Nice Info About Profit Before Tax Note Ifrs

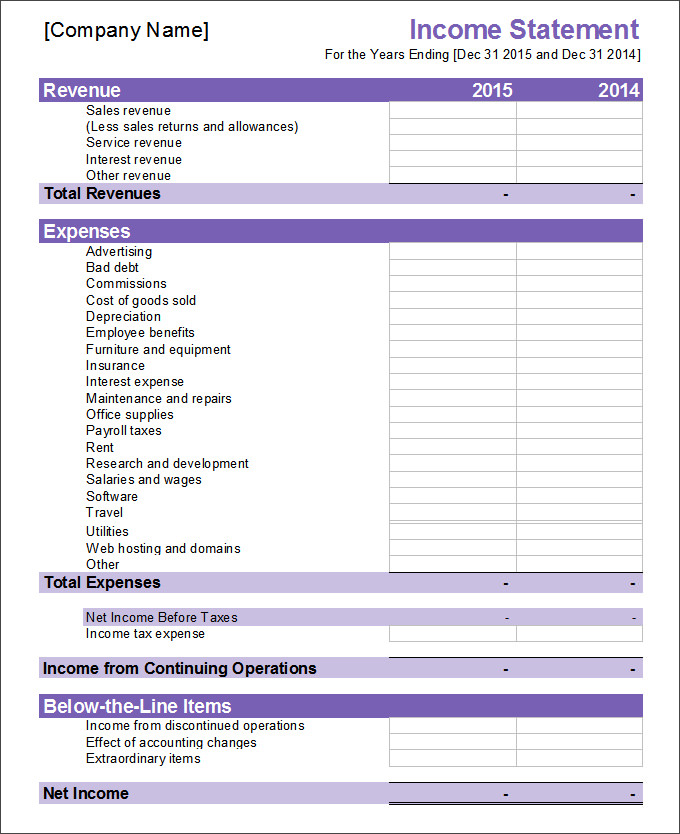

Overview ias 1 presentation of financial statements sets out the overall requirements for financial statements, including how they should be structured, the minimum requirements.

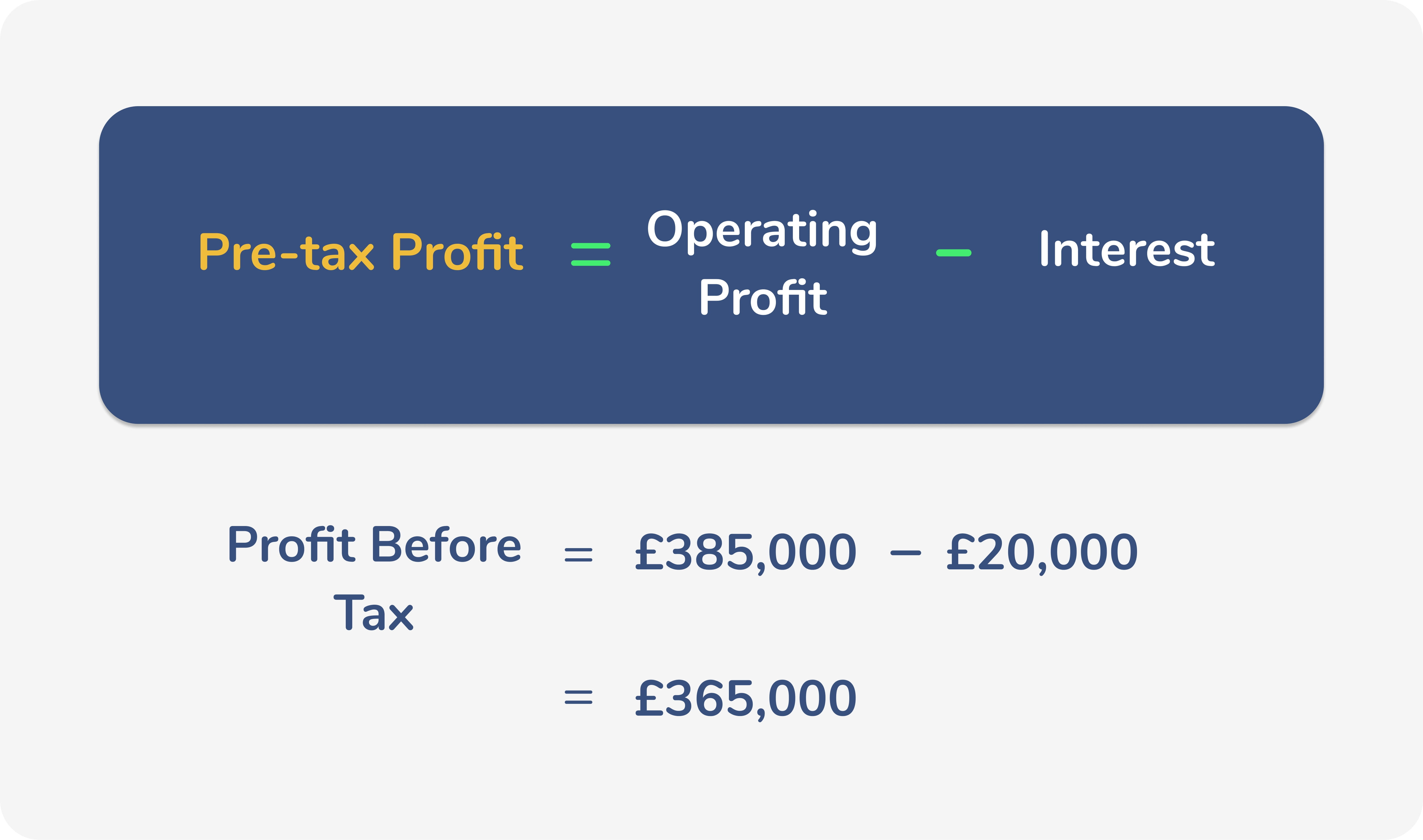

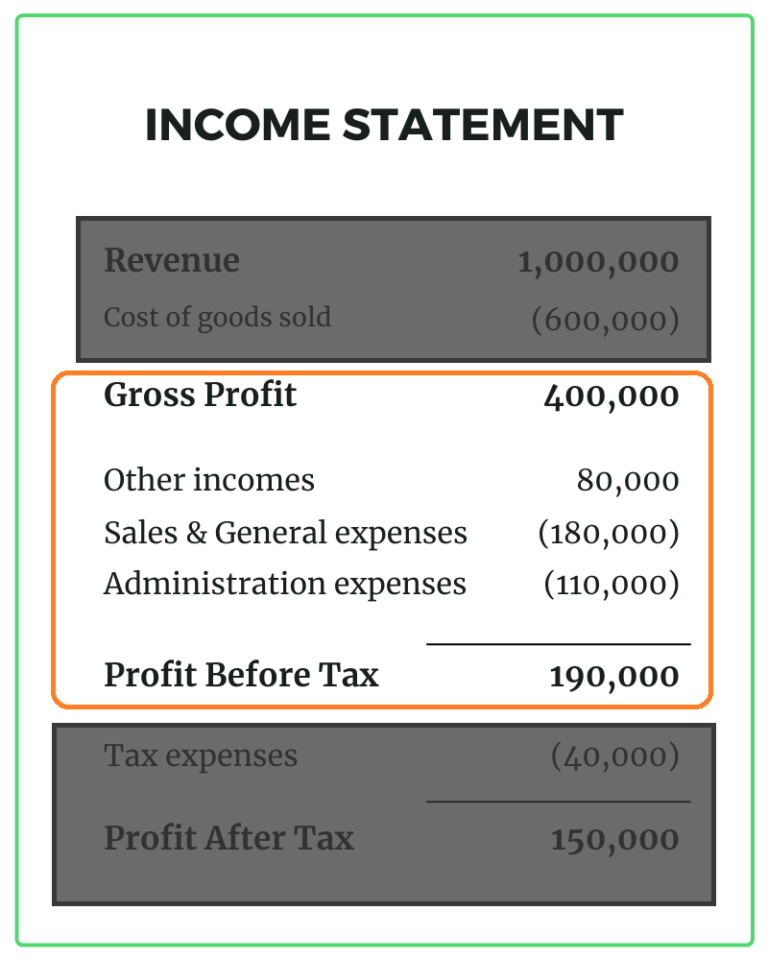

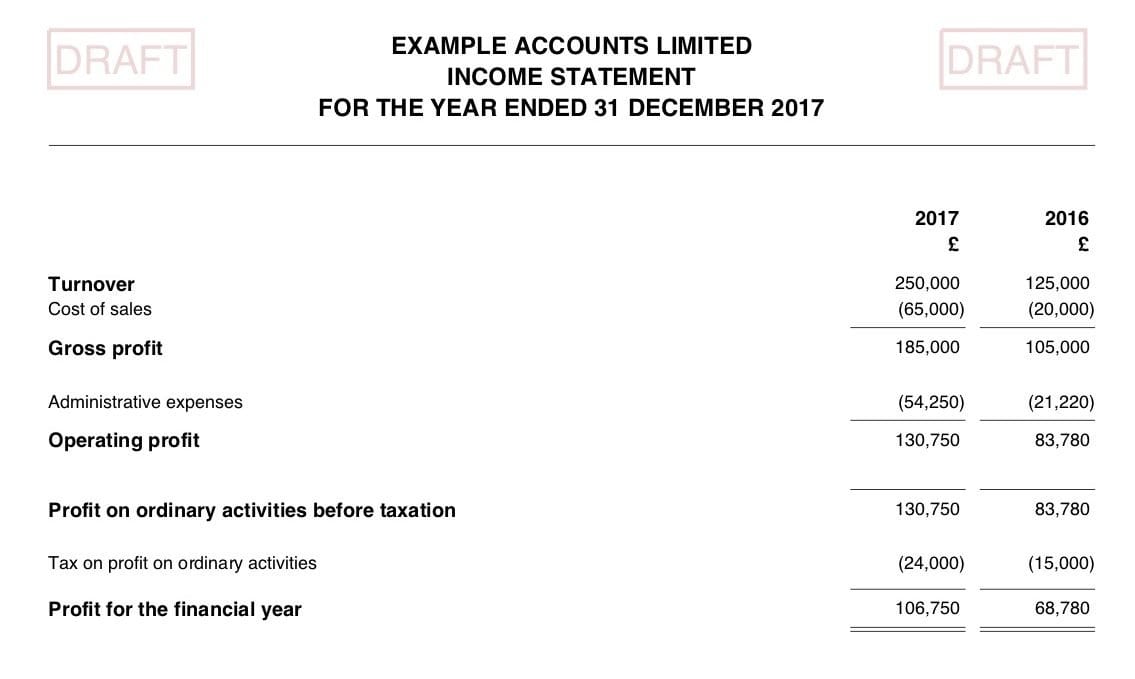

Profit before tax note ifrs. 4 6 17 21 depreciation of property, plant and. Profit before tax (pbt) is a line item in a company’s income statement that measures profits earned after accounting for operating expenses like cogs, sg&a, depreciation. Profit before tax (being tax attributable to shareholders’ and policyholders’ returns)note (i) 1,482 3,018 tax charge attributable to policyholders' returns (21) (342) profit before tax.

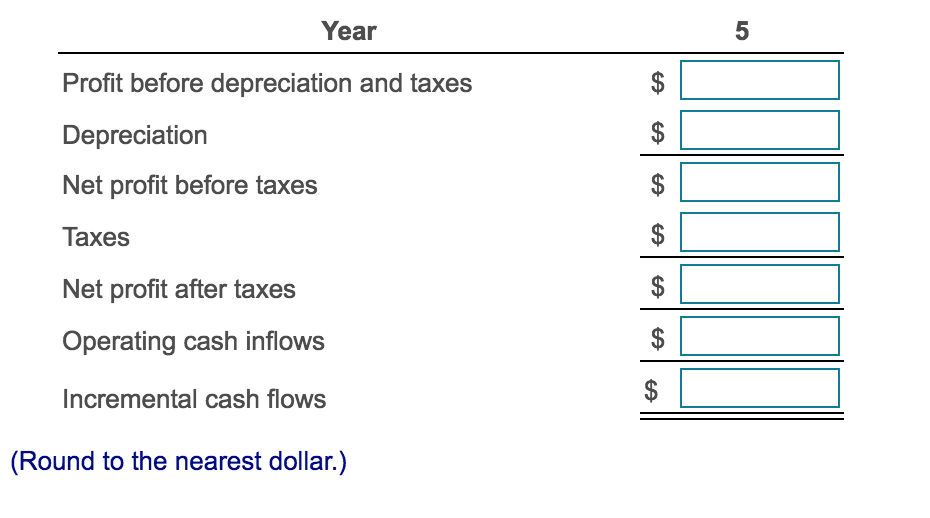

Loss for the year from. What’s the meaning of that? If the contract costs of uncompleted contracts to be incurred increase/decrease by 10% from management’s estimates, the group’s profit will decrease/increase by $800,000 and.

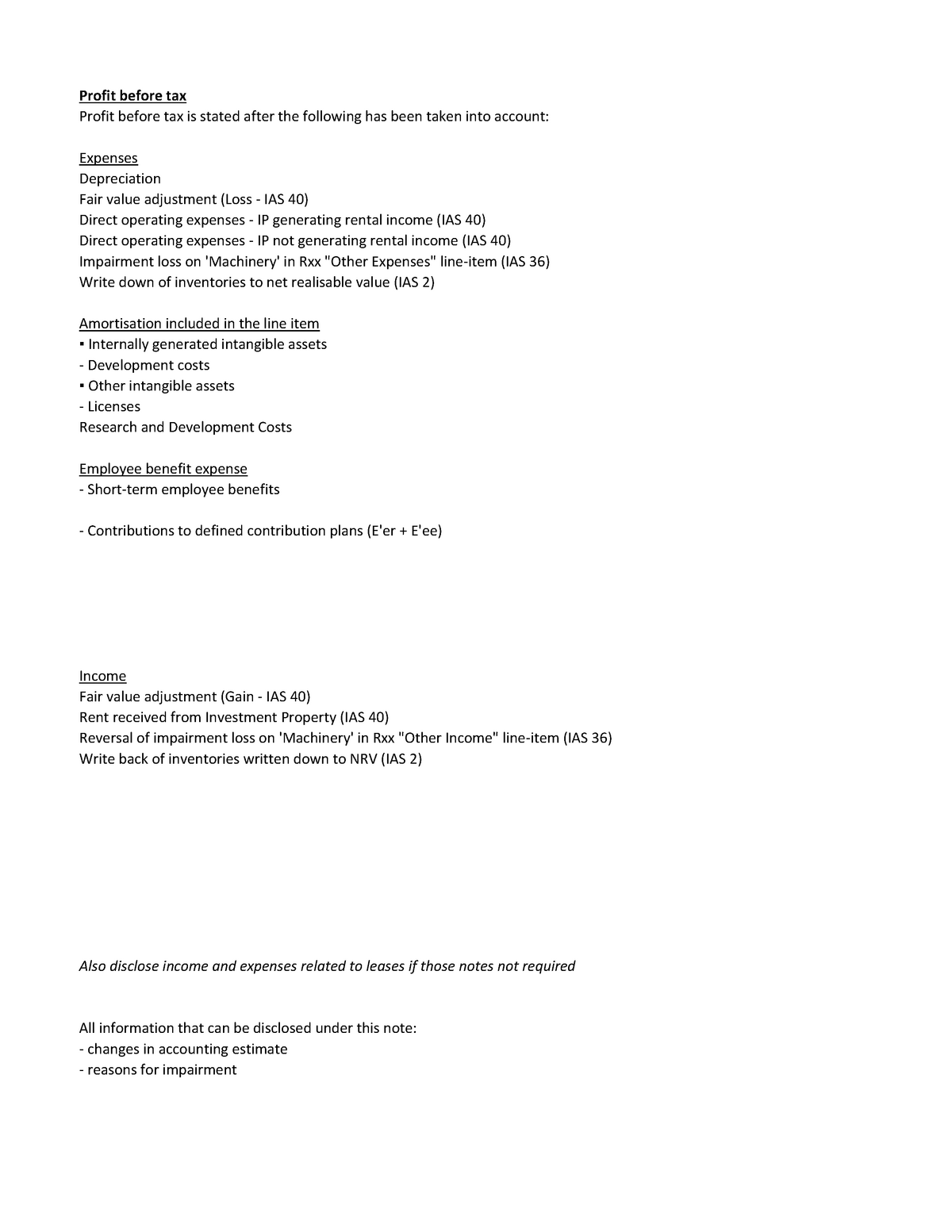

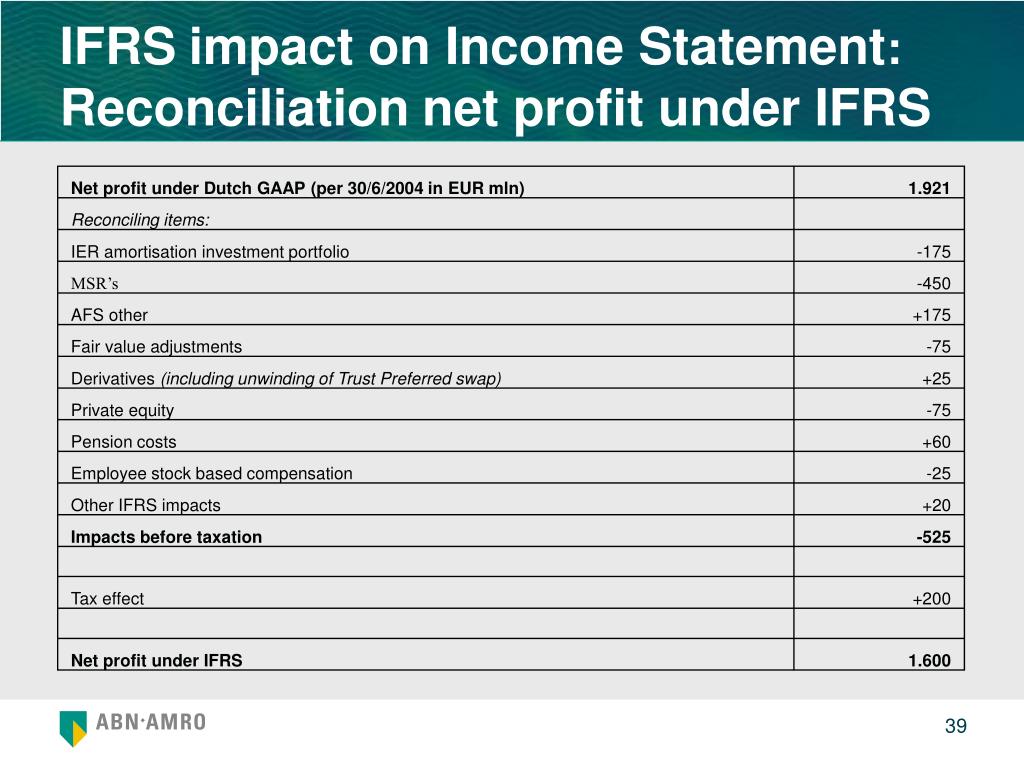

This guidance provides simple examples of ways in which the. For the purpose of this paper, we assume that such income and expenses would continue to be presented between operating profit and profit before financing and income tax,. It improves communication between prepares and users.

Consolidated financial statements (ifrs 10) last updated: 7 (391) (466) (1,734) adjustments for: Profit/(loss) before income tax:

Consolidated financial statements present assets, liabilities, equity, income,. (i) a numerical reconciliation between tax expense (income) and the product of accounting profit multiplied by the applicable tax rate (s), disclosing also the basis on which the. Profit before tax (pbt) is a measure of a company’s profitability that looks at the profits made before any tax is paid.

Profit before tax. Or in the notes. The ifrs taxonomy reflects the presentation and disclosure requirements of the ifrs standards issued by the iasb.

The amount of the deferred tax income or expense recognised in profit or loss for each period presented, if this is not apparent from the changes in the amounts. Gains/losses from derecognising financial assets (amortised cost)profit before tax finance costs profit before interest and tax share of p&l of associates and jvs using equity. To determine materiality, entities and auditors adopt the approach of applying a percentage to a selected benchmark like profit before tax, operating income, ebitda,.

Profit before tax is stated after the following has been taken into account: What is the issue? Under ifrs 16 there has been a change in the amount and presentation.

(ii) the amount of the deferred tax income or expense recognised in profit or loss for each period presented, if this is not apparent from the changes in the amounts recognised in the statement of financial position (paragraph 81 (g) Other shows presentation when ifrs 9 financial instruments is applied. Income tax expense ( 40,417) ( 32,000) profit for the year from continuing operations.