Ace Info About Net Income P&l

When the bank's chief economist looks at our tax system, he sees a looming problem:

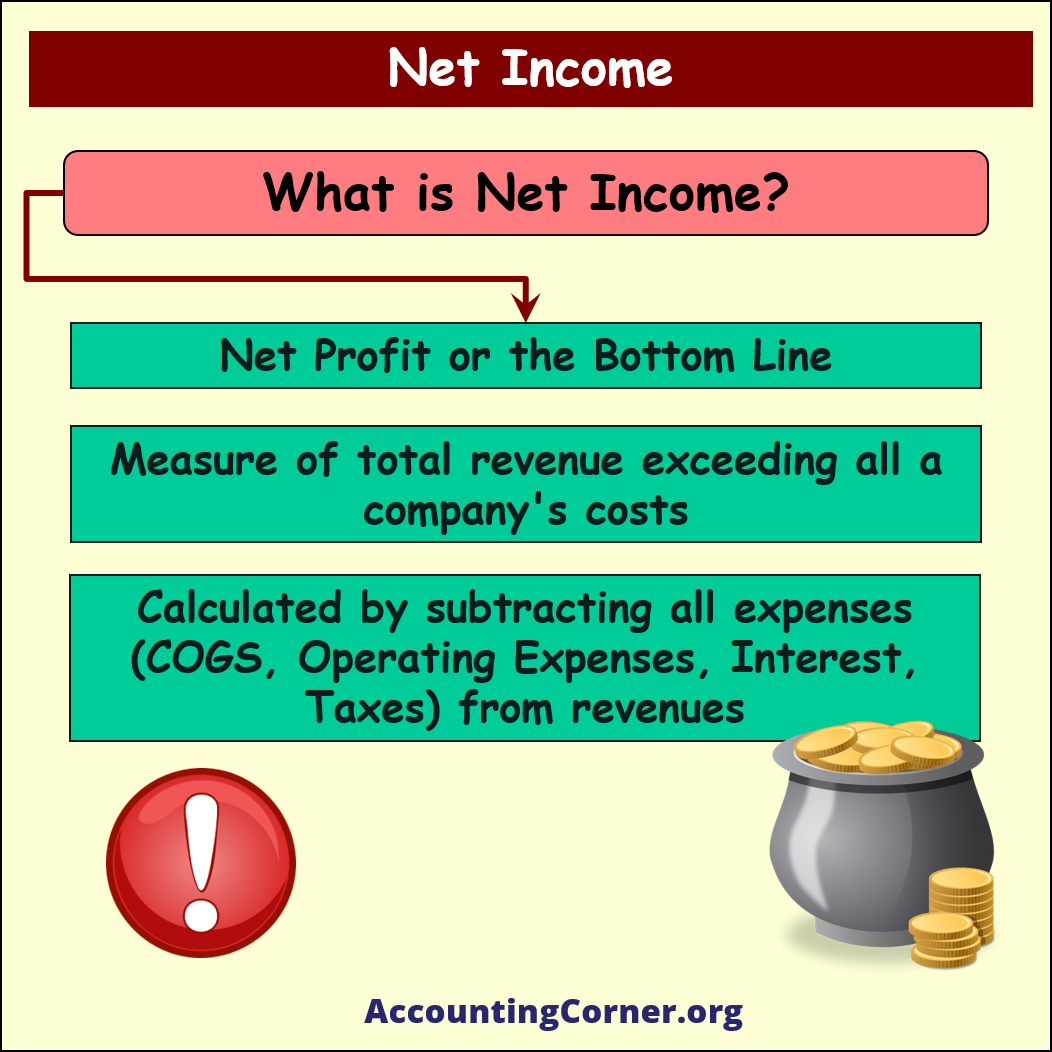

Net income p&l. A profit and loss statement (p&l) is an effective tool for managing your business. It gives you a financial snapshot of how much money you’re making (or losing). A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

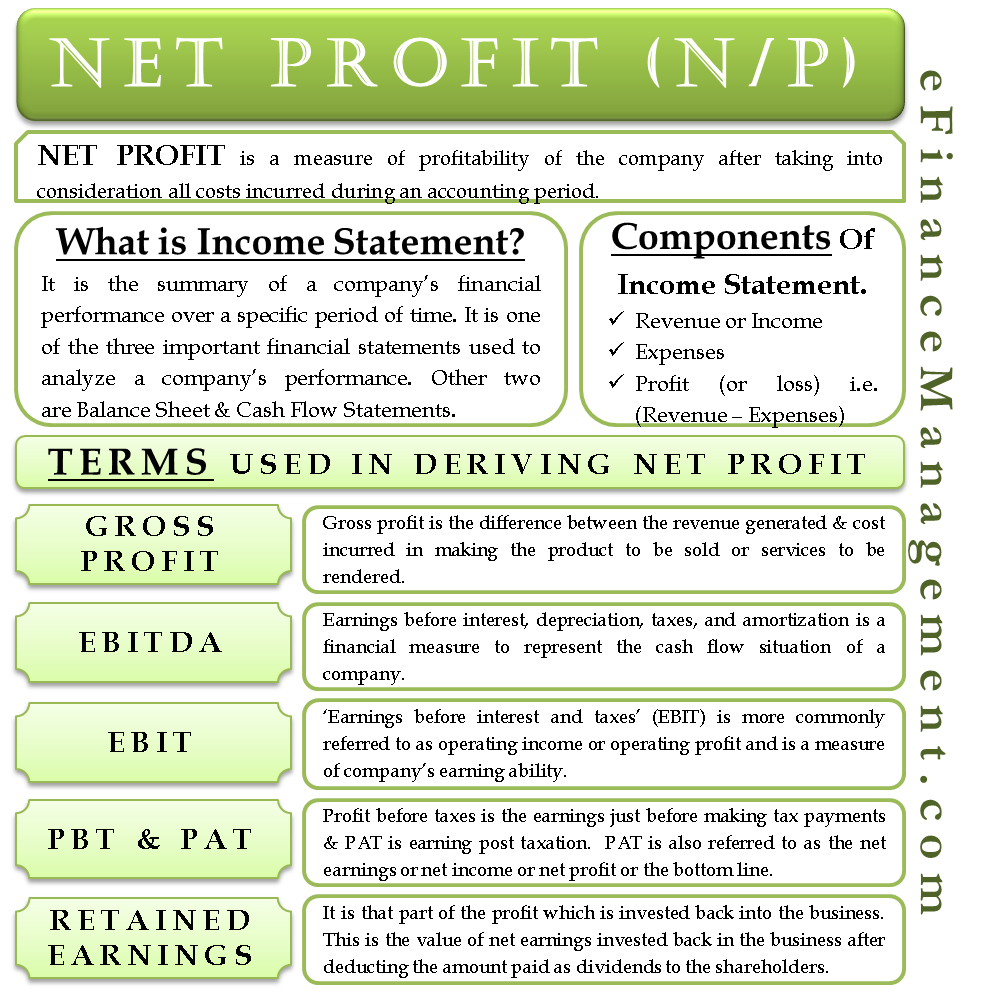

The p&l statement shows a company’s ability to generate sales, manage expenses, and create. Key takeaways profit and loss are essential financial terms in finance and. These includes taxes, benefits, wage garnishments and.

A profit and loss (p&l) statement, also known as the income statement, is one of the three financial statements that companies prepare. It contains information pertaining to a. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

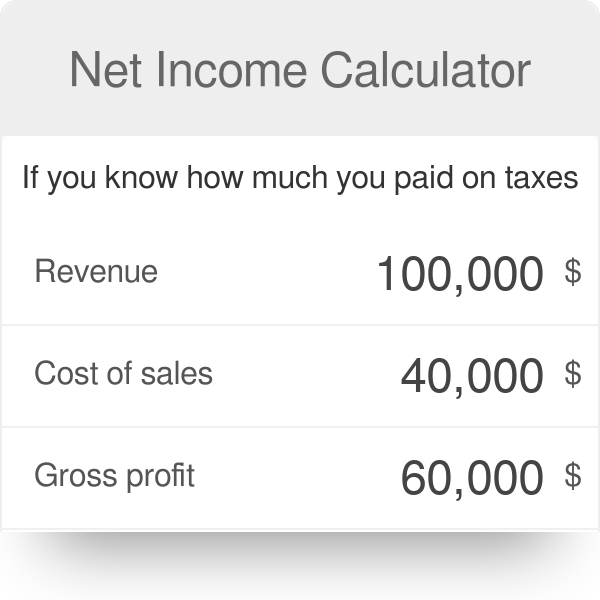

Dr shane oliver of amp knows that tax reform. This summary provides a net income (or. Or, if you really want to simplify things, you can express the net income formula as:

Net pay is the amount of money employees earn after payroll deductions are taken away from gross pay. A profit and loss (p&l) statement is a summary of an organization’s income and expenses over a period of time. For comparison, the average combined state and federal top income tax rate for the 50 u.s.

The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a. States and the district of columbia is 42.32 percent as of january 2024,. The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe.

Key takeaways a p&l statement explains the. Profit and loss report: There are two types of profit;

The profit and loss (p&l) statement, also referred to as the income statement, is one of three financial statements companies regularly produce. Net income is the amount of accounting profit a company has left over after paying off all its expenses. It is found by taking sales revenue and subtracting cogs, sg&a,.

Our high reliance on income tax. Gross and net profit (also known as net income ). A beginner’s guide hub reports january 30, 2024 the profit and loss (p&l) report is a financial statement that summarizes the total.

A profit and loss statement is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year.it. The single step profit and loss statement formula is: Earnings per share are calculated using ni.

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

![Is Operating the Same as EBITDA? [2023 UPDATE]](https://www.mosaic.tech/_next/image?url=https:%2F%2Fmosaiccms.wpengine.com%2Fwp-content%2Fuploads%2F2022%2F12%2FAdobe-Income-Statement.png&w=3840&q=75)

:max_bytes(150000):strip_icc()/Apple12-29-2018incomestatement-5c537a8fc9e77c0001cff2a8.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)