Awesome Info About Meaning Of Comprehensive Income

Other ways that employee training might benefit your organization include:

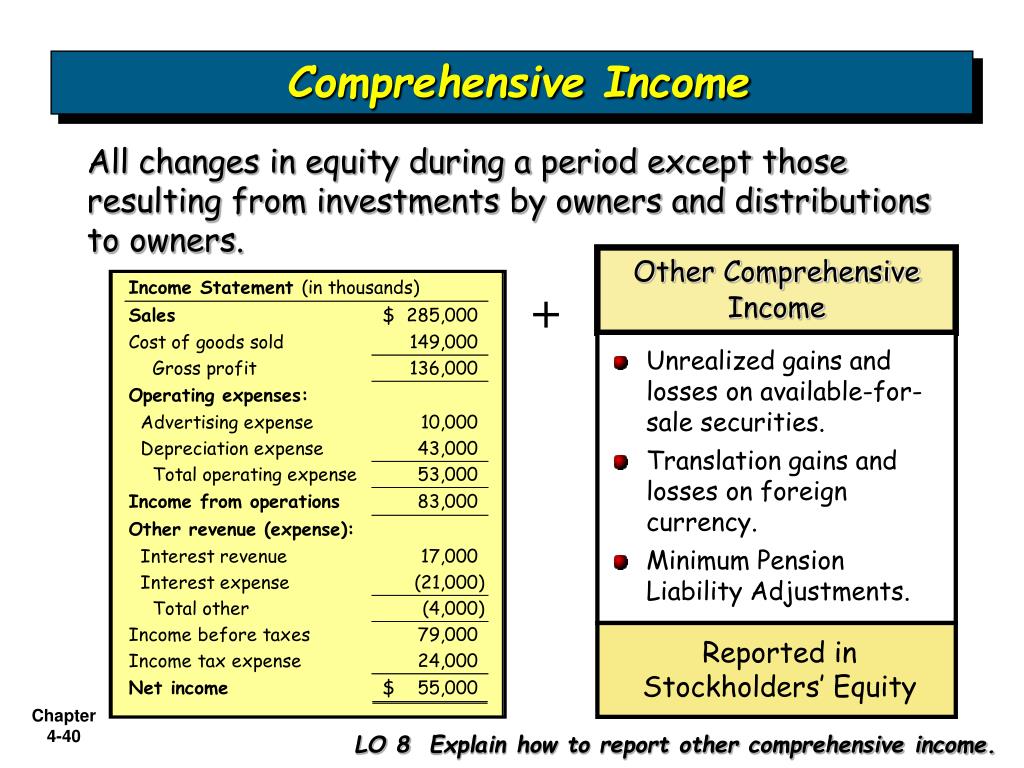

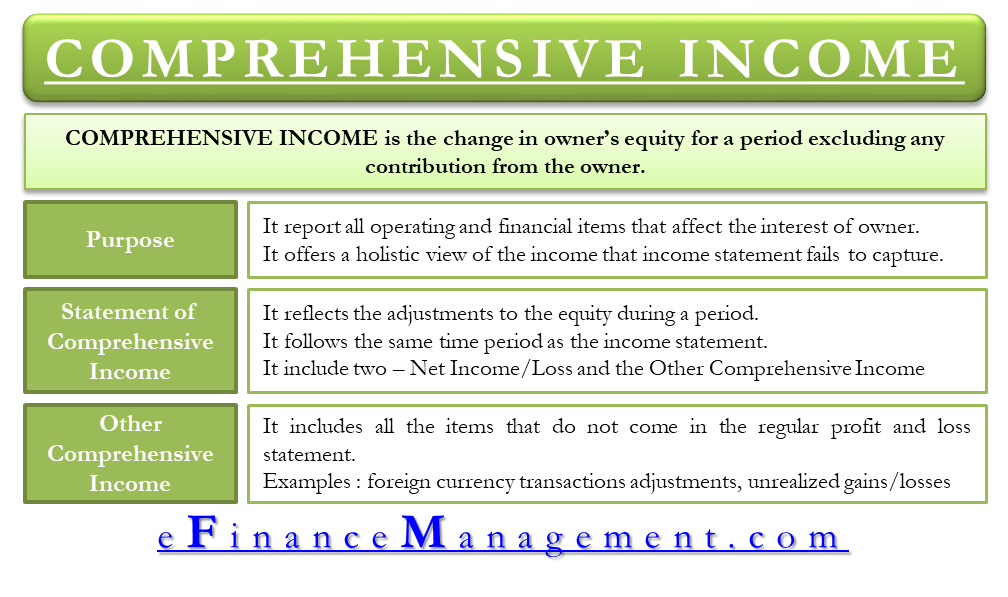

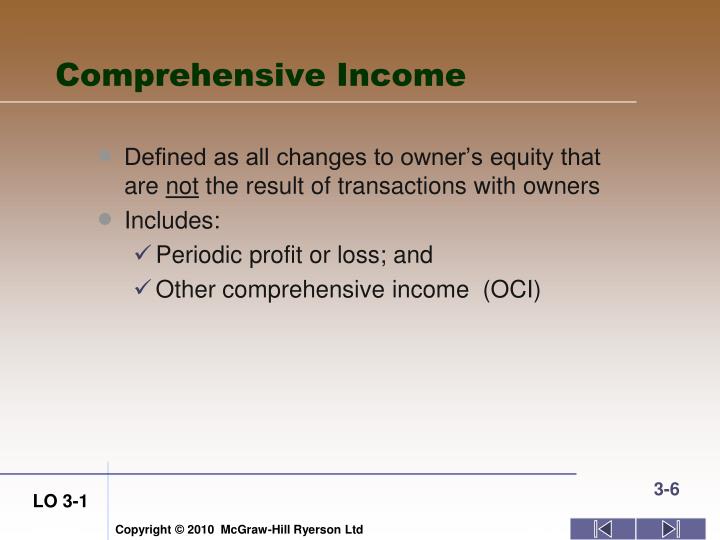

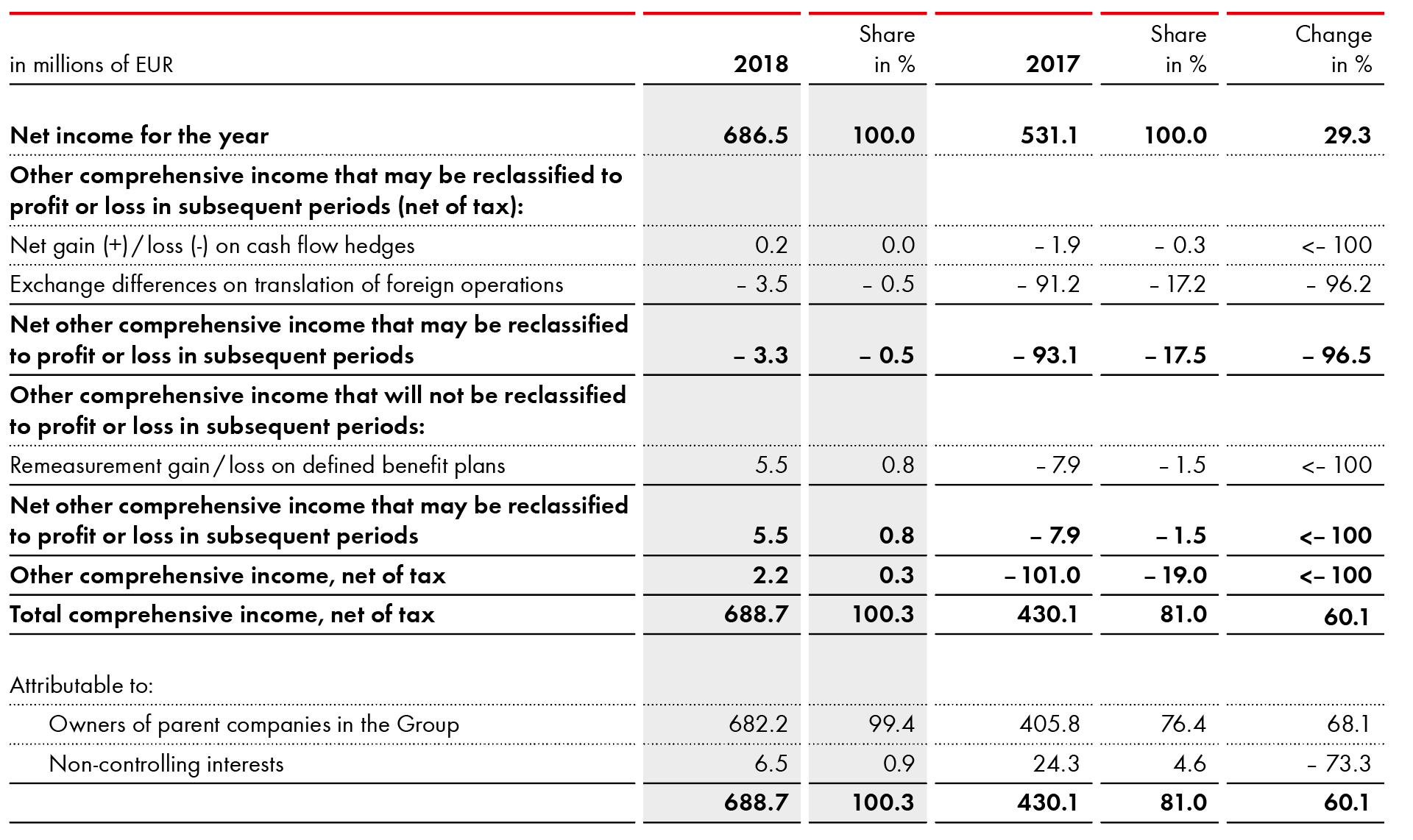

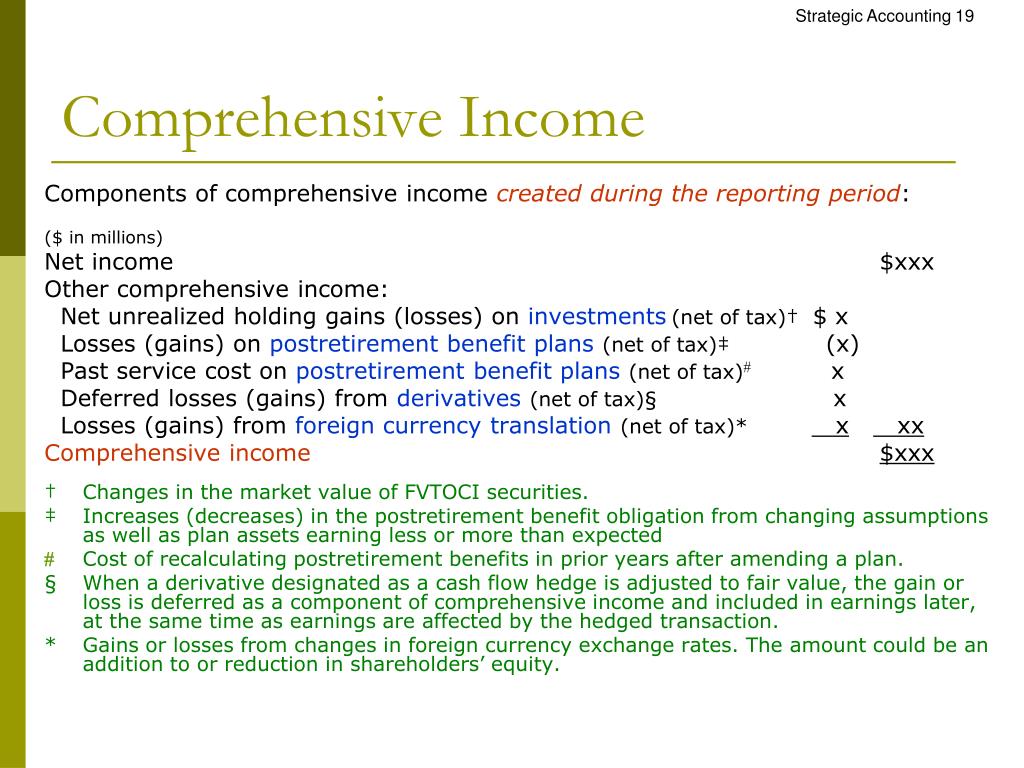

Meaning of comprehensive income. Comprehensive income is the sum of regular income and other comprehensive income. The fasb's technical definition of comprehensive income is the change in equity [net assets] of a business enterprise during a period from transactions and other events and circumstances from non. Find out what qualifies as comprehensive income and how to report it below.

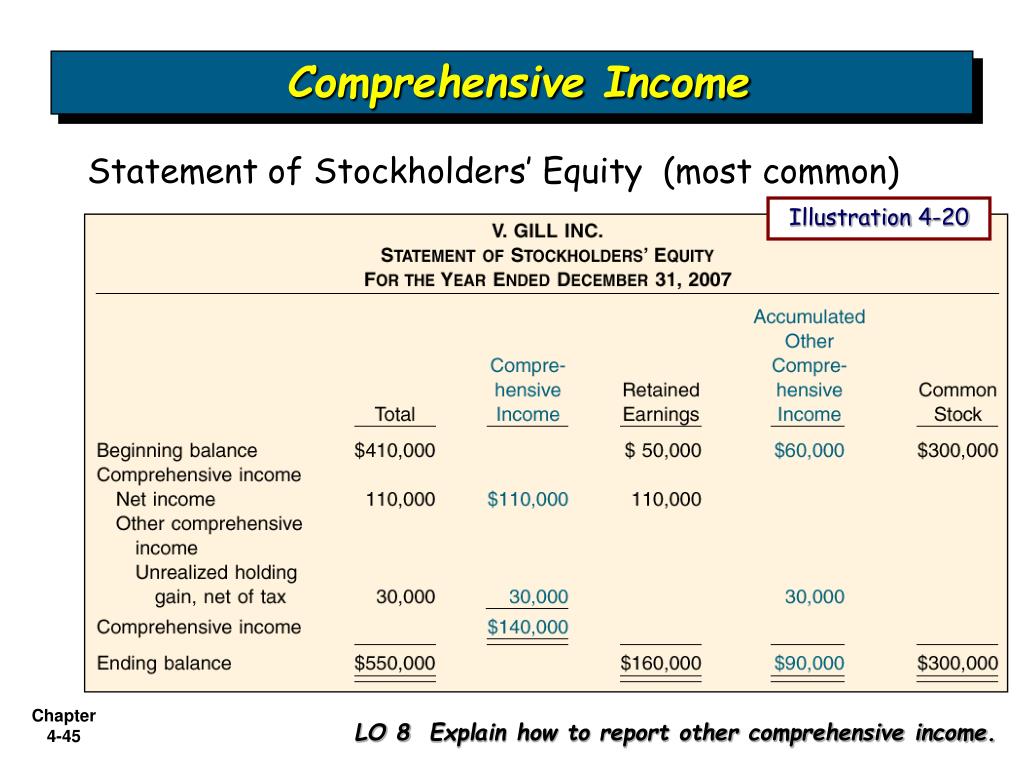

Comprehensive income is the net change in equity for a period not including any owner contributions or distributions. Net income or net loss (the details of which are reported on the corporation's income statem. The statement should be classified and aggregated in a manner that makes it understandable and comparable.

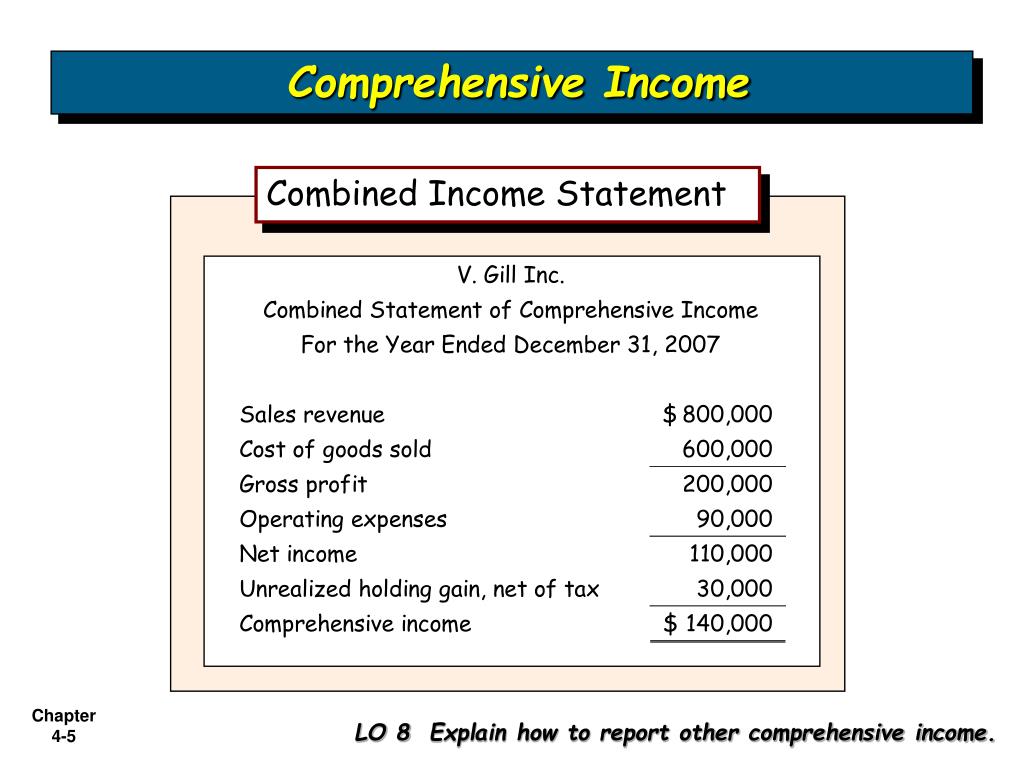

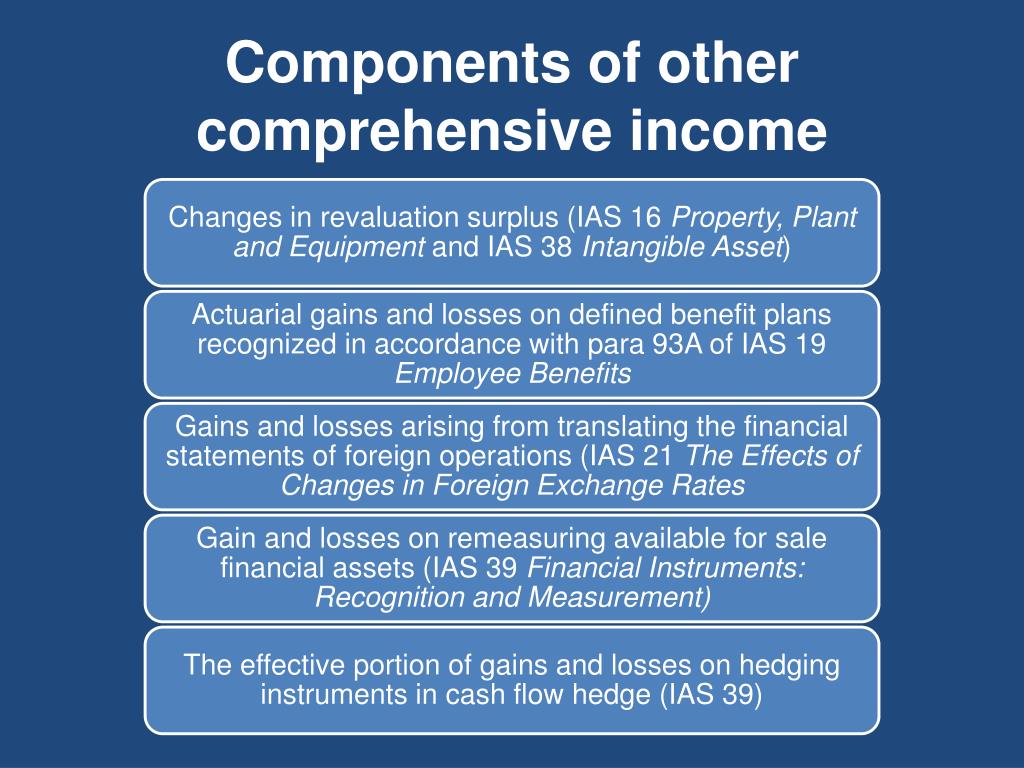

Comprehensive income includes net income and oci. For example, it might relate to gains and losses from foreign currency transactions, or unrealized gains from hedge financial instruments. It accompanies an organization’s income statement, and is intended to present a more complete picture of.

Lewis what is comprehensive income? This article explores the purpose and definition of comprehensive income, its components, pros, and cons, and its significance for investors and companies. Companies use it to measure the changes in their equity over a certain period, and it includes net and unrealized income to provide a more comprehensive understanding of a company's value.

Gross profit represents the income or profit remaining after production costs have been subtracted from revenue. These amounts cannot be included on a company’s income statement because the investments are still in play. The statement of comprehensive income contains those revenue and expense items that have not yet been realized.

A corporation’s comprehensive income includes both net income and unrealized income. What is the statement of comprehensive income? Knowing these figures allows a company to measure changes in the businesses it has interests in.

Be mindful of the difference in account names as that can be confusing to students. As a straightforward explanation, the account (other comprehensive income) is used to adjust the increase or decrease in fair value of certain investments. Comprehensive income adds together the standard net income with other comprehensive income.

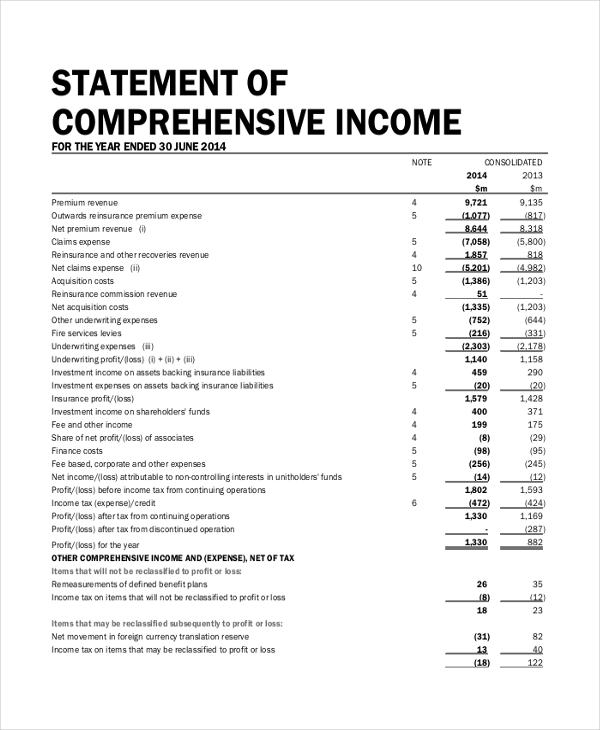

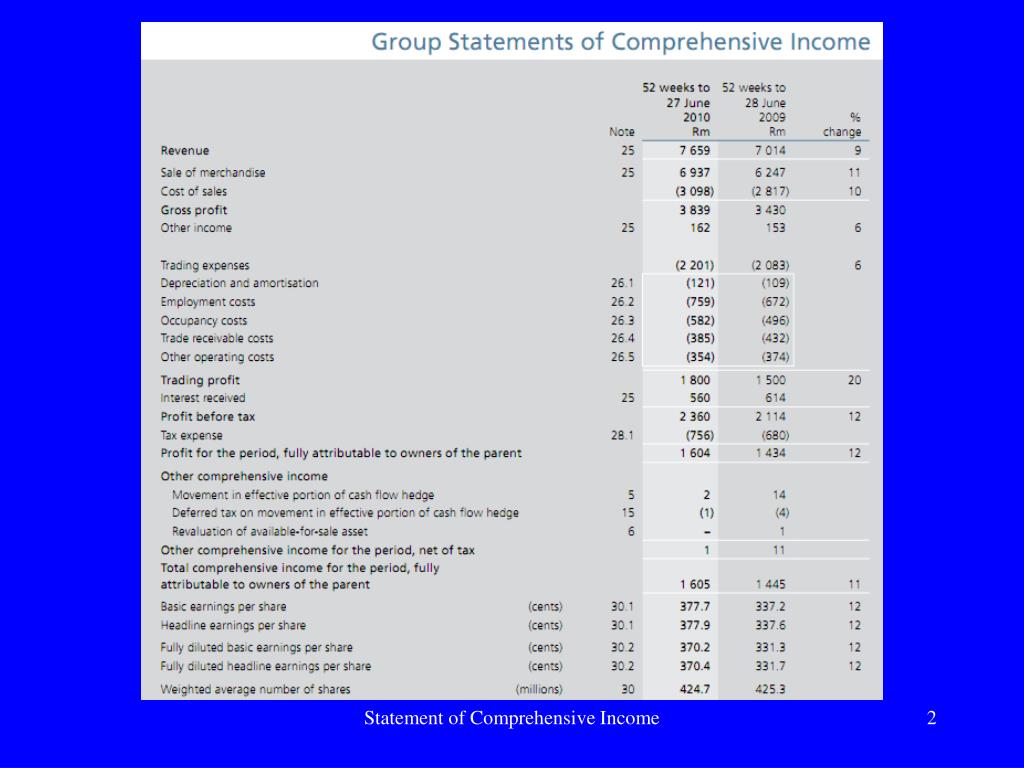

At times, companies accrue gains. In simple terms, it is the total of all revenues, gains, expenses, and losses and the unrealized gains and losses resulting in a change in the equity or the net assets. The statement of comprehensive income covers the same period of time as the income statement and consists of two major sections:

The statement of comprehensive income is one of the five financial statements required in a complete set of financial statements for distribution outside of a corporation. A corporation’s comprehensive income includes both net income and unrealised income. As explained earlier, the statement of comprehensive income encompasses the.

Once approved, these will be the world’s first rules on ai. A definition and examples september 22, 2022 by susan s. Definition of comprehensive income comprehensive income for a corporation is the combination of the following amounts which occurred during a specified period of time such as a year, quarter, month, etc.:

:max_bytes(150000):strip_icc()/comprehensiveincome_final-2ff1de7967204cd2a69a4ab5b8778fff.png)