Supreme Tips About 3 Statement Model Balance Sheet And Income Data Indicate The Following

![[Solved] Missing Amounts from Balance Sheet and Statement Data](https://d2vlcm61l7u1fs.cloudfront.net/media/064/0646e80f-f006-498c-b657-761e22a13f74/phpQ4giZj.png)

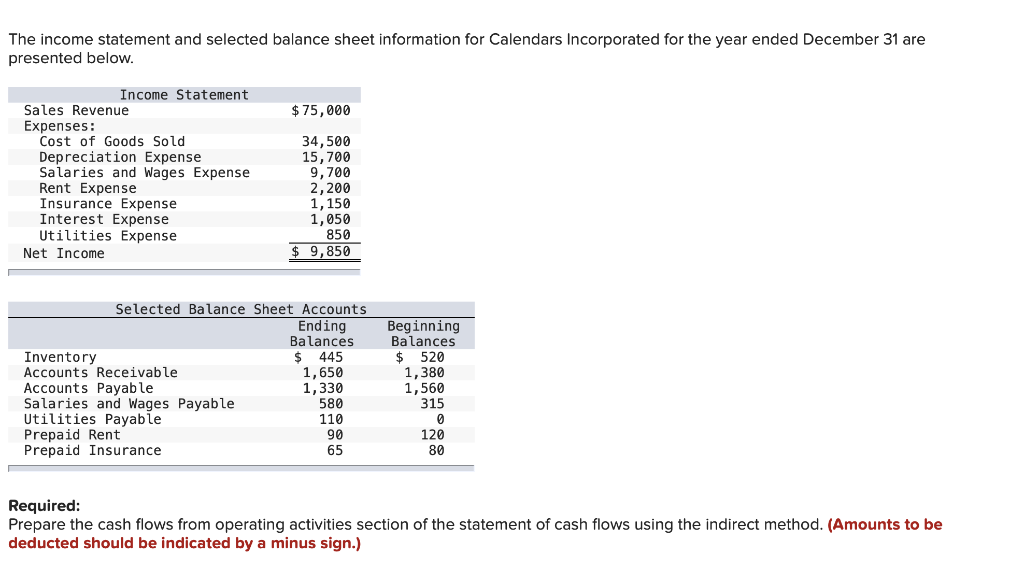

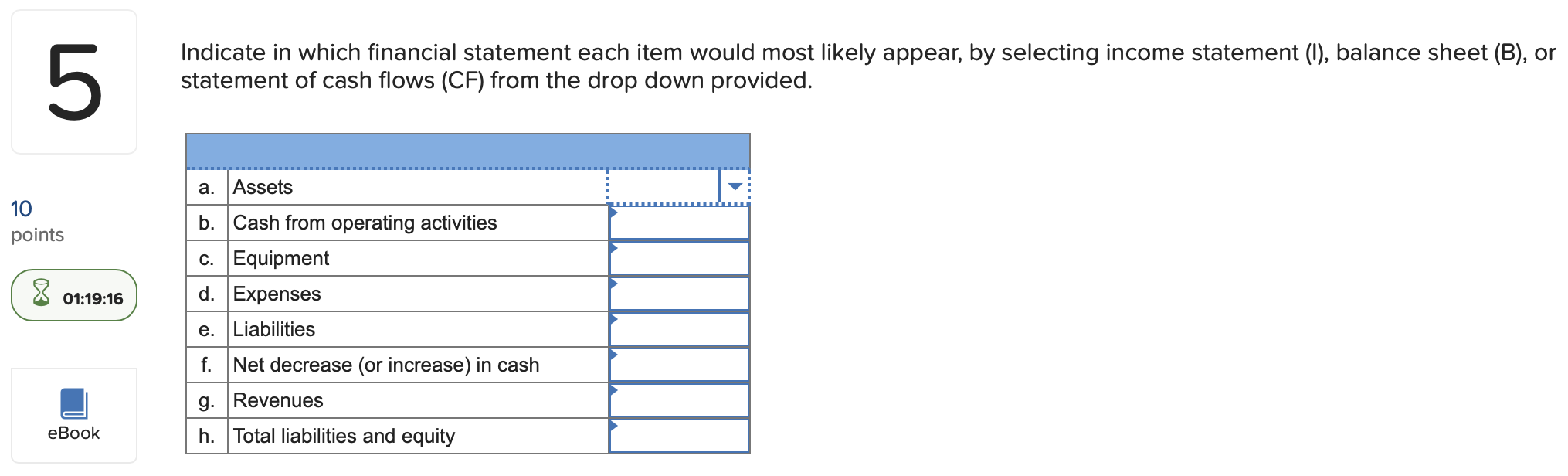

(1) the income statement, (2) the balance sheet, and (3) the cash flow statement.

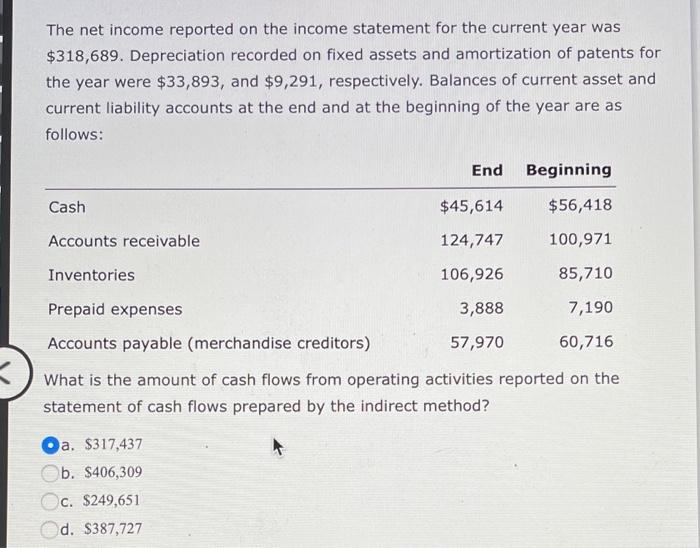

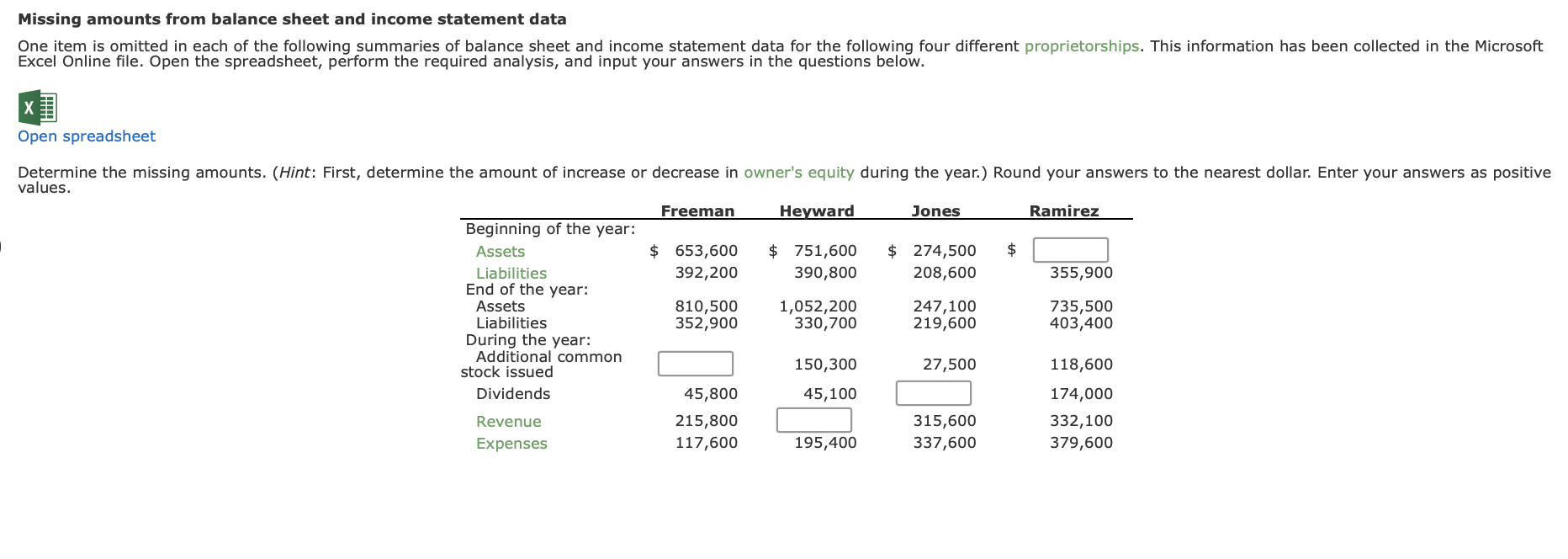

3 statement model balance sheet and income statement data indicate the following. Identify connected elements between the balance sheet and the income statement. In financial modeling, the “3 statements” refer to the income statement, balance sheet, and cash flow statement. The balance sheet and the income statement provide distinct yet interconnected perspectives on a company’s financial standing.

Net income on the income statement grows retained earnings on the balance sheet. 4.9/5 (373) take your financial modeling skills to the next level! The three financial statements are the company's income statement, the balance sheet, and the cash flow statement (sometimes called the statement of cash flows).

Each of the financial statements provides important. A three statement model allows for forecasts and predictions to be made of a company’s financial data. Differentiate between expenses and payables.

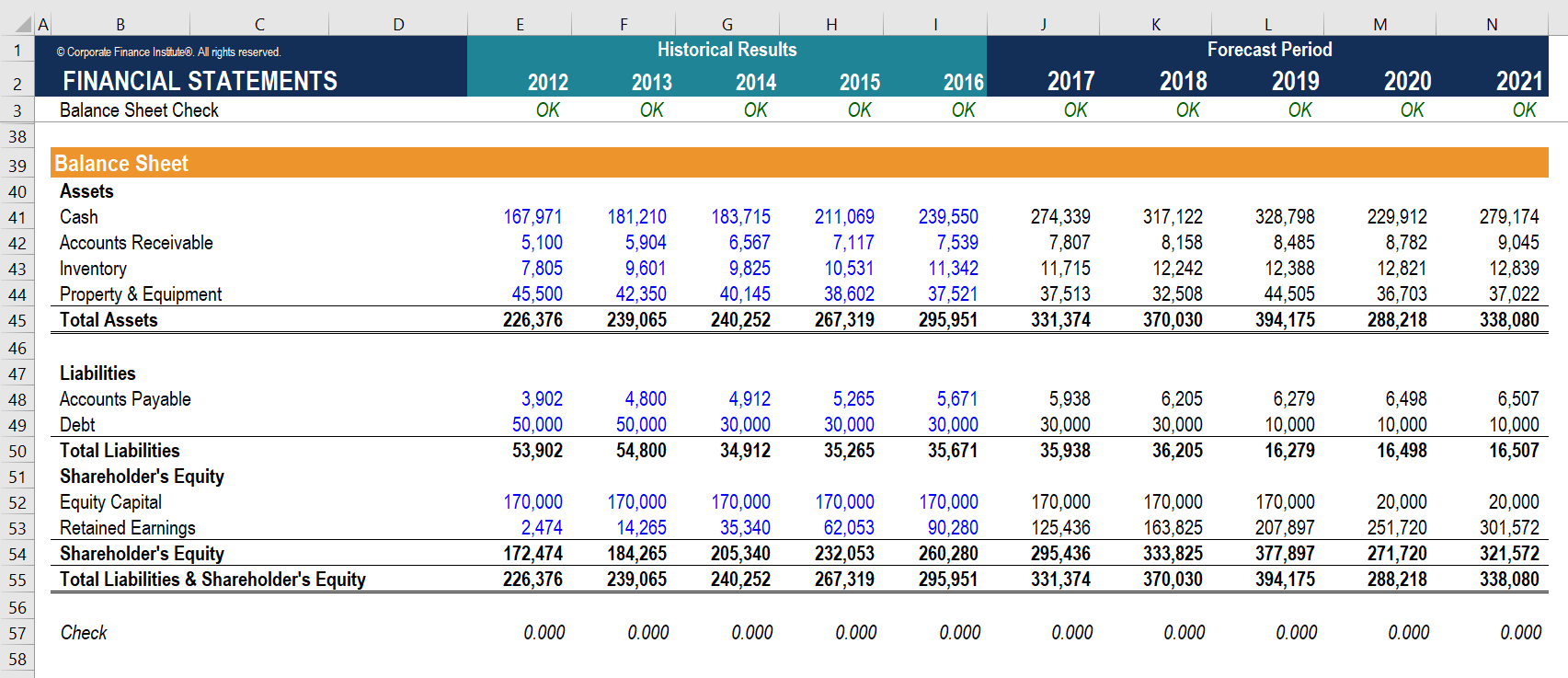

The cash flow statement starts with net. As fixed assets age, they begin to lose their value. 3 statement models are built in excel and typically the income statement is created first, followed by the balance sheet and then the cash flow statement.

The p&l feeds net income on the liabilities and equity side of the balance sheet. Net income and retained earnings as. The three financial statements are:

The p&l, balance sheet, and cash flow statements are three interrelated parts. Data found in the balance sheet, the income statement, and the cash flow statement is used to calculate important financial ratios that provide insight on the. Key learning points.

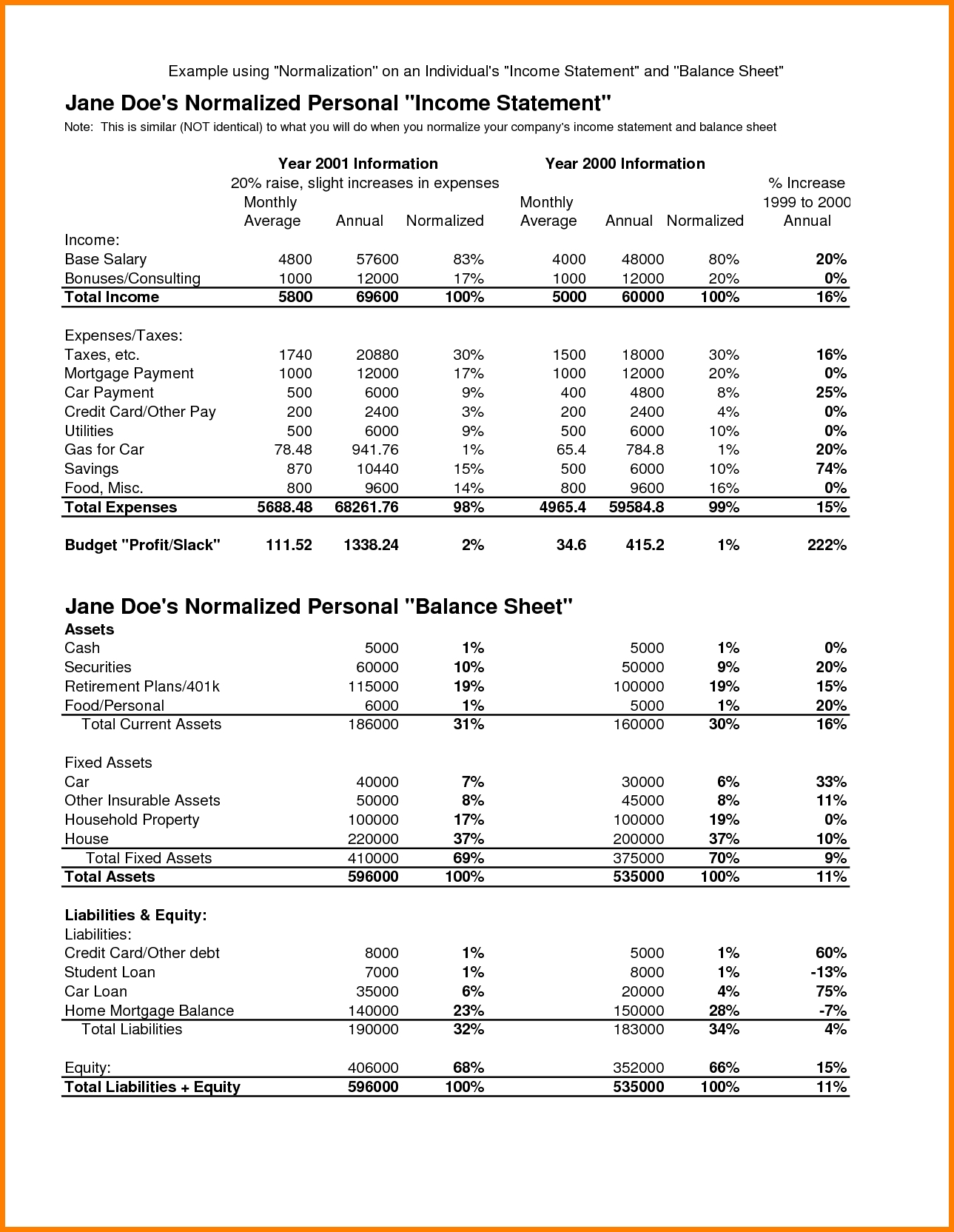

Income statement the income statement, often called the profit and loss statement, is your business’ performance report for a specific period.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

![[Solved] Missing amounts from balance sheet and sta](https://media.cheggcdn.com/study/a14/a149478d-dcc9-4ea1-a6d1-e29b0e14458f/image)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)