Beautiful Work Tips About Preferred Equity On Balance Sheet

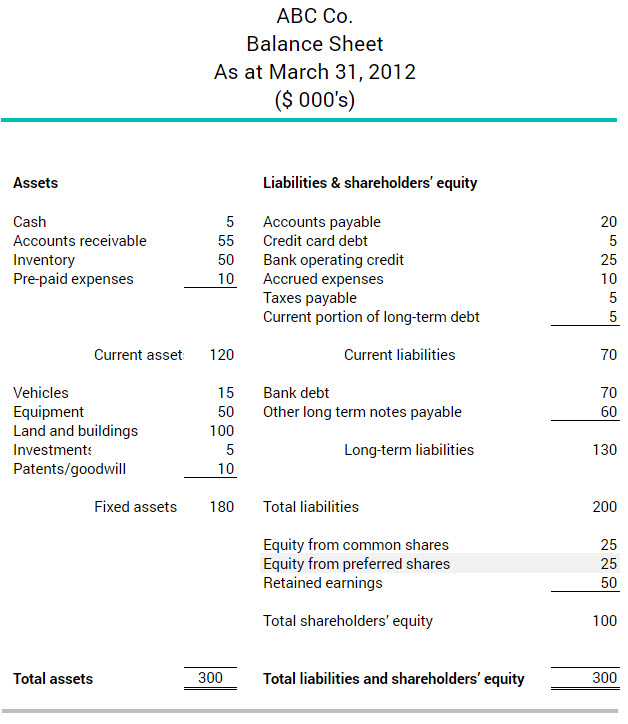

Balance sheets provide the basis for.

Preferred equity on balance sheet. Only the annual preferred dividend is reported on the income statement. A balance sheet must always balance; The annual preferred dividend requirement is subtracted from a corporation's net income and the remainder is described as the income available for.

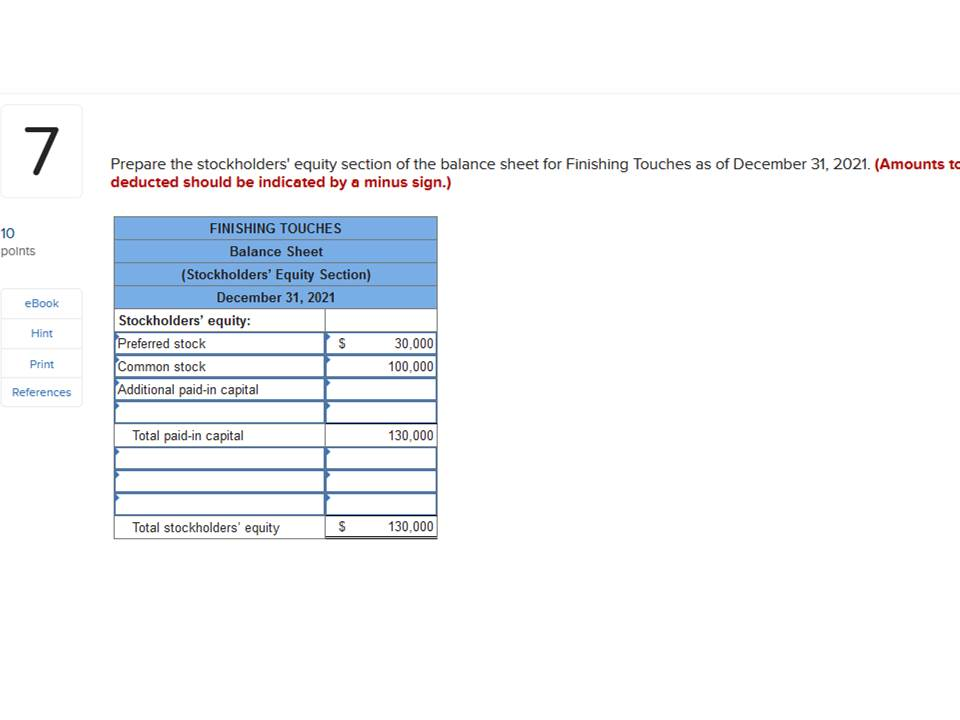

Comes from the statement of retained earnings financial statement. Preferred stocks can be considered part of debt or equity. The precise location can vary depending on the reporting format of the balance sheet, but preferred stock is consistently classified as part of shareholders’ equity.

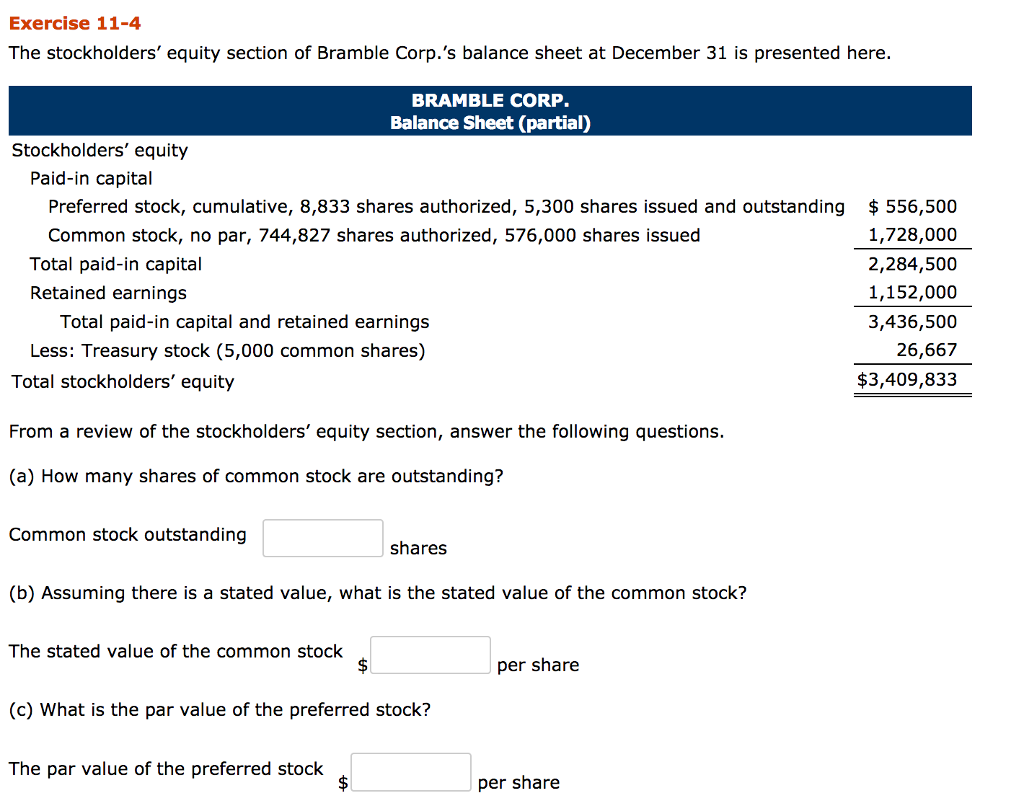

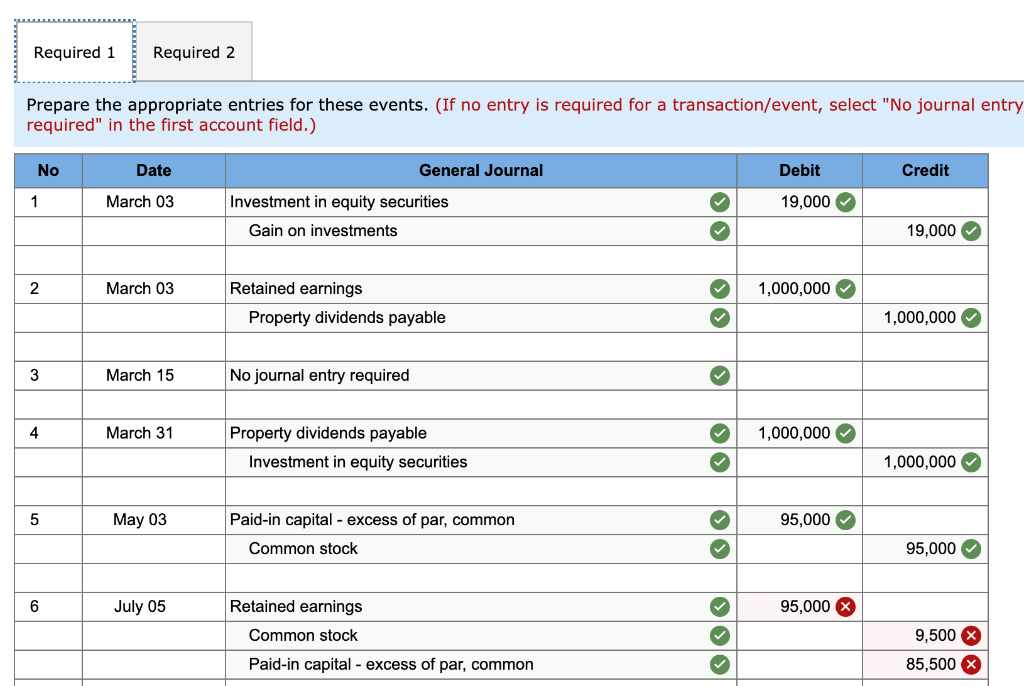

Then, they report another net income figure known as net income applicable to common. now, suppose a company earned $10 million after taxes and paid $1 million in preferred stock dividends. The video explains we have 3 sections in stockholder’s equity: Preferred stockholders have a higher claim on.

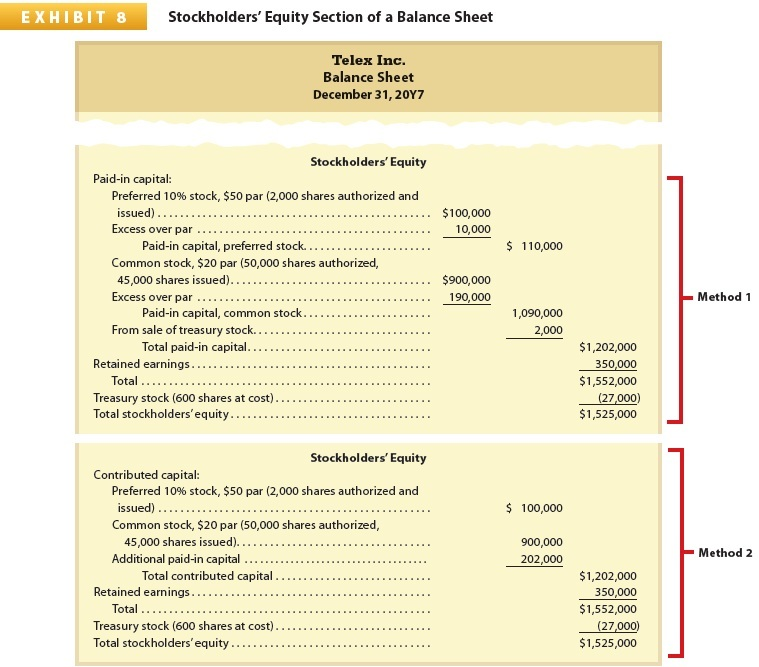

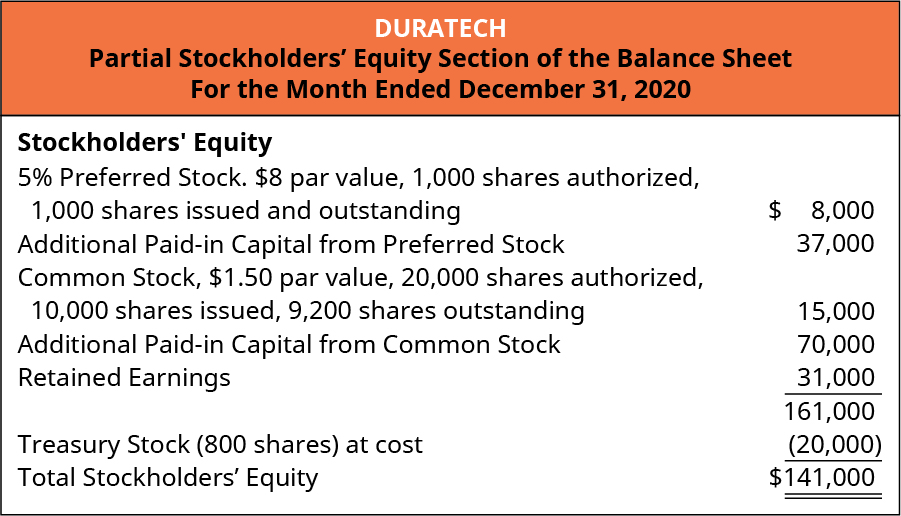

Preferred shares are hybrid securities that combine some of the features of common stock with that of corporate bonds. Many companies include preferred stock dividends on their income statements; The proper presentation is shown below:

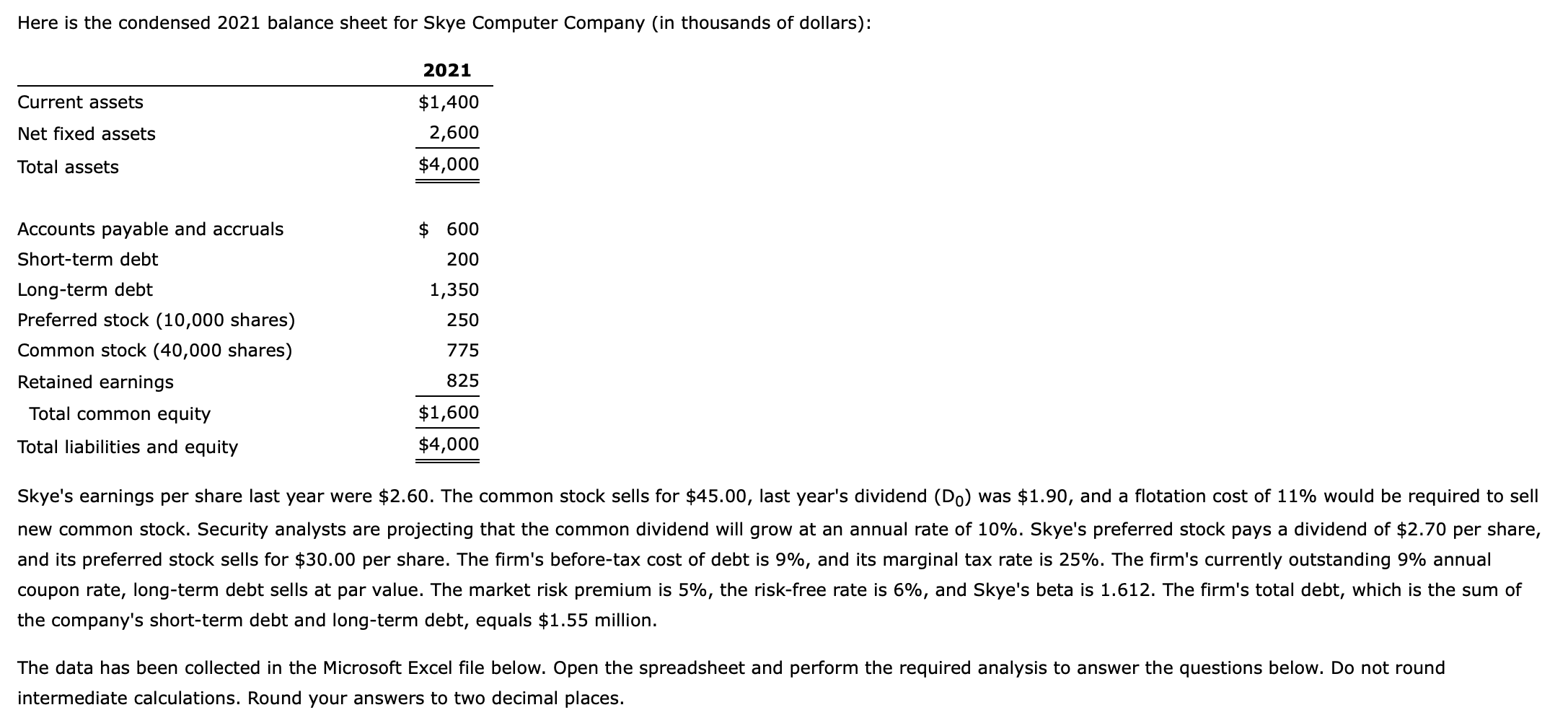

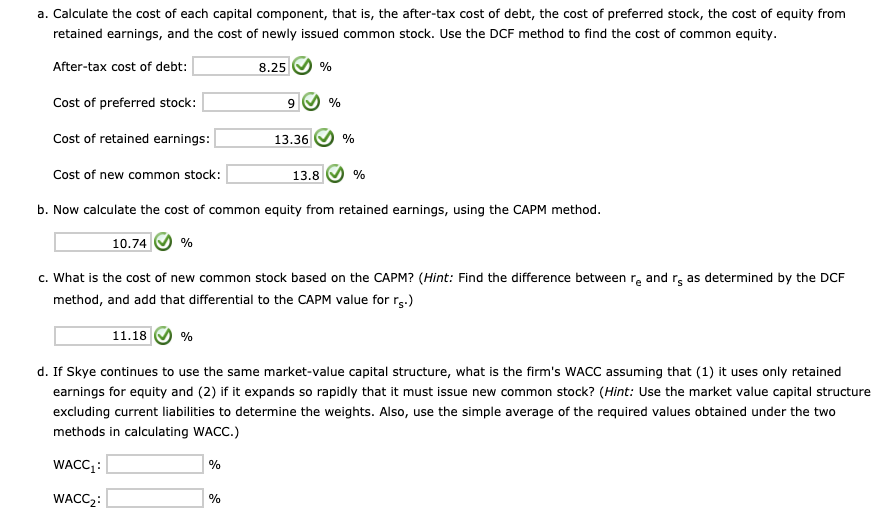

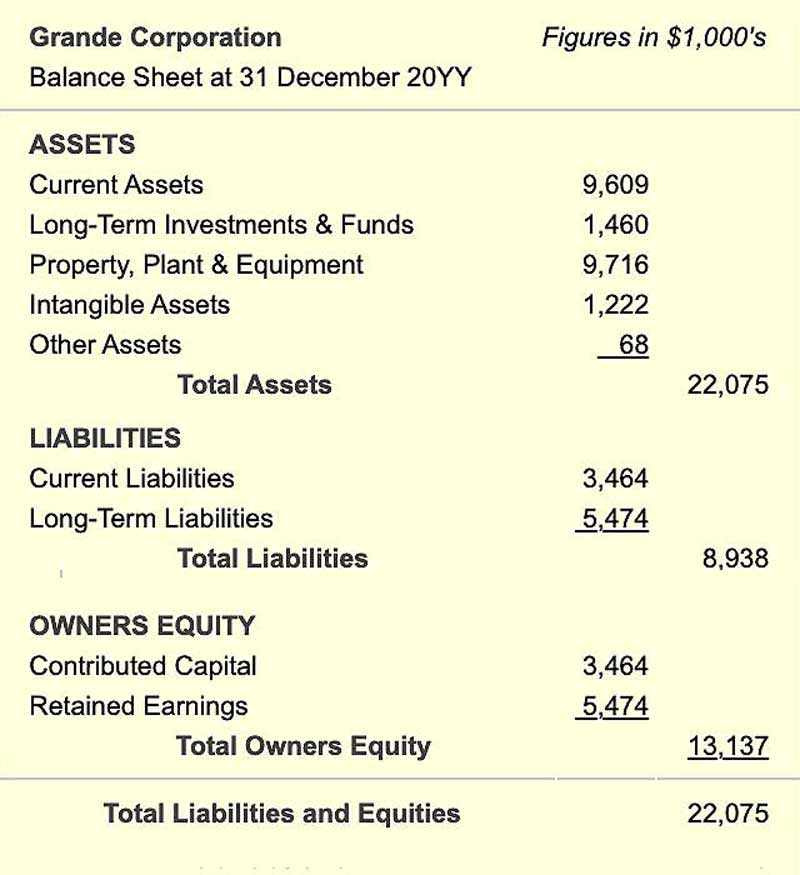

Preferred stock is listed first in the shareholders' equity section of the balance sheet, because its owners receive dividends before the owners of common stock, and have preference during. All the information required to compute shareholders' equity is available on a company's balance sheet, including total assets: The company holds zero debt on its balance sheet (i.e.

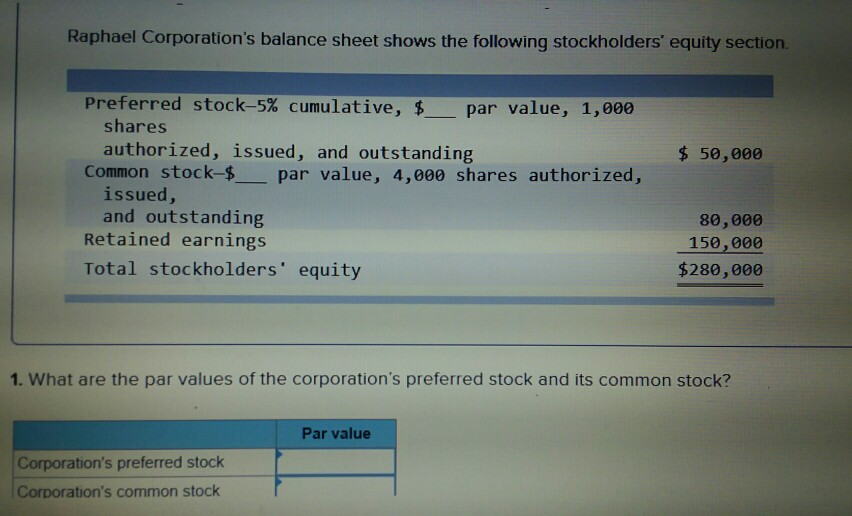

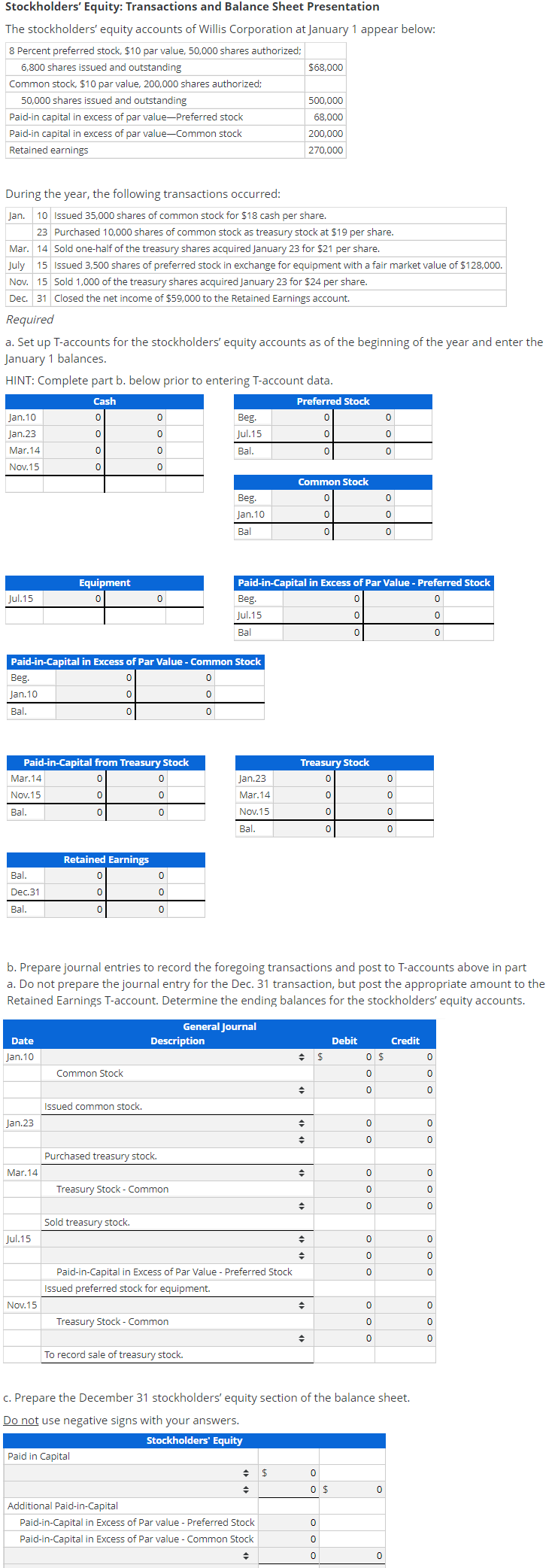

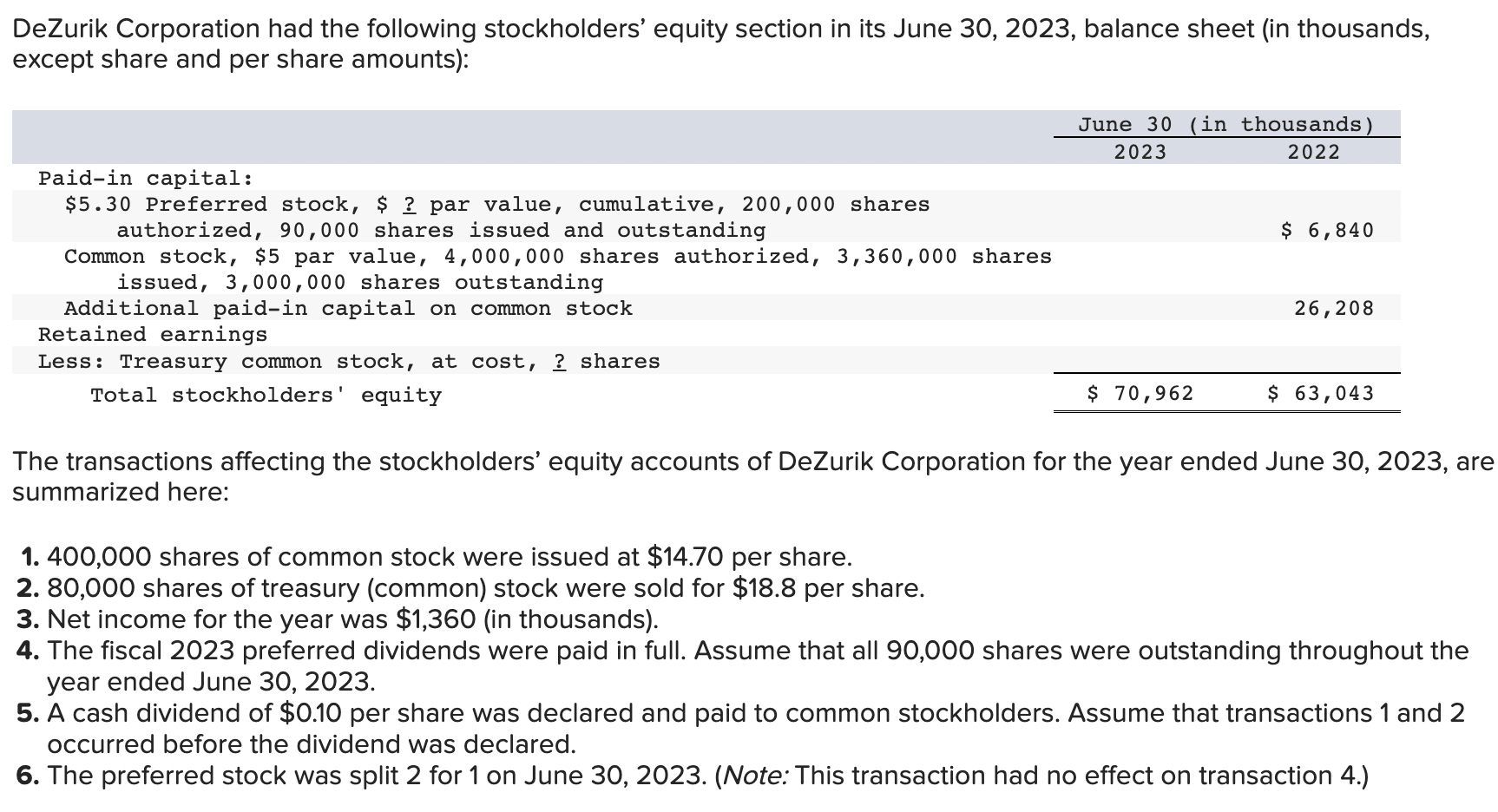

In above example, the company is authorized to issue 100,000 shares of preferred stock and 2,000,000 shares of common. It is calculated by taking the total assets minus total liabilities. Balance sheet presentation of common and preferred stock.

Amount that would be paid, or the number of shares that would be issued and their fair value, determined based on the conditions in the contract if the settlement were to occur at the balance sheet date; Preferred stock is a different type of equity that represents ownership of a company and the right to claim income from the company's operations. On a balance sheet, preferred stock is included in the capital stock subsection of stockholders' equity.

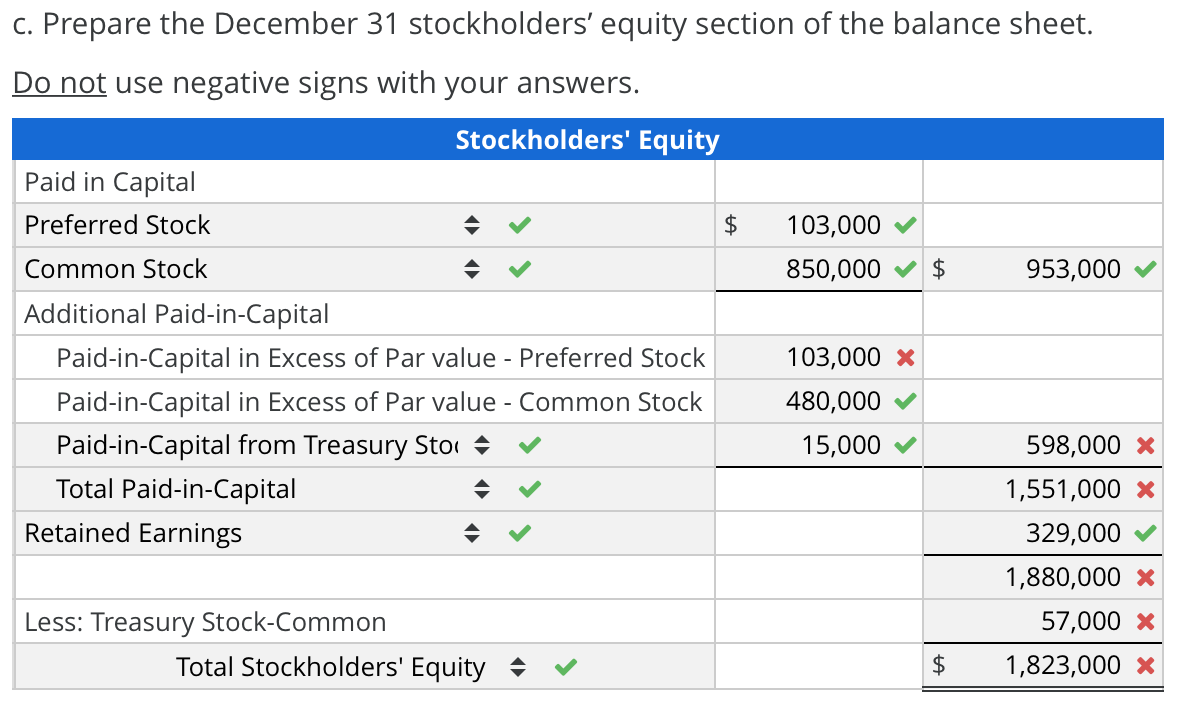

Includes common stock, preferred stock, and any paid in capital accounts including paid in capital for treasury stock. 100% preferred and common equity) from the date of initial purchase to the date of exit. The issuance of preferred stock provides a capital source for investment uses.

Preferred stock should be recognized on its settlement date (i.e., the date the proceeds are received and the shares are issued) and is generally recorded at fair value. Upon dividing the $100mm of capital invested by the 20% ownership, the implied total equity value of the target is $500mm. Stockholders’ equity section stockholders’ equity is funding that a company doesn’t have to pay back.

Preferred stock is classified as an item of shareholders' equity on the balance sheet. Assets = liabilities + owners’ equity. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

:max_bytes(150000):strip_icc()/ScreenShot2021-05-03at11.03.30AM-985f846f70e347c69f0f288359e7beed.png)