Build A Tips About Balancing The Balance Sheet

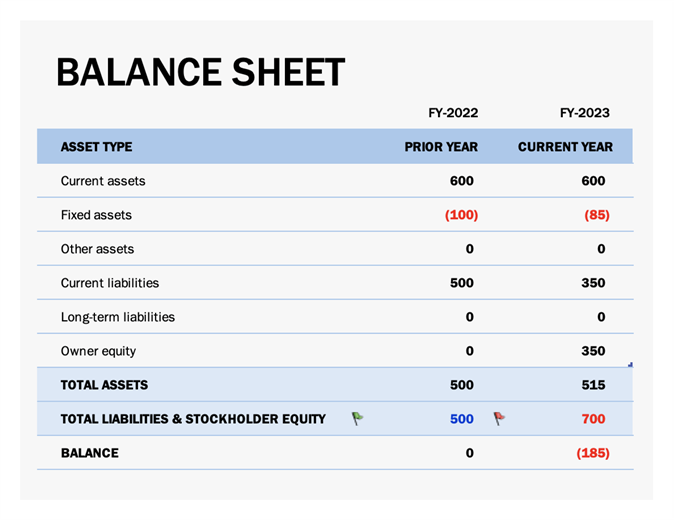

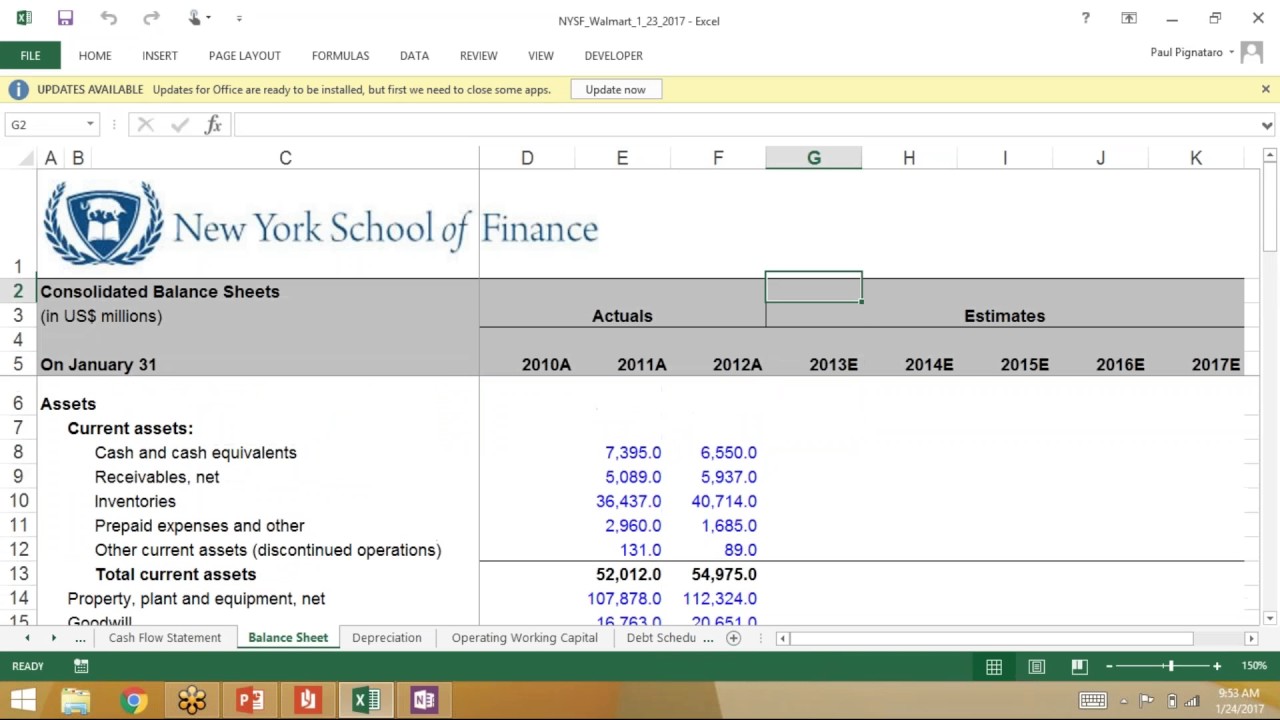

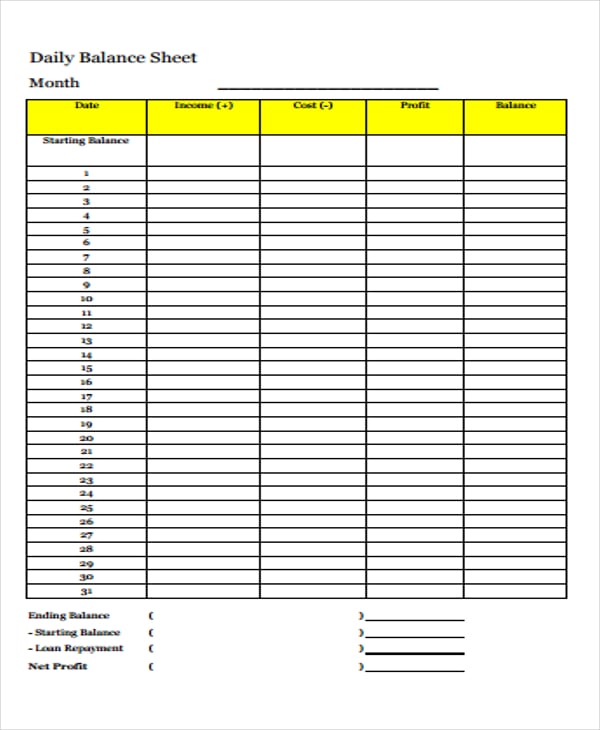

This session will show you a simple trick to get your balance sheet to balance first time, every time using simple modelling techniques, a little accounting knowledge, gratuitous use of error checks and a very basic control account.

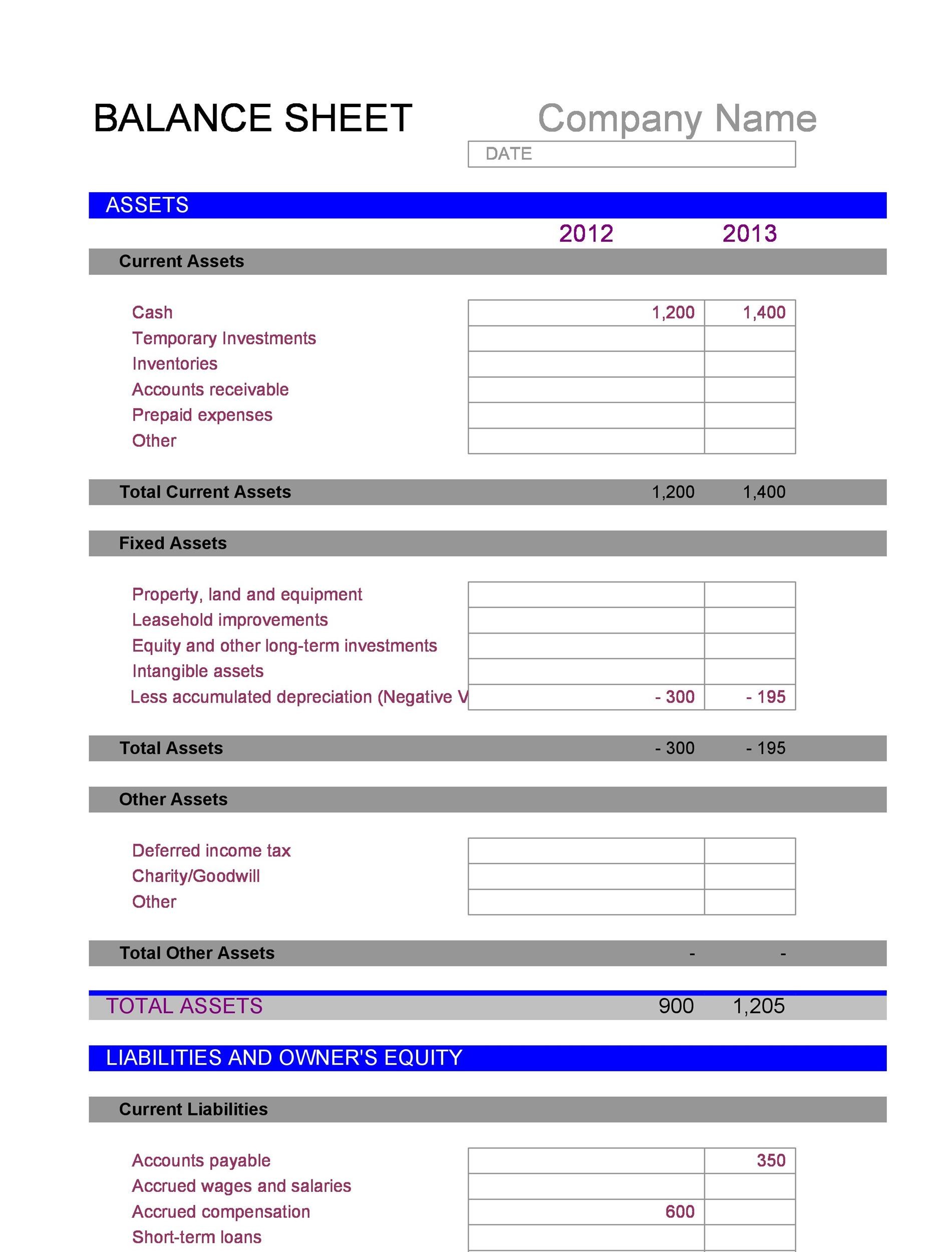

Balancing the balance sheet. Hence, a balance sheet should always balance. The “balance” in balance shee t indicates the 2 sides have to balance every time. This means that the assets of a company should equal its liabilities plus any shareholders’ equity that has been issued.

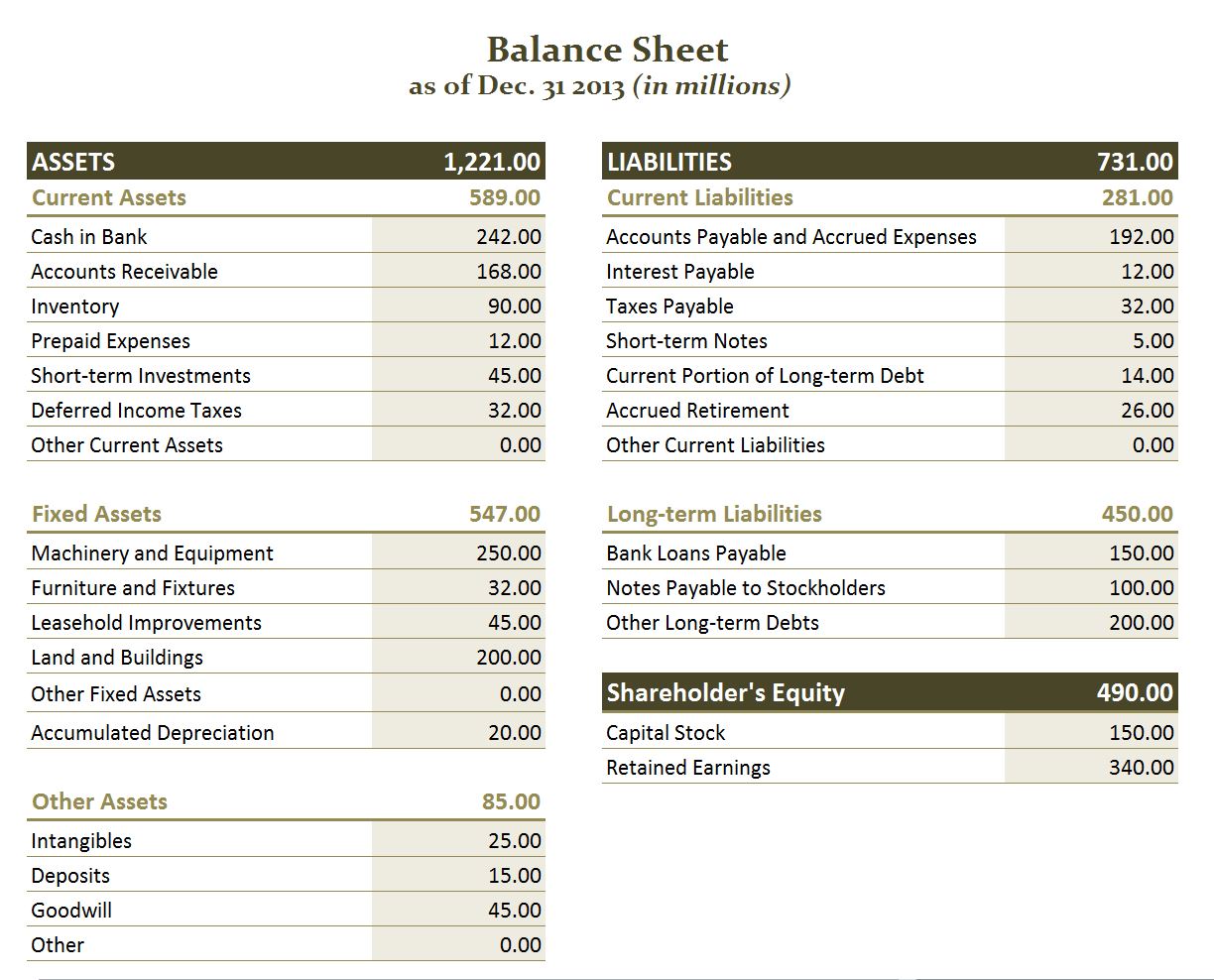

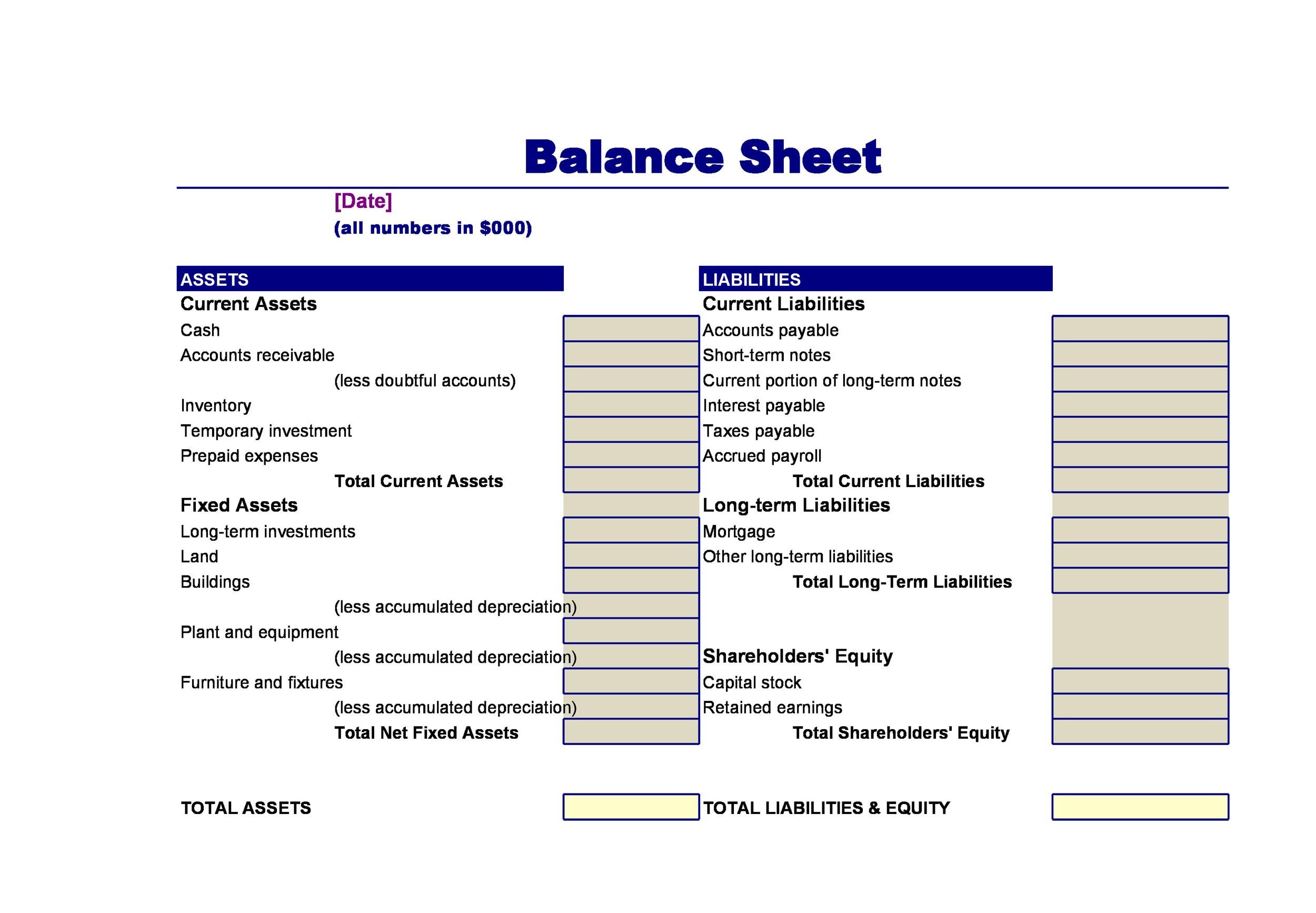

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. The purpose of balancing the balance sheet is to create a snapshot of the company’s financial status. Now, let’s walk through the steps needed in order to know how to start balancing the balance sheet.

Assets = liabilities + equity. Balancing the balance sheet. The balance sheet is based on the fundamental equation:

Assets, liabilities, and shareholder’s equity. A balance sheet is guided by the accounting equation:

The balance sheet presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time, highlighting its financial position. Be in control of your modelling and account for your outputs efficiently and effectively. A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date.

In other words, the balance sheet looks at what the company owns, how much it owes to debtors, and how much is invested. Wire the balance sheet so that it always balances by making retained earnings equal to total assets less total liabilities less all other equity accounts. It highlights three important categories:

Often, the reporting date will be the final day of the accounting period. For the balance sheet to balance, total assets should equal the total of liabilities and shareholders' equity. On the other hand, the income statement offers a dynamic view of a company’s profitability over a particular period, showcasing its revenue, expenses, and net income.

Both parts should be equal to each other or balance each other out. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Therefore, the company ‘s assets always have to equal liabilities plus owners’ equity.

Determine the reporting date and period. Balance sheets provide the basis for.