Glory Tips About Income Statement Trading Account

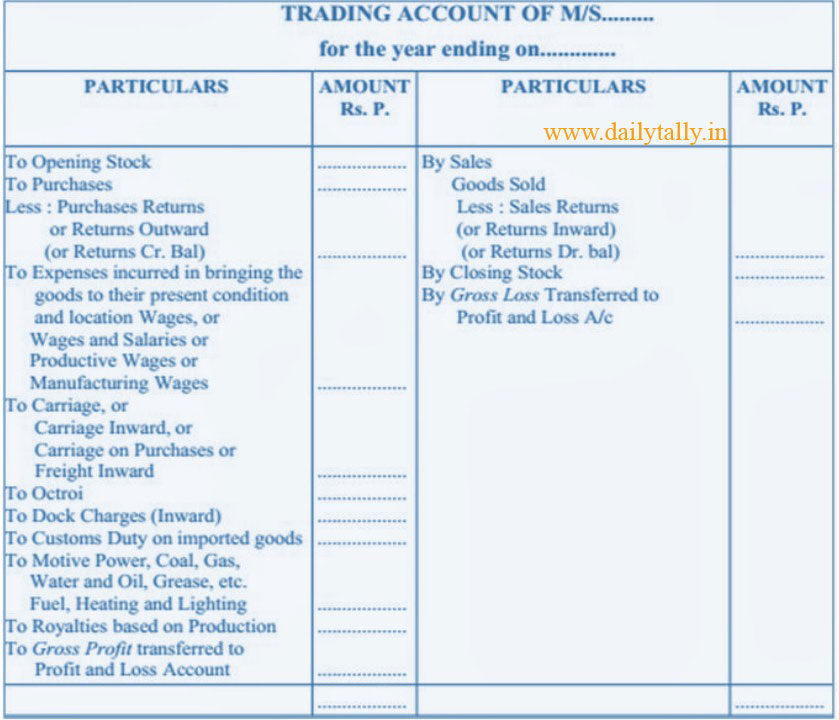

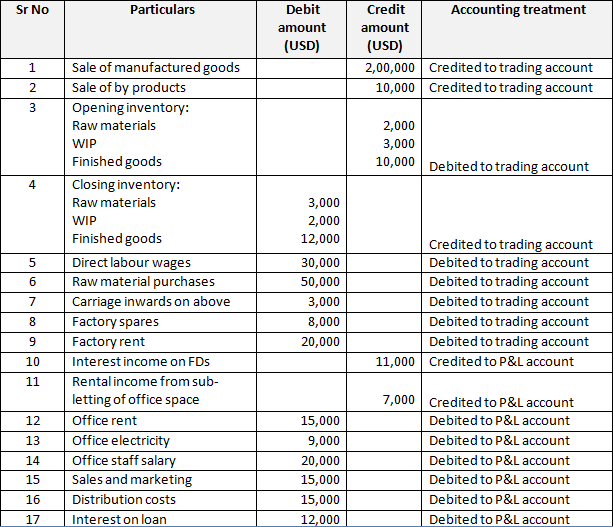

A trading account is a financial statement that shows the revenue, cost of goods sold, and gross profit or loss of a business for a given.

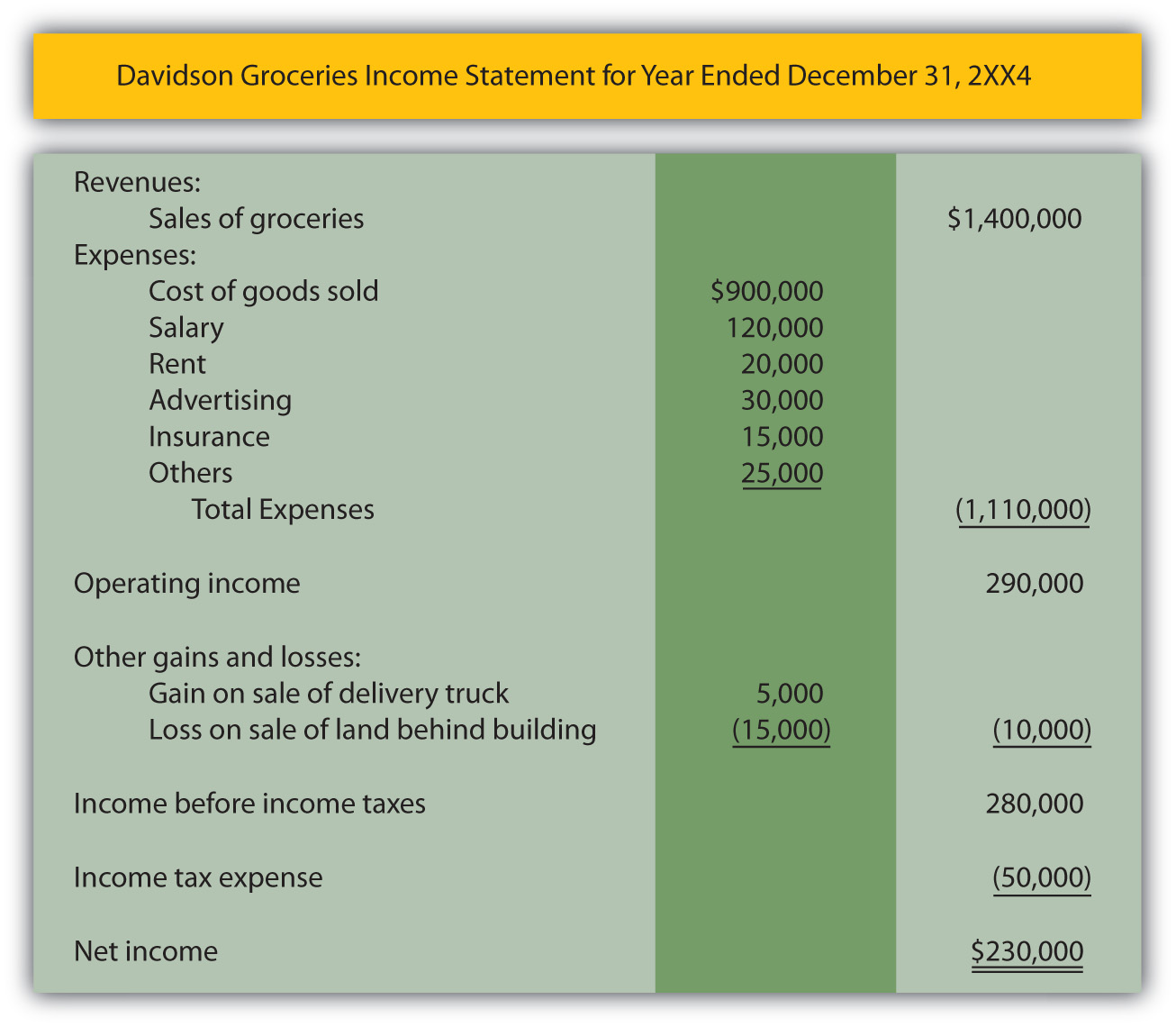

Income statement trading account. It shows the gross profit of business activities during a specific period. The income statement lists a company’s sales, revenue, and gross profit. Difference between trading and profit and loss account and income statement:

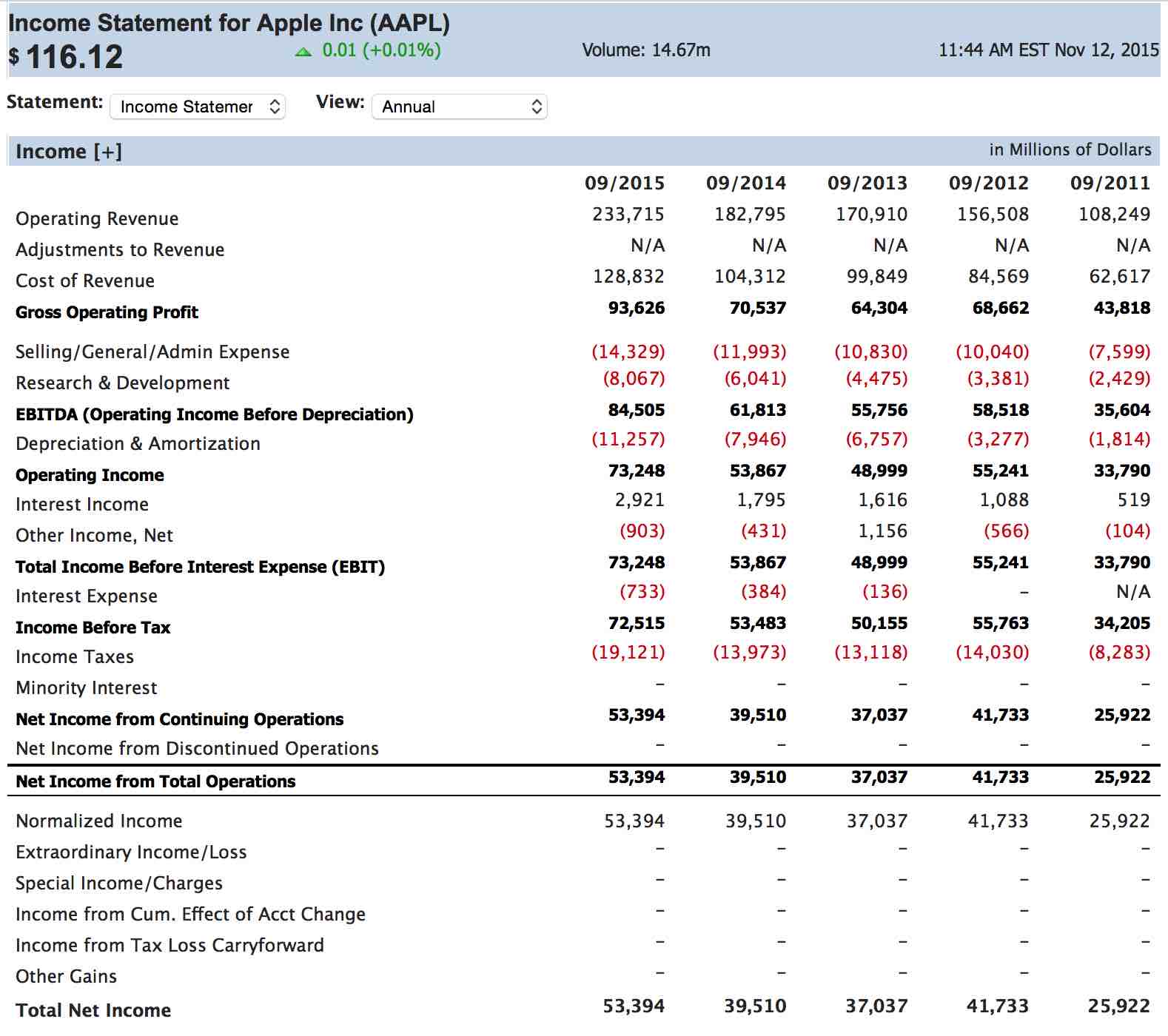

What is trading account? The income statement, balance sheet, and statement of cash flows are required financial statements. It can also be referred to as an.

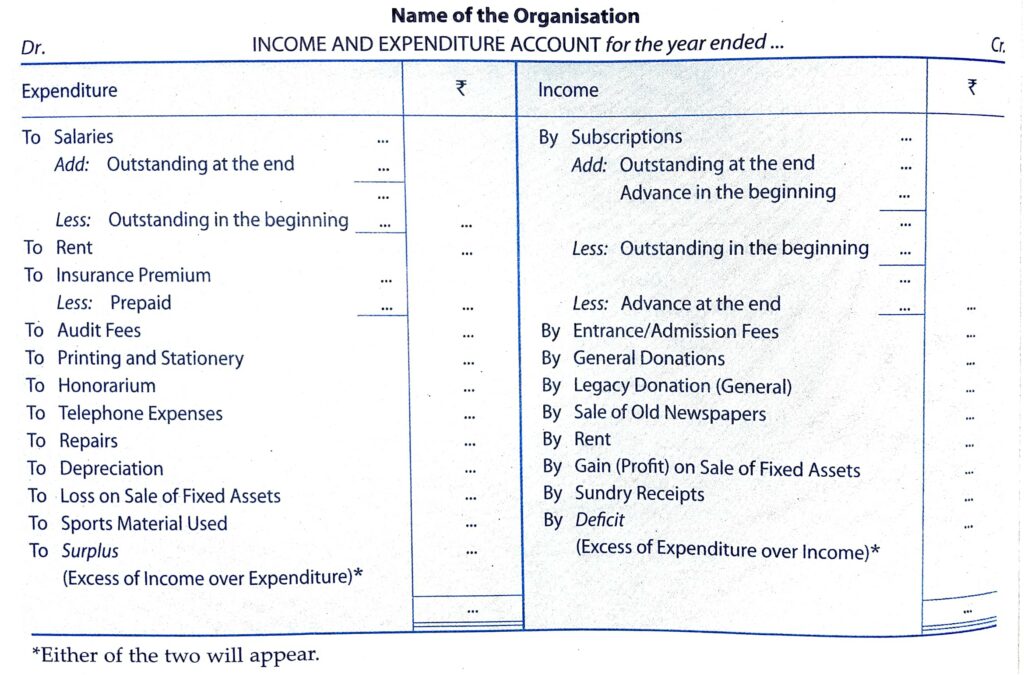

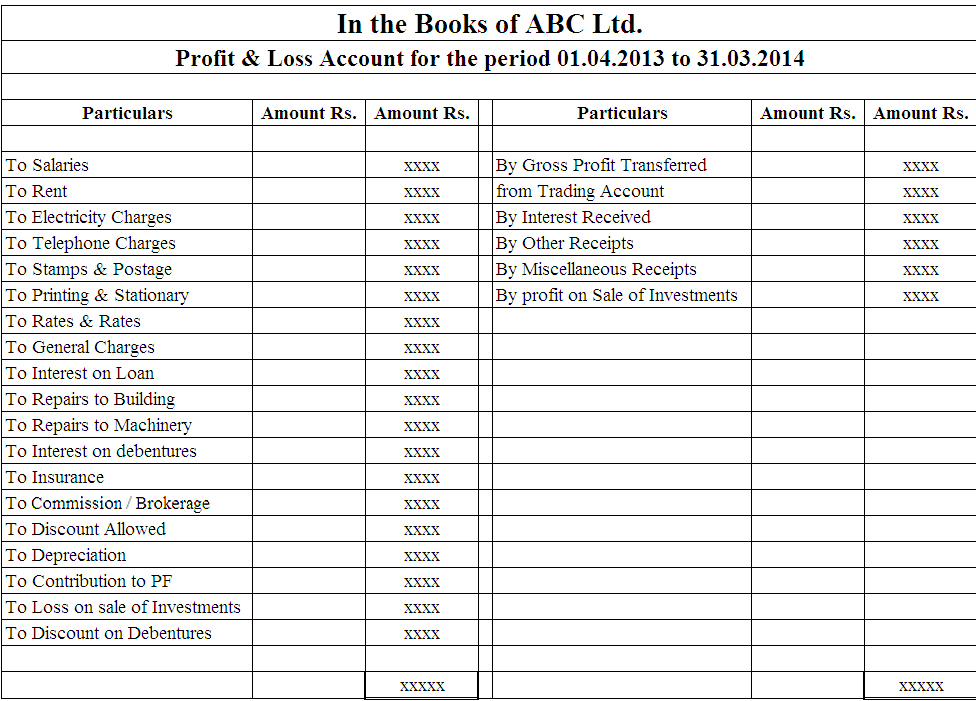

These three statements are informative tools that traders can use to. Income statement (trading and profit & loss account) 1) to calculate the profits or losses of a business; Then the investments must be increased to the new fair value and the.

Income and expense statements are two important components of p/l accounts. Santa clara, calif., feb. Urban logistics reit plc (urban logistics or the company) notes the statement released by the panel on takeovers and mergers (the takeover panel).

Profit and loss account or. The income statement generally has the following five steps: Yearly statement of account.

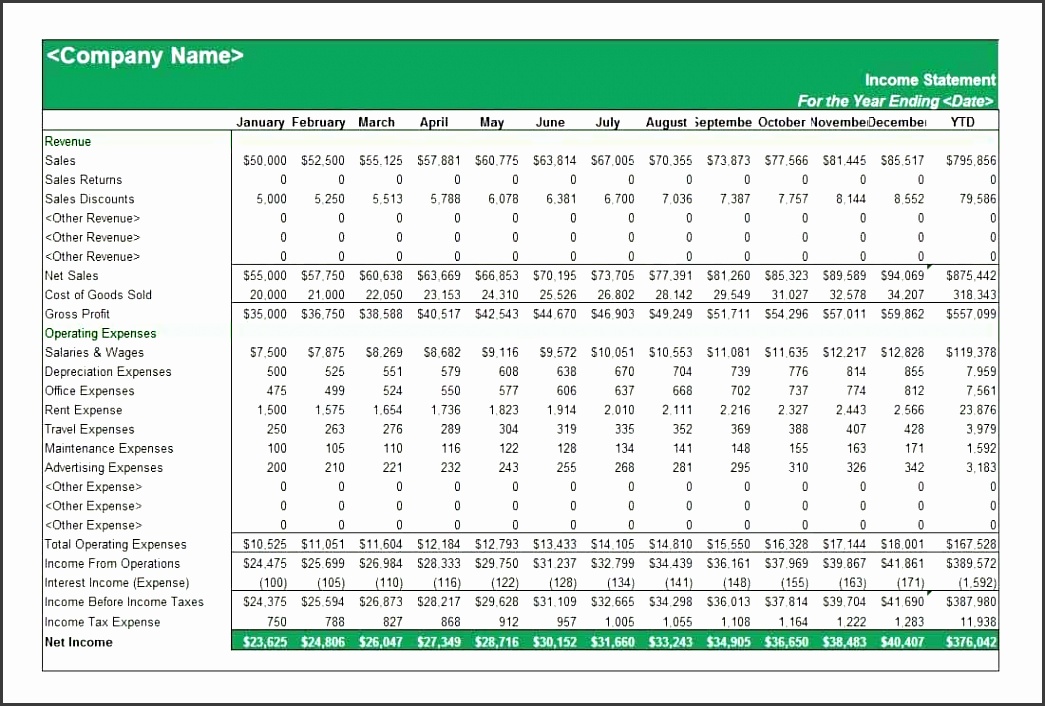

Nvda) today reported revenue for the fourth quarter ended january 28,. Record income & expenses and the template produces a trial balance, trading profit and loss accounts, cash flow statement and balance sheet. This video shows how to prepare the trading section of the income statement.i break this down step by step instead of giving you a full, complete format to.

An income statement, also known as a profit and loss statement, is a financial report that summarizes a company's revenues, expenses, and profits or losses. The income statement is a historical record of the trading of a business over a specific period (normally one year). In contrast, activities that are part of the cost of goods sold, such as purchasing raw materials, opening stock, direct expenses, etc., are shown on the debit side (left).

Both income statement and trading and profit and loss account are prepared to ascertain. It is a part of the final accounts of. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

2) to prepare reports for stakeholders, (stakeholders are. Key takeaways • income statements are a valuable financial document that provide investors with insight into a company’s performance. The profit or loss is determined by taking all.

The p&l statement aligns with the income statement, which records information about a company's ability or its inability to generate profit by increasing the. Trading account used to find the gross profit/loss of the business for an accounting period: Account debit credit;

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)