Out Of This World Info About Income Tax Payable On Balance Sheet

How is this reflected in the balance sheet?

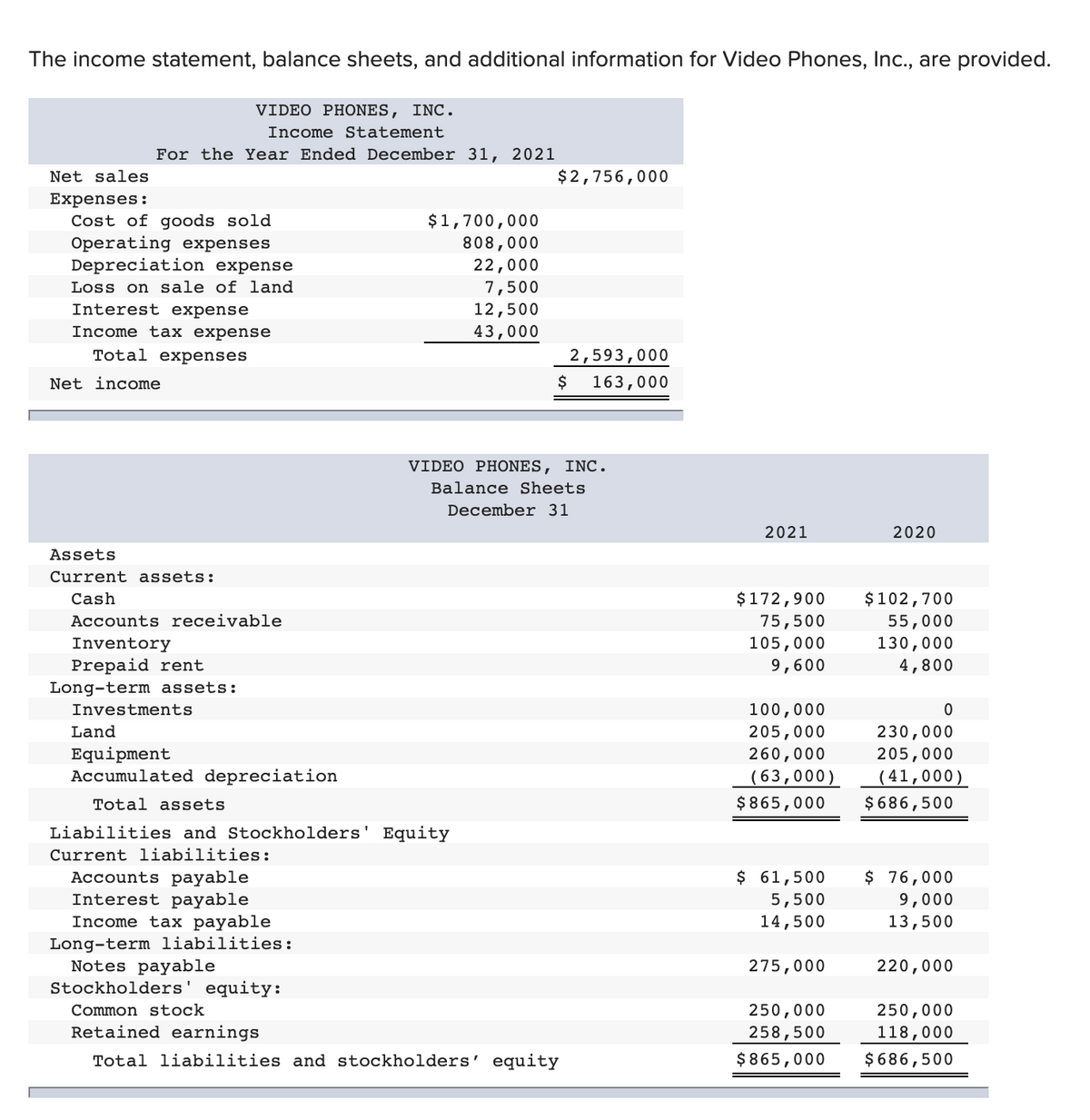

Income tax payable on balance sheet. Obtain balances for your payable federal income tax, social security taxes, medicaid taxes and unemployment insurance payable. The tax expense estimate of 100.0 was correct. Find out how to report income tax.

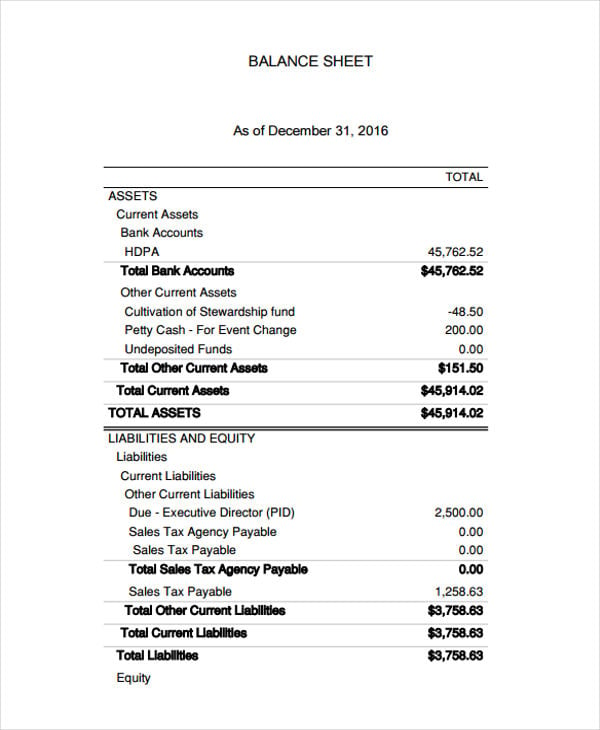

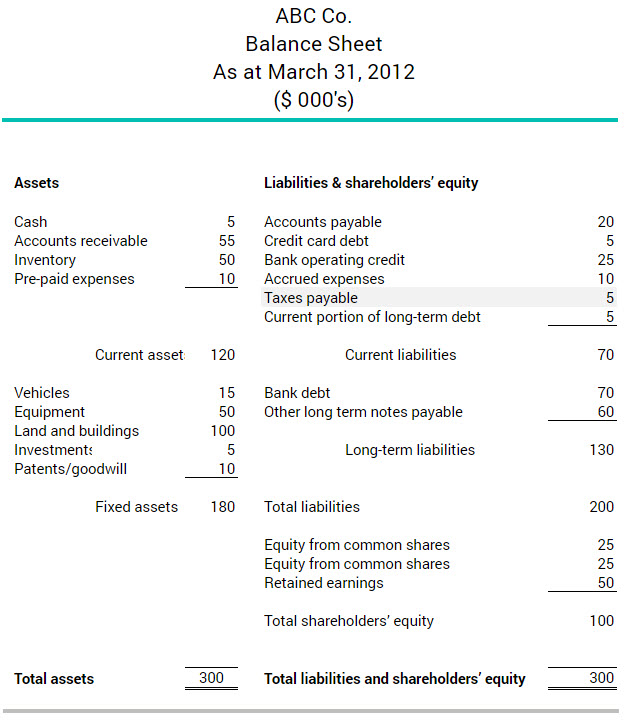

Something you owe that should be repaid within a year. Rent, taxes, and utilities payable. Income tax payable represents the taxes a company expects to pay within 12 months, reported on the balance sheet.

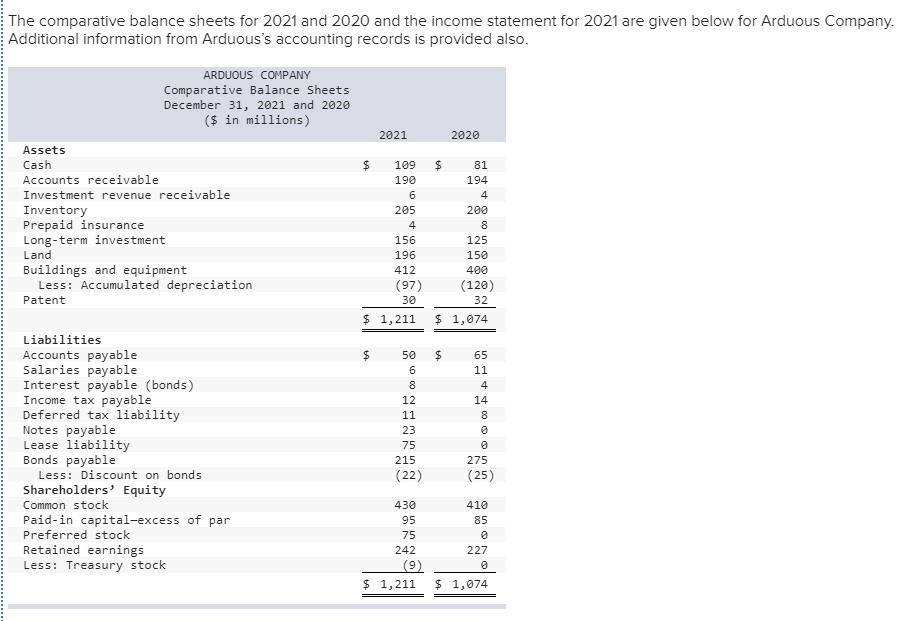

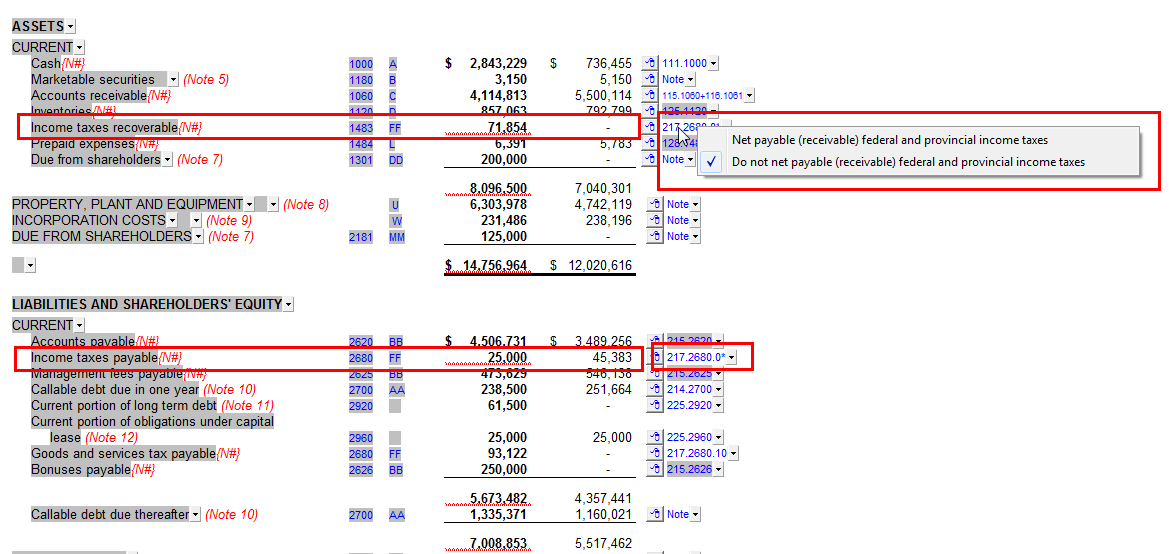

Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. Income tax payable is the amount a business anticipates paying in income taxes, which shows up as a liability on a company’s balance sheet. The newly inserted clause (h) provides that any sum.

Income tax payable goes on the balance sheet while you find tax paid in the cash flow statement. Income tax payable is an amount of taxes due to be paid within 12 months, which is reported as a current tax liability on a company’s balance sheet. Accounts payable is listed on a company's balance sheet.

On a general note, income tax payable and deferred income tax liability are similar in the sense that they are financial accountabilities that are indicated on a company’s balance sheet. The tax base of an item is crucial in determining the amount of any temporary difference, and effectively represents the amount at which the asset or. However, they are distinctly different items from an accounting point of view because income tax payableis a tax that.

Tip you report income tax payable on your current profits as a. Cancelling student loan debt for more than 930,000 borrowers who have been in repayment for over 20 years but never got the relief they earned because of. Accounts payable is a liability since it is money owed to creditors and is listed under current.

Presentation of income tax payable. Bambi inc pays 90.0 to the tax authority at the year end. The income tax payable is usually classified as a current liability in the balance sheet, since it is normally payable to the.

Learn why it matters for businesses. Income tax payable is the line in a balance sheet's current liability section for income taxes due to the irs within 12 months. As both the balance sheet and income statement together provide a fuller picture of a company's current health and future.

Income tax liability and the balance sheet generally speaking, your balance sheet does not provide any information on your income tax liability. How to forecast the balance sheet? Add the balances of these accounts.

The order in which the current liabilities will appear on the balance sheet can vary. However, there is a difference between the definition and treatment. Learn the definition, examples, and accounting principles of income tax expense and income taxes payable for a regular u.s.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)