Here’s A Quick Way To Solve A Tips About The Statement Of Profit And Loss Is Also Called

Other than that, though, the two statements are essentially the same.

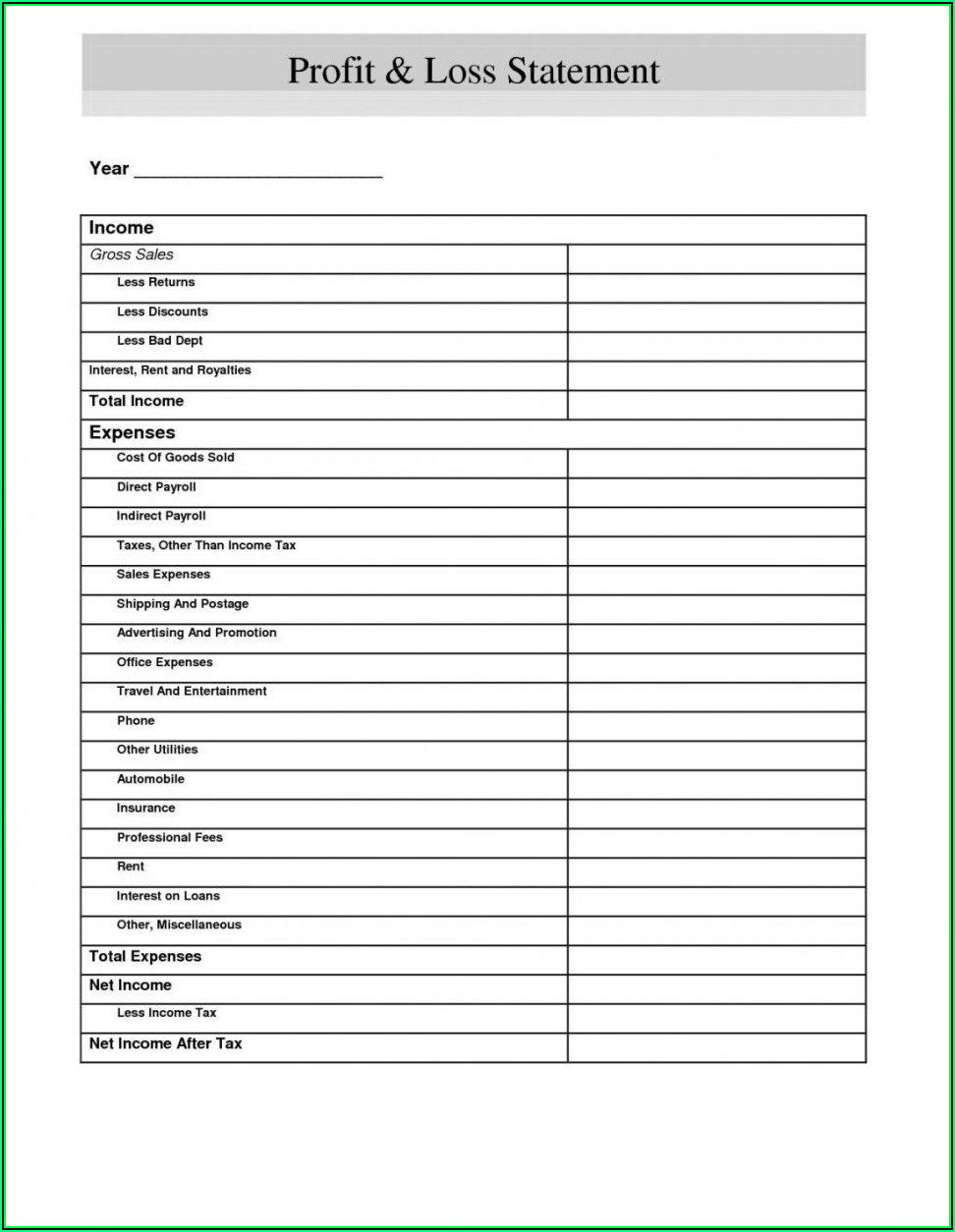

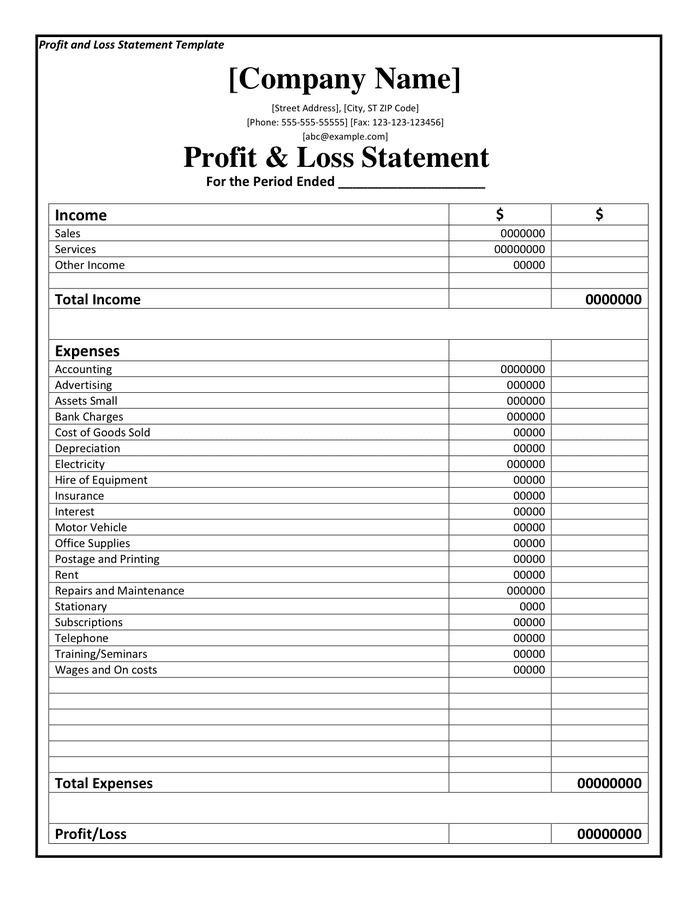

The statement of profit and loss is also called the. While gains and losses are infrequent in a business, it is not uncommon that a business would present. A profit and loss statement, also called an income statement or p&l statement, is a financial document that summarized the revenues, costs, and expenses incurred by a company during a specified period. Profit and loss and when and how to use them.

In this article, we define income statement vs. In general, it provides information on profit gained by the company ( guilding, 2010 ). Where the proprietor maintains incomplete records, he only prepares cash account, debtors account and creditors account properly.

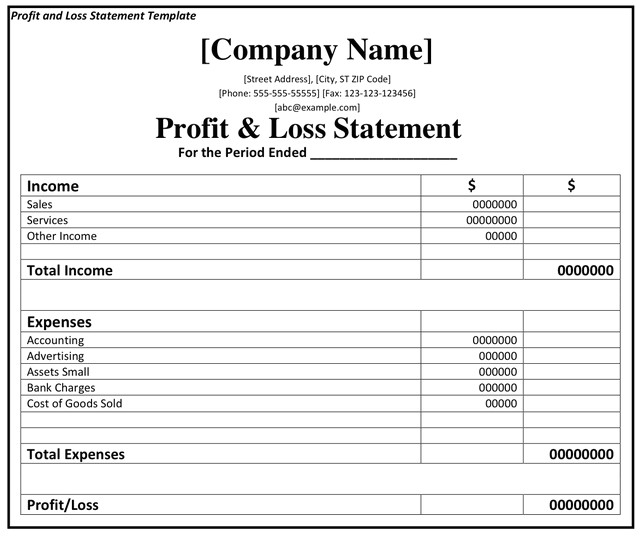

The profit and loss (p&l) statement is also referred to as income statement. But to be clear, we’re talking about profit and loss statements (also called income statements). A profit & loss statement, also called an income statement, is a financial statement that reports a company’s revenues and expenses for a given period of time.

Which of the following is not a type of cash flows shown in the cash flow statement?* o operating cash flow o investing cash flow o accounting cash flow o financing cash flow 3. The accounting records that are not maintained as per the double entry system but as per single entry are called incomplete records. The first thing you need to know about a profit and loss statement is that it goes by other names.

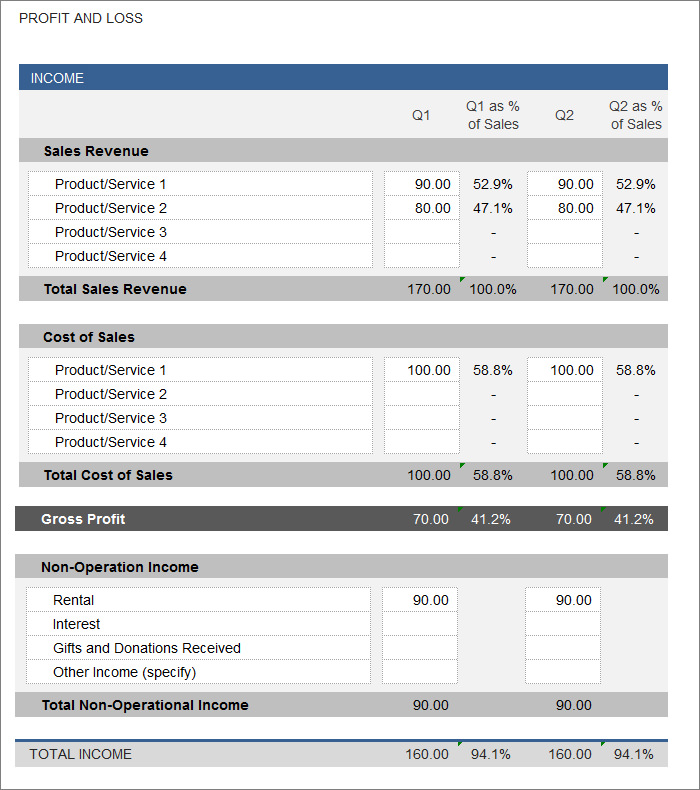

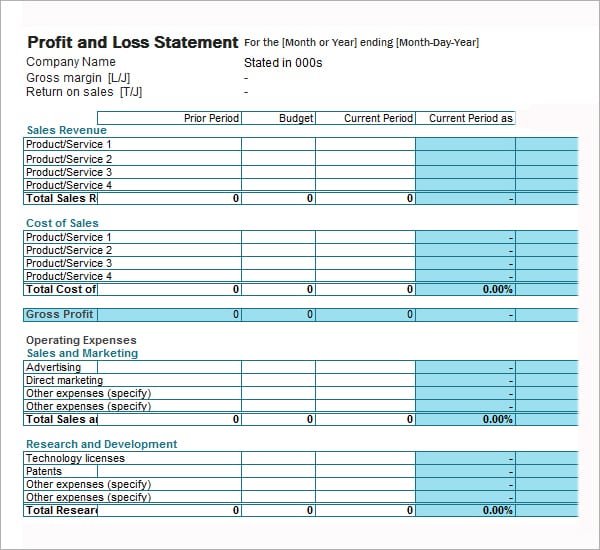

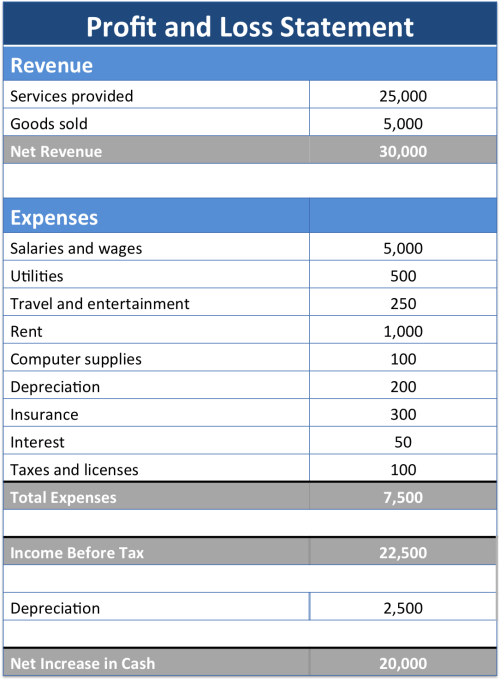

Net sales, which is sales volume; A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Shown as a formula, the net income (loss) function is:

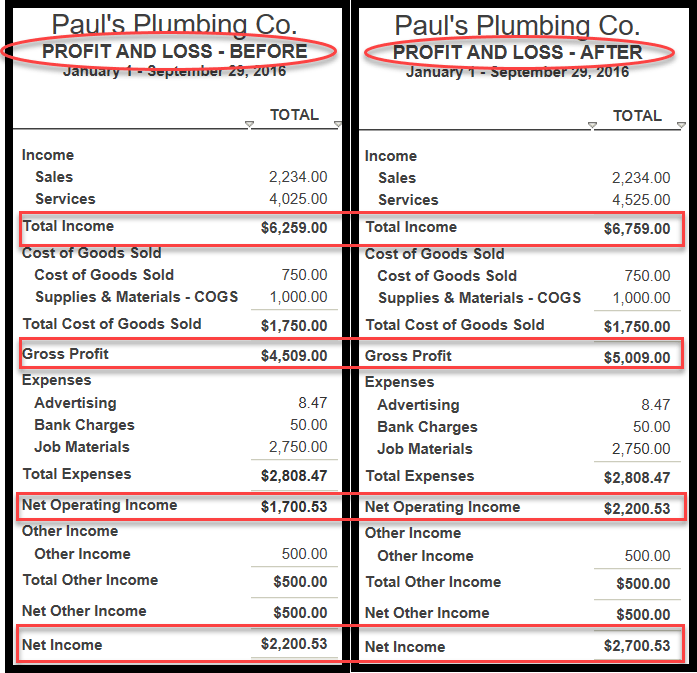

Then, it subtracts the costs of making those goods or providing those services, like. To be complete, we must also consider the impact of gains and losses. Gross profit is a company's profits earned after subtracting the costs of producing and selling its products—called the cost of goods sold (cogs).

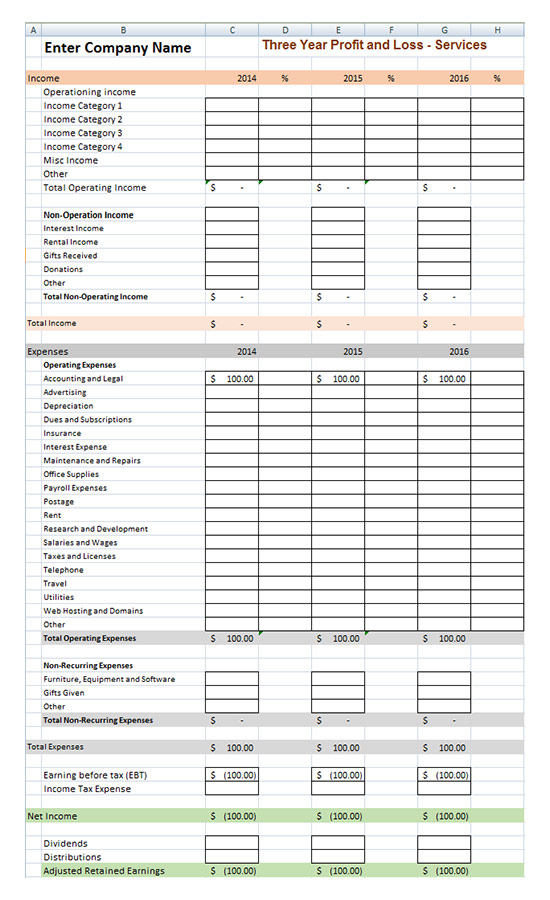

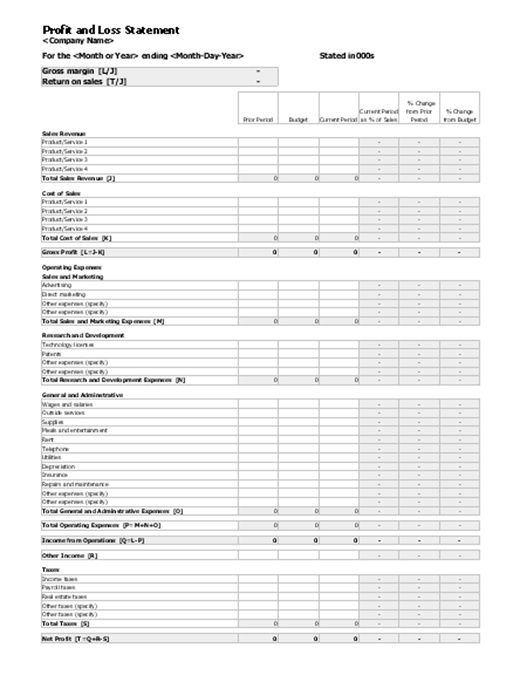

Cost of merchandise sold, which is also called cost of goods sold; Profit and loss statement sample. A profit and loss statement demonstrates the results of operations for a fiscal period, reflecting revenue, expenses, and profitability.

You also might see it called a r evenue statement, earnings statement, or an o perating statement. The financial statements that show a company's profits during a certain period are called income statements or profit and loss statements. It is also called ebit (earnings before interest and taxes).

Gross profit provides insight into how. Two approaches to calculating p&l statements are: Creating one is a standard way to compile historical data for your business to tell its financial story over time.

What is a profit and loss statement? The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. The p&l report is one of a business’s most important accounting tools, as it provides important insights into business operations.