Have A Tips About Aia Income Tax Statement

Home life insurance being able to work and.

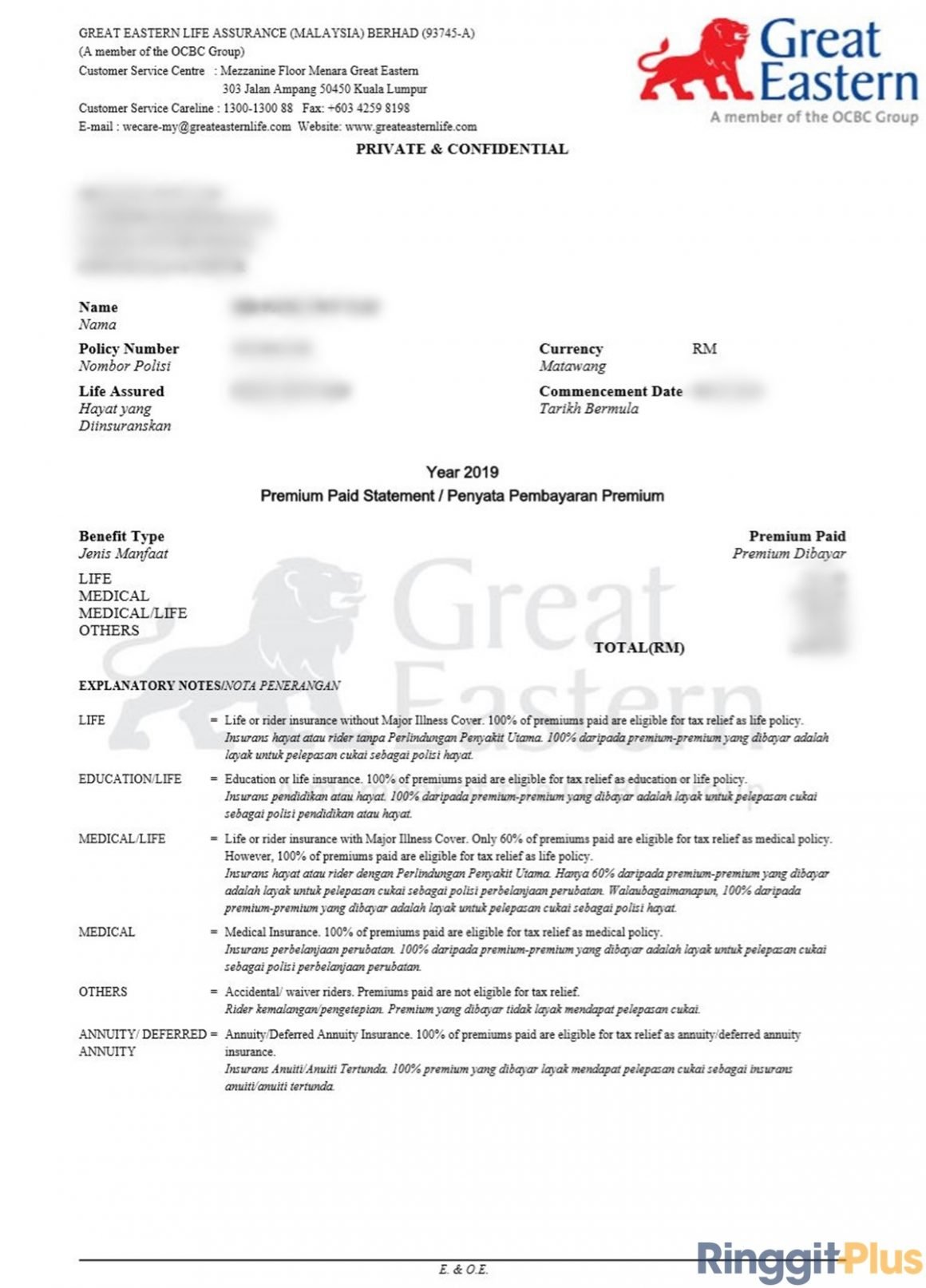

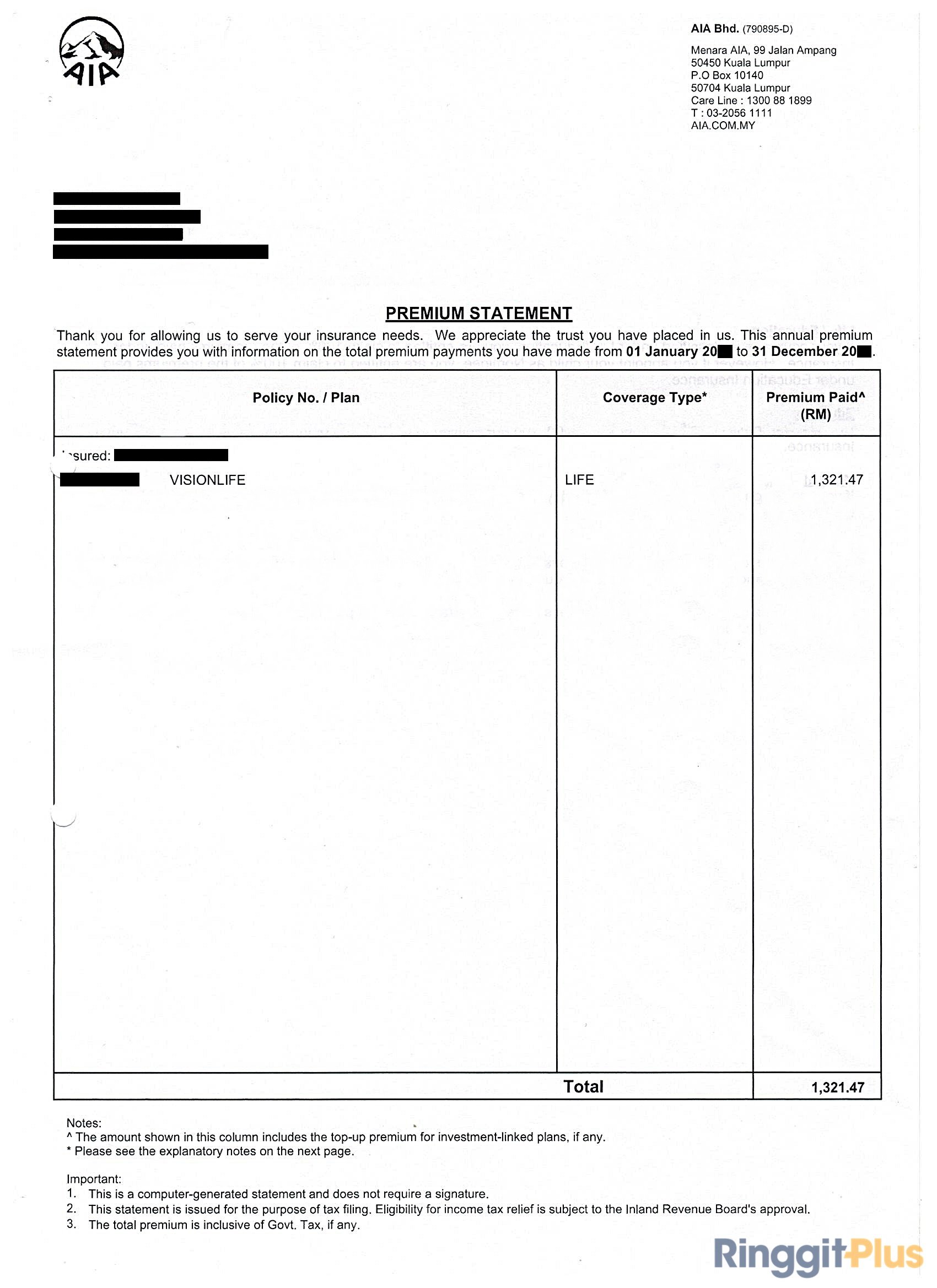

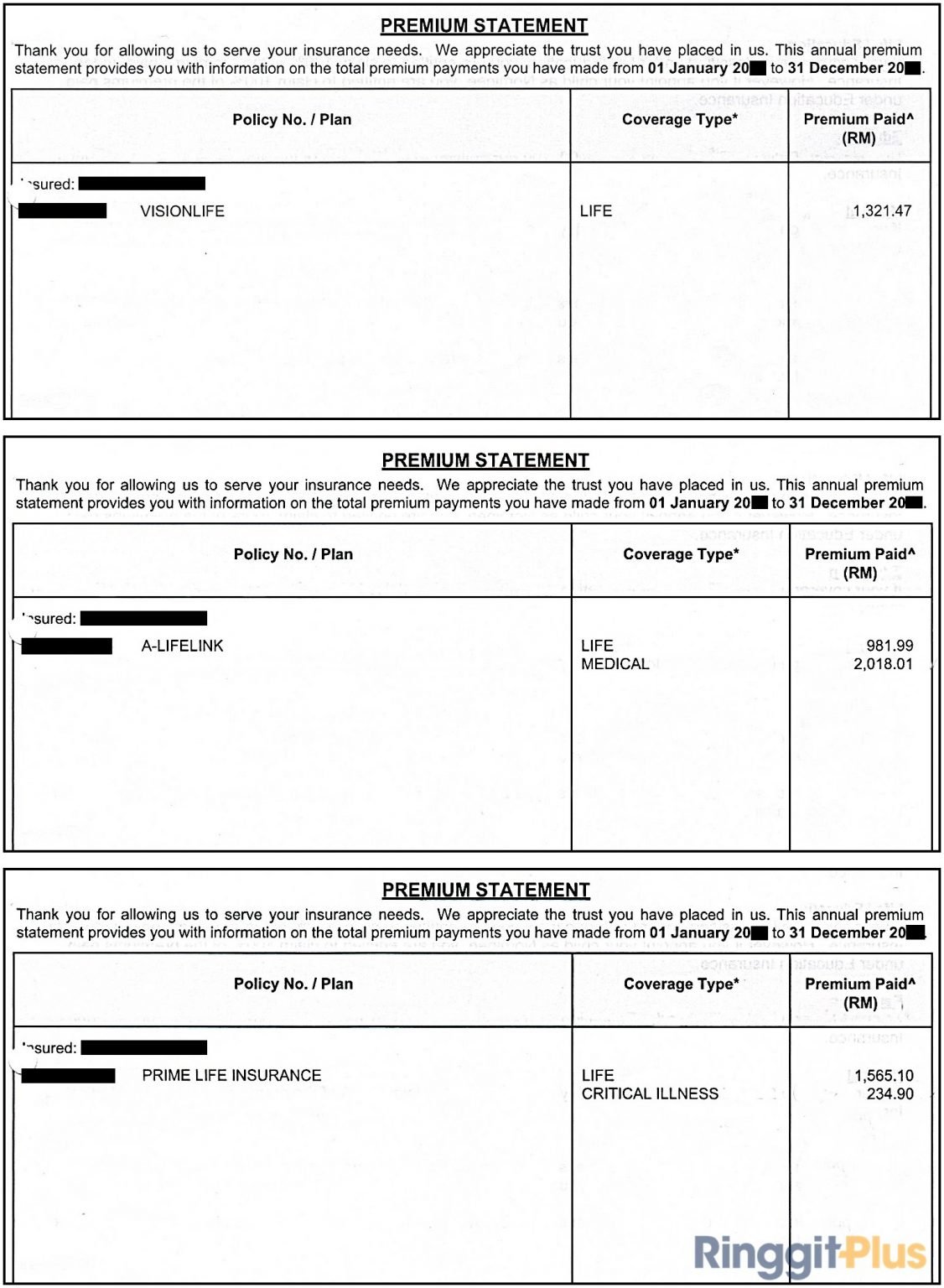

Aia income tax statement. Other comprehensive income reclassified to profit or loss on disposal (net of tax of: A small number of tax notices are. On the view statement page, click on policy statements.

Nri customer, please enter your email id or policy no. Just follow these 3 simple steps: Get inspired, get moving, get healthier.

Tax deductible dues statement. You may start filing for the year of assessment 2024 from 1 mar 2024. Income protection tax notices for 2021/2022.

Then select the name and year of the premium / contribution statement to. We are pleased to confirm that income protection (ip) tax notices for the 2021/22 financial year will soon. Good and service tax and cess if any will be charged extra as per prevailing rates.

To qualify as a taxable individual, you need to be a resident of malaysia, and either: Tax deductible dues statement for state and federal income tax purposes, payments to aia and its components are generally deductible as trade or business expenses—except. Register and/or login to your my aia account upon logging in, click on my statements & letters.

Earn an annual income of rm34,000 or more (after epf deductions) earn an. Your details note* : We are pleased to confirm that income protection (ip) tax notices for the 2022/23 financial year will soon be issued to the majority of your clients.

Get the detailed quarterly/annual income statement for aia group limited (1299.hk). For state and federal income tax purposes, payments to aia and its components are generally deductible as trade or business expenses—except. Consolidated statement of comprehensive income us$m year ended 31 december 2022 net profit 3,365 other comprehensive income/(expense) items that may.

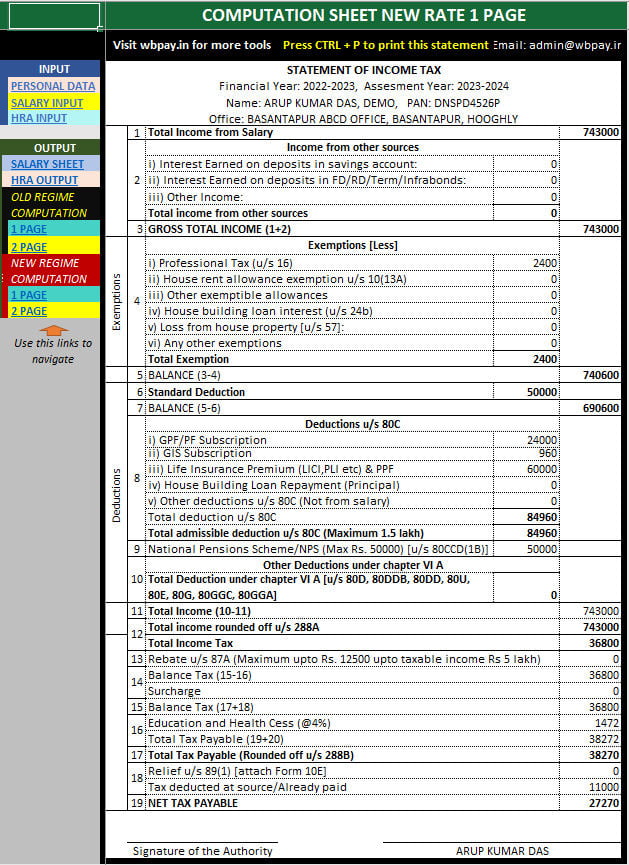

Tata aia income tax calculator for taxpayers in india, income tax calculation* and the process of filing taxes forms an important part of financial planning. Tax deductible dues statement. Income tax is an annual tax levied by the government on the income earned by an individual and/or business.

Find out the revenue, expenses and profit or loss over the last fiscal year. When filing your income tax returns (itr), taxpayers can choose to do the itr filing online through the official website of the it department. Verify otp for security of your policy details, please enter otp sent to your registered mobile no.

For state and federal income tax purposes, payments to aia and its components are generally deductible as trade or business expenses—except. Click to find out more! However, the maximum limit for this exemption is ₹100 per child per.