What Everybody Ought To Know About Bank Cash Flow Statement

We will use these names interchangeably throughout our explanation, practice quiz, and other materials.

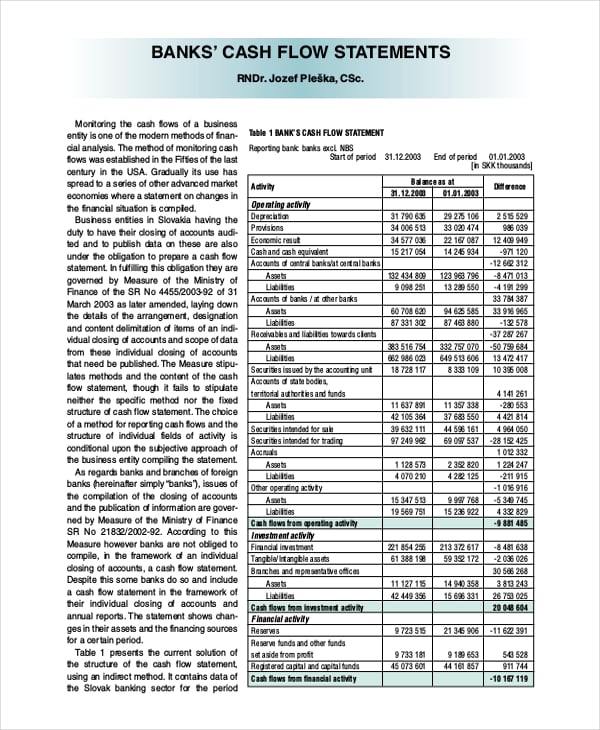

Bank cash flow statement. Pay its creditors when they fall due; This statement is one of the three key reports (with the income statement and the balance sheet) that help in determining a company’s performance. The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf.

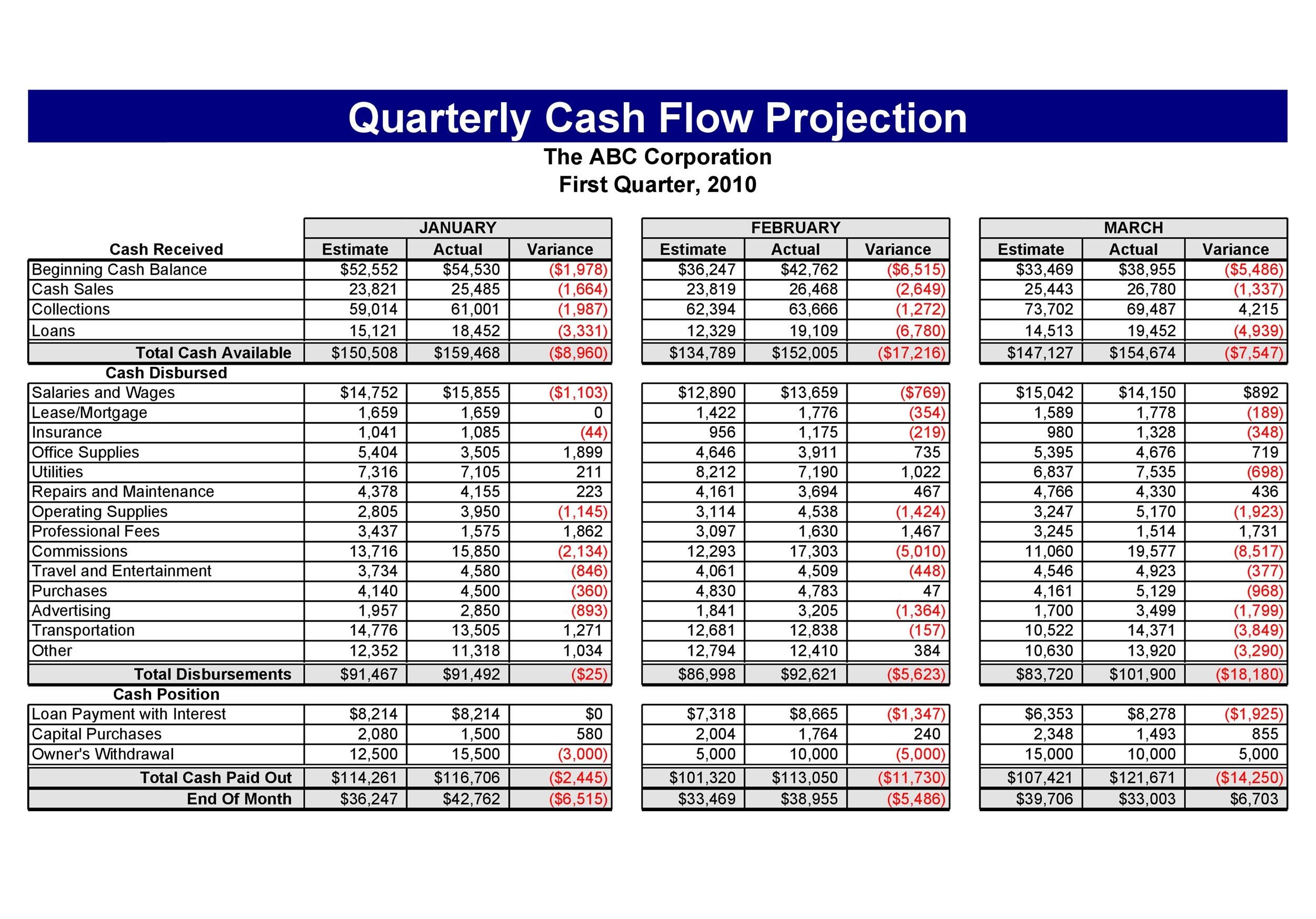

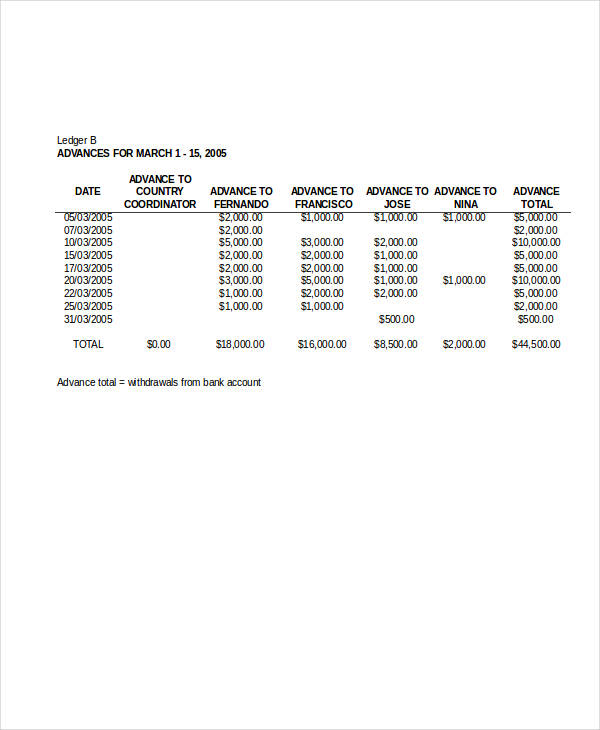

Cash flow statements are financial accounting statements that provide a detailed picture of the movement of money through a company — both what comes in and what. This value can be found on the income statement of the same accounting period. Choose from 15 free excel templates for cash flow management, including monthly and daily cash flow statements, cash projection templates, and more.

The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

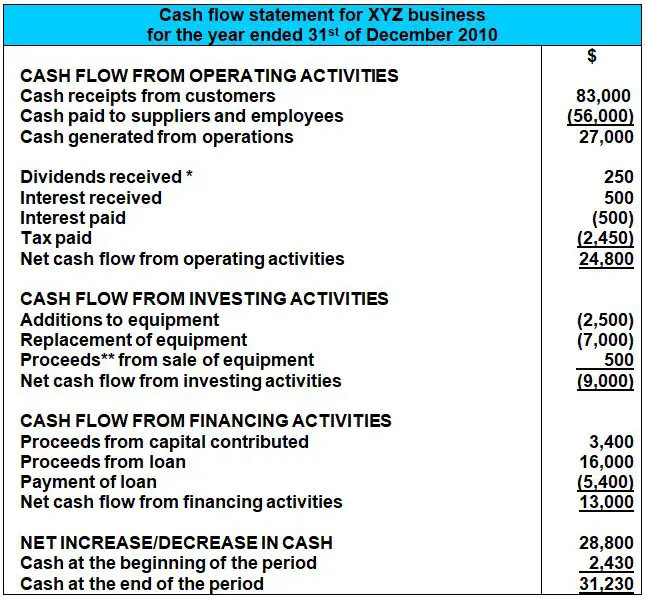

A cash flow statement is an important tool used to manage finances by tracking the cash flow for an organization. Statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period. Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period.

Cash inflows refer to receipts of cash while cash outflows to payments or disbursements. How to prepare a cash flow statement? The cfs highlights a company's cash management, including how well it generates.

How to prepare a cash flow statement Your statement of cash flows summarizes cash transactions over a set period of time (often a month, quarter, or year), so you get a picture of how cash moves through your business and how irregular income and expenses affect the cash you have available. By cash we mean both physical currency and money in a checking account.

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. A cash flow statement tells you how much cash is entering and leaving your business in a given period. Following are the basic steps to proceed with a cash flow statement:

The cash flow statement looks at the inflow and outflow of cash within a company. The cash flow statement is required for a complete set of financial statements. Add all the annual cash inflow from operating, investing, and financing activities.

Write the opening balance of cash and bank for the year. Invoices you received but haven’t paid. If a company's business operations can generate positive cash flow, negative overall cash flow.

It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. It also reconciles beginning and ending cash and cash equivalents account balances. The general layout of the direct method statement of cash flows is shown below, along with an explanation of the source of the information in the statement.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)