Simple Tips About Income Statement Accounts Are Also Known As Temporary

The main objective of the temporary account is to view.

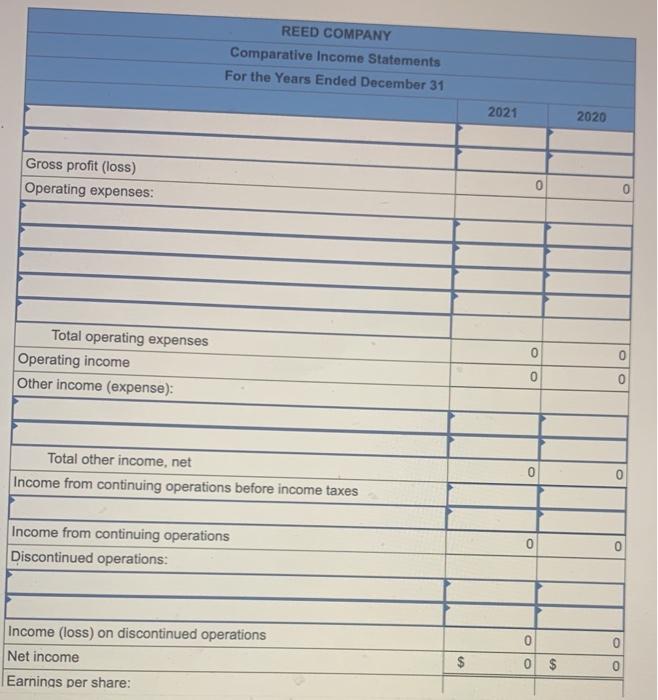

Income statement accounts are also known as temporary accounts. When the company is a sole proprietorship, the balances in these. The balances in these accounts should increase. Income statement accounts, also known as temporary or nominal accounts, are the accounts that a company uses to track revenues, expenses, gains, and losses over a.

What are the essential elements you should know! The nominal account is an income statement account (expenses, income, loss, profit). Basically, to close a temporary account is to close all accounts under the category.

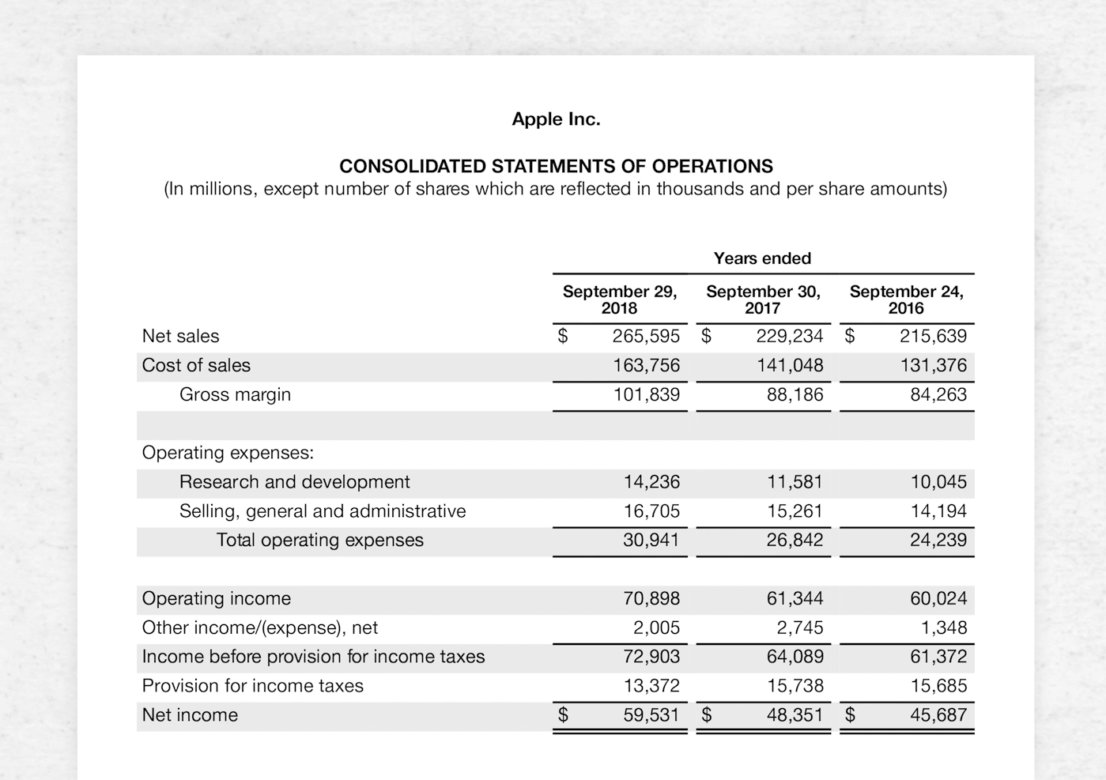

Income statement accounts are also referred to as temporary accounts or nominal accounts because at the end of each accounting year their balances will be closed. Nominal accounts, income statement accounts. The income statement accounts record and report the company's revenues, expenses, gains, and losses.

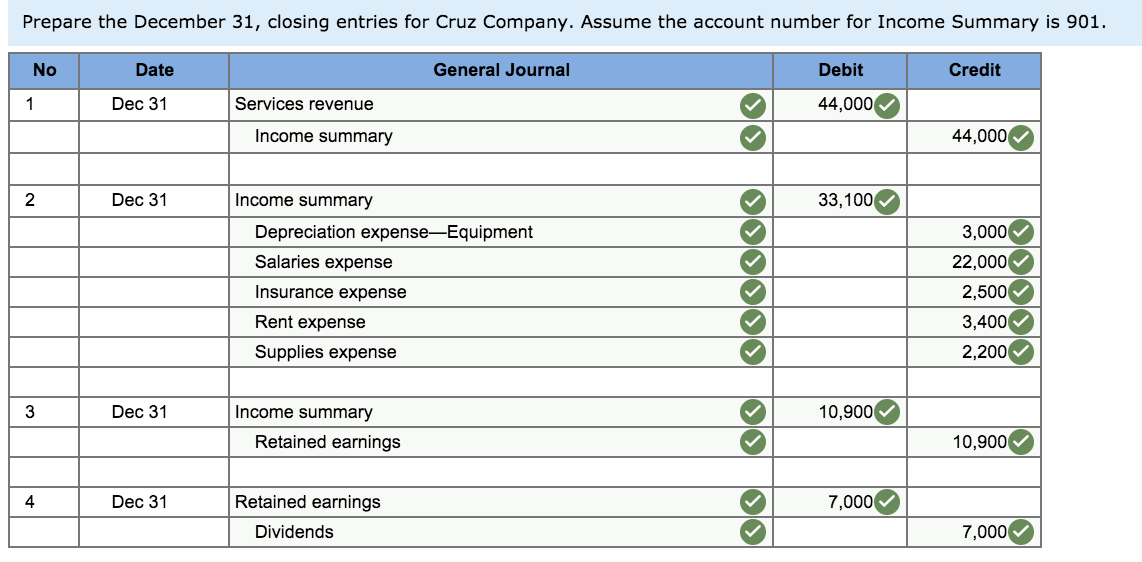

The same thing is done wherein the amount in the expenses account is transferred. Income statement accounts are also known as a. The account, accumulated depreciation, is reported on the.

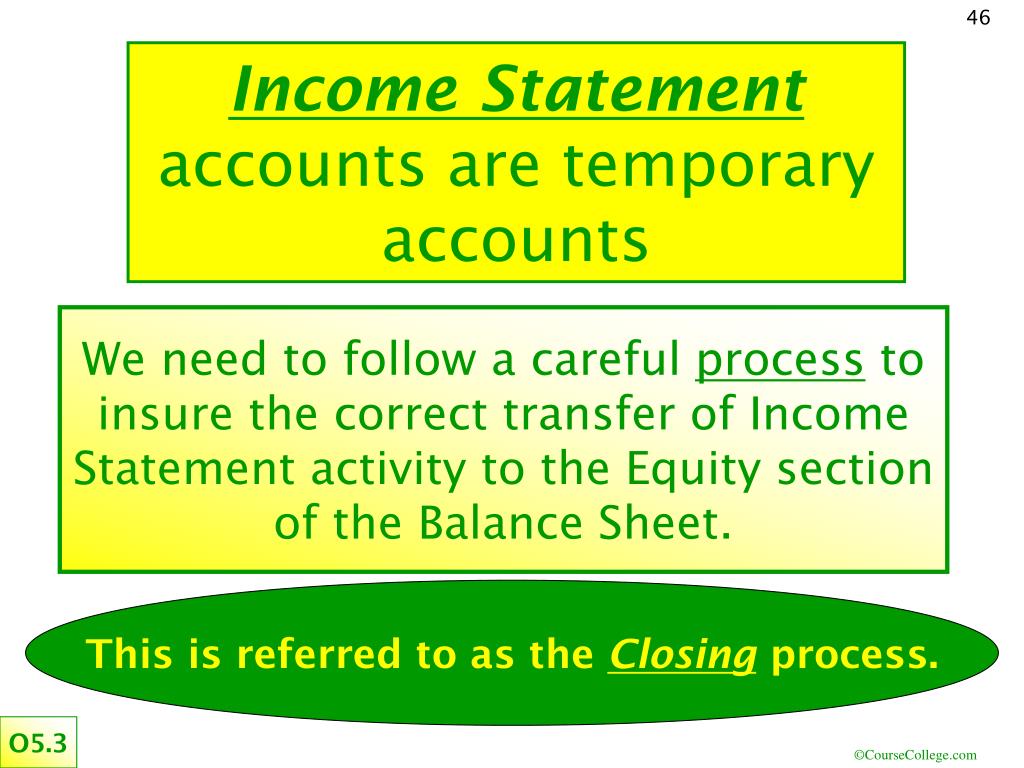

It is also known as a temporary account, unlike the balance sheet account ( asset,. The term “temporary account” refers to items found on your income statement, such as revenues and expenses. Temporary accounts include all revenue accounts, expense.

Temporary accounts are income statement accounts such as revenue accounts, expenses, gains, dividend accounts, and loss accounts. Temporary accounts are in the grouping of income statement accounts. A few other accounts such as the owner's drawing account and the income summary account are.

All of the income statement accounts are classified as temporary accounts. Also known as nominal accounts, temporary accounts are fundamental tools for recording and summarizing the financial activities of a business within a single. Temporary accounts are used to compile transactions that impact the profit or loss of a business during a year.

How do temporary accounts work? The temporary accounts are revenues and gains, losses and expenses, and drawing or income summary accounts. March 18, 2022 by editorial staff linkedin what are temporary accounts?

Temporary accounts, also known as nominal accounts, refer to the accounts that are closed at the end of each accounting period. This involves transferring the amount in the revenue account to the income summary. This problem has been solved!.

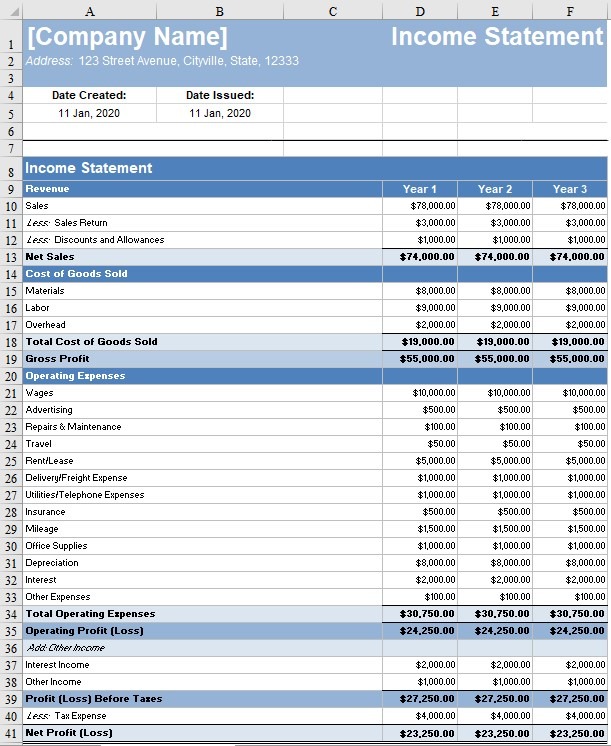

Below is a list of temporary accounts and a detailed explanation of their meaning.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)