Breathtaking Info About Income Statement Net Loss Example

Dividend of € 1.80 per share;

Income statement net loss example. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. Net cash € 10.7 billion. Netto losing is an accounting term, and it refers to a neg range for salary.

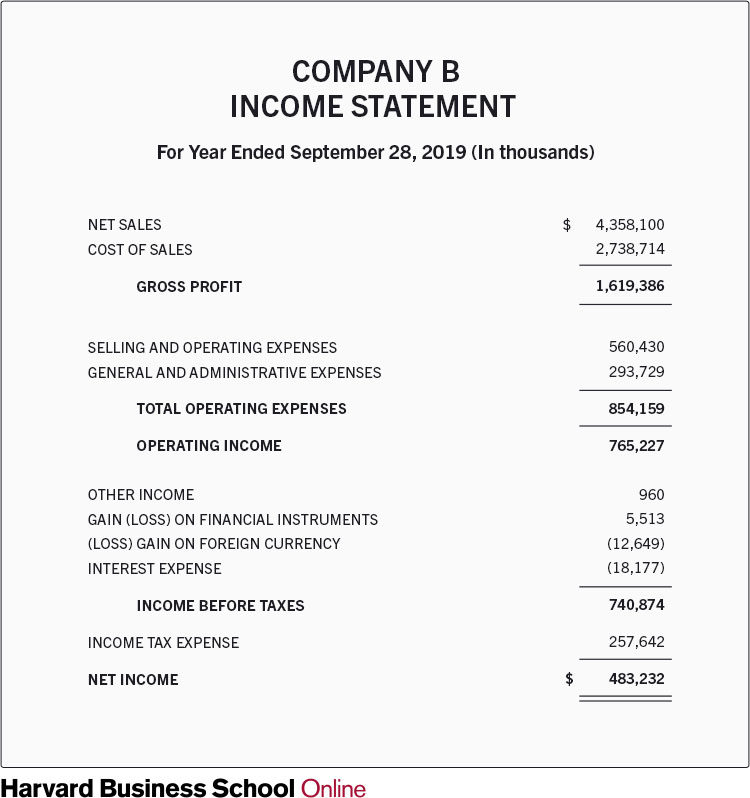

The income statement complies with the accrual basis of accounting. Also called the bottom line, this figure is your total profit or loss after accounting for all revenues, expenses, taxes, and deductions. An income statement is a financial statement that shows you the company’s income and expenditures.

However, a business must eliminate its net losses. Trump was penalized $355 million plus interest and banned for three years from serving in any top roles at a new york. What is an income statement?

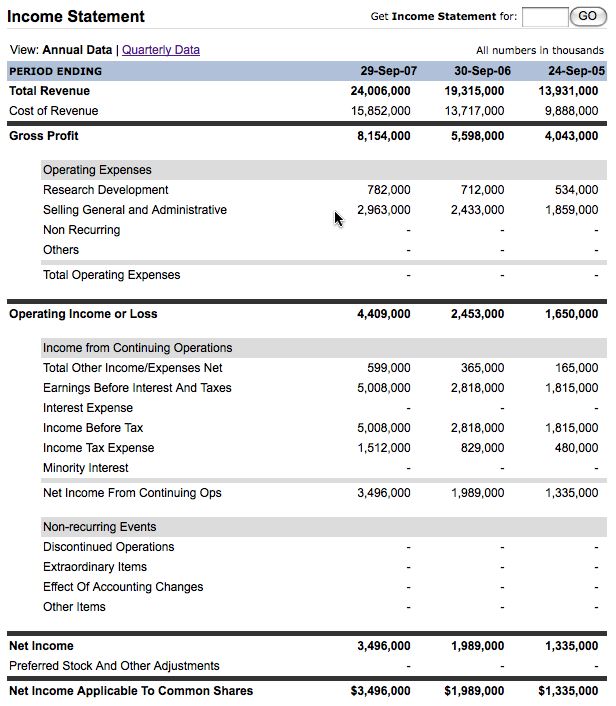

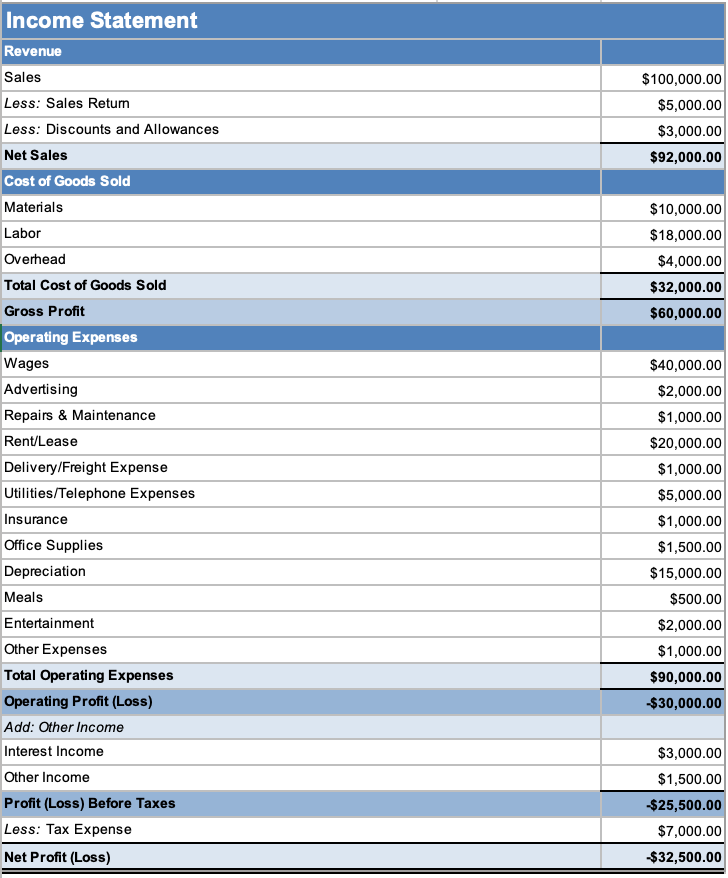

In that case, you likely already have a profit and loss statement or income statement that shows your net income. For example, company abc might earn revenues worth $150,000 in a specific period, and cogs are $100,000 while expenses mount up to $60,000 against the revenues earned. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain,.

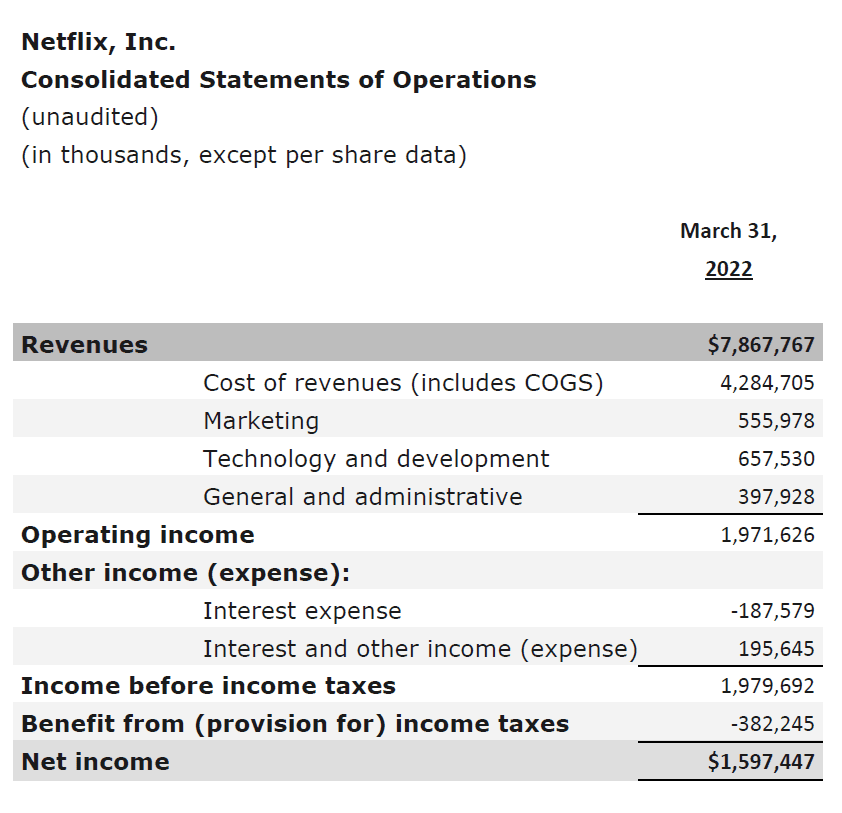

All expenses are included in this calculation, including the effects of income taxes. Includes other words, a company incurs one net loss when the expenses. First, determine the revenue, which is the income the business generates.

Net loss is the excess of expenses over revenues. Free cash flow before m&a and customer financing € 4.4 billion; So be sure to pay attention to the type of profit referenced (net profit, gross profit, etc.) to make sure that you’re using net profit as the correct synonym for net income.

If net income and net loss are the bottom line of a financial statement, then revenue is the top line. As you can see at the top, the reporting period is for the year that ended on sept. Net income is calculated by taking revenues and subtracting the costs of doing business such as depreciation , interest.

An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter. All revenues and expenses are matched for the given. Since revenues ($85,000) are greater than expenses ($79,200), cheesy chuck’s has a net income of $5,800 for the month of june.

For example, revenues of $900,000 and expenses of $1,000,000 yield a net loss of $100,000. It means the company has spent more than it earned, resulting in a negative income. It also shows whether a company is making profit or loss for a given period.

Net loss occurs when a company spends more money than it makes at a particular time. Figure 2.7 displays the june income statement for cheesy chuck’s classic corn. This means that the income and expenses presented in the income statement have already been.

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)