Unique Tips About Income Tax Refund In Cash Flow Statement

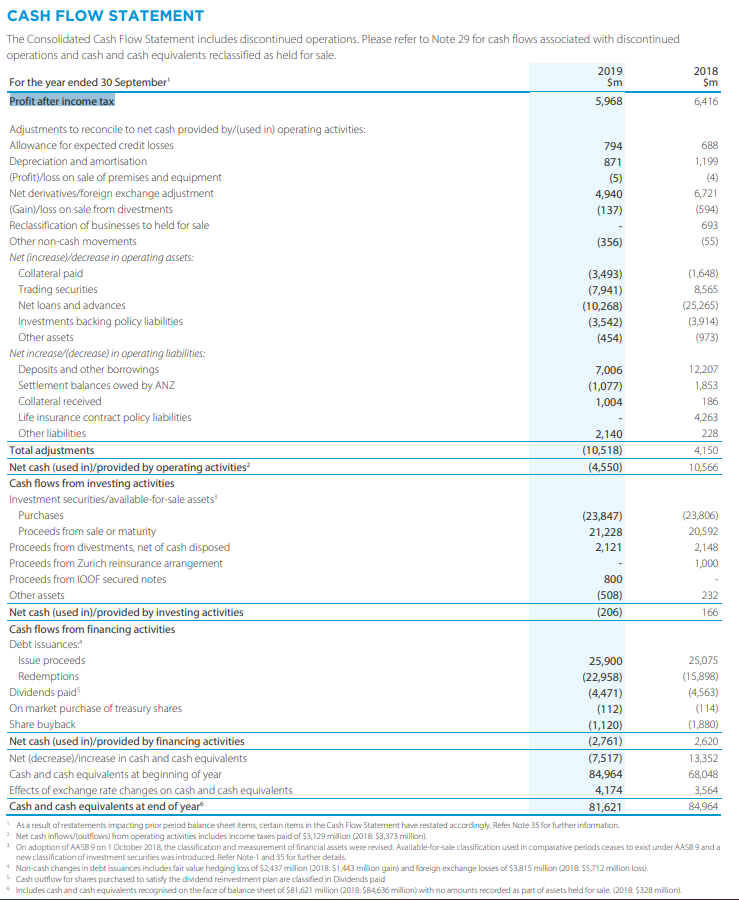

Cash received from customers cash paid to suppliers cash paid for operating expenses (includes research and development) group 2:

Income tax refund in cash flow statement. To check your refund status, you will need your social security number or itin, your filing status and the exact refund amount you are expecting. A company's ebit —also known as its earnings. Record adjusted ebitda margin fourth.

Hello studentsin this lecture we will discuss about accounting treatment of refund of tax. The current portion of income tax expense for xyz limited can be calculated as follows: Cash flow from operating activities is calculated by adding depreciation to the earnings before income and taxes and then subtracting the taxes.

Did you get it ⬇️樂 question: Interest received interest paid group 3: Investment income (12,000) finance cost.

The irs updates the tool’s refund status daily. We will also consider treatment of refund of tax in cash flow stat. Income tax expense cu 30000 deferred component of income tax expense cu (3000) current component of income tax expense cu 27000 the beginning balance of current tax payable of cu 14000 is increased by the current portion of income tax expense,.

Cash payments or refunds of income taxes unless they can be specifically identified with financing and investing activities; Adjusted extraordinary items (+/ ) (f) xxx: Like other unpaid debts, accounting treats income tax payable as a liability.

This can be seen in the completed statement of cash flows following step 8. Lic is pursuing the balance with the income tax department. This statement is one of the three key repo.

This is a general cash flow item that may appear in any of the operating activities, financing activities or investment activities of the cash flow statement, associating tax payments or receipts with the corresponding group of activities. Income from operations of $652 million; When it comes to preparing cash flow statements, there are several common errors that can take place.

The total amount of refund was ₹25,464.46 crore. This article considers the statement of cash flows of which it assumes no prior knowledge. Next we must take a look at the interest recorded in the statement of comprehensive income.

When income tax refund is given along with provision for taxation of the previous and current year is given in question. When added to the opening cash balance of $250,000, the resulting total of $307,500 is equal to the ending cash balance for the year ending december 31, 2020. It is relevant to f3 financial accounting and to f7 financial reporting.

(e) cash payments or refunds of income tax, unless they can be specifically identified with financing and investing activities (f) cash receipts and payments from investments, loans and other contracts held for dealing or trading purposes, which are similar to inventory acquired specifically for resale Interest paid was $12,000 and taxation paid was $13,000. As noted earlier, the cash flow statement is broken down into three categories:

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)