Nice Tips About P&l Account And Balance Sheet

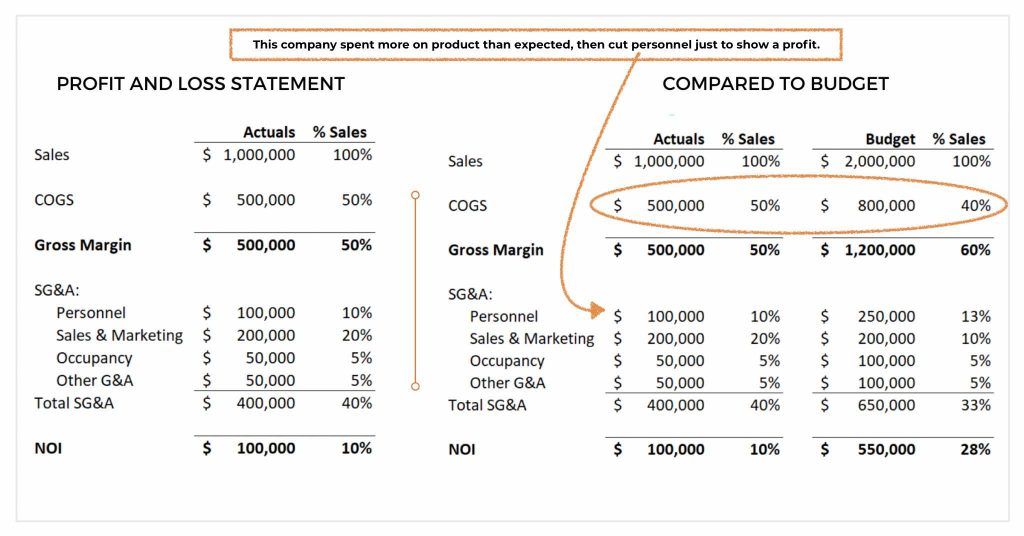

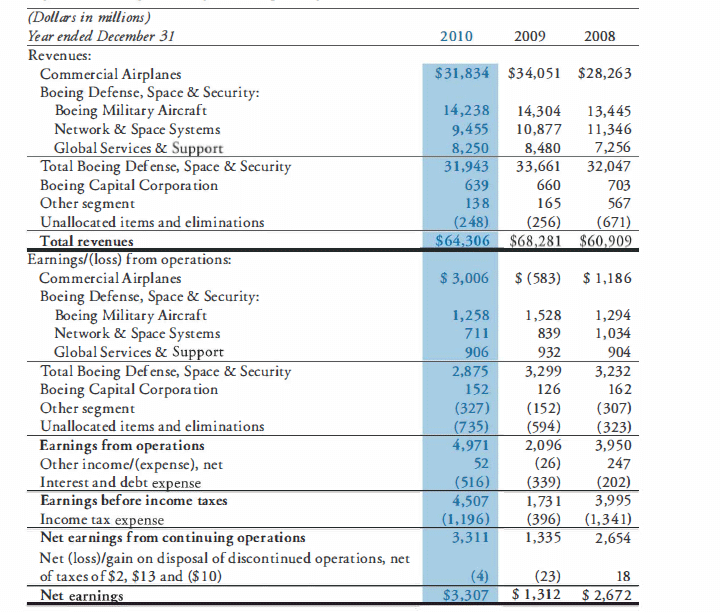

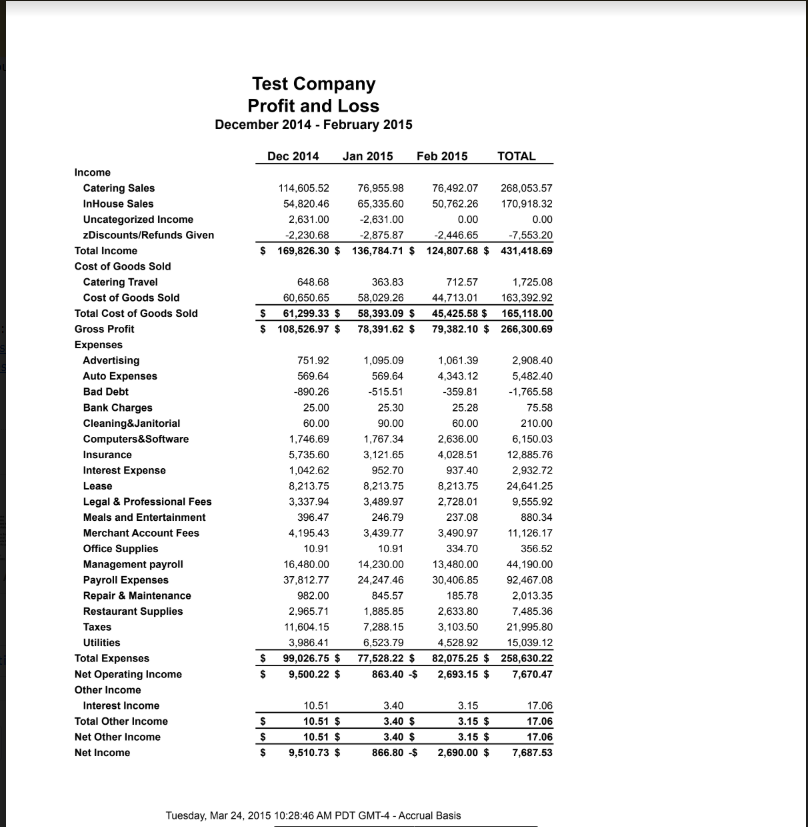

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

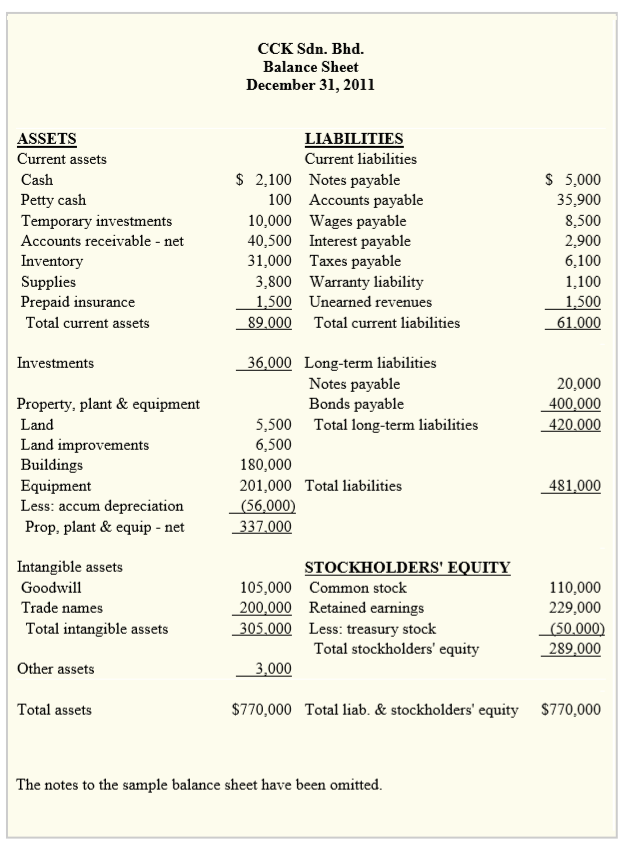

P&l account and balance sheet. A profit and loss account is an account that shows the revenue and expenses of the firm from business operations during a financial year. The p&l statement is one of the three most important financial statements for business owners, along with the balance sheet and the cash flow statement (or statement of cash flows). The main difference is that the balance sheet yields information regarding a company’s assets, liabilities, and shareholders’ equity, while the profit and loss statement summarizes information about revenues, and expenses.

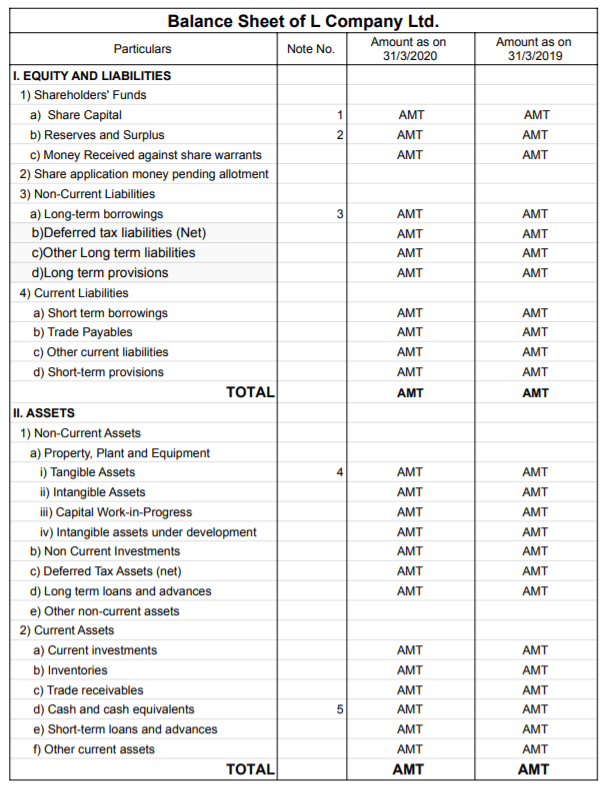

The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. The balance sheet is a statement of assets, liabilities, and equity. Such statements provide an ongoing record of a company's.

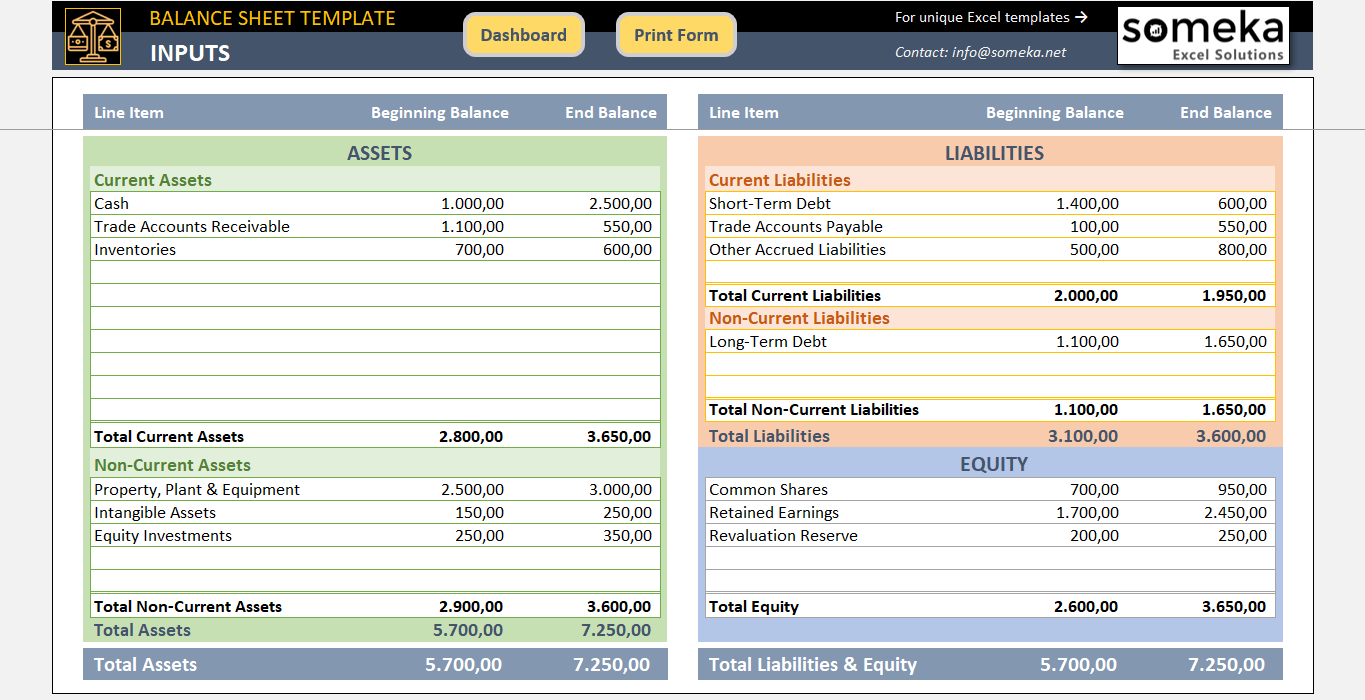

You will learn about these two types of g/l accounts in sap fi, important differences between them, and how to maintain them in relevant transaction (s). The balance sheet on the other hand, is a snapshot showing what the business owns and owes at a single moment in time. Profit and loss account vs balance sheet vs cash flow statement.

This profit and loss (p&l) statement template summarizes a company’s income and expenses for a period of time to arrive at its net earnings for the period. Online bookkeeping and tax filing powered by real humans. Balance sheets provide the basis for.

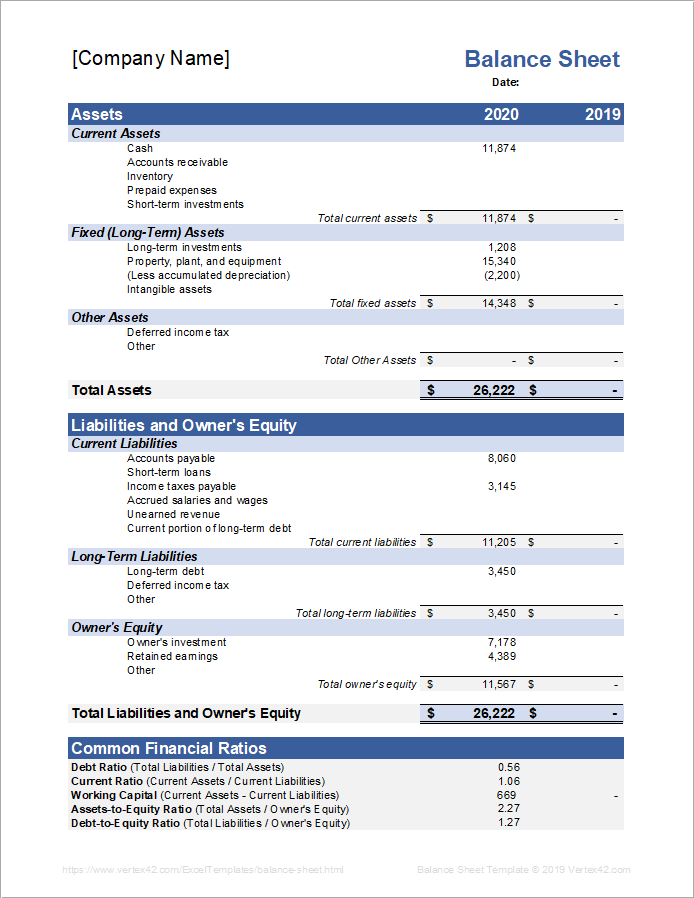

There are several key differences between the p&l and balance sheet, particularly the information presented and what it means. The balance sheet, by comparison, provides a financial snapshot at a given moment. Below is a screenshot of the p&l statement template:

Cash accounting is when the business enters the figures for revenue or expenditure on the transaction date. Think of the balance sheet as a bucket and the p&l as the flow of the water. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

They are both useful for evaluating the company’s value for purchase or sale. Profit and loss account. The balance sheet and the profit and loss (p&l) statement are two of the three financial statements companies issue regularly.

The balance sheet balances because assets (what’s owned) = liabilities (what’s owed) + owner’s equity (what’s left over for the owners). P&l statements can be created to analyze and compare business performance over a month, a quarter or a year, and are an effective tool to review cash flow and predict future business performance. The balance sheet vs.

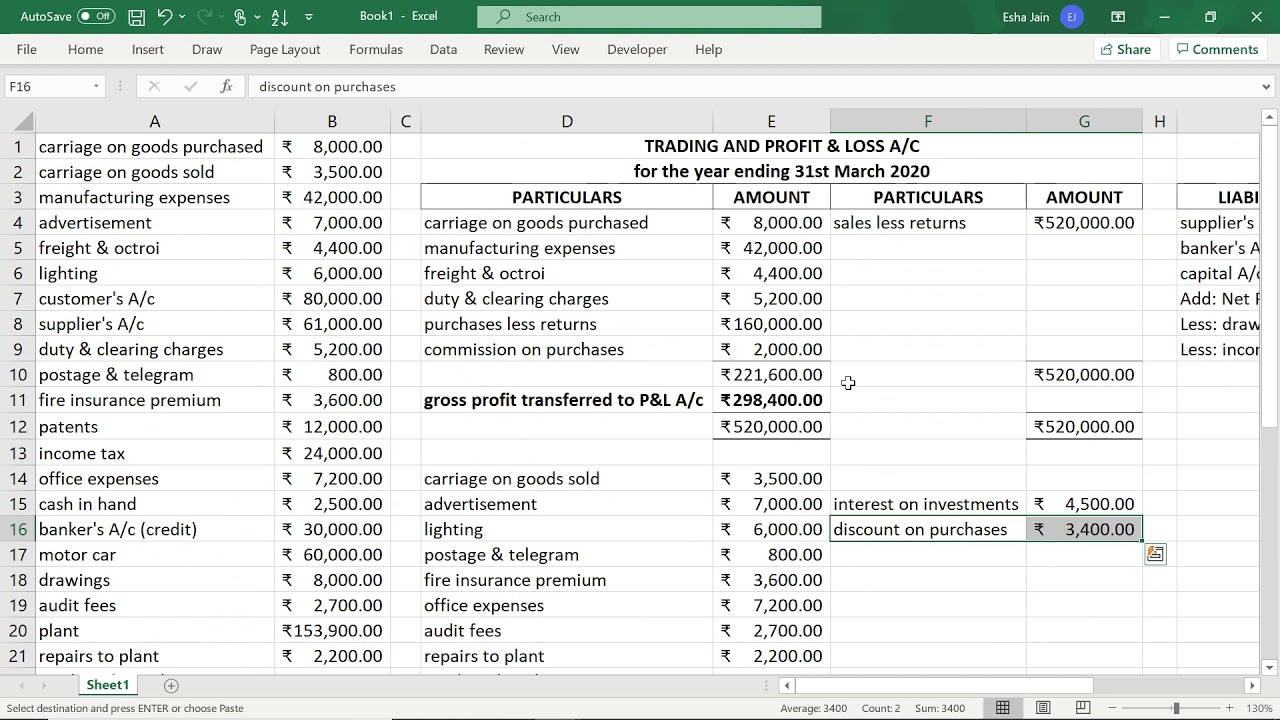

A profit and loss statement (p&l) is an effective tool for managing your business. Trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business while the profit and loss account is the second part of the account, which is used to determine the net profit of the business. Income statement difference between p&l and balance sheet | tabulation trial balance vs.

The term profit and loss (p&l) will refer to your financial statement. A p&l statement shows investors and other interested parties the amount of a company's profit or loss. The p&l statement is one of three financial.