Real Info About Accruals In Cash Flow Statement

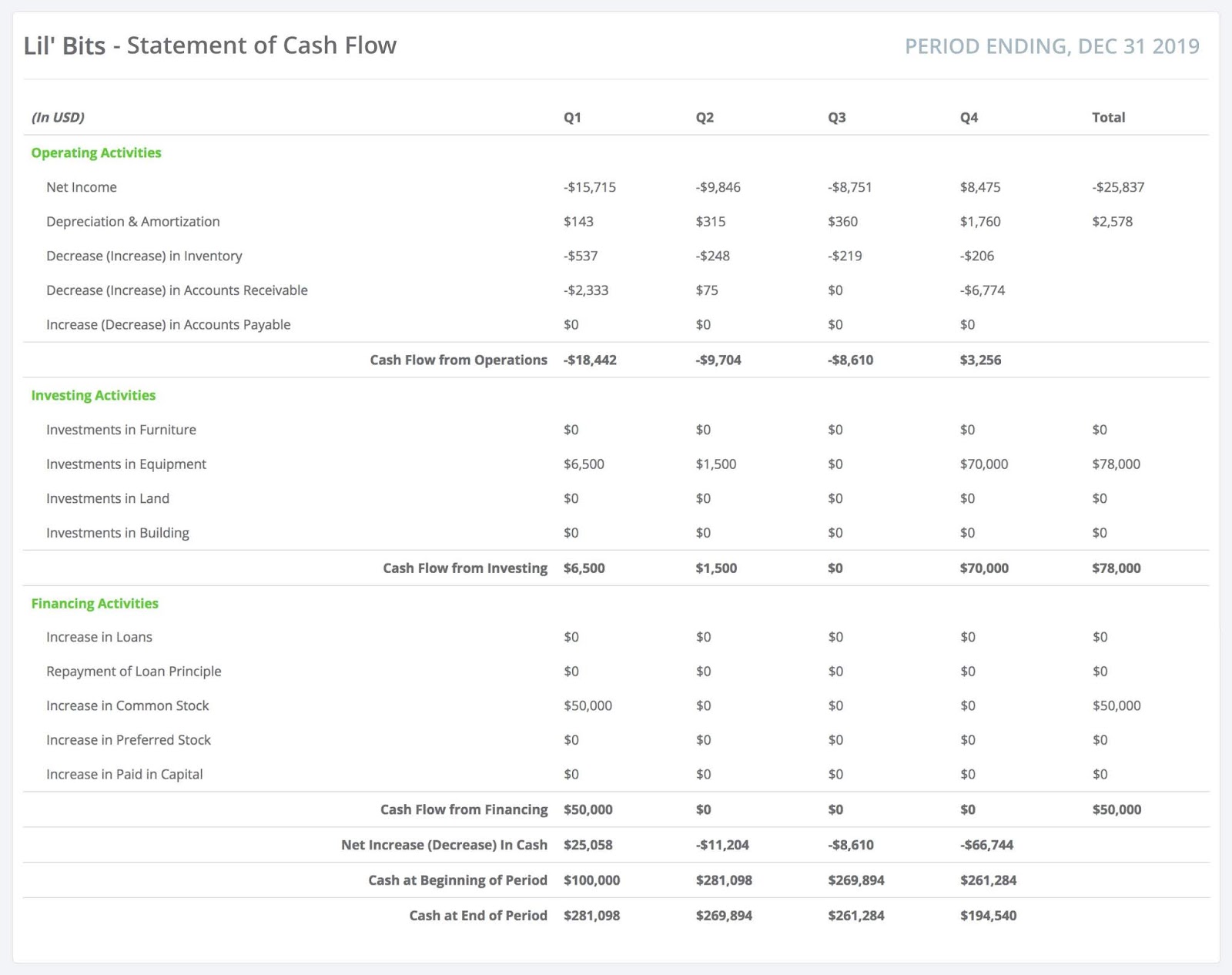

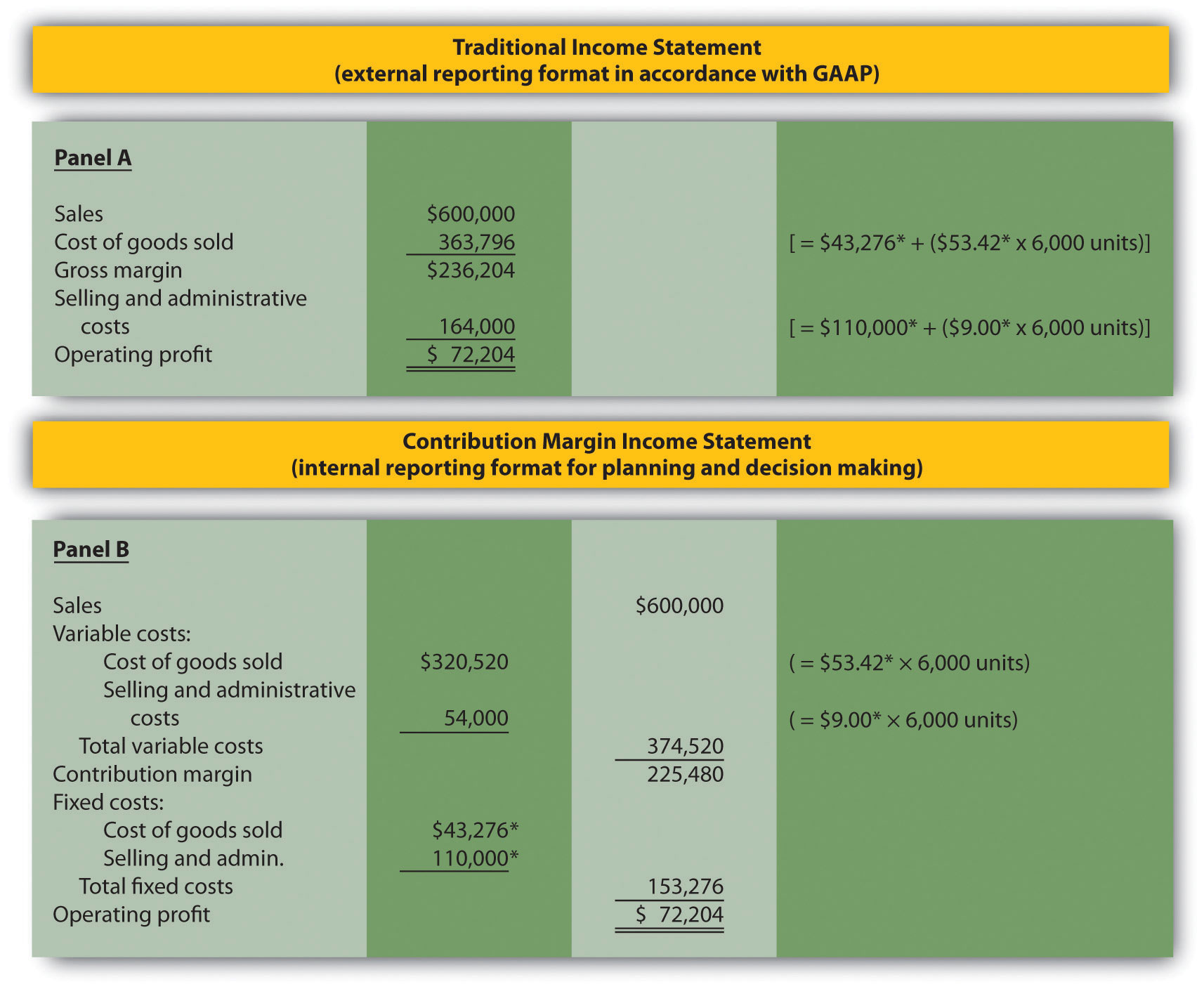

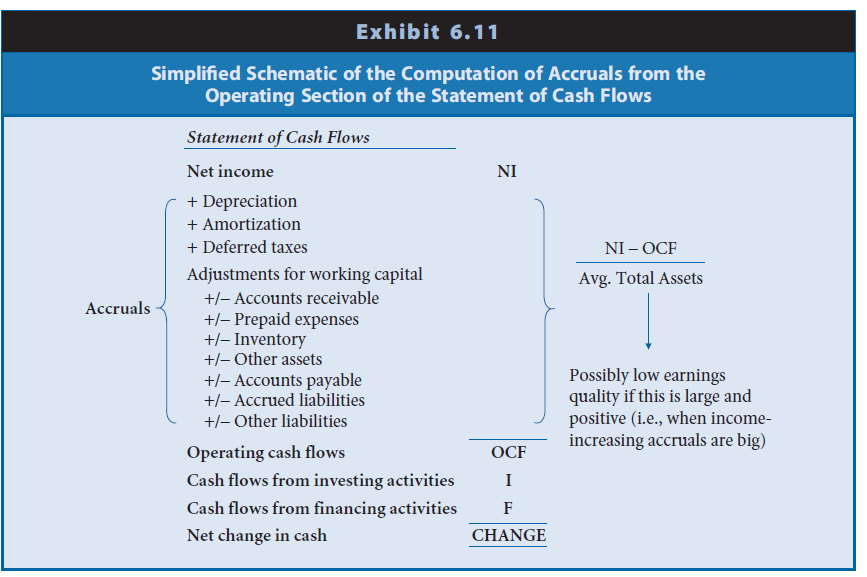

First, accruals are identified as the numbers that reconcile earnings to cash flows in the cash flow statement.

Accruals in cash flow statement. Solution here we can take the opening balance of ppe and reconcile it to the closing balance by adjusting it for the changes that have arisen in period that are not cash. The final financial statement is the statement of cash flows. When payment is received or made.

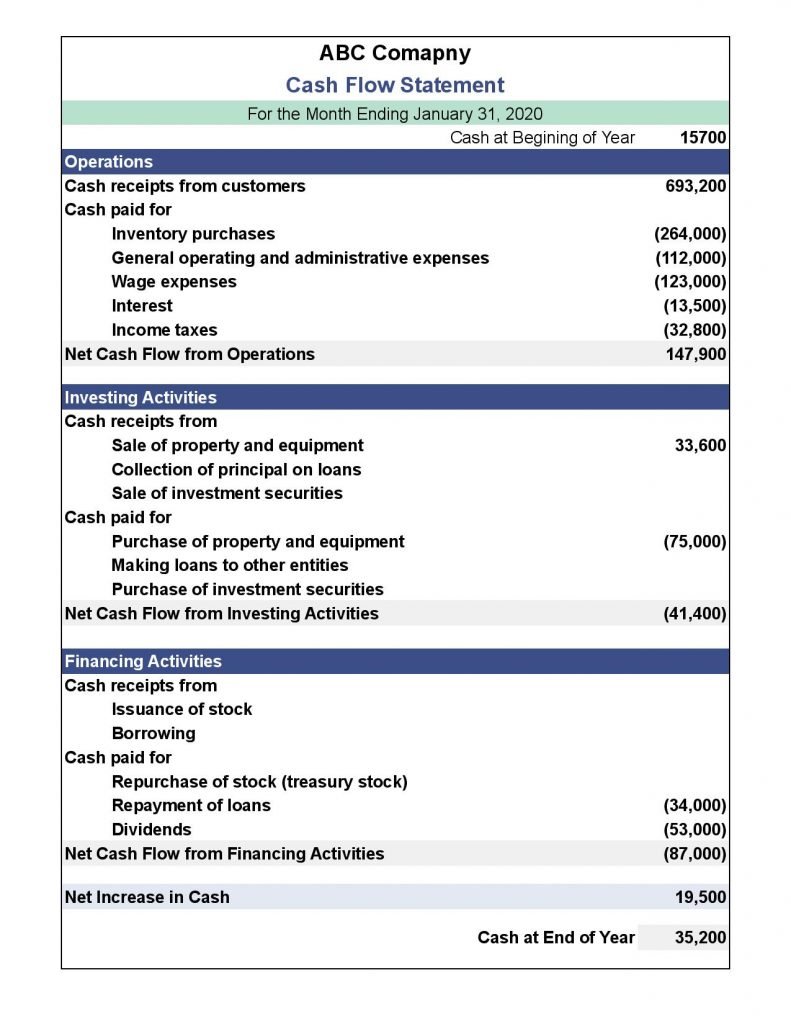

Impact of accruals on cash flow cash and cash equivalents. We distinguish accruals based on the source financial statement of the accruals, either the cash flow statement, balance sheet, or statement of owners’ equity. Using the indirect method, operating net cash.

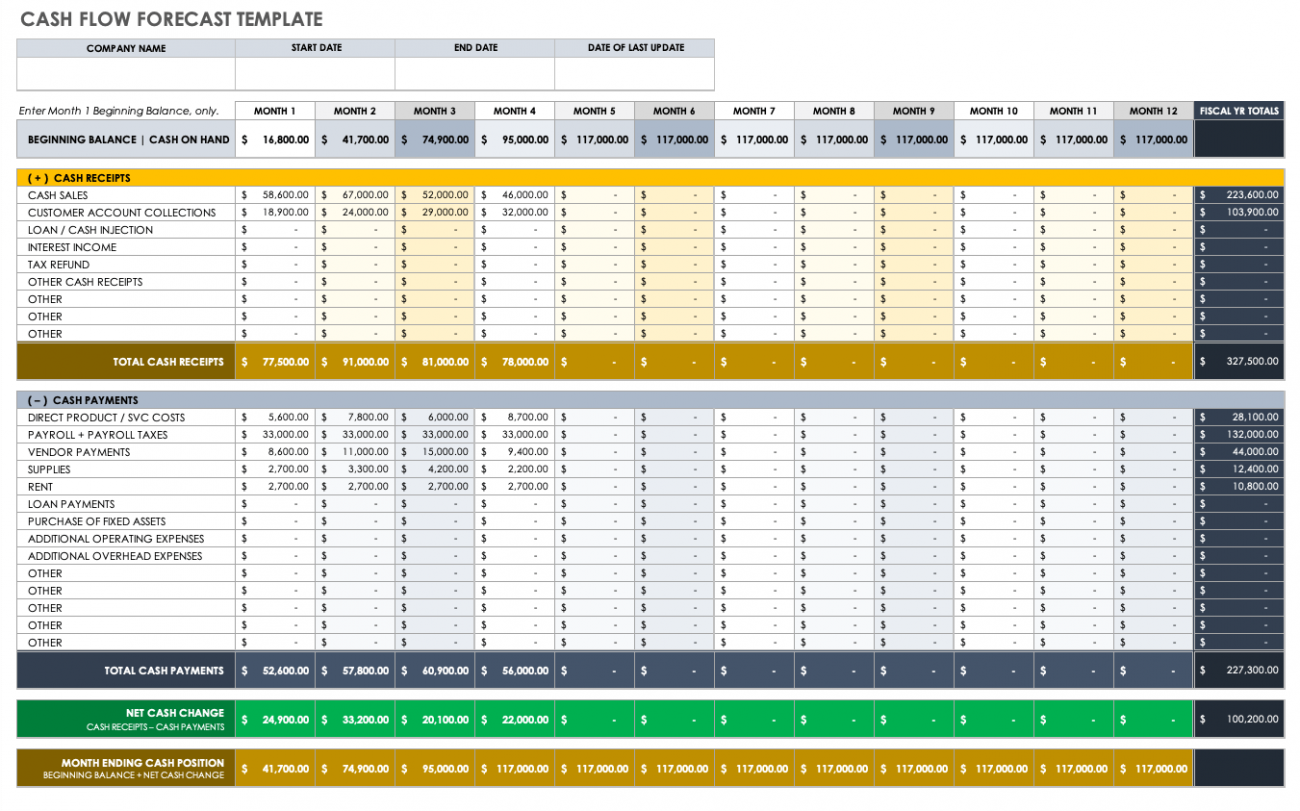

Determine net cash flows from operating activities. To illustrate how operating cash flows (prepared on the cash basis of accounting) relate to net income (prepared on the accrual method of accounting), as discussed in asc 230. Accrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs vs.

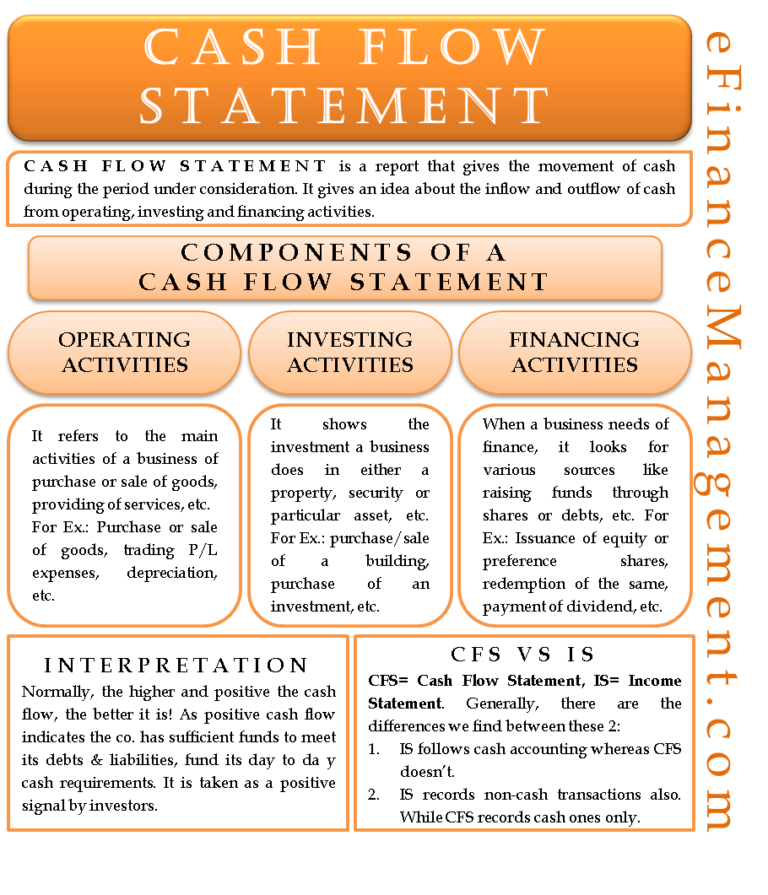

Any increase in accruals shall be added to the profit before tax and any decrease in. In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of. A company might look profitable in the long term but actually have a challenging, major cash shortage in the.

In order to prepare the cash flow statement, we adjust the profit before tax with working capital adjustments and operating expenses and accrual is an operating expense payable. The accrual method doesn't track cash flow. It is a crucial statement, as it shows the sources of and uses of cash for the firm during the accounting period.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)