Looking Good Tips About Sources Of Funds In Balance Sheet

If the statement is prepared for the purpose of examining the capital structure of a business, the source of funds can be the profit or trading surplus for the year.

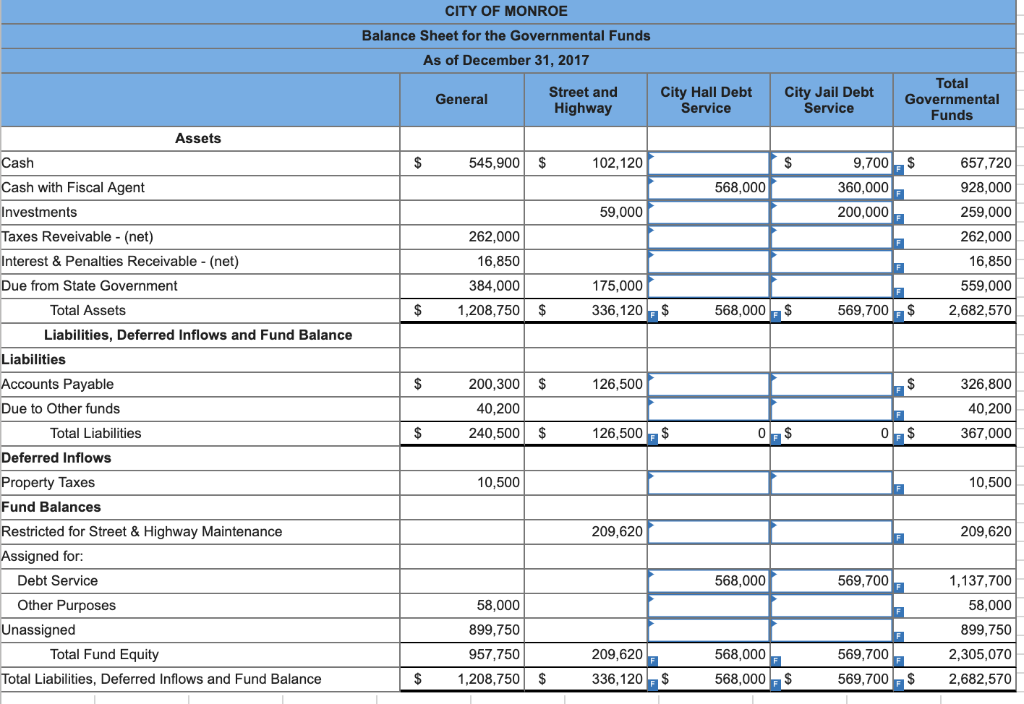

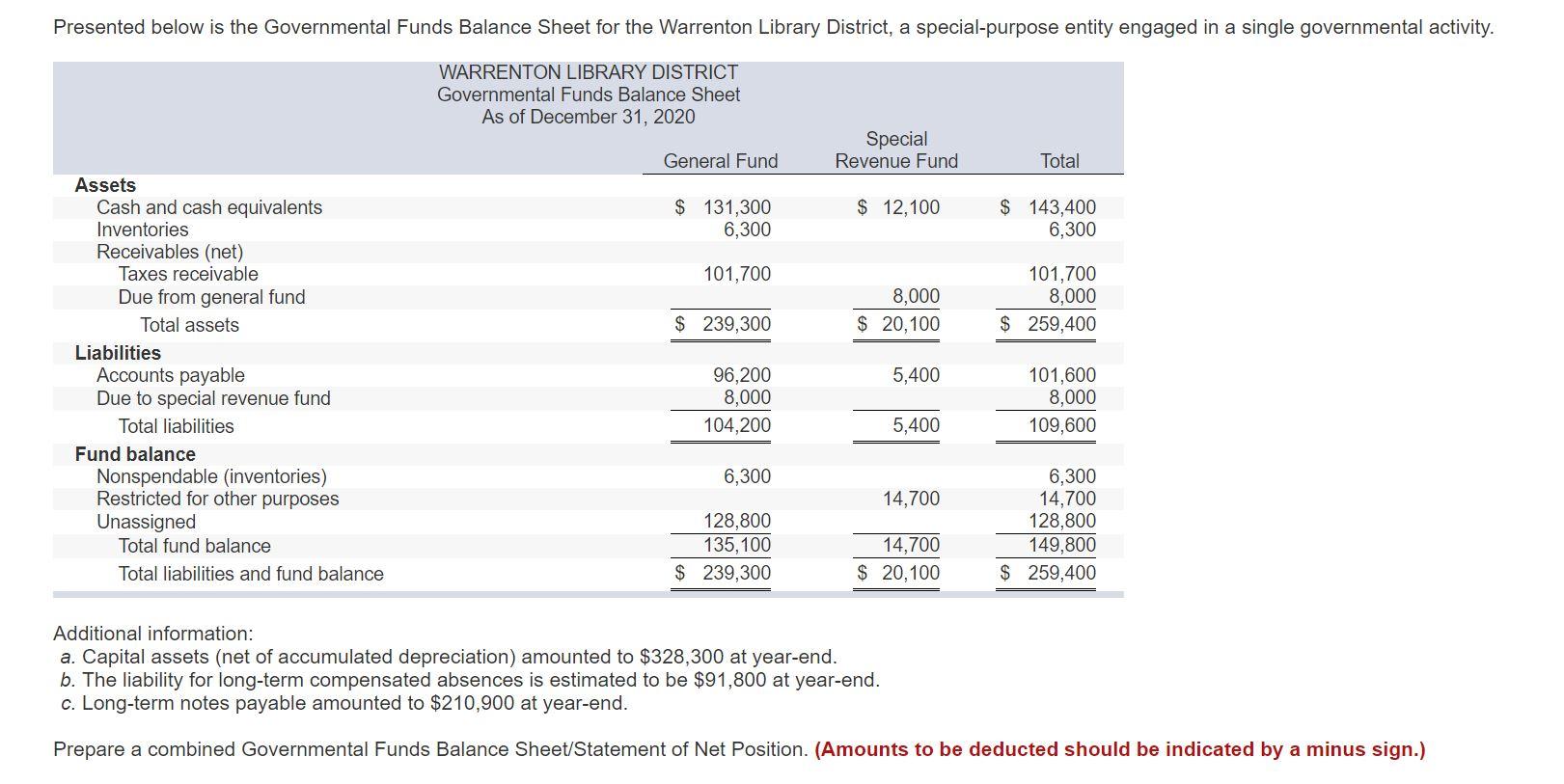

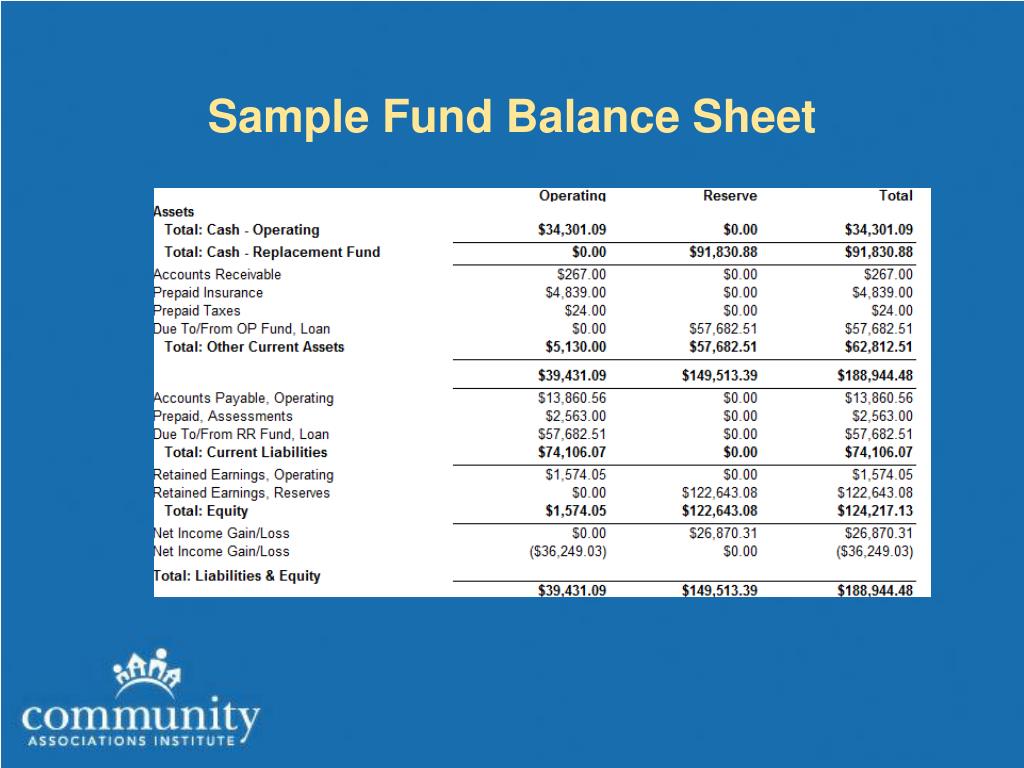

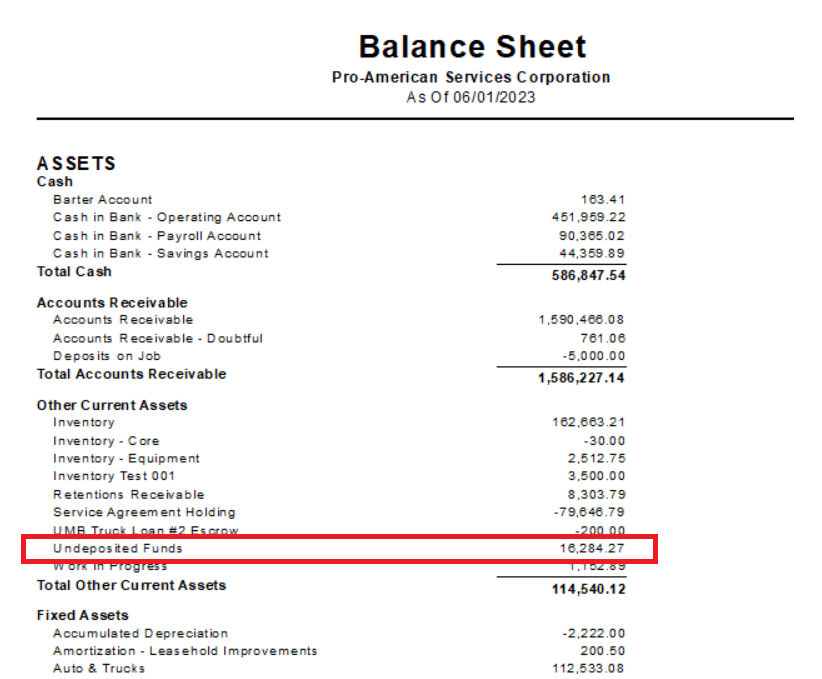

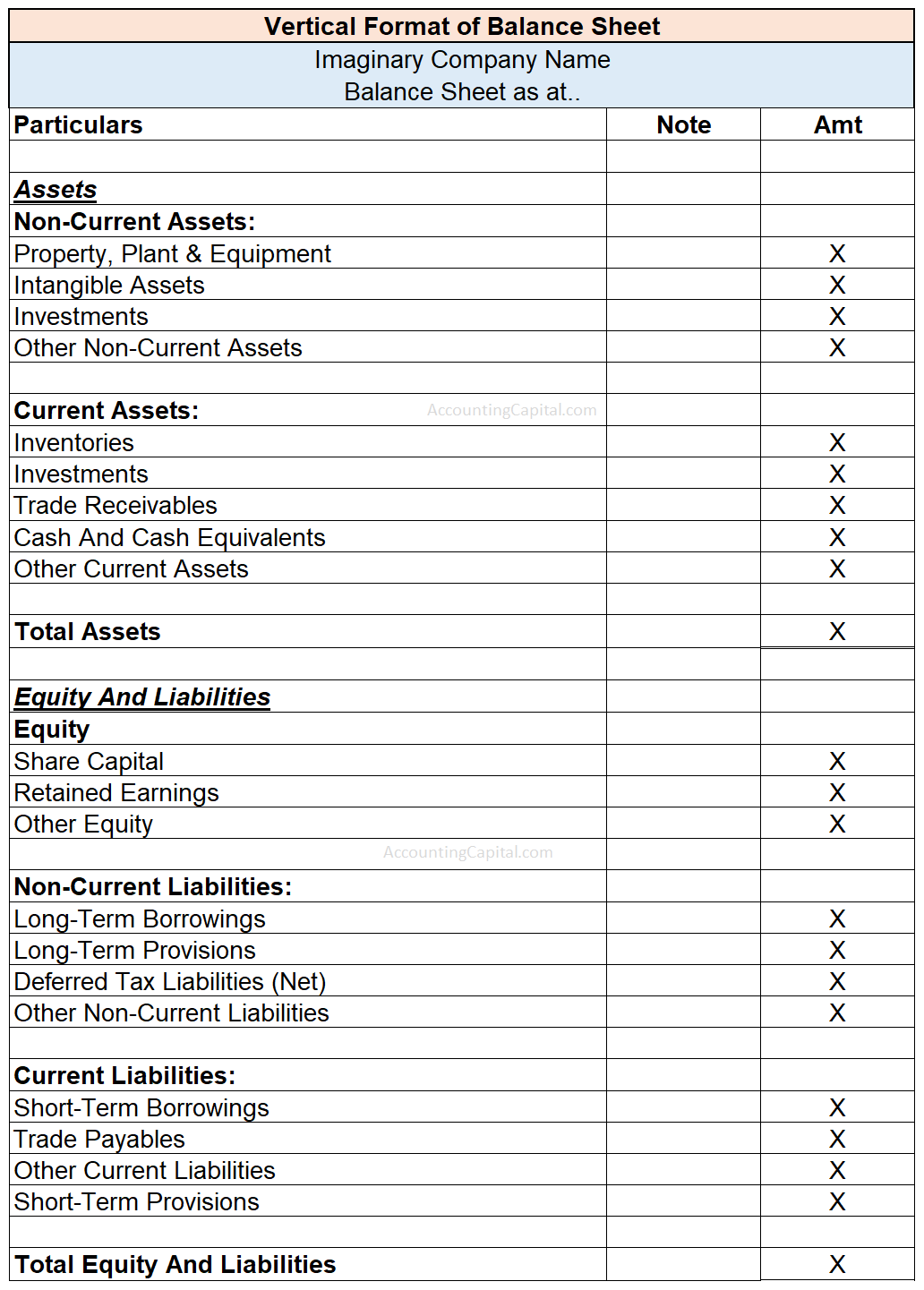

Sources of funds in balance sheet. Just like how the assets side must be equal to the liabilities and equity side on the balance sheet, the “sources” side (i.e. The balance sheet is based on the fundamental equation: This study used a sample of 70 newly listed firms during 2000 to 2014 on karachi stock exchange (kse).

It simply stays on the balance sheet, so it’s both a source and a use of funds and doesn’t impact us at all. In this case the saf becomes more similar to the traditional balance sheet. The total funding) must be equal to the “uses” side (i.e.

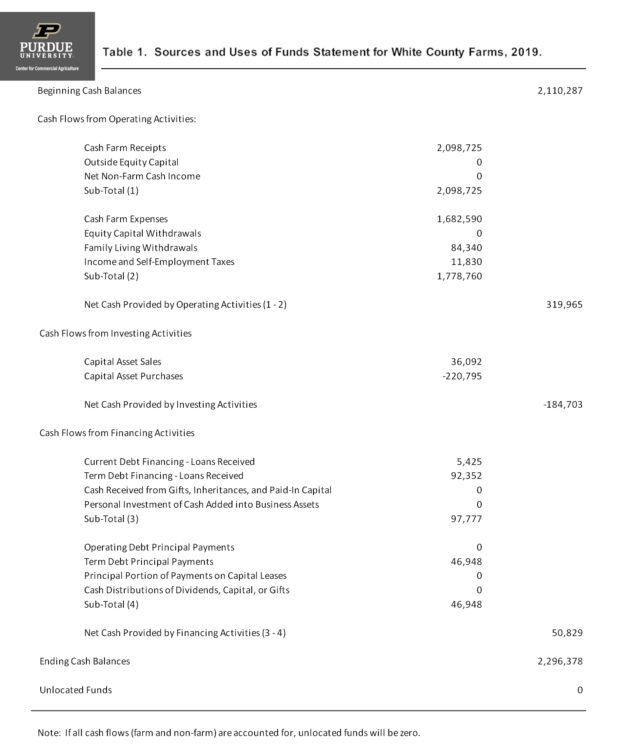

4) current assets ***** capital: If all cash is accounted for unlocated funds will be zero. The major portion usually comes from donations by individuals, corporate entities, and grants from government or international bodies.

Funding sources and applications for a. Companies use retained earnings from business operations to expand or distribute dividends to their shareholders. Assets/properties are the valuable thing/ economic resources owned the firm/enterprise.

The total amount being spent). It displays the movement of money in and out, i.e. Assets assets are anything the company owns that holds some quantifiable value, which means that they could be liquidated and turned into cash.

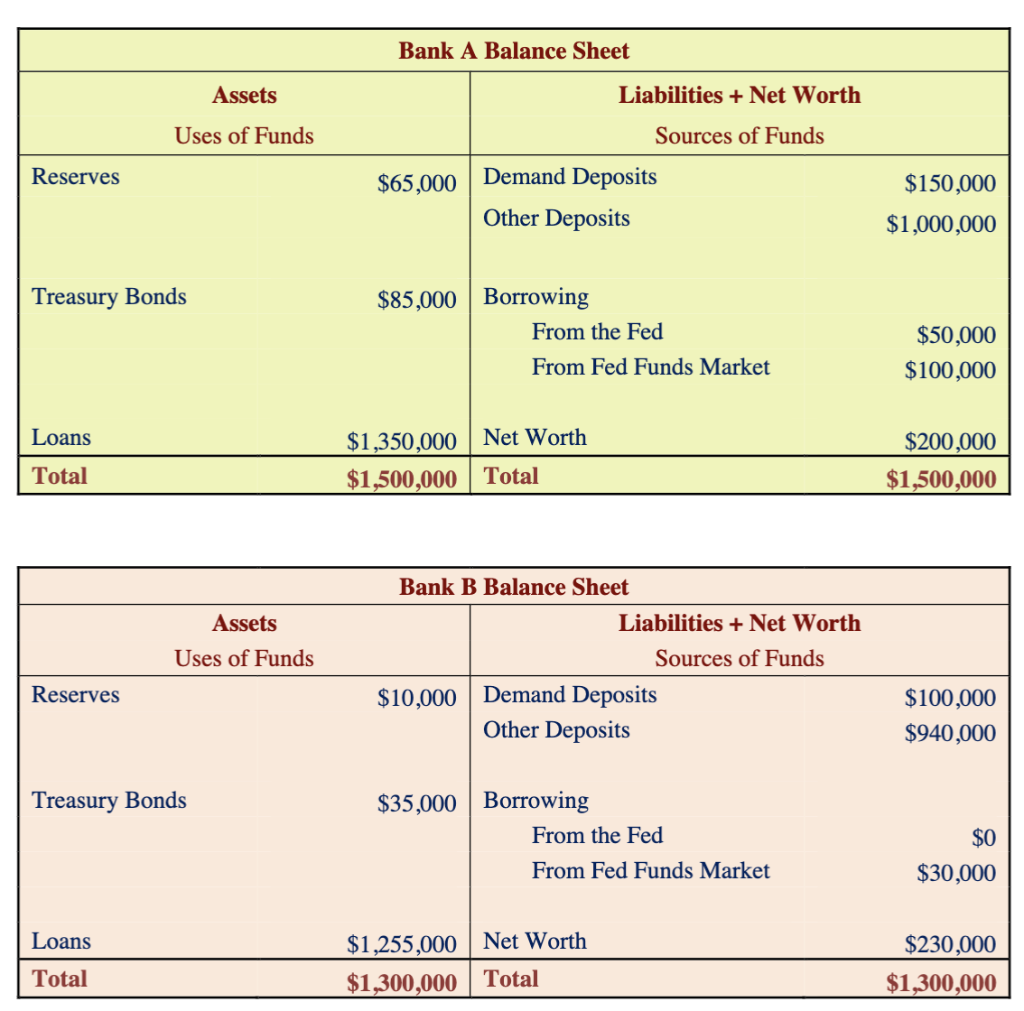

A flow of funds statement is a document created to examine the factors that led to changes in a company’s financial position between two balance sheets. A sources and uses of cash schedule gives a summary of where capital will come from (the “sources”) and what the capital will be spent on (the “uses”) in a corporate finance transaction. Debt assumed — this appears under both the sources and the uses sides and has no impact on the cash required to do the deal.

19x1 £ £ cash 1000 1800 assumption (2) some of the sales were made on credit, leaving debtors outstanding at the end of the month of £200. Assets, liabilities, and shareholders’ equity. Balancing these sources is crucial for cash flow optimization.

Elena cardone is organizing this fundraiser. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. The money needed for various purposes for business startup, including.

Businesses raise funds by borrowing debt privately from a bank or by going public (issuing debt securities). The company could sell $250,000 in bonds, increasing its debt to $225.25 million. As you can tell from its title, a sources, and uses of funds statement shows the reader the information needed to get the big picture of:

Influence of management judgments and estimates: Here's how in sum sources the applications of funds to your company's balance sheet in excel to get a obvious picture of whereby the changes affect your cash fluss. When computing their total amounts, the sources and uses accounts should equal each other.