Real Tips About Income Statement Activity

31,” while the corresponding income statement shows profit.

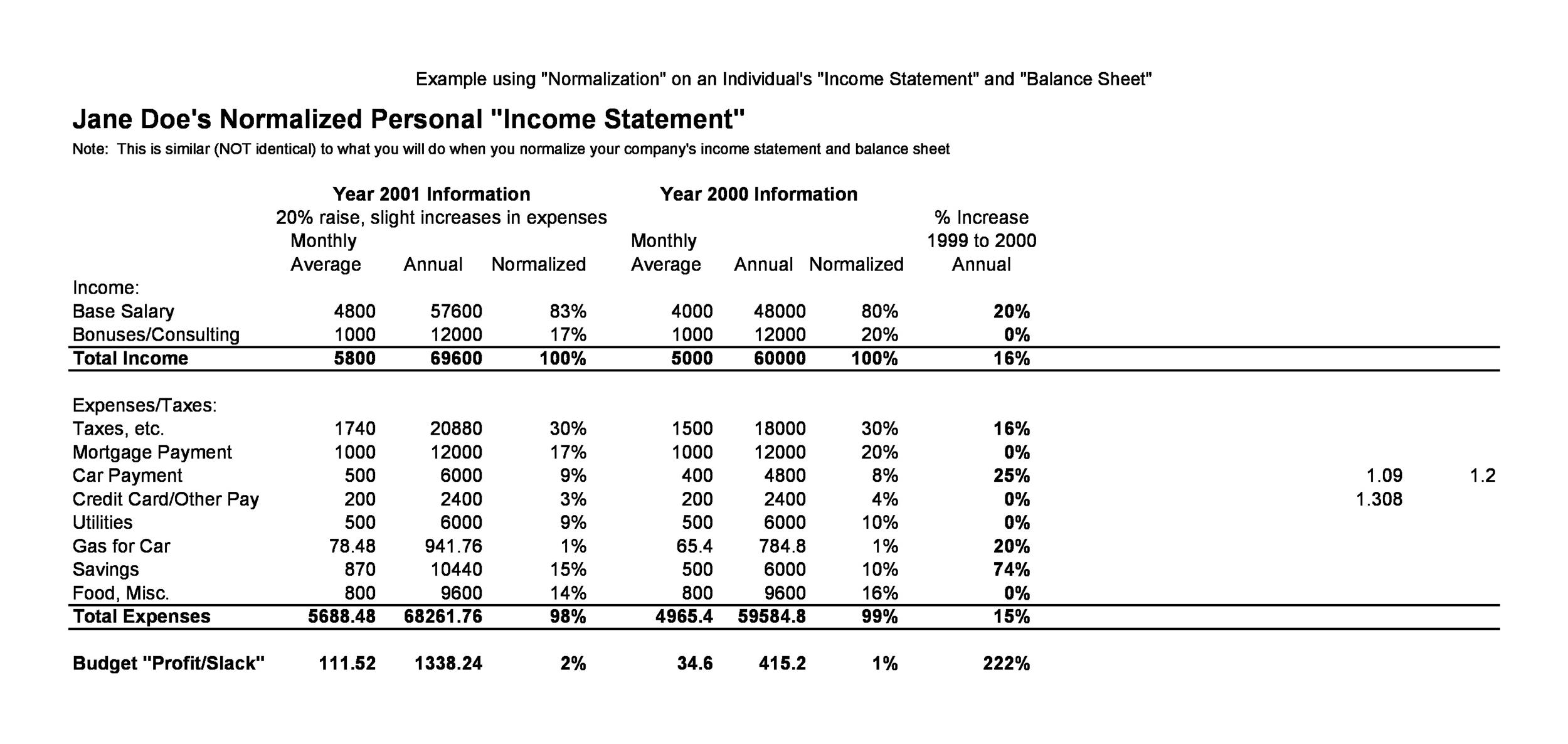

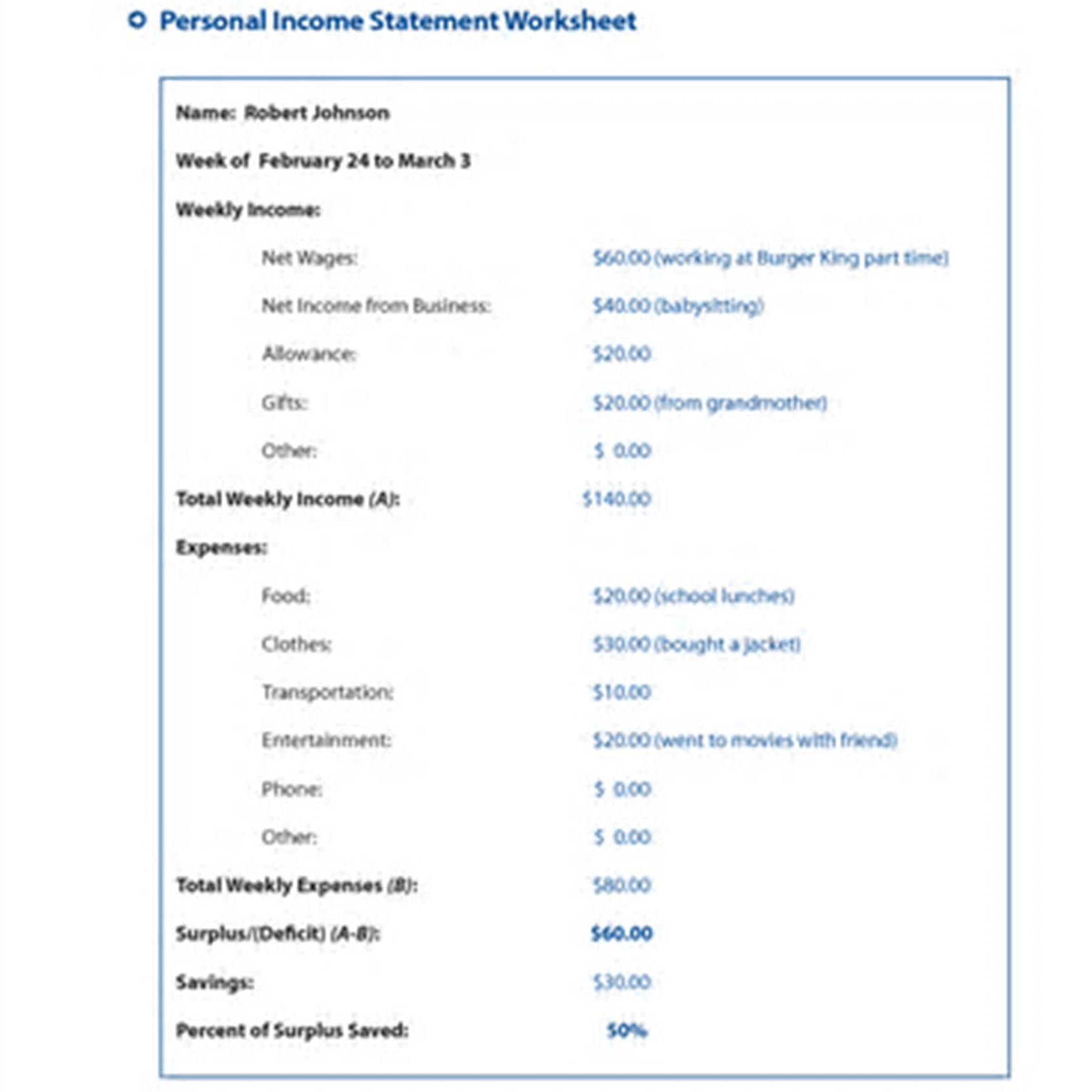

Income statement activity. This year, the process of filing an income tax and benefit return may feel particularly daunting. This tax information and impact note is about the introduction of making tax digital for income tax self assessment for sole traders and landlords with income over £30,000. Sales on credit) or cash vs.

From april 2026 making tax digital (mtd) for income tax, will apply to relevant persons (unincorporated businesses and landlords) with business and/or property income over £50,000, followed by. Revenue, expenses, gains, and losses. Santa clara, calif., feb.

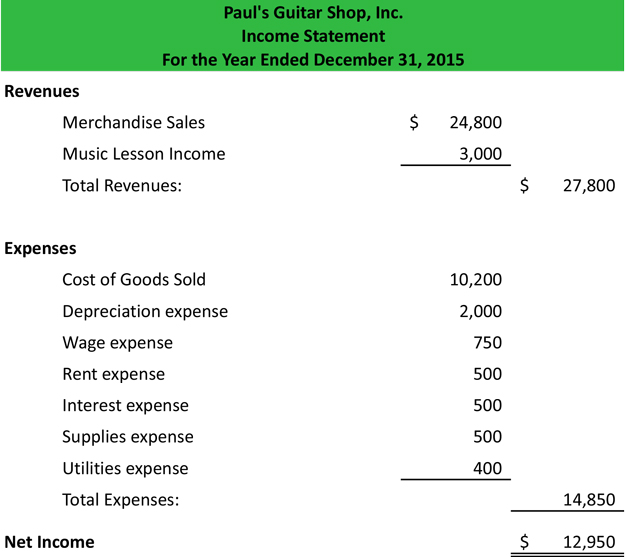

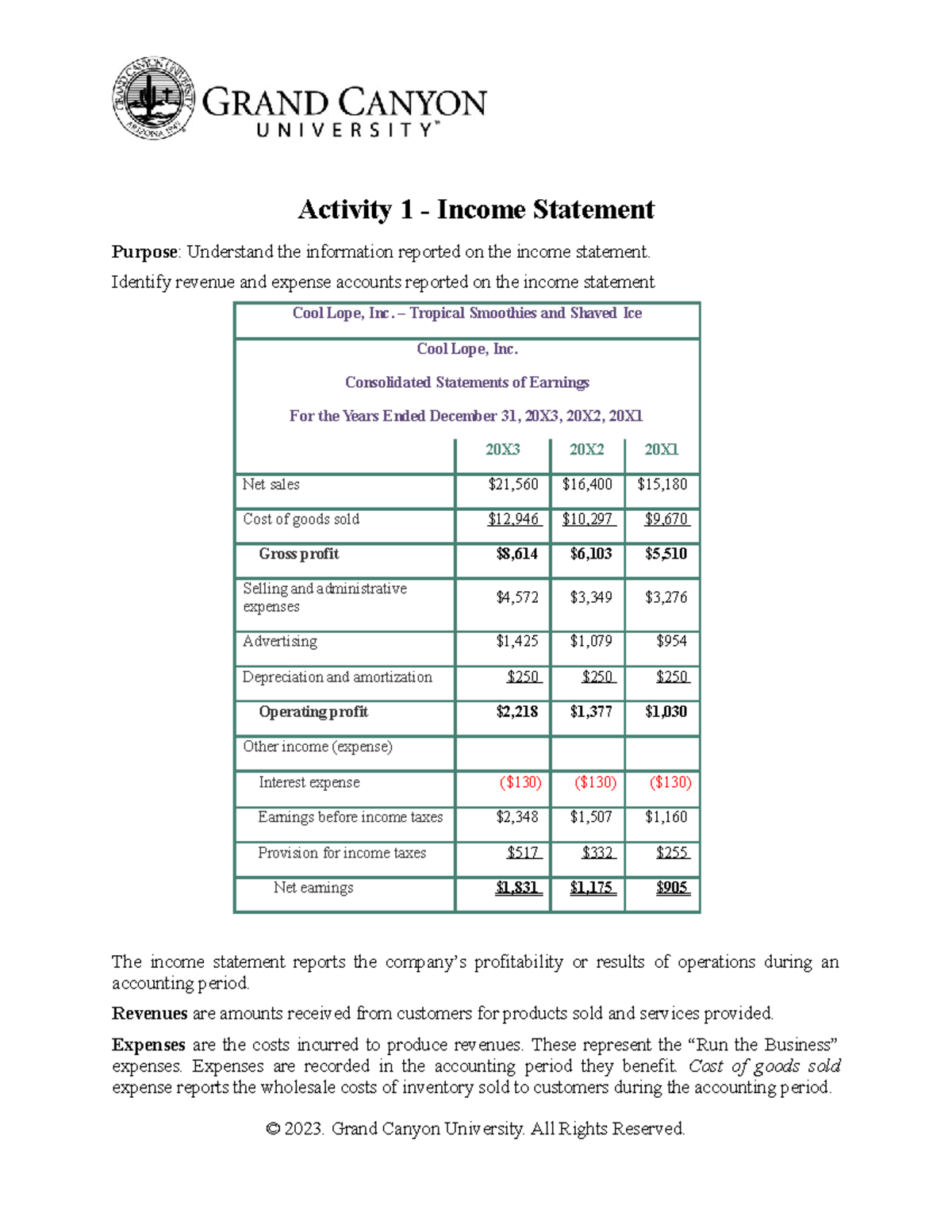

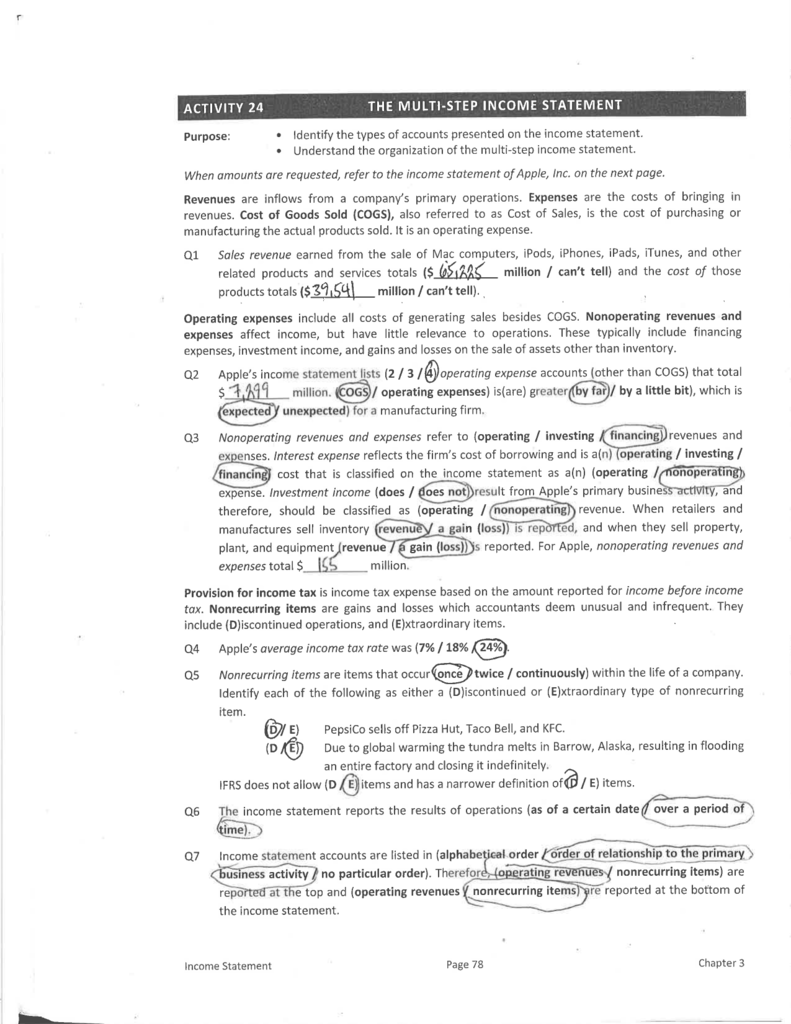

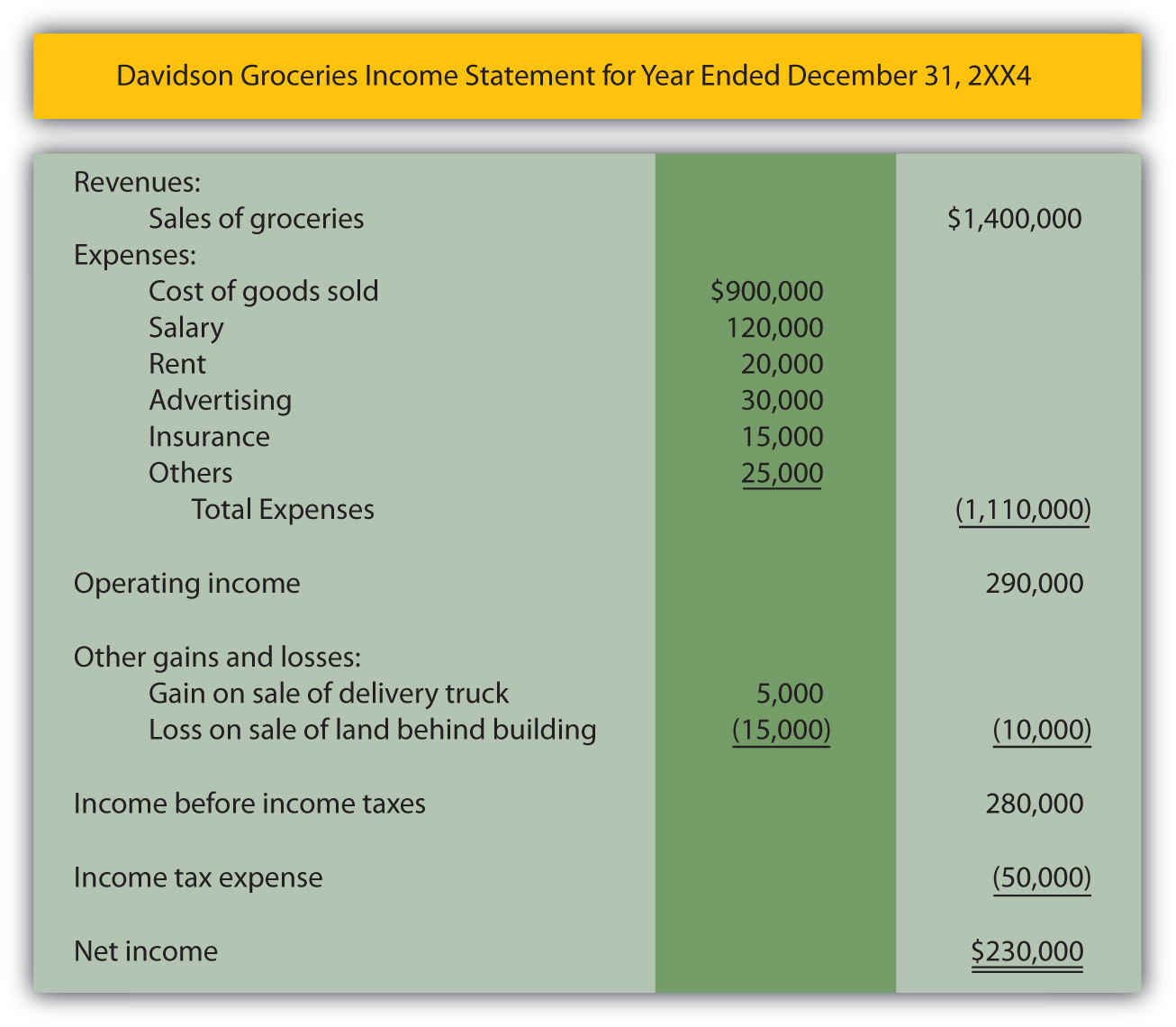

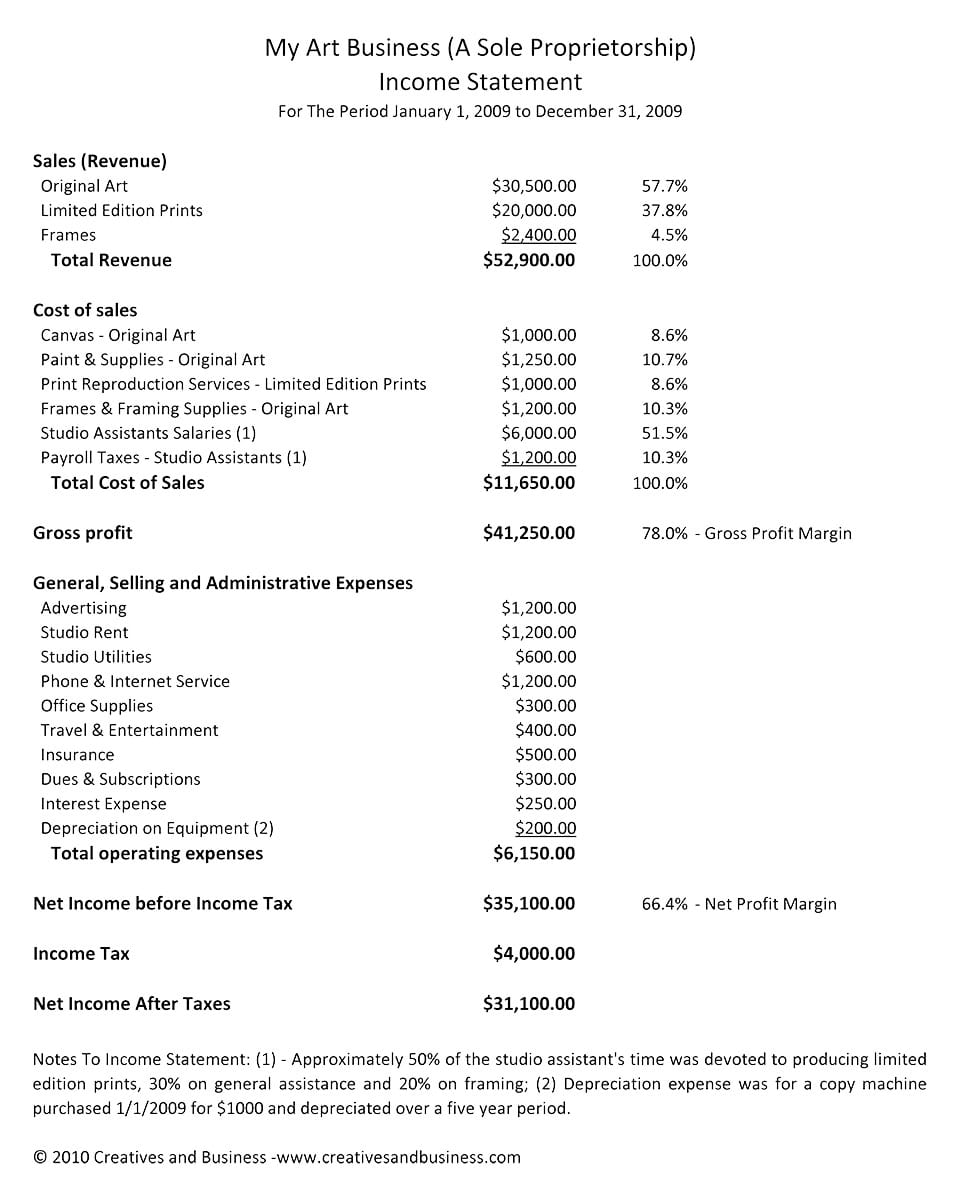

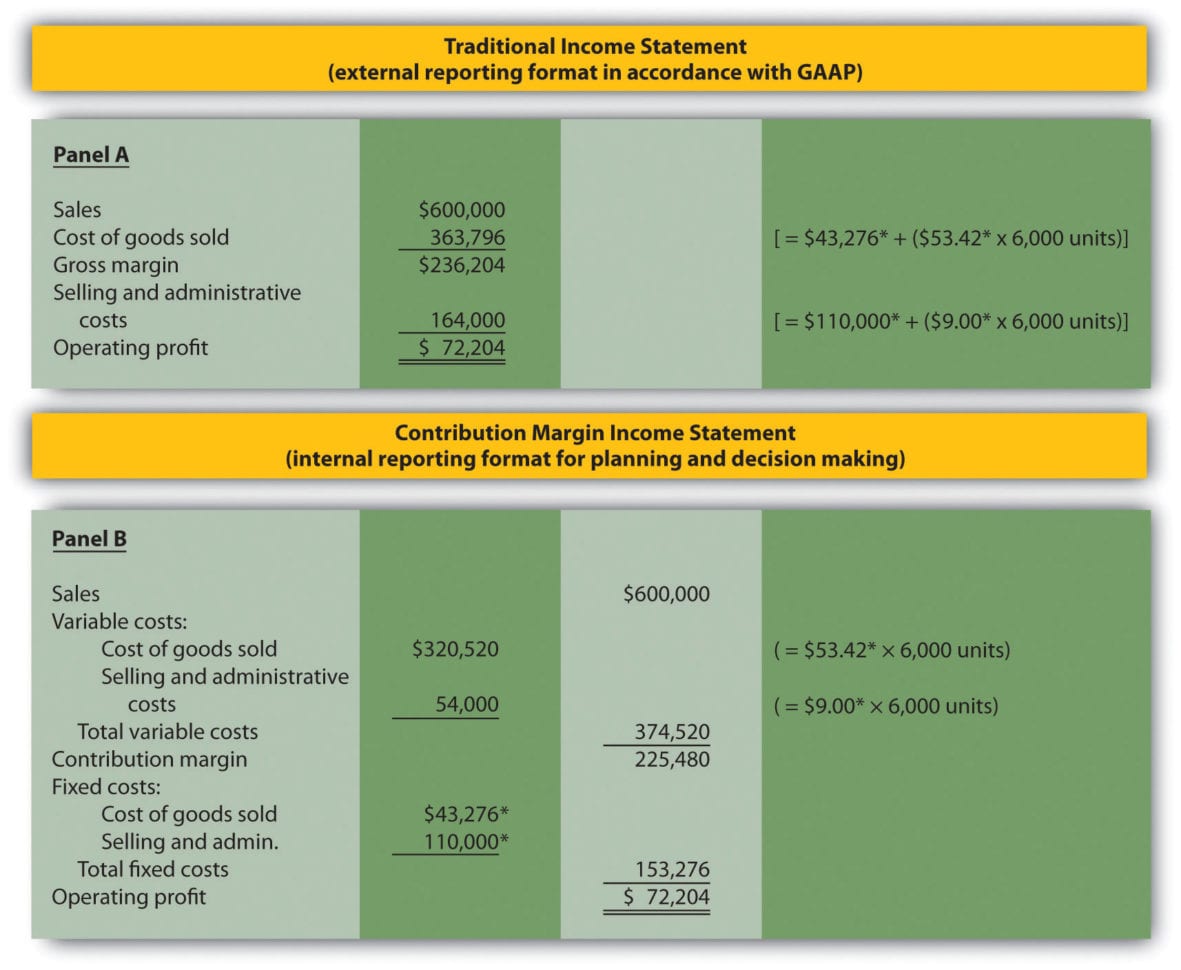

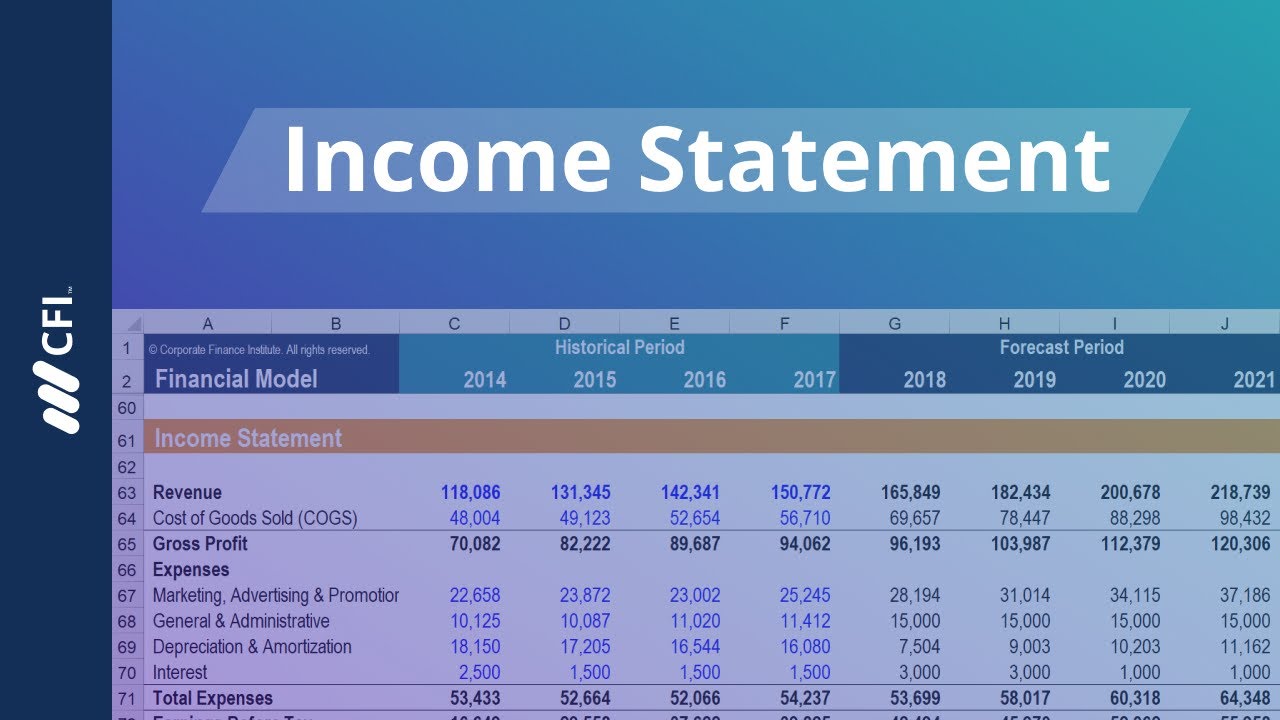

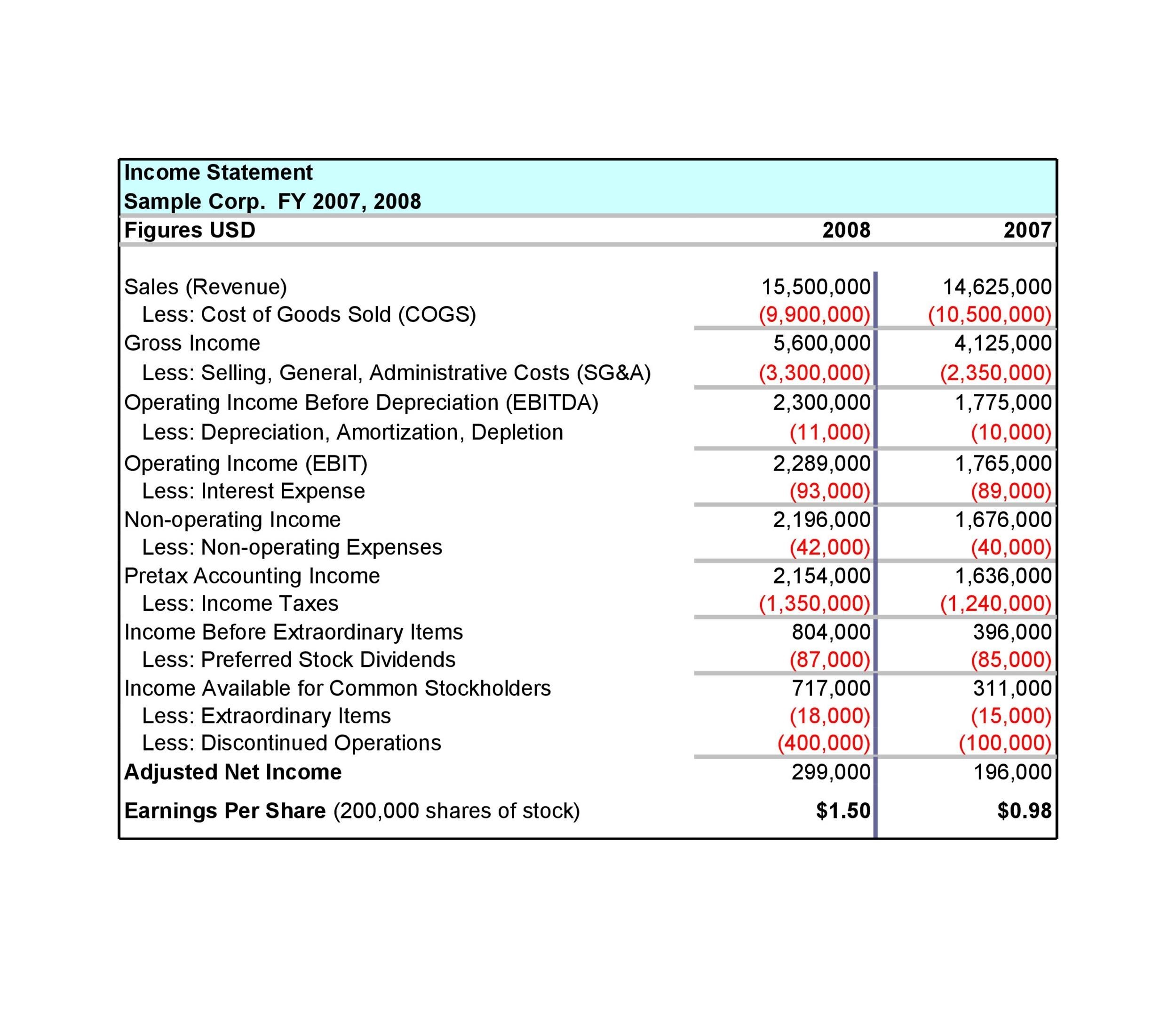

The income statement reports revenues, expenses, gains, losses, and the resulting net income which occurred during the accounting period shown in its heading. An income statement is a profitability report. The income statement starts with a heading made up of three lines.

Investors and business managers use the income statement to determine the company’s financial health. It’s one of the core financial statements that all nonprofits need. The headings on these financial statements reflect the fact that a balance sheet is a snapshot taken at the end of a period, while an income statement reflects activities over the entire period.

2.3 prepare an income statement, statement of. The income statement is the financial account that explains the trading performance of a business in terms of the achieved profit or loss. For the quarter, gaap earnings per diluted share was $4.93, up 33% from the previous quarter.

(1) the name of the company, (2) the title of the financial statement, and (3) the period covered by the report. The income statement communicates how much revenue the company generated during a period and what costs it incurred in connection with generating that revenue. It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually.

The income statement, also known as the profit and loss (p&l) statement, is the financial statement that depicts the revenues, expenses and net income generated by an organization over a. The income statement of a service type business is quite simple. Year ended june 30, 2022.

The income statement, along with balance sheet and cash flow statement, helps you understand the financial health of your business. It records revenues, gains, expenses, and losses to evaluate net income. The income statement always begins with gross revenues (or gross income), which is the total amount of money a company actually receives during a specific period of time.

The income statement is a historical record of the trading of a business over a specific period (normally one year). What is the income statement? You may also hear it referred to as a profit and loss statement or income and expense report.

Business reference topic videos income statement Income from operations of $652 million; It is also called the “top line,” as all other costs are subtracted from this to get the net income, or the “bottom line.”