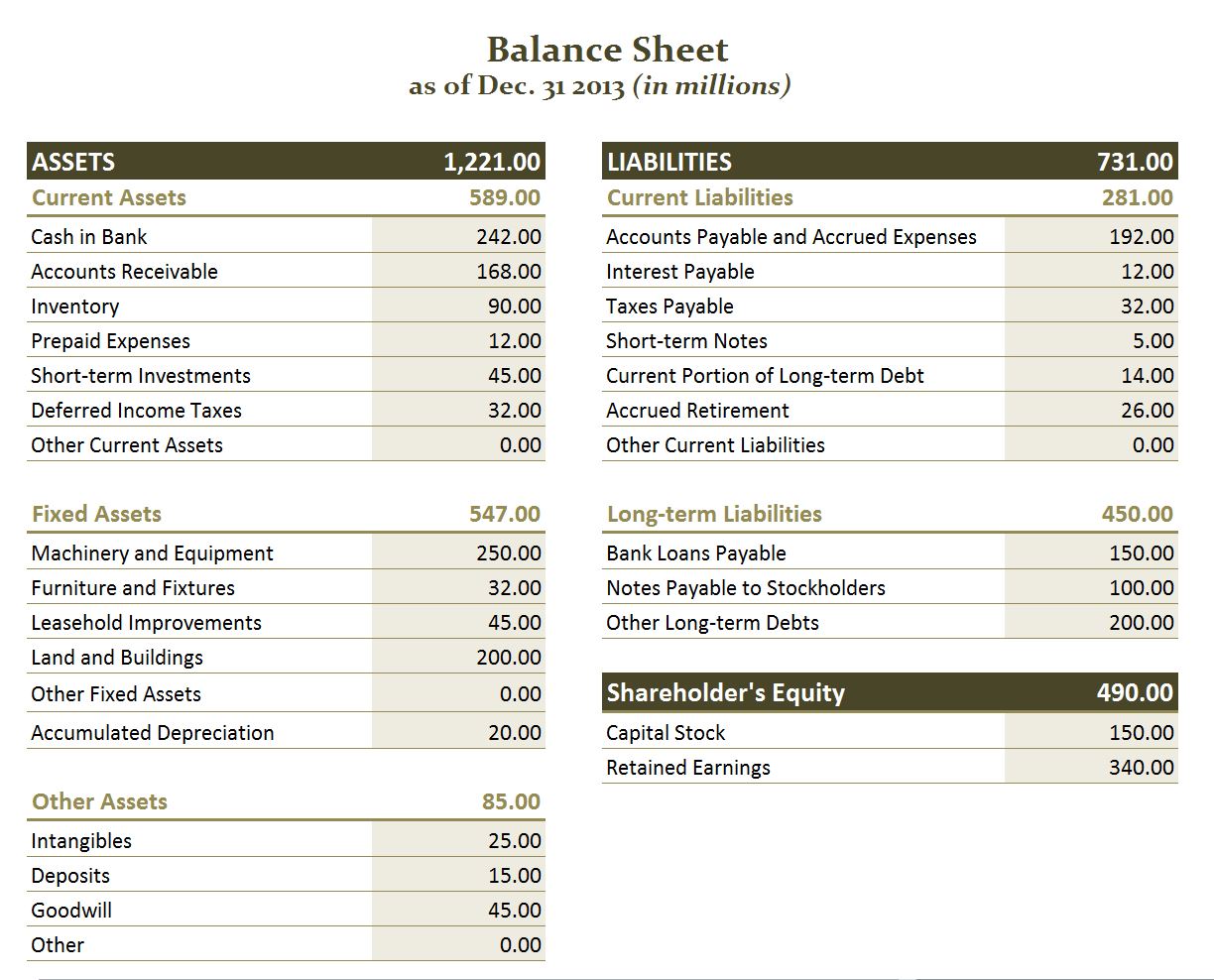

A balance sheet provides a summary of a business at a given point in time. Balance sheet the company’s balance sheet is an accounting report that shows a company’s assets, liabilities, and shareholders’ equity. An accounting balance sheet is a snapshot of your company’s financial situation.

As a general rule, the total assets of your company should always be equal to the sum of liabilities and equity. Step one in the preparation of the balance sheet is to set a reporting date and period, as it is going to show all the assets, liabilities, and shareholders’ equity. It’s very easy to prepare a balance sheet because it requires only 8 steps to follow:

By selecting a balance sheet. The fundamental accounting equation states that a company’s assets must be equal to the sum of its liabilities and shareholders’ equity. Any source that shows updated account balances can be used.

Determine the period you need the balance sheet to cover. Whether you’re a business owner or an accountant, you can follow these steps to make a basic balance sheet: Determine the reporting date and period.

Assets are the company's resources, such as office space or equipment. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable education (save) repayment plan. You can create a personal balance sheet by completing the following steps, including getting all relevant documents, listing your assets and liabilities, and calculating your net worth.

Often, the reporting date will be the final day of the accounting period. A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. Follow these steps on how to prepare a balance sheet:

Your situation may have changed since you first took out or renewed your mortgage, and major changes usually have an impact on your finances. We will present the balance sheet preparation steps: Liabilities include any debts the company may owe.

Pick the balance sheet date. After the reporting period is over, it may take you a few days or weeks to make a balance sheet. Define reporting date and period.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

![Making Sense of Your Balance Sheet [Infographic] Learn accounting](https://i.pinimg.com/originals/f7/0d/ec/f70dec3a63cbcc1511efabd76241ea3c.jpg)