Have A Info About Trial Balance Entries

The result is a report that shows the total debit or credit balance for each account, where the grand total of the debits and credits stated in the report sum to zero.

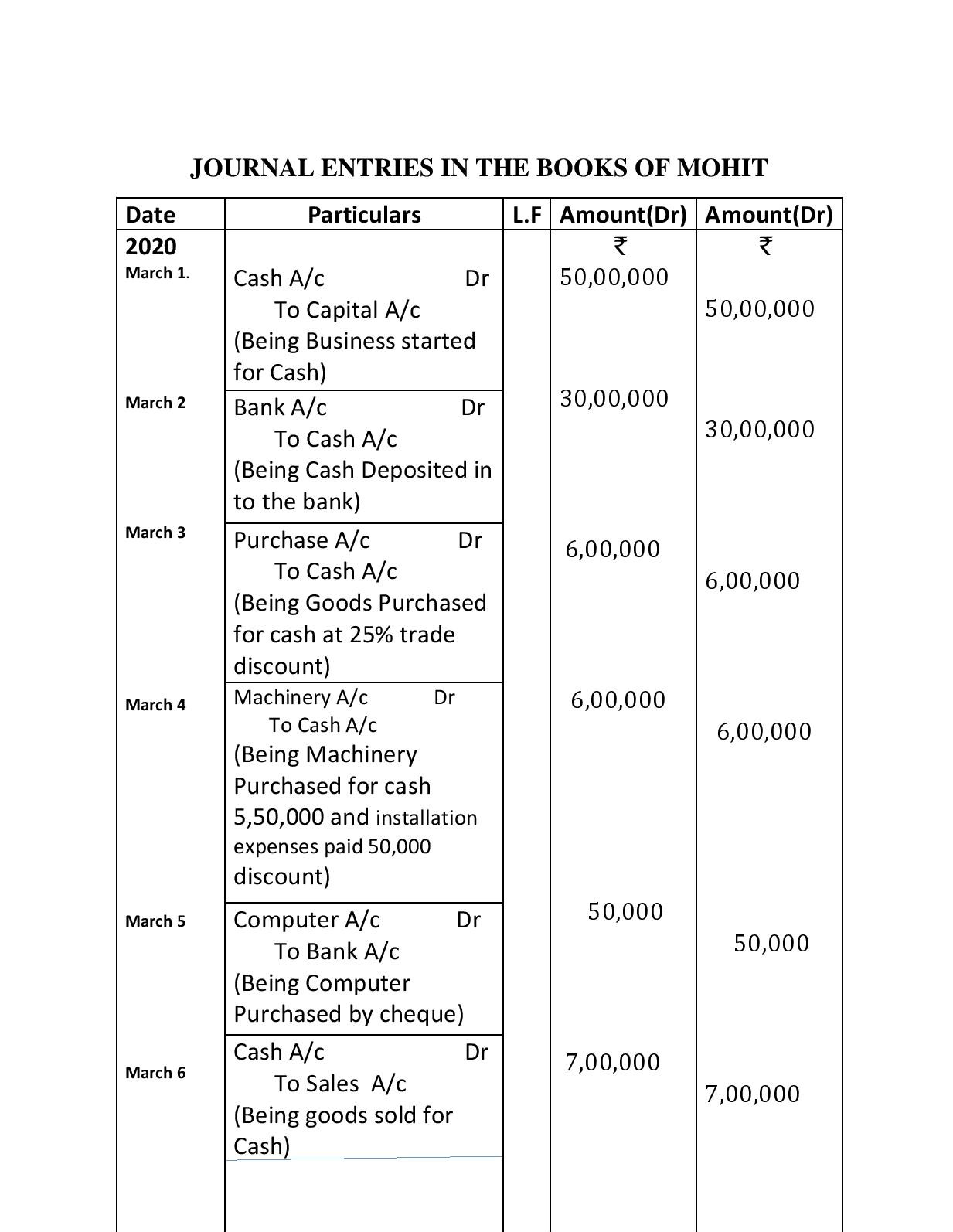

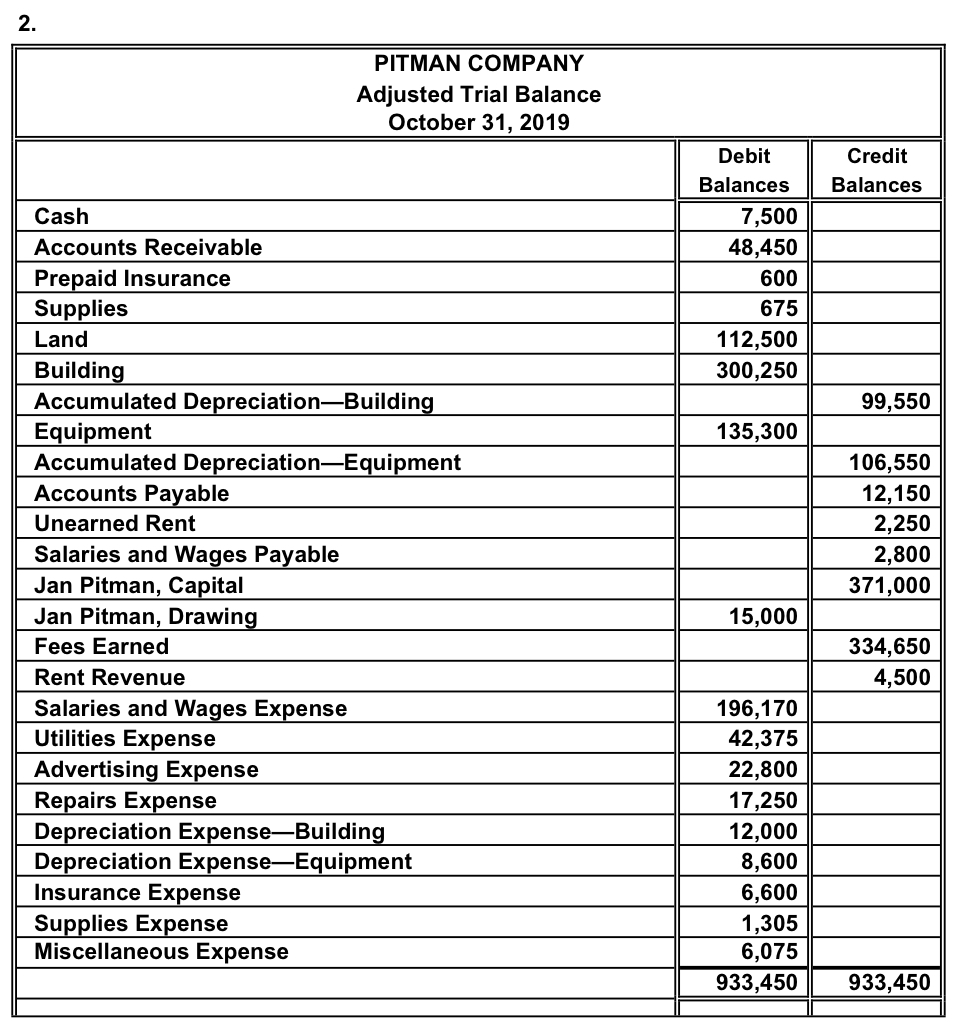

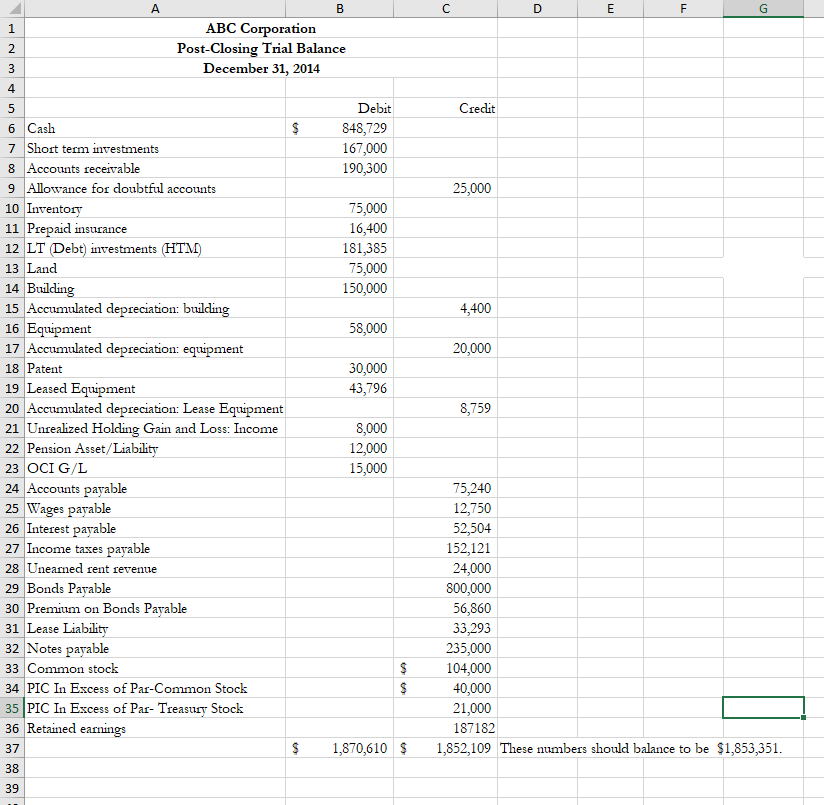

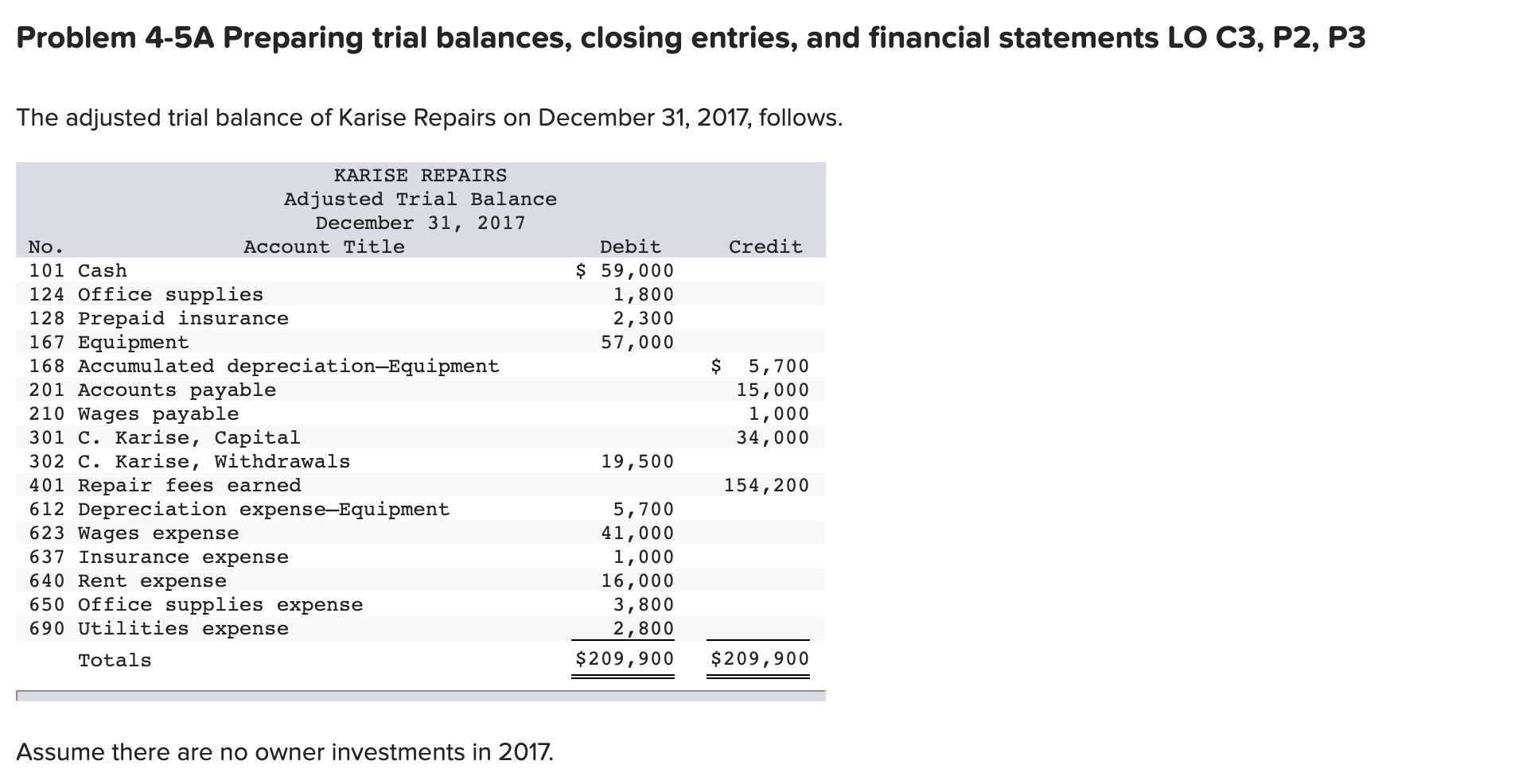

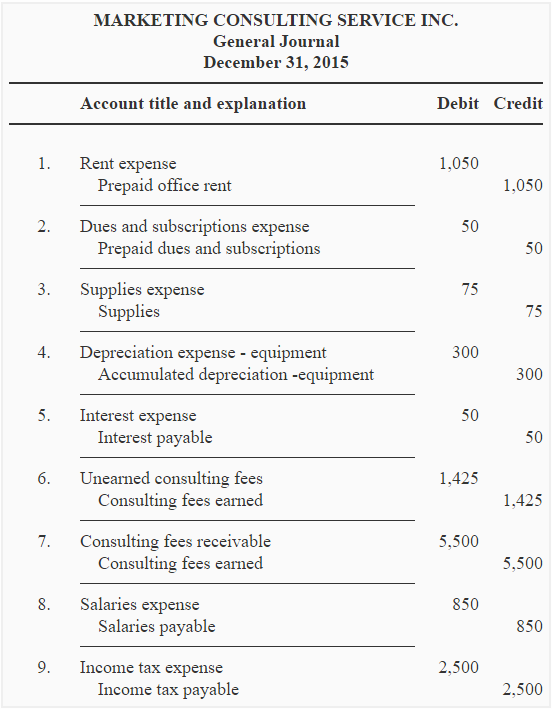

Trial balance entries. Trial balance has a tabular format that shows details of all ledger balances in one place. The form and content of a trial balance is illustrated below, using the account numbers, account names, and account balances of big dog carworks corp. This information is then used to prepare financial statements.

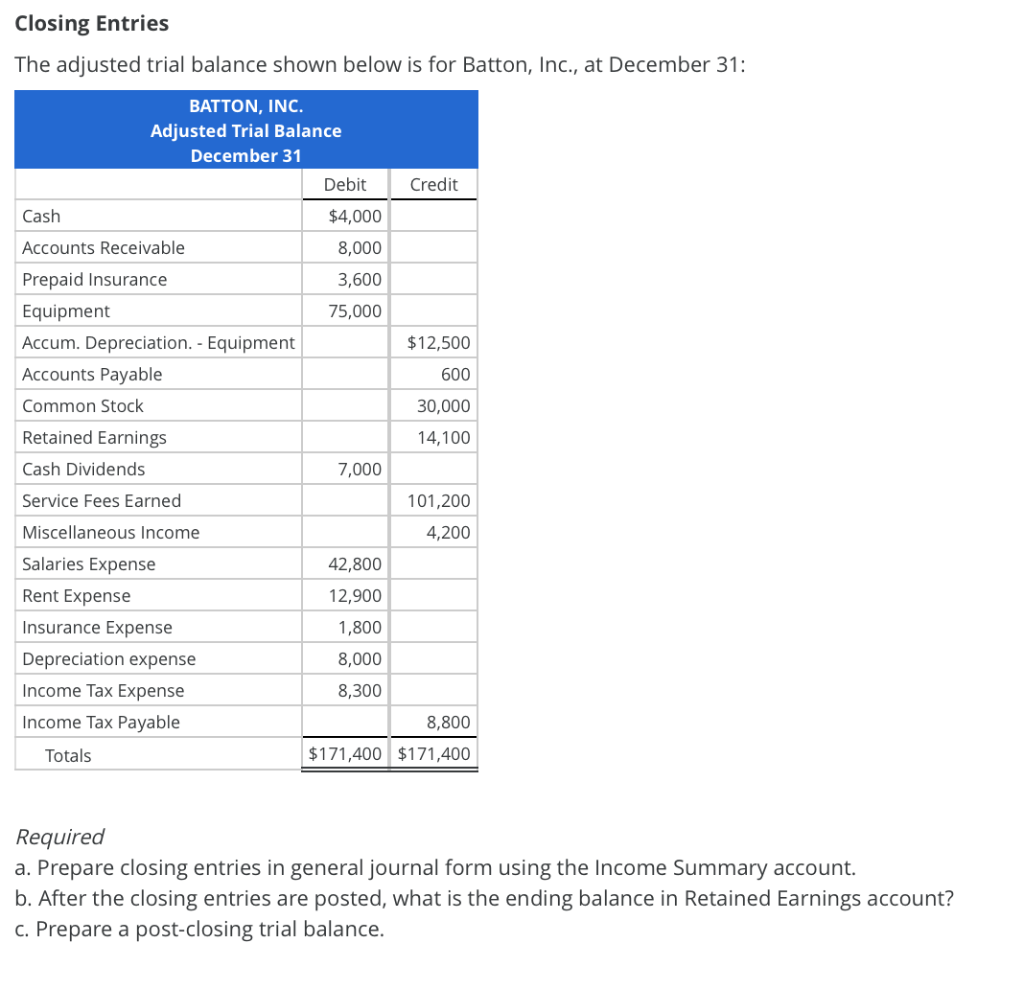

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. Discover the meaning of a journal entry and a trial balance, types of journal entries, how a general ledger differs from a trial balance, and some examples. Adjusted trial balance records the account balances of an organization after adjusting the transaction to various expenses, including the depreciation amount, accrued expenses, payroll expenses, etc.

The balances are usually listed to achieve equal. The accounts included are the bank, stock, debtors, creditors, wages, expense codes and sales. List all the credit balances on the credit side and sum them up.

The trial balance is useful for checking the arithmetic accuracy and correctness of the bookkeeping entries. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. This is done to determine that debits equal credits in the recording process the trial balance is the first step toward recording and interesting your financial results.

It includes transactions done during the year and the opening and closing balances of ledgers, as every entity needs to evaluate its financial position over a particular period. Steps to prepare trial balance. The primary purpose of a trial balance is to identify errors and ensure the equality of debits and credits.

A trial balance is an internal document that lists all the account balances at a point in time. It is a statement of debit and credit balances that are extracted on a specific date. This method states that each account’s total debit and credit amount are displayed in the two columns of amount against it, i.e., one for the debit balance the debit balance in a general ledger, when the total credit entries are less than the total number of debit entries, it refers to a.

Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top roles at a new. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate. Hub reports april 13, 2023 to prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts.

By kate christobek. Cast/ balance all the ledger accounts in the books. The trial balance is an accounting report that lists the ending balance in each general ledger account.

Definition of trial balance in accounting as per the accounting cycle, preparing a trial balance is the next step after posting and balancing ledger accounts. The total debits must equal total credits on the trial balance. The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains,.

The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. A trial balance includes the figures from the profit and loss (income statement) and the balance sheet financial statements. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.