Lessons I Learned From Tips About Forecasting Balance Sheet Items

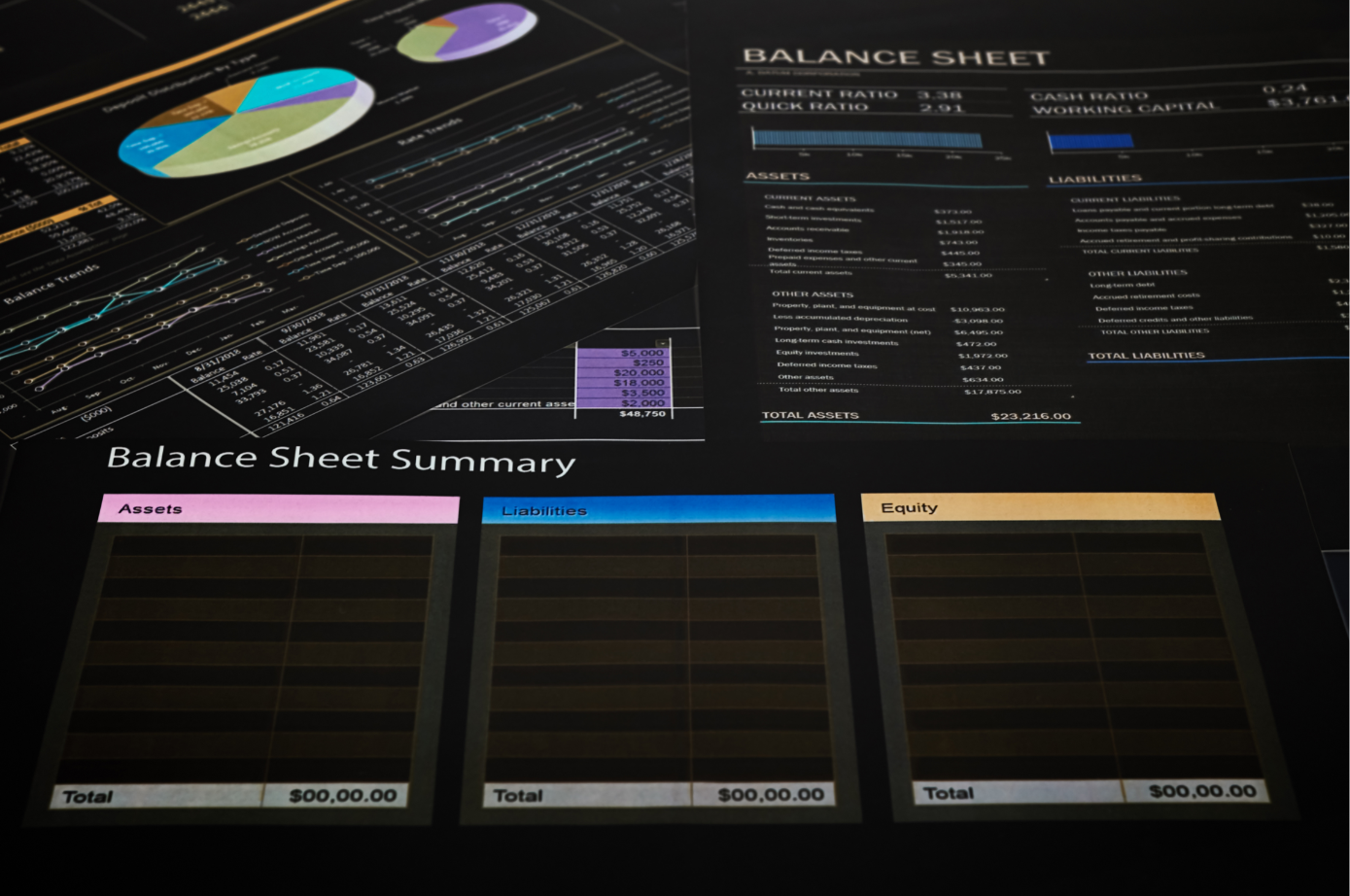

That's why we put together the ultimate balance sheet forecast guide with example calculations, tips and best practices.

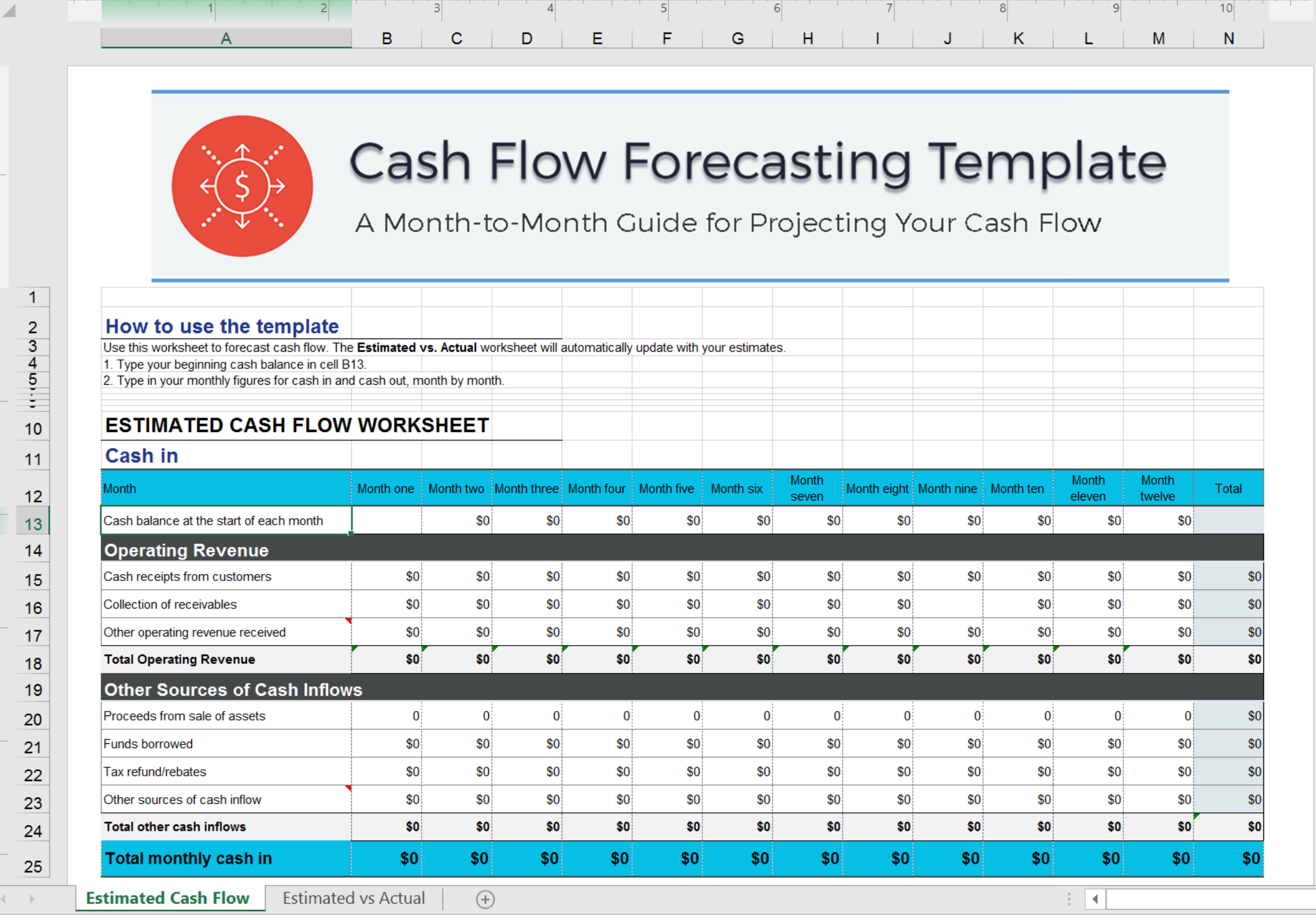

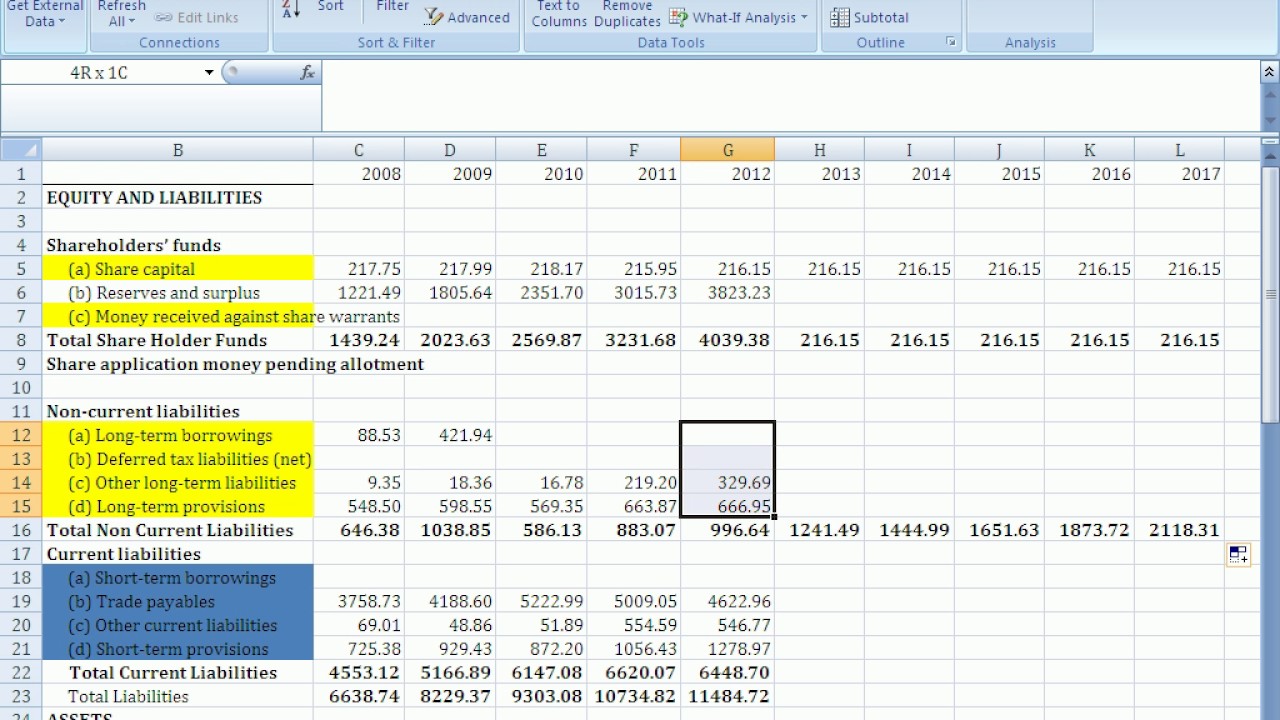

Forecasting balance sheet items. While the process can be complex and depends on various factors, here are some general steps to. This forecasting process is typically conducted using historical data and financial software to project the future state of the balance sheet. =sum (c8:c9) here, c8 and c9 cells refer to the values of $4,219,625 and $125,000.

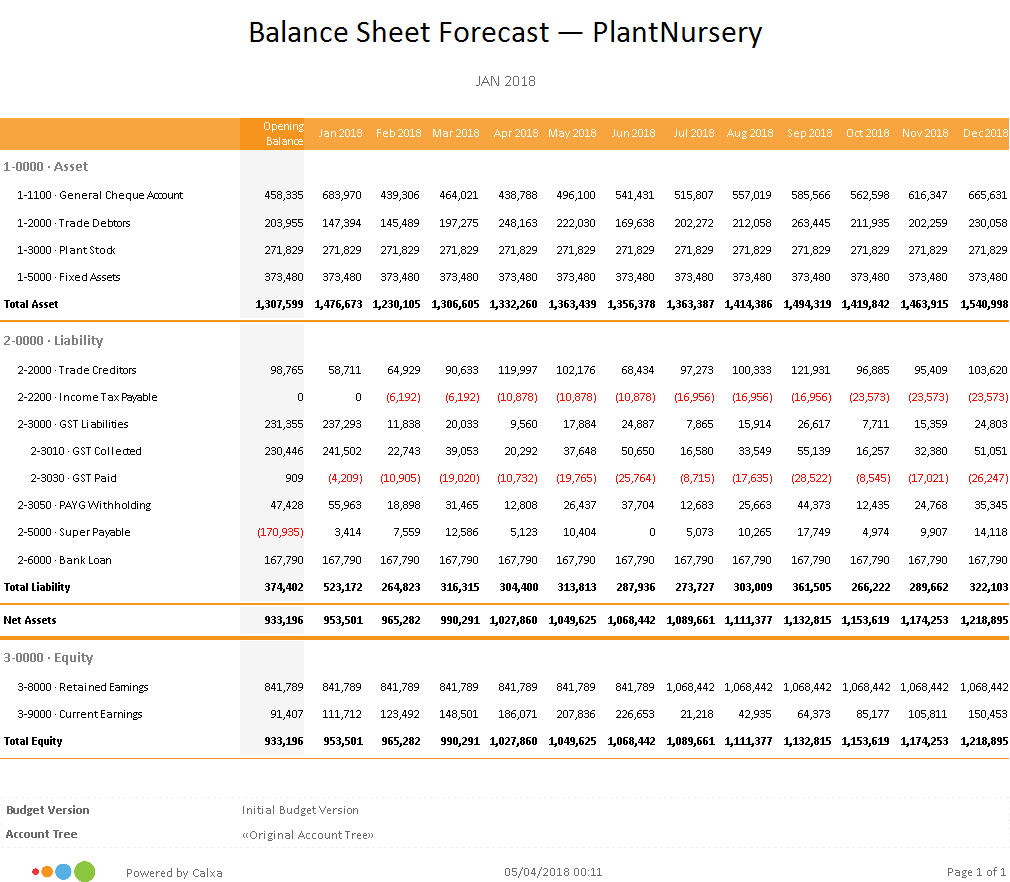

Relying on your appraiser to make estimates and guide the process; How to forecast a balance sheet? A balance sheet forecast is an estimation of your company’s assets, liabilities, and equity in the near future.

A balance sheet forecast is a projection of what your company’s assets, liabilities, and equity will be in the future, based on your understanding of current growth, historical trends, market and industry economics, and the strategic financial initiatives you have in play currently. A simplified approach using percentages of revenue; A projected balance sheet also starts with forecasting sales revenues.

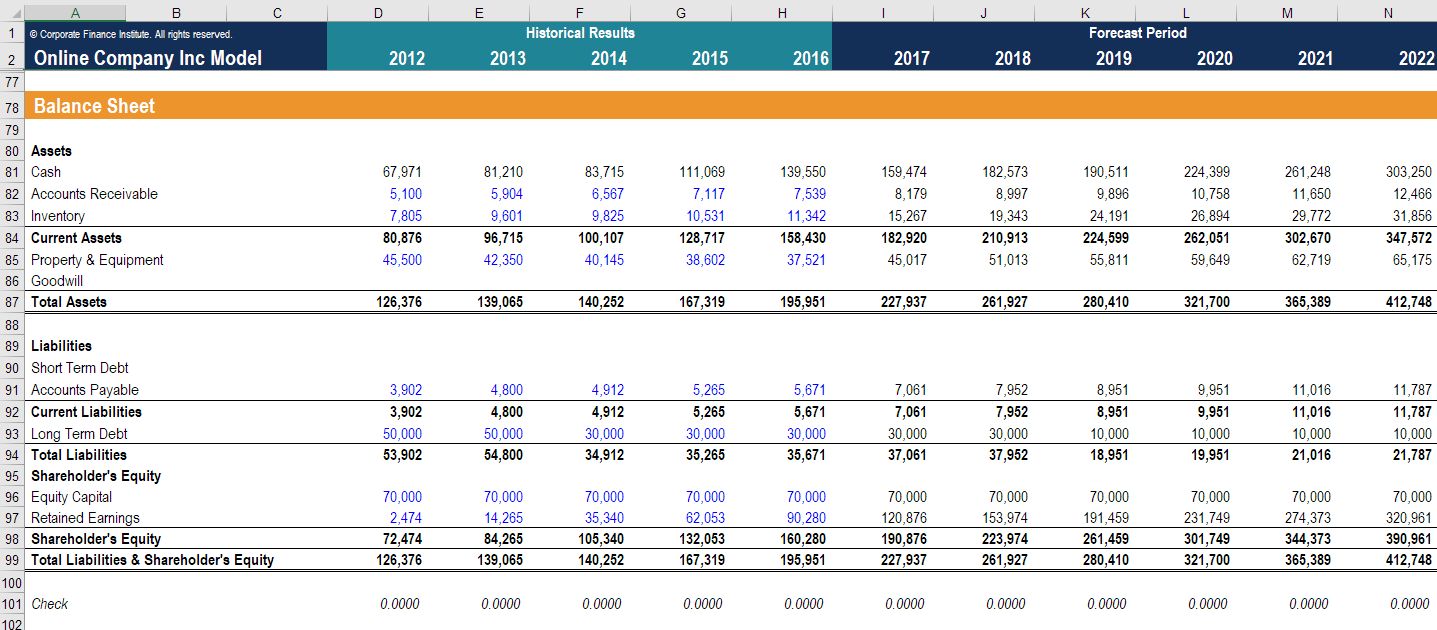

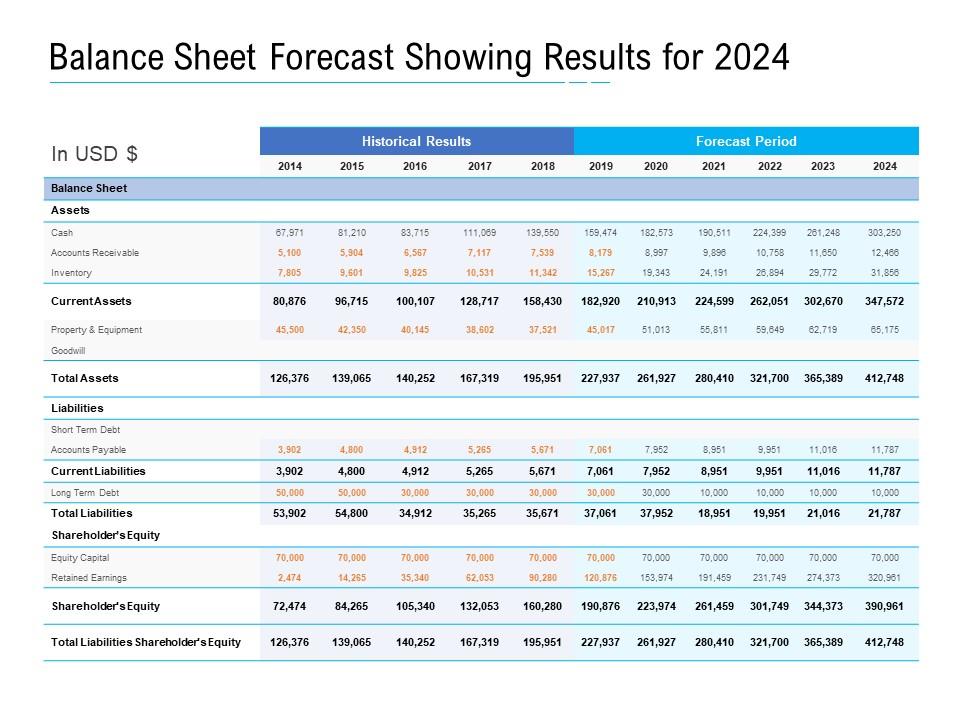

Balance sheet forecast items. The forecasts are based on the current balance sheet. You’ll also see an example of how to check your work, how to tell when you’ve linked something incorrectly, and what to do with more “random” line items.

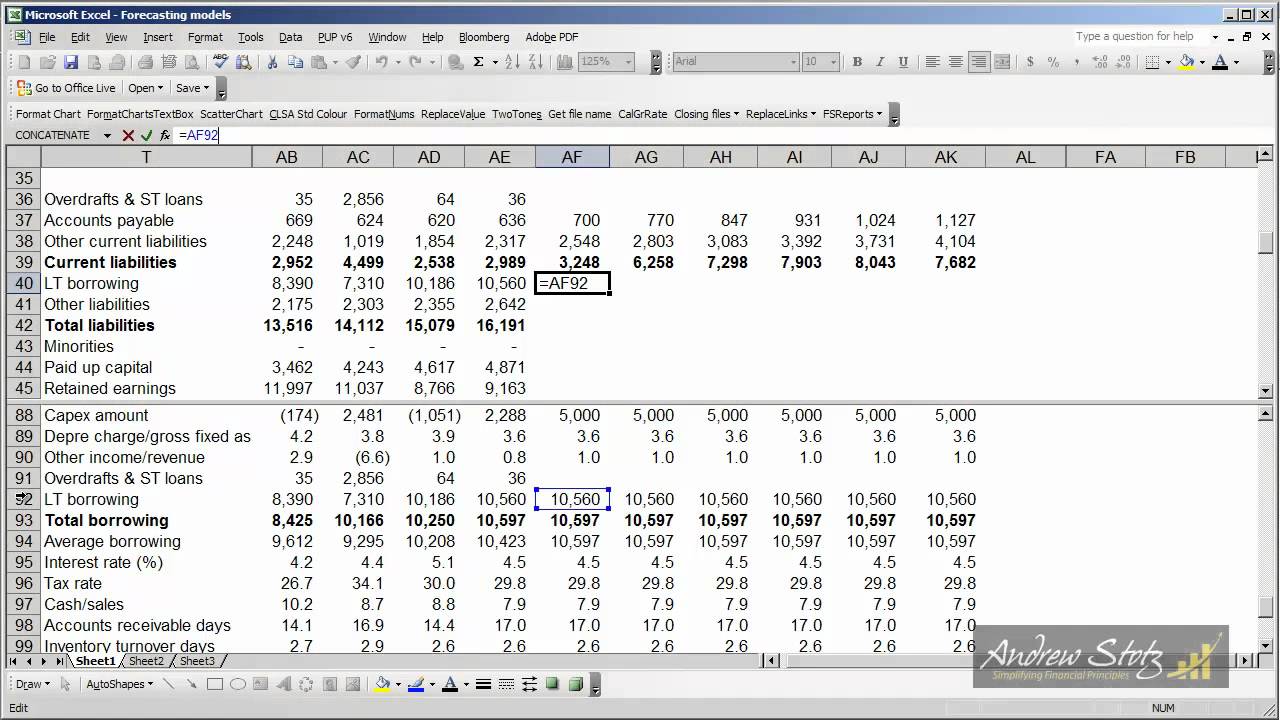

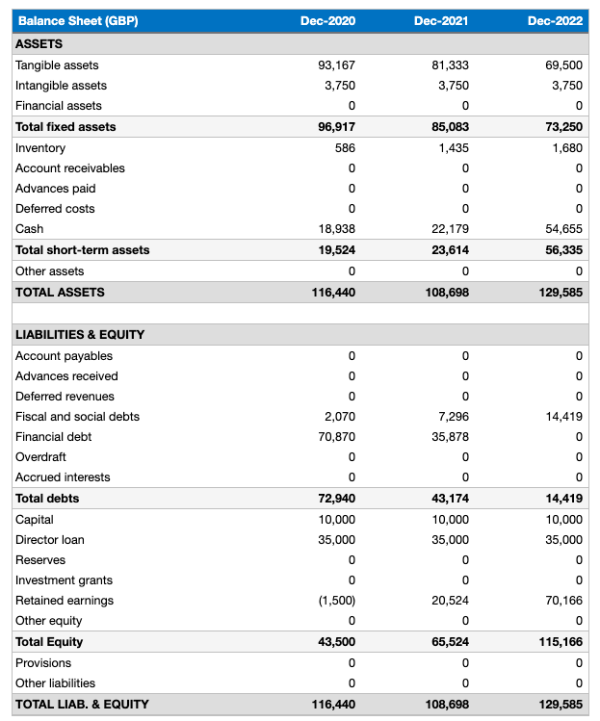

Follow these steps to forecast a balance sheet: Projecting balance sheet line items involves estimating the values of various assets, liabilities, and equity accounts to forecast the future financial position of the organization. While every balance sheet looks a little different, there are a few major line items that will be consistent across every business.

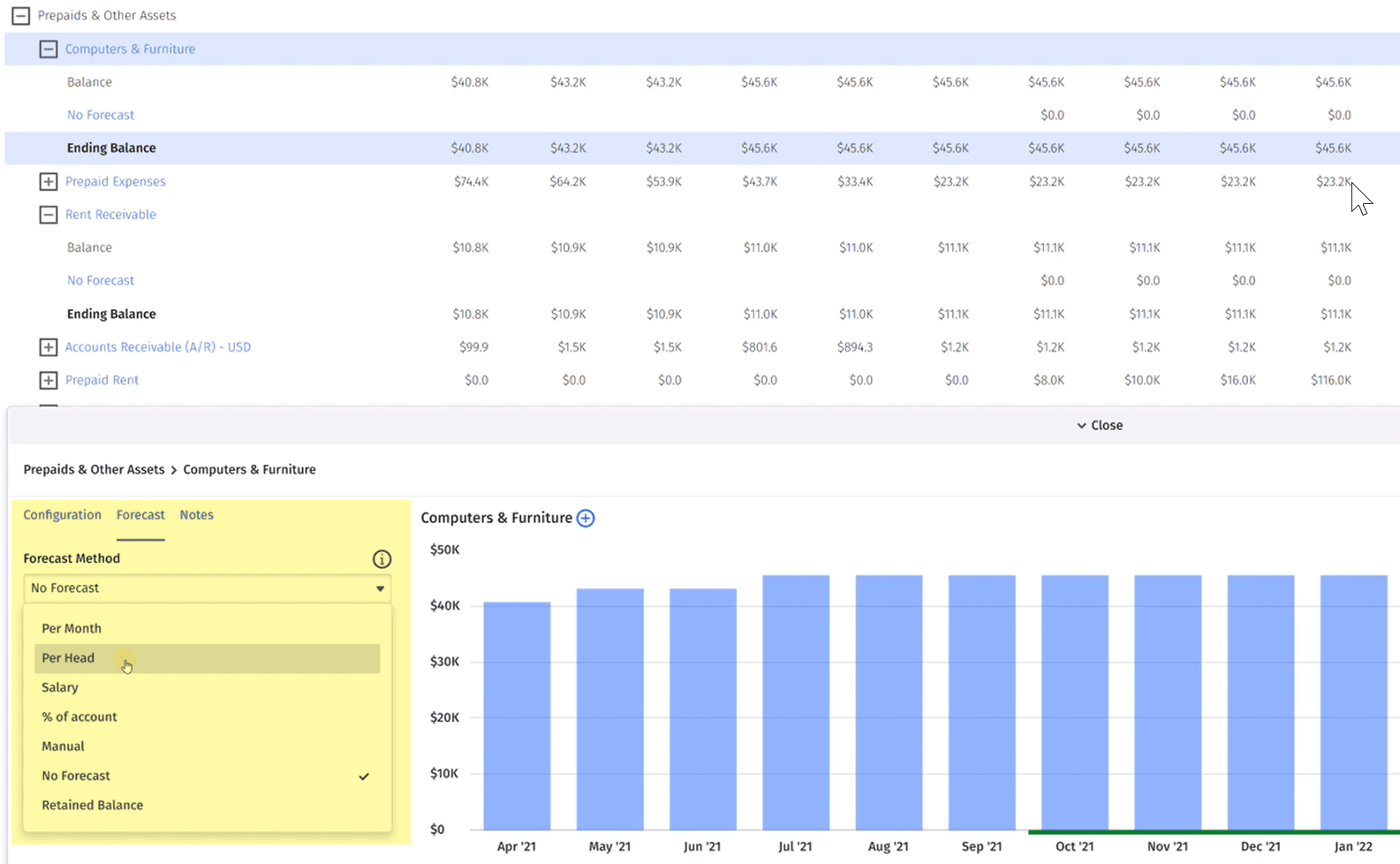

As part of the financial modeling process, analysts will need to forecast the company’s balance sheet. In this tutorial, you will learn which income statement line items should be linked to balance sheet accounts such as accounts receivable, prepaid expenses, and deferred revenue. A balance sheet projection (also called a balance sheet forecast) is a guide to a business’s financial situation in the future.

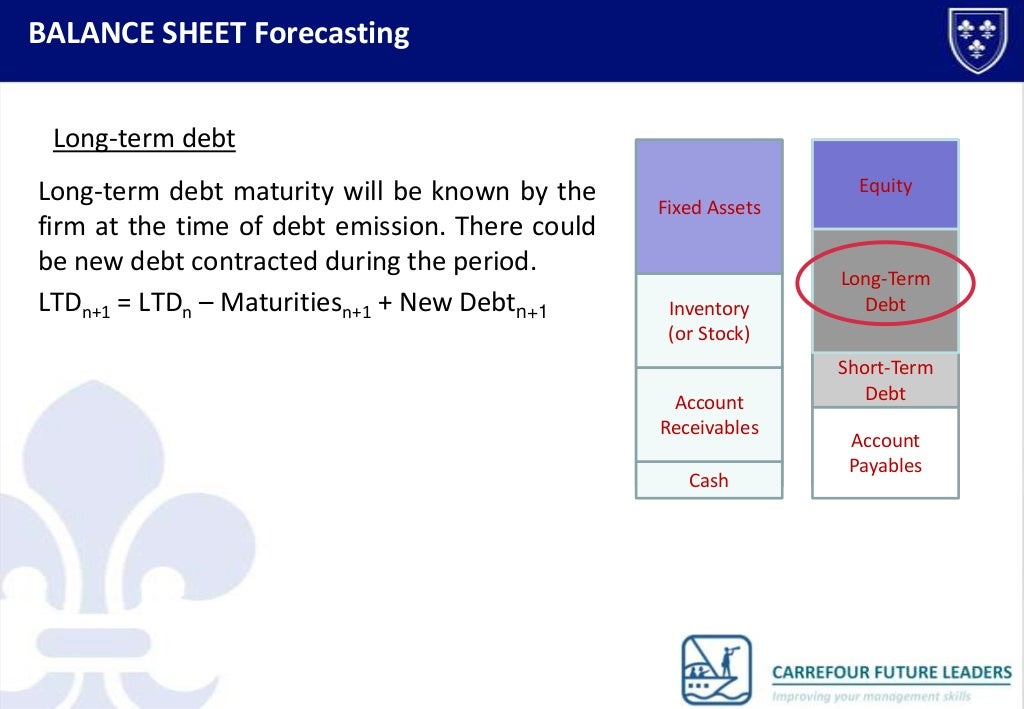

Balance sheet forecasting is a dynamic financial analysis process that extends beyond a mere snapshot of an organization's financial position. This will help show how the assets and liabilities are ‘moving’ through the forecasted period. As we forecast out assets and liabilities, we have to think about what are the “drivers” behind each specific item.

Next, go to the c10 cell and use the sum function as shown below. Business plans often focus on anticipated future sales. Forecasting a balance sheet by estimating the assets, equity, and liabilities at a specific point in the future, companies can make informed decisions about their capital, debt, and other financial aspects.

Importance of forecasting balance sheet items. Certain balance sheet items, such as inventory, accounts receivable. Net working capital is the total of your current assets and liabilities.

What is “forecasting balance sheet line items”? How to forecast the balance sheet? Forecasting a balance sheet involves predicting the future financial position of a company by estimating its assets, liabilities, and equity.