Marvelous Info About Coca Cola Financial Ratios

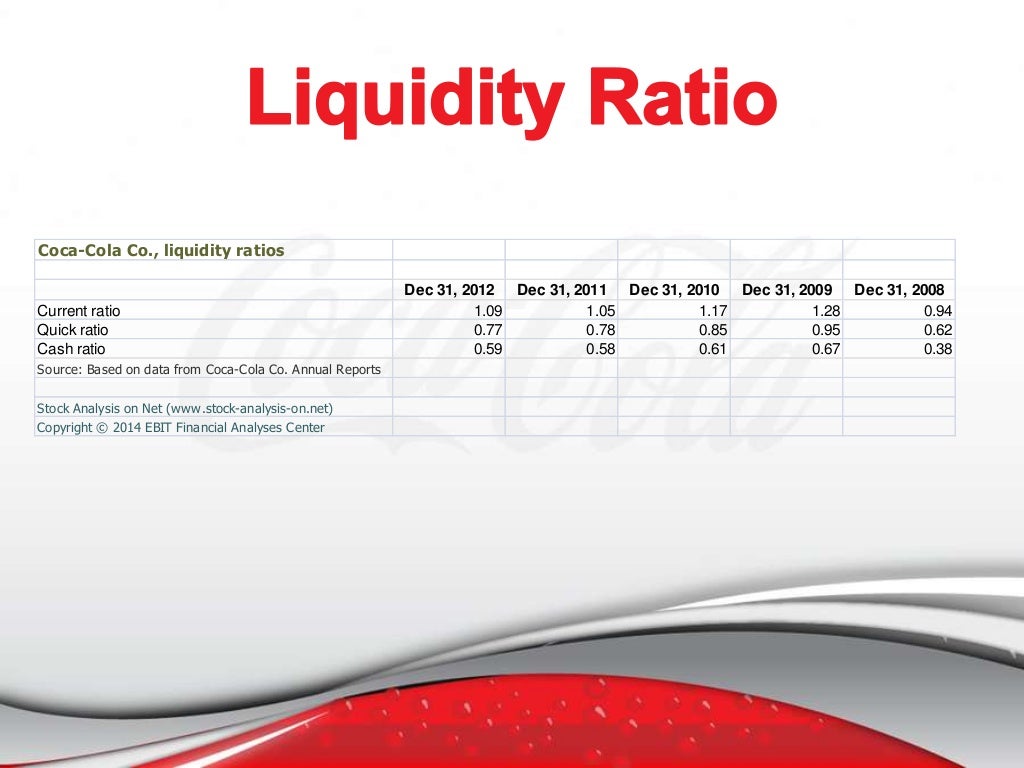

Current ratio can be defined as a liquidity ratio that.

Coca cola financial ratios. The beverage titan recently closed out its fiscal 2023 year and told its. Currency in usd follow 2w 10w 9m. 29 rows market cap in millions usd.

View ko.us financial statements in full. Price to sales ratio 6.46: 61 rows roa roi return on tangible equity current and historical current ratio for cocacola (ko) from 2010 to 2023.

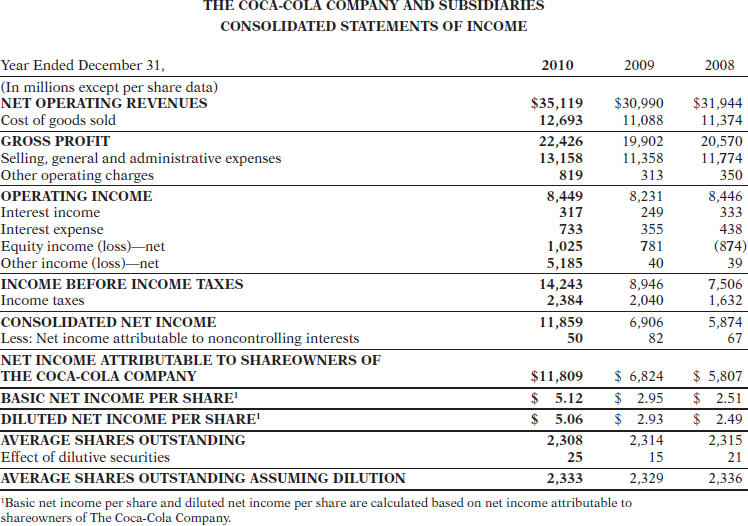

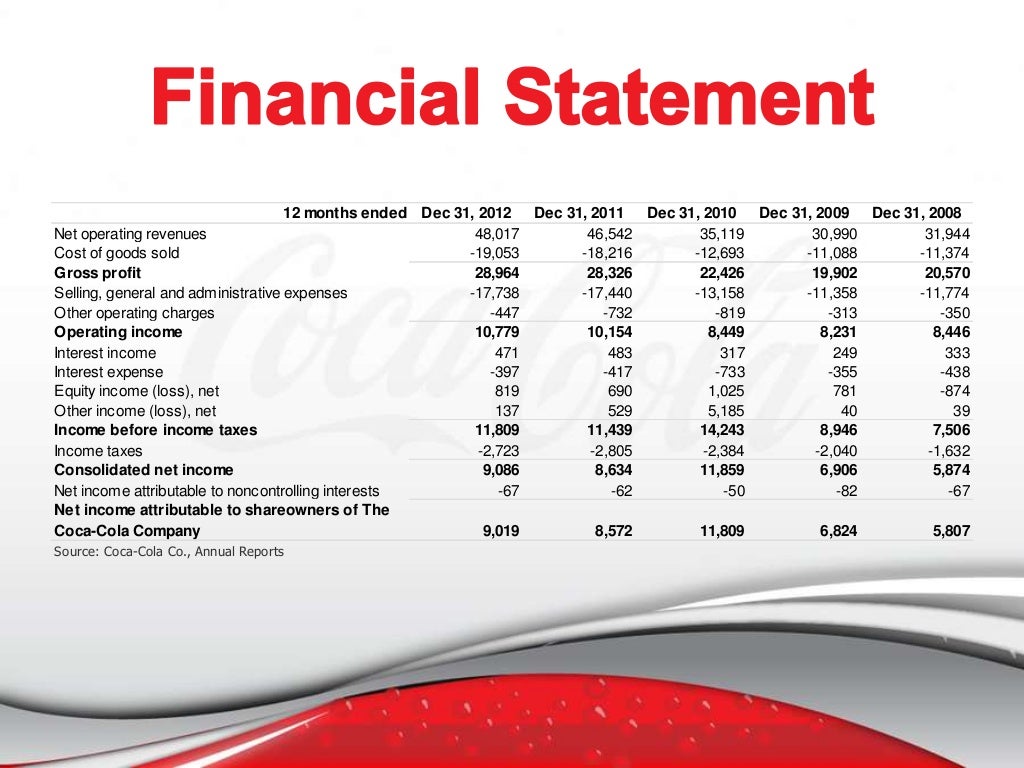

Ten years of annual and quarterly financial statements and annual report data for cocacola (ko). Balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. Income statement ( annual) financials in millions usd.

Margin analysis schedule pdf transcript pdf audio mp3 global unit case volume declined 1% for the quarter and grew 5% for the full year net revenues grew. While there are never any guarantees when it comes to dividends, three stocks i expect should increase their payouts for years and be able to pay you for the rest of your. Financials are provided by nasdaq data link and sourced from audited reports submitted to the securities and.

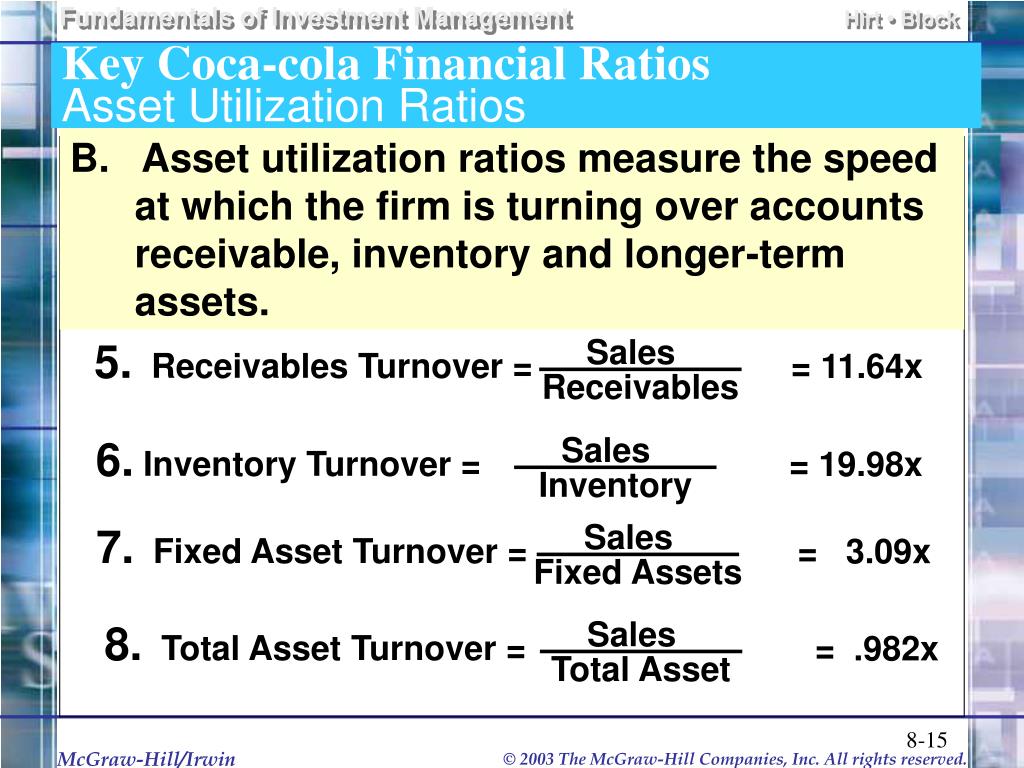

The company has an enterprise value to ebitda ratio of 20.99. $24.99 analysis of profitability ratios annual data quarterly data profitability ratios measure the company ability to generate profitable sales from its resources (assets). Income statements, balance sheets, cash flow statements and key ratios.

P/e ratio (including extraordinary items) 23.99: Price to book ratio 11.42: P/e ratio (ttm) 24.06:

Margin analysis schedule pdf audio mp3 transcript pdf global unit case volume grew 9% for the quarter and 8% for the full year net revenues grew 10% for. Ten years of annual and quarterly financial ratios and margins for analysis of cocacola (ko). The company gave a 2024 organic revenue outlook that beat expectations, with a diverse group of products expected to boost results.

Global unit case volume grew 2% for the quarter and 2% for the full year. The balance sheet is a financial report. Includes annual, quarterly and trailing numbers with full history and charts.

Net revenues grew 7% for the quarter and 6% for the full year;. Its net revenue rose 7.4% to $10.95 billion beating. The data provider is financial modeling prep and the numbers are sourced.

Ten years of annual and quarterly balance sheets for cocacola (ko).