Recommendation Tips About Balance Sheet Ratios Pdf

Creditors/investors/managers in particular can quickly assess a.

Balance sheet ratios pdf. A current ratio of 1.76 means that for every $1. Everything you’ll learn in the financial ratios definitive guide. Cash flow statements (nssch) section 1 ratios by the end of this section you should be able to:.

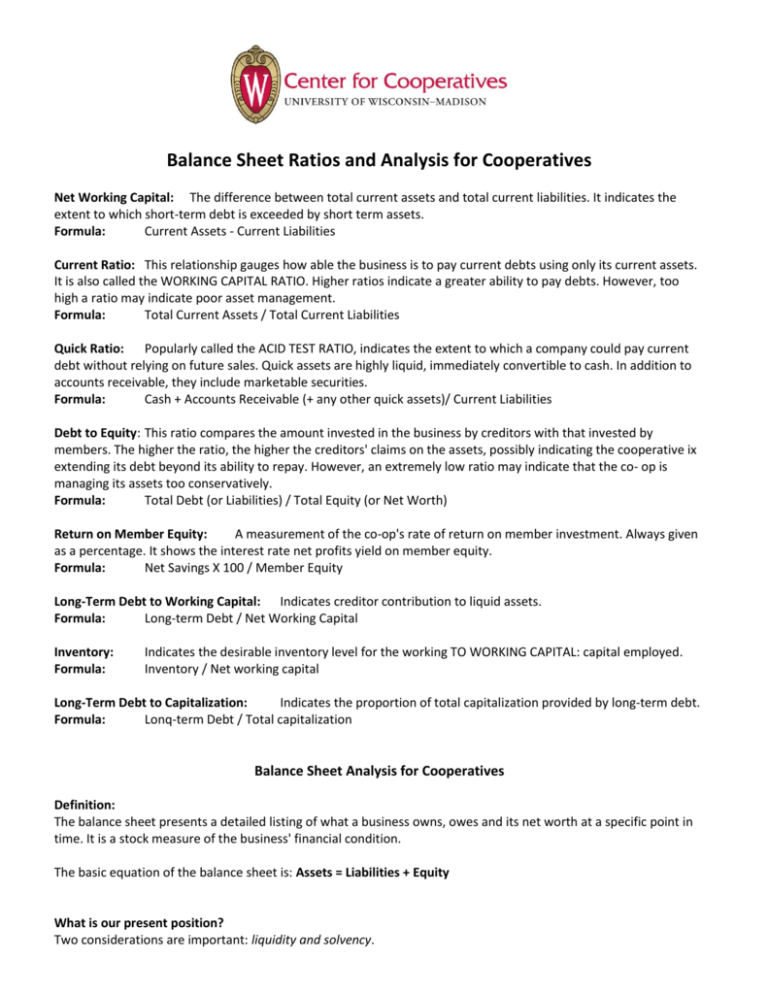

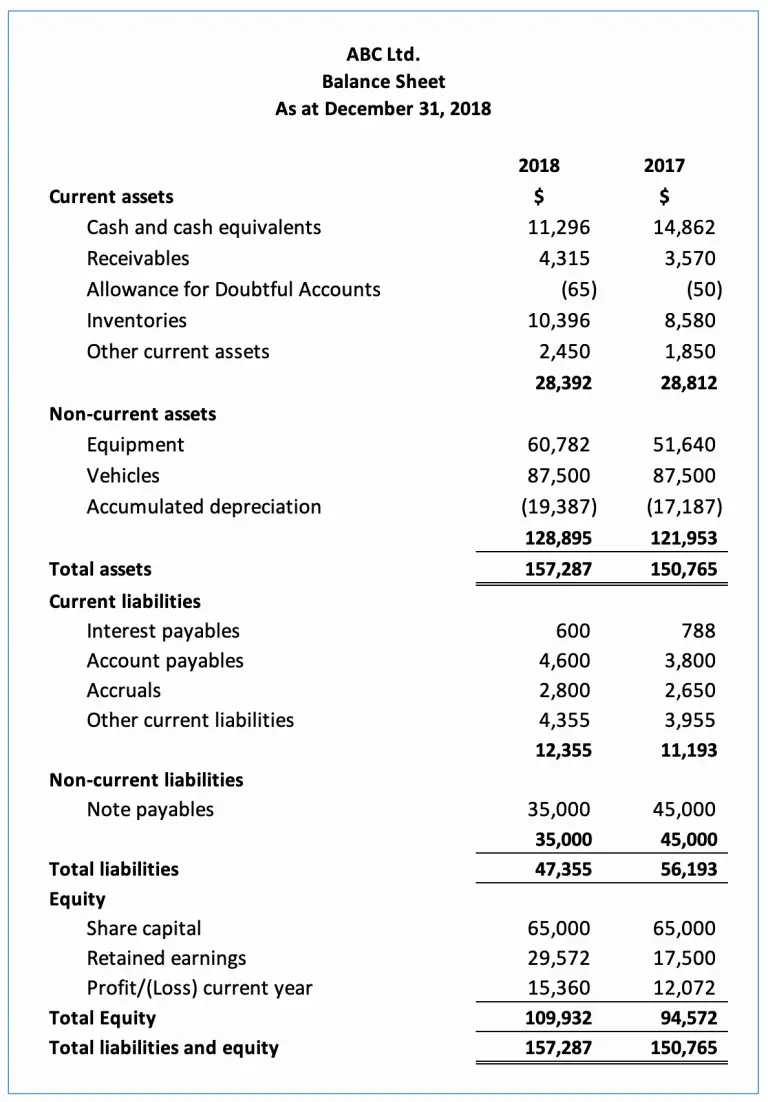

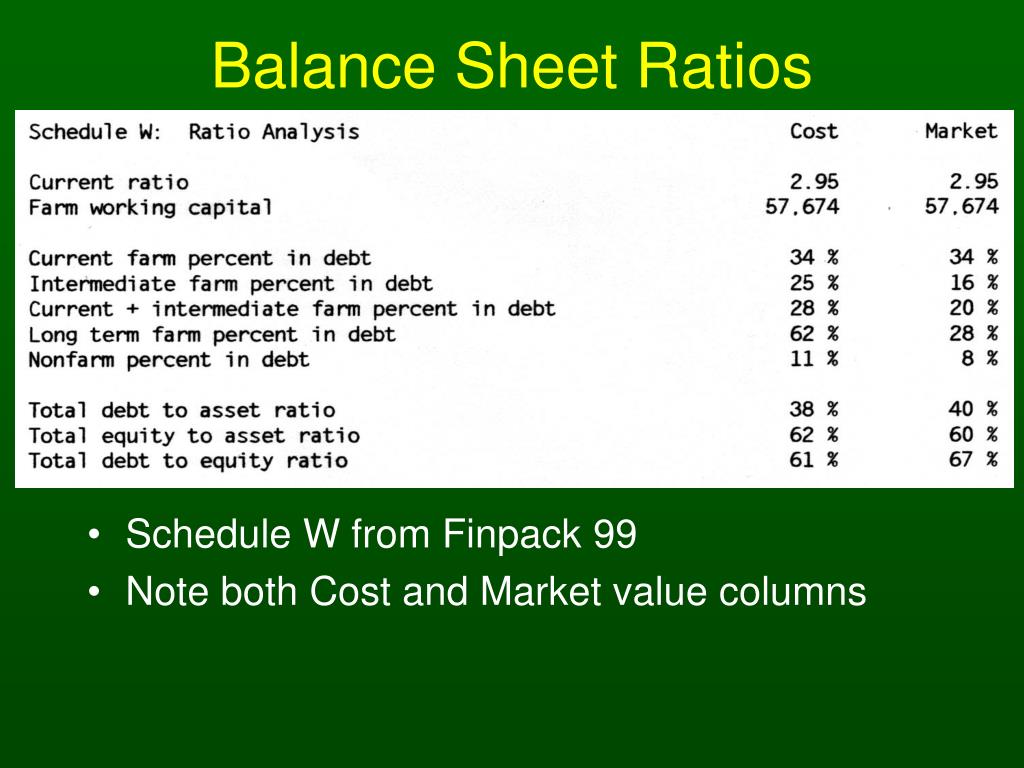

Balance sheet ratio analysis important balance sheet ratios measure liquidity and solvency (a business's ability to pay its bills as they come due) and leverage (the extent. These ratios focus on the availability of cash to manage the day to day operations of the company. Popularly called the acid test ratio, indicates the extent to which a company could pay current debt.

Convert balance sheets to common. Ratio #1 working capital. This publication covers the fundamental concepts to construct and analyze these critical financial statements.

Describe the components of shareholders’ equity; Managing work budget & accounting free balance sheet templates get free smartsheet templates by andy marker | january 7, 2019 (updated april 28, 2023). In particular, we define the.

Why to use ratio analysis; The 20 best balance sheet ratios, formulas, and metrics to analyze. Credit/investment/management decisions based on financial analysis:

Current ratio = current assets ÷ current liabilities most analysts prefer would consider a ratio of 1.5 to two or higher as adequate, though how high this ratio depends. 20 balance sheet ratios to help you determine the financial health of a company & includes a pdf download. A ratio is a mathematical number calculated as a reference to relationship of two or more numbers and can be expressed as a fraction, proportion, percentage and a number of.

Describe different types of assets and liabilities and the measurement bases of each; There are two additional financial ratios based on balance sheet amounts. Total current assets / total current liabilities.

Nomic flows of all previous periods. Your free download includes comprehensive coverage of 30+ financial ratios, and: First we look at the liquidity ratios of a company.

Providing a complete interpretation of a company's results quantitatively, balance sheet ratios are used to compare two items on the balance sheet or analyze balance sheet. The uses of accounting statements section 3: Understand the company’s financial health and measure its growth, understand how well a company generates.

Initial balance sheet, the leverage ratio is a measure of potential, rather than actual, capital gain. Ratio #3 quick (acid test) ratio. By analyzing the components of the balance sheet you can;