Exemplary Tips About Prepayments In Balance Sheet

Here’s more information on the meaning of prepayments and how to include prepayments in the balance sheet.

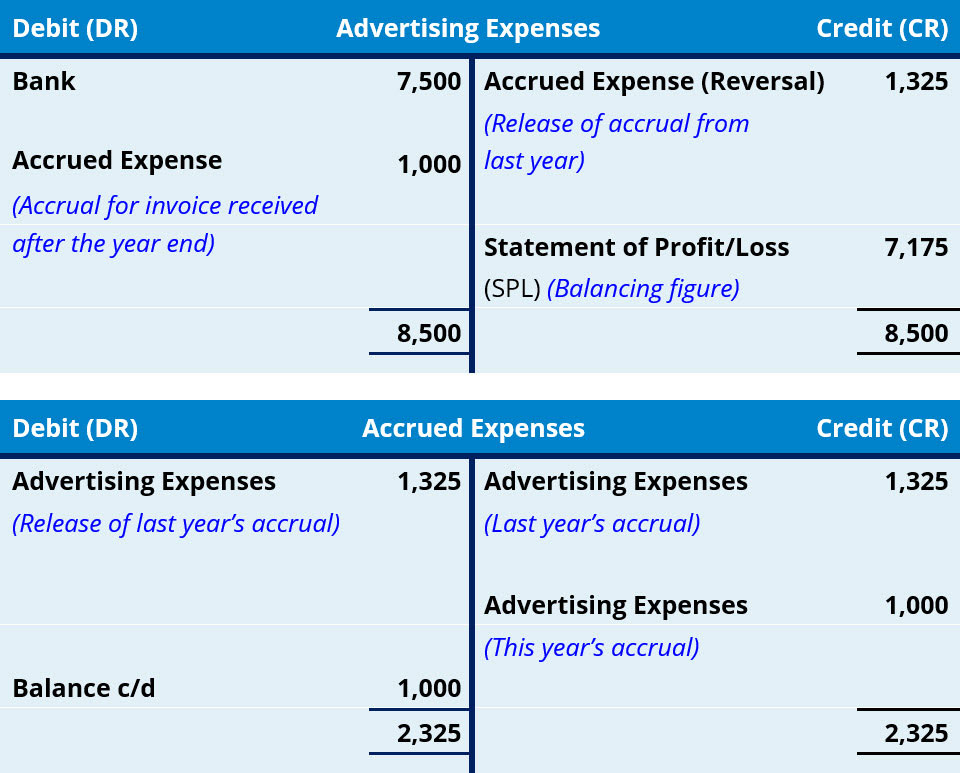

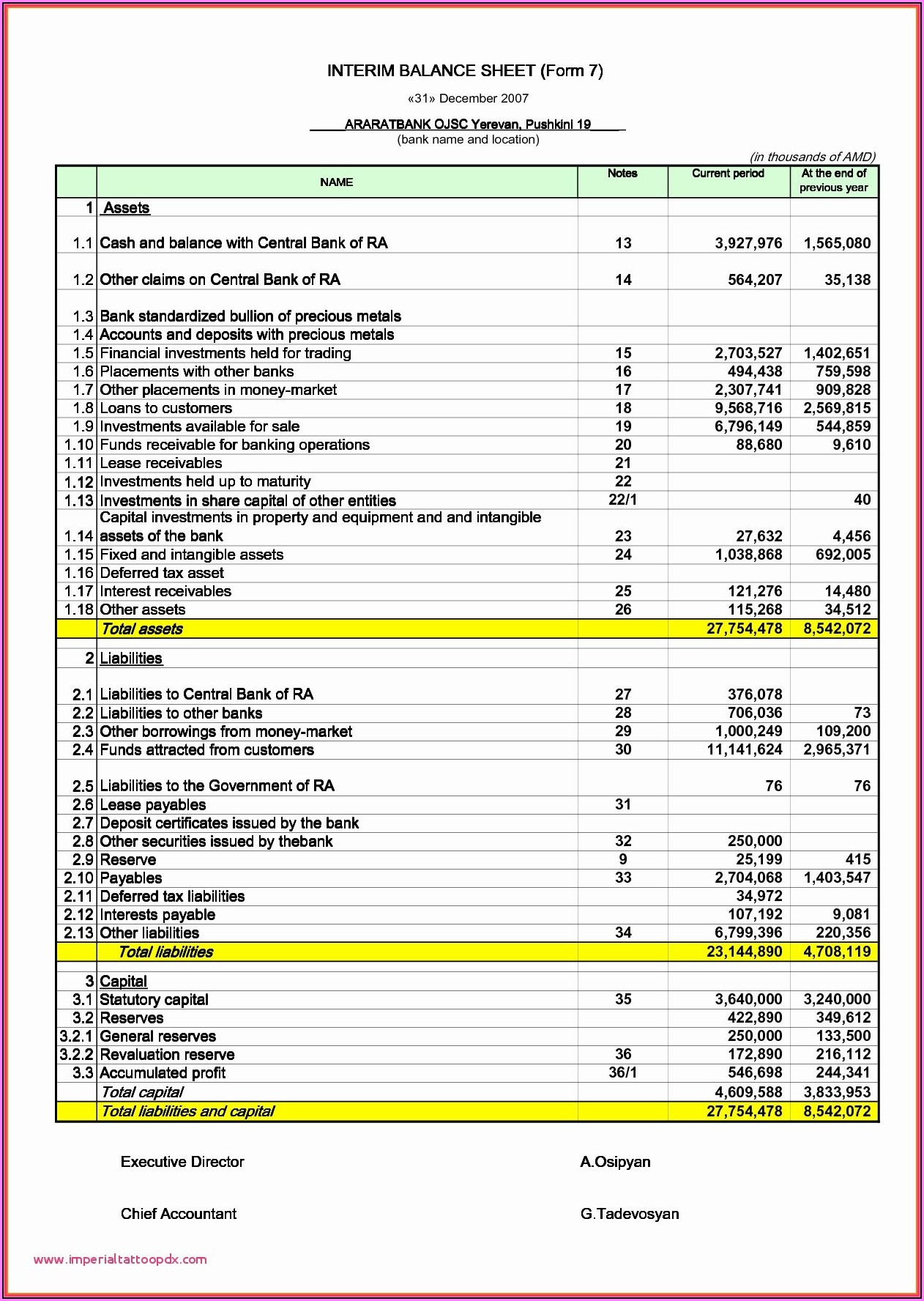

Prepayments in balance sheet. In short, a prepayment is recorded as an asset by a buyer, and as a liability by a seller. We’ll discuss how to record both incoming and outgoing prepayments in your business’s balance sheet,. Prepayment is commonly required in order to reserve advertising space.

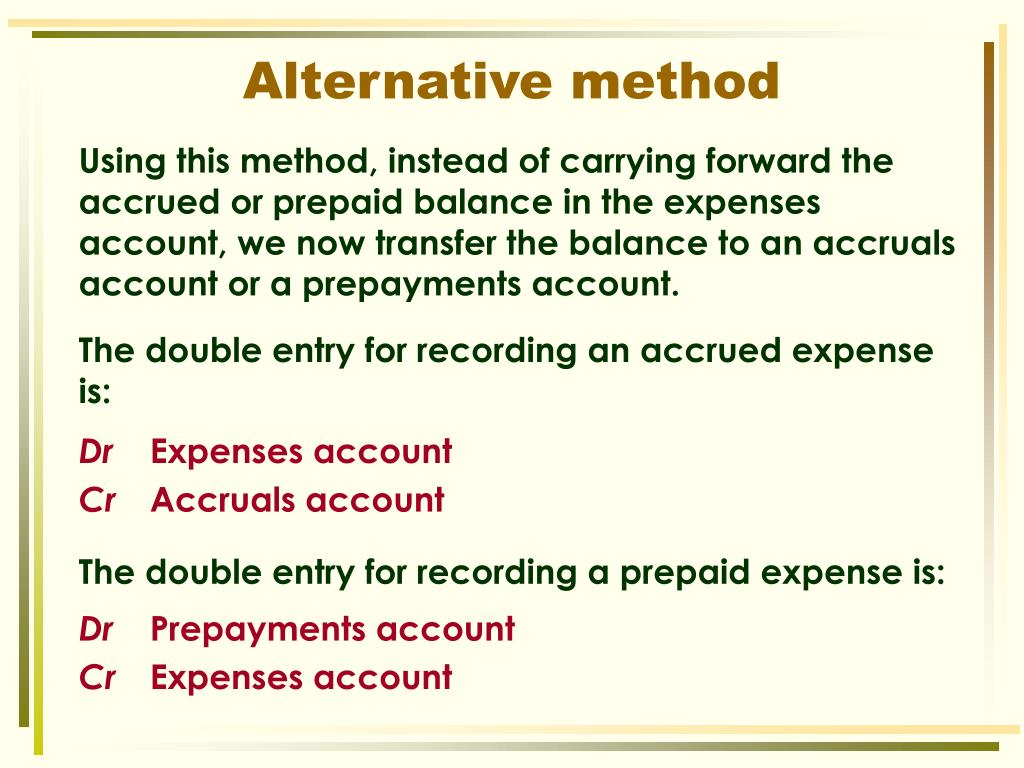

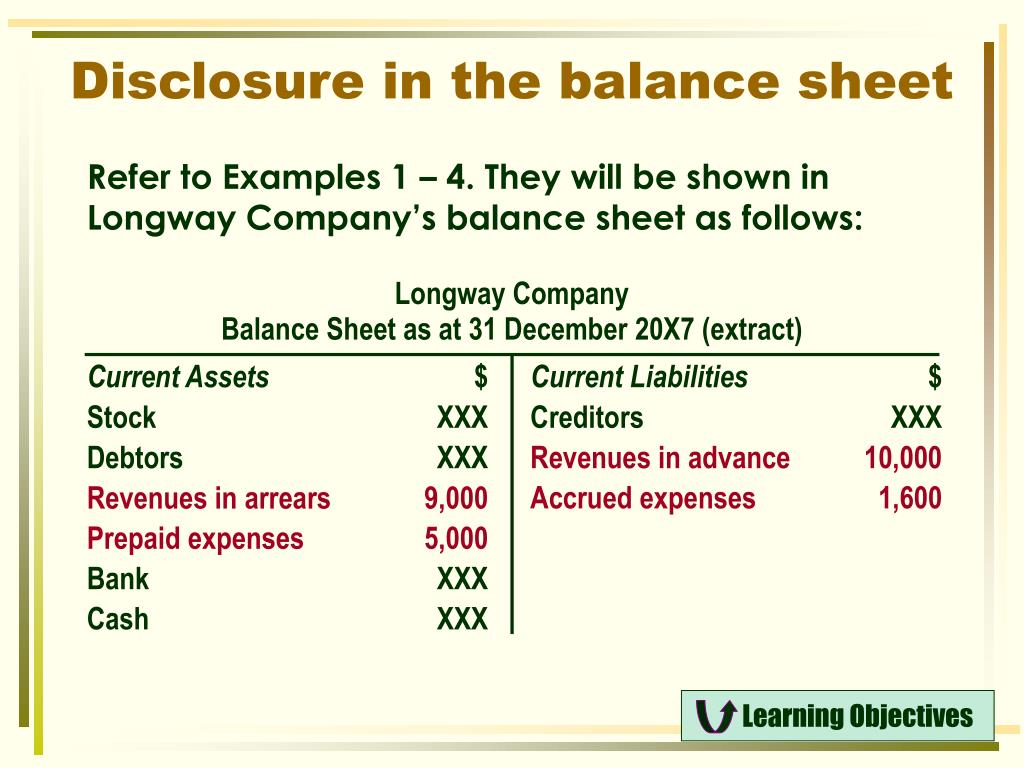

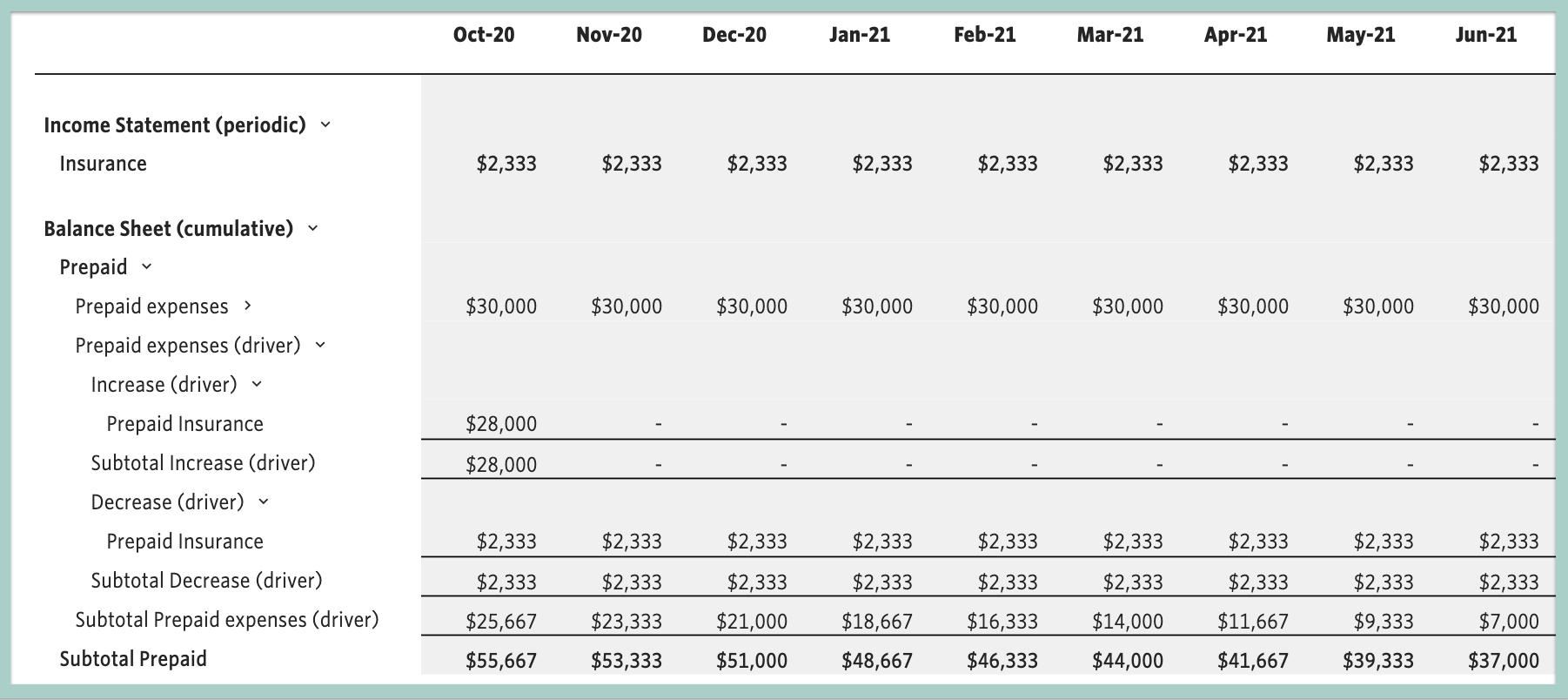

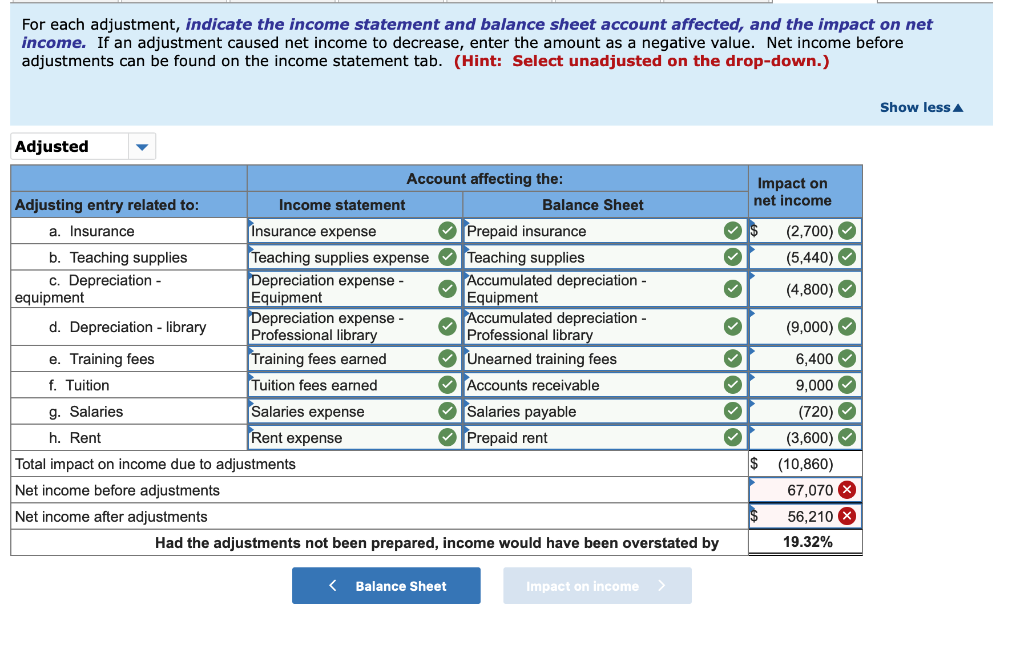

Initially, the prepaid expense is recorded as a prepayment in a current account on the company's balance sheet. For first contract advance (say of us$ 10,000) is given and for second contract goods are received before balance sheet date (say of us$ 12,000). 1 accruals basis of accounting the accruals basis of accounting means that to calculate theprofit for the period, we must include all the income and expenditurerelating to the.

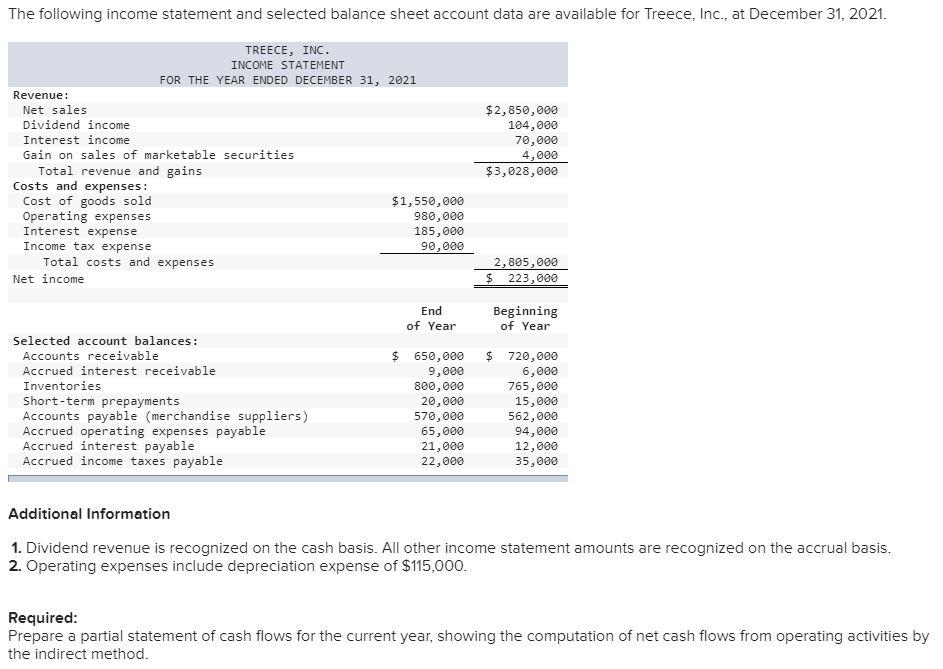

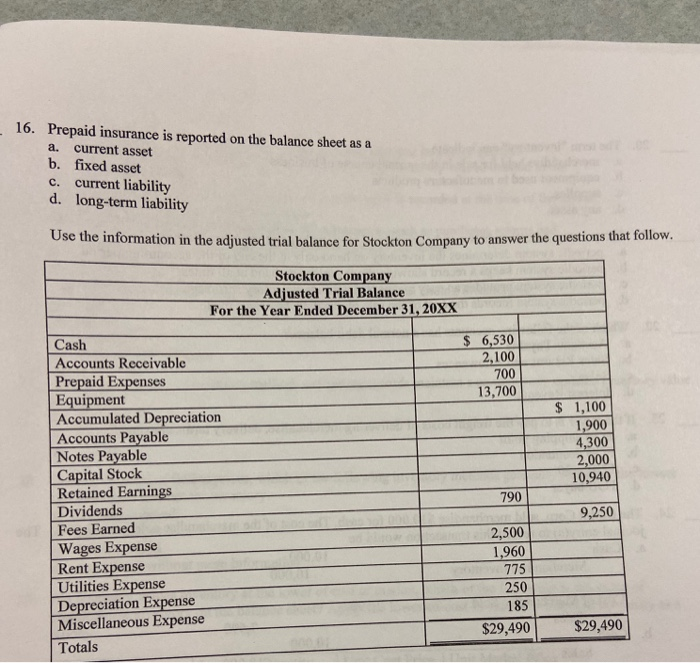

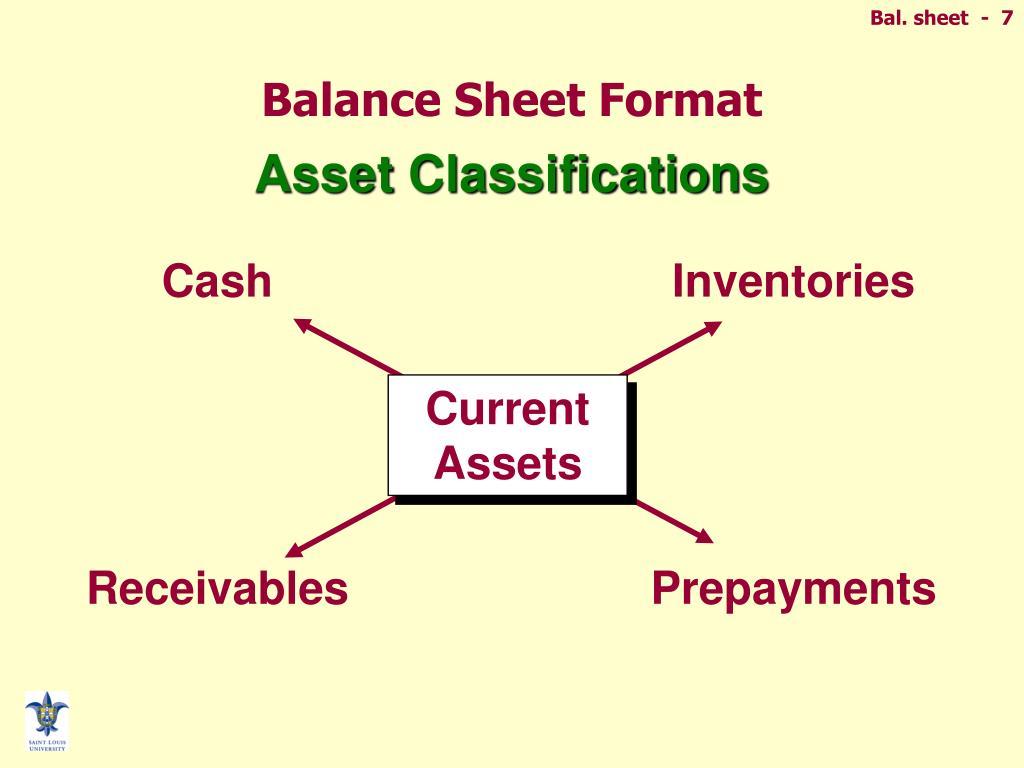

Prepayments explained prepayment is a term used in. The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Prepayment is an accounting term referred to the types of expenses not incurred yet but for which payment is made in advance.

Prepaid expenses will allocate to income. These items are usually stated as current assets and current liabilities, respectively, in the balance sheet of each party, since they are generally resolved within. Some of these examples are given below:

Basically, any form of debt that your business has gained can be paid off as a prepayment. Prepaid expenses are listed on the balance sheet as a current asset until the benefit of the purchase is realized. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet.

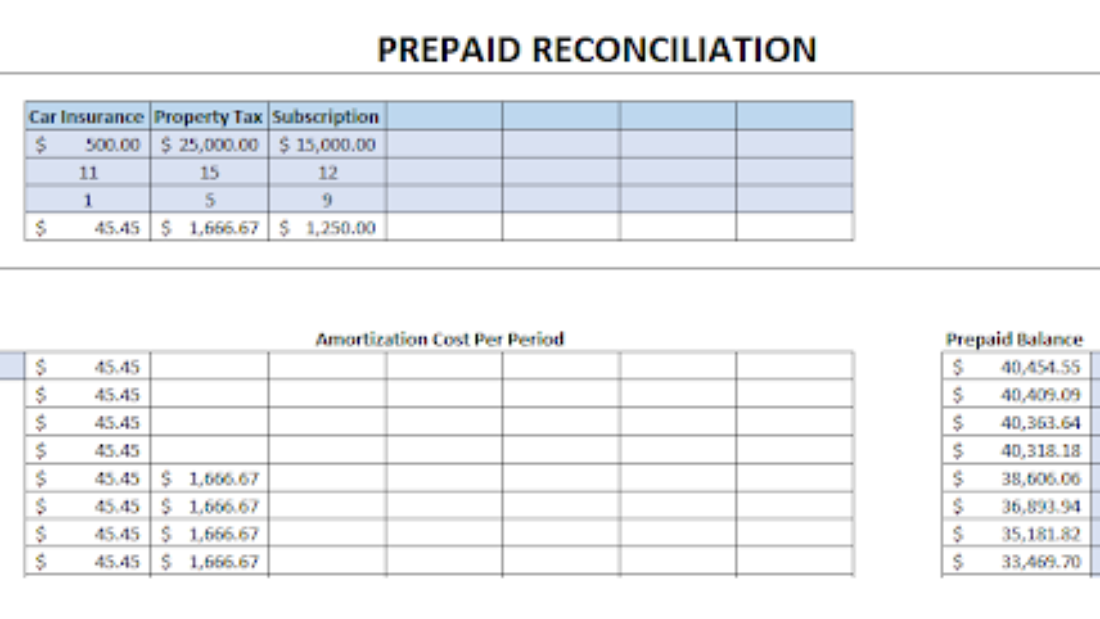

Present expenses are not recorded in the income statement since they are the balance sheet account and effect only balance sheet. But the expense should be recognized when the ads run, not when they are paid. Prepayment entry in balance sheet

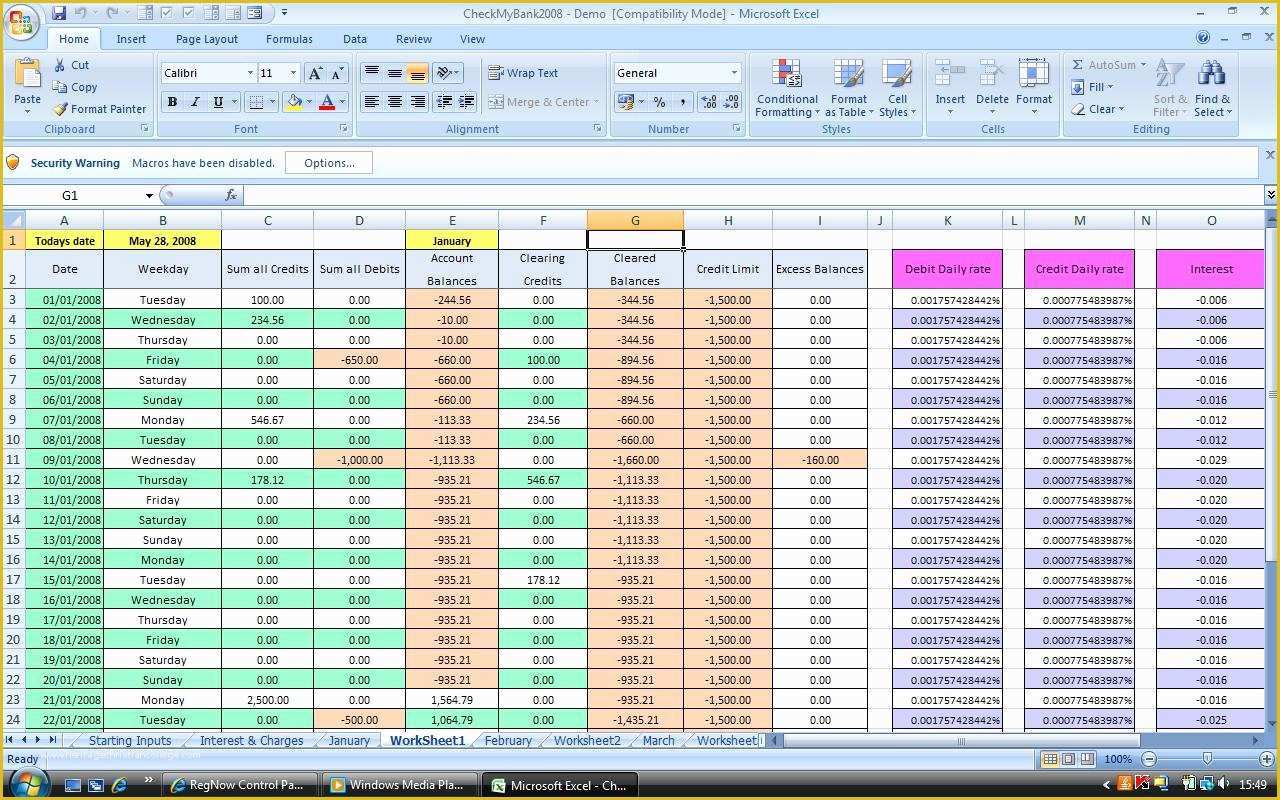

Besides paying off business loans early, this includes paying for your lines. For example, the following screenshot from the balance sheet of. As the economic benefits from such resources are.

Initially, the balance sheet classifies the prepayment as a current asset and later reclassifies it as an expense in the income statement once the asset is consumed. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. The gaap matching principle prevents expenses from being recorded.

As the expense is utilized or consumed, it is gradually.