Brilliant Strategies Of Tips About Financial Plan And Projections Example

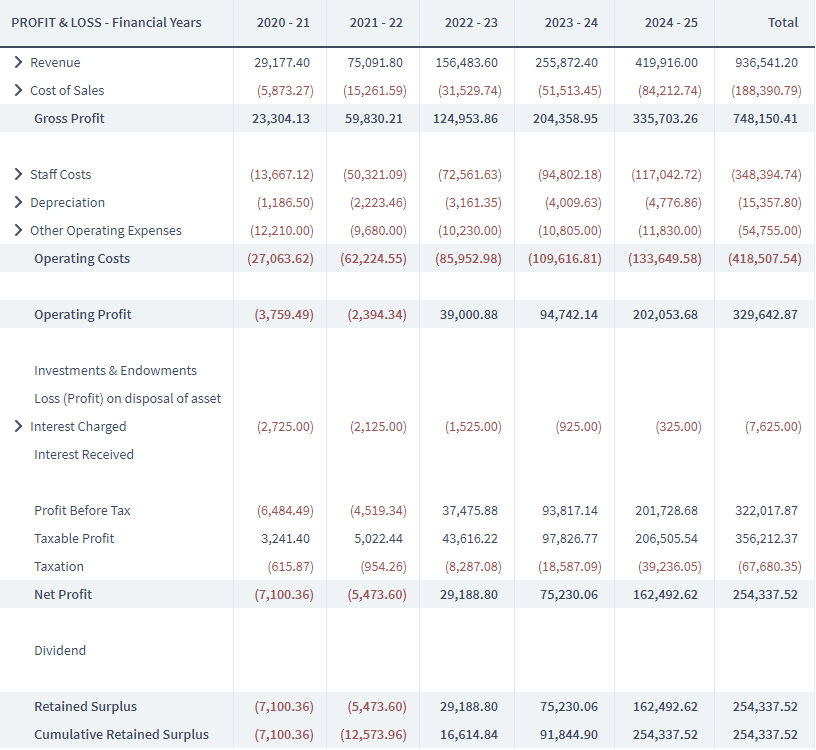

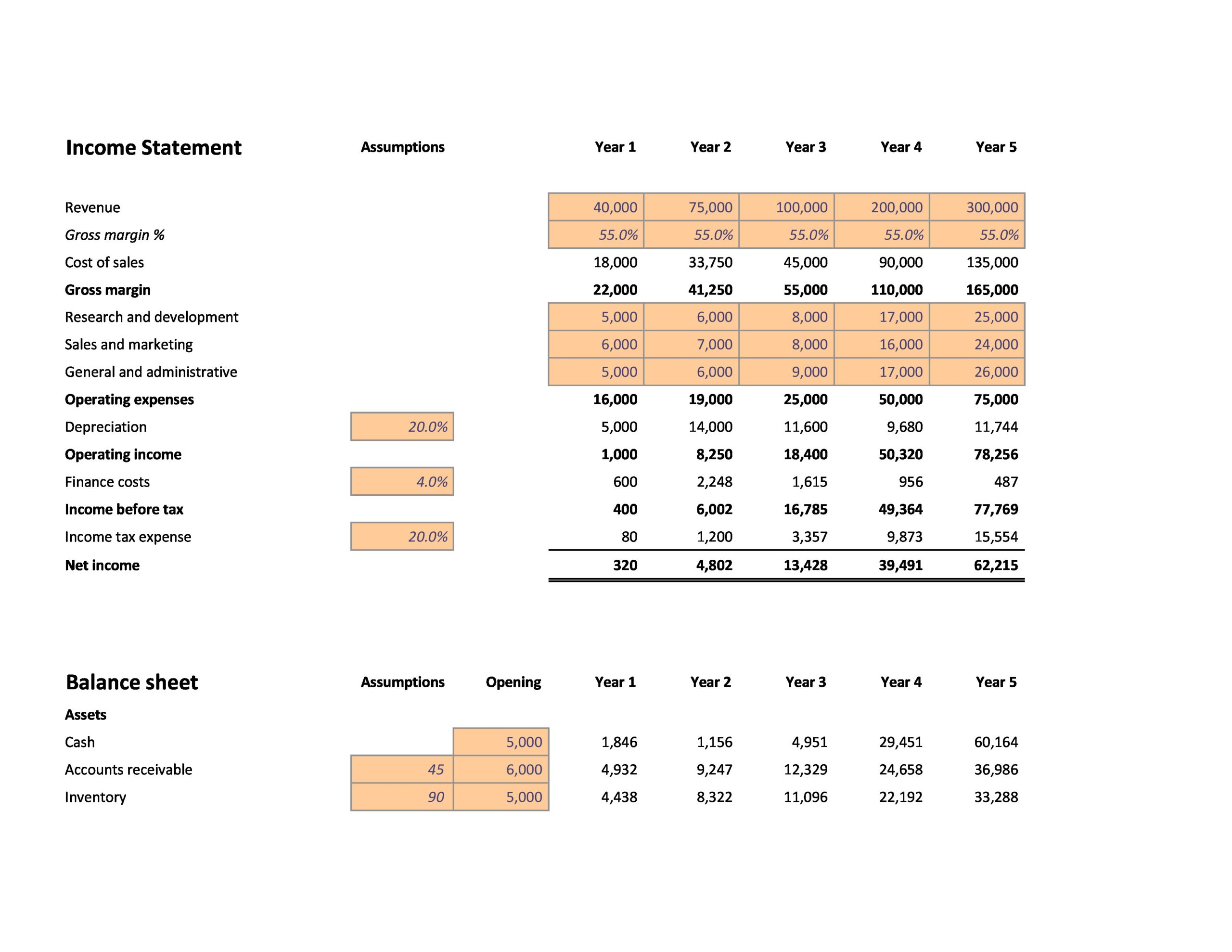

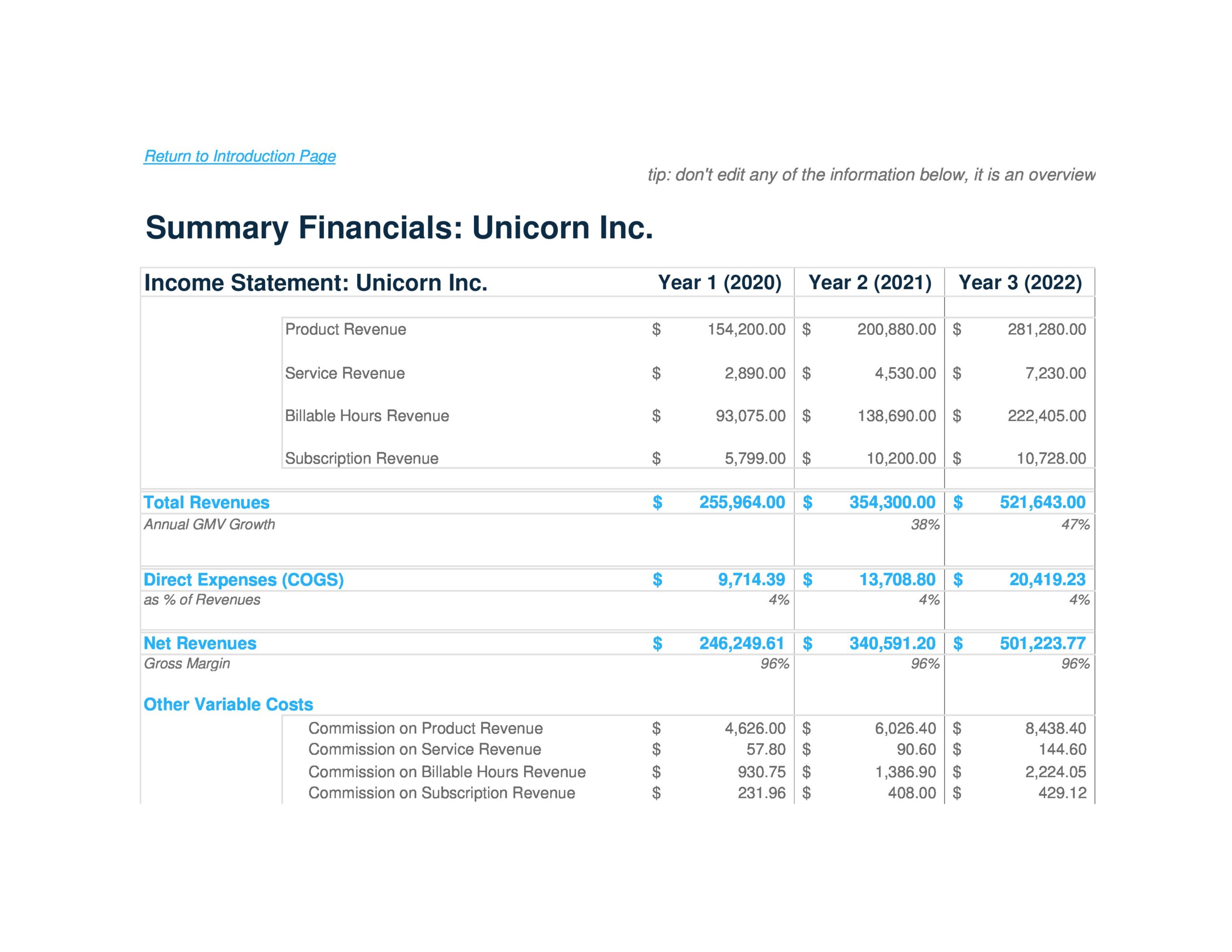

Income statement also called the profit and loss statement , this focuses on your company’s expenses and revenues generated for a specific period of time.

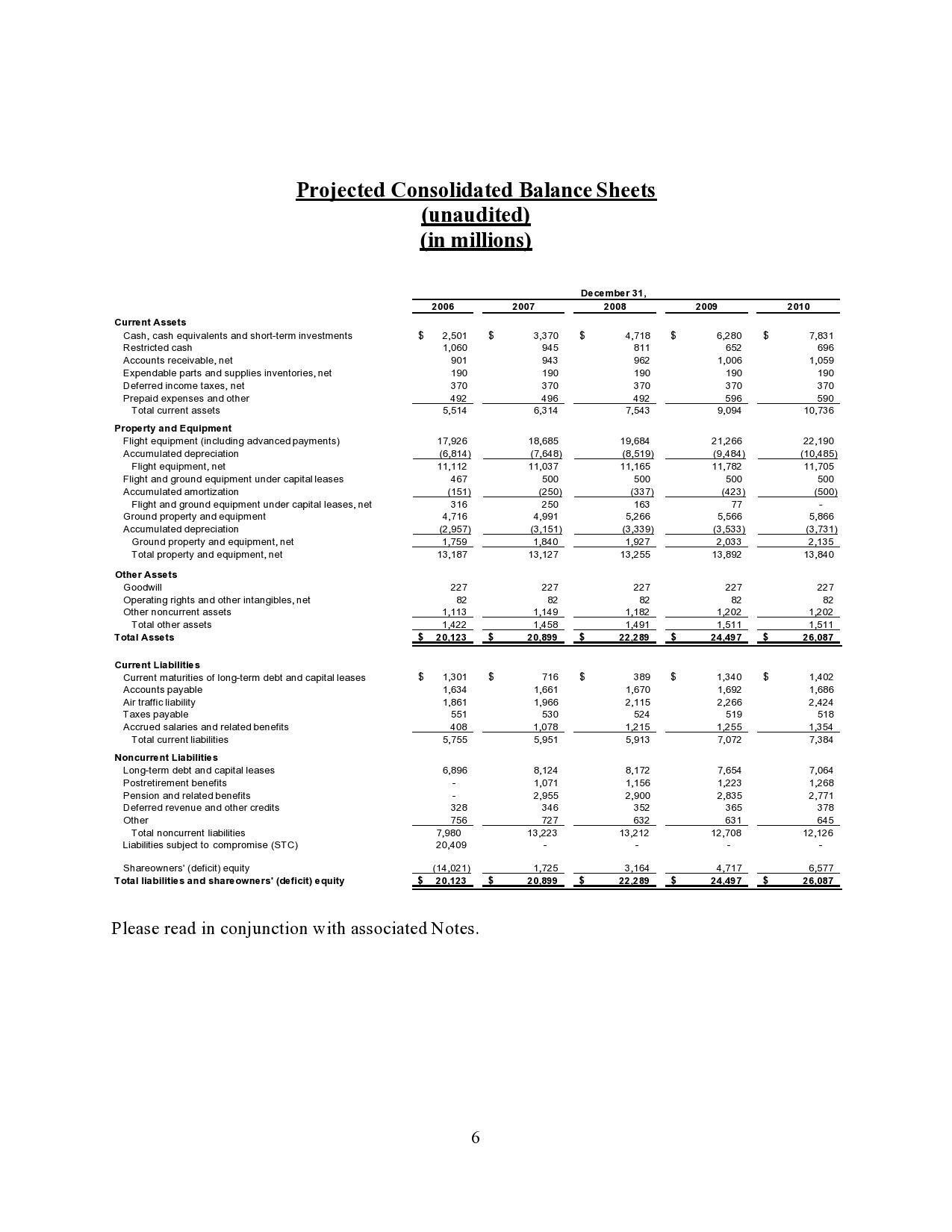

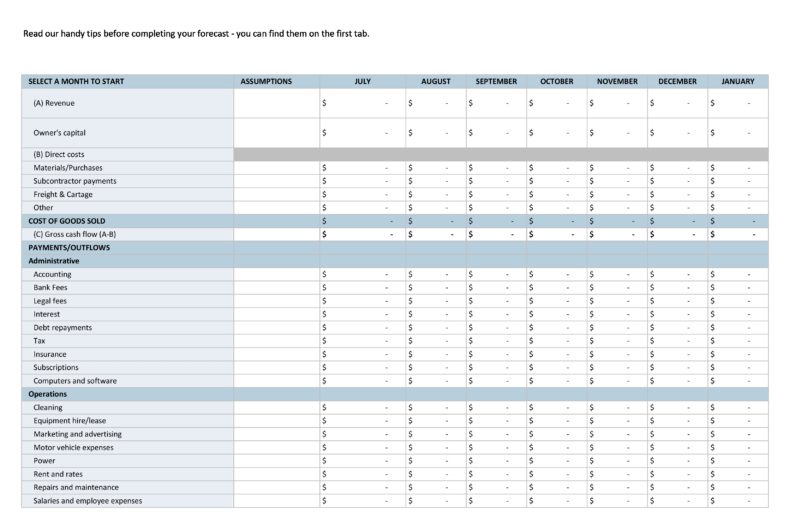

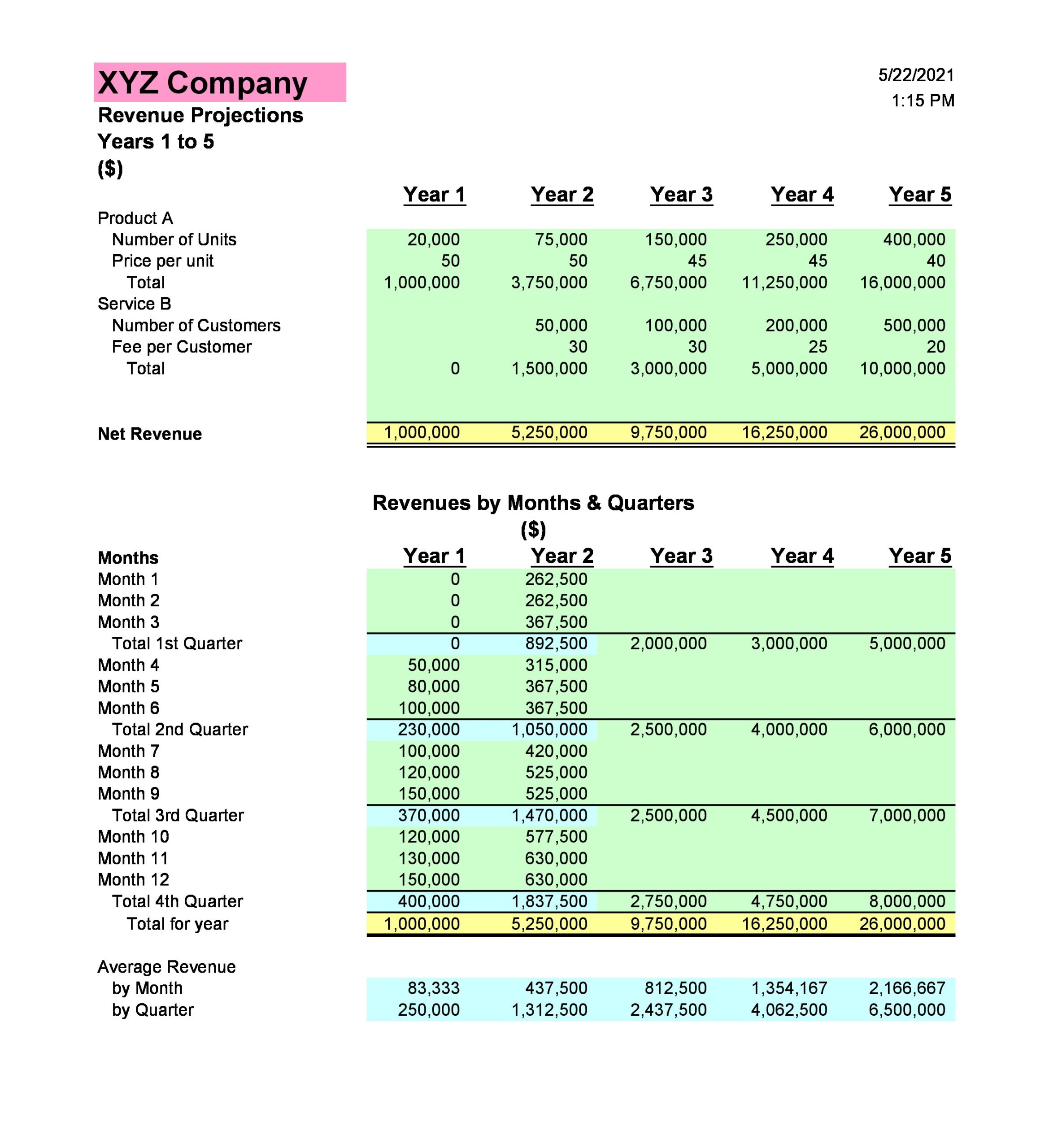

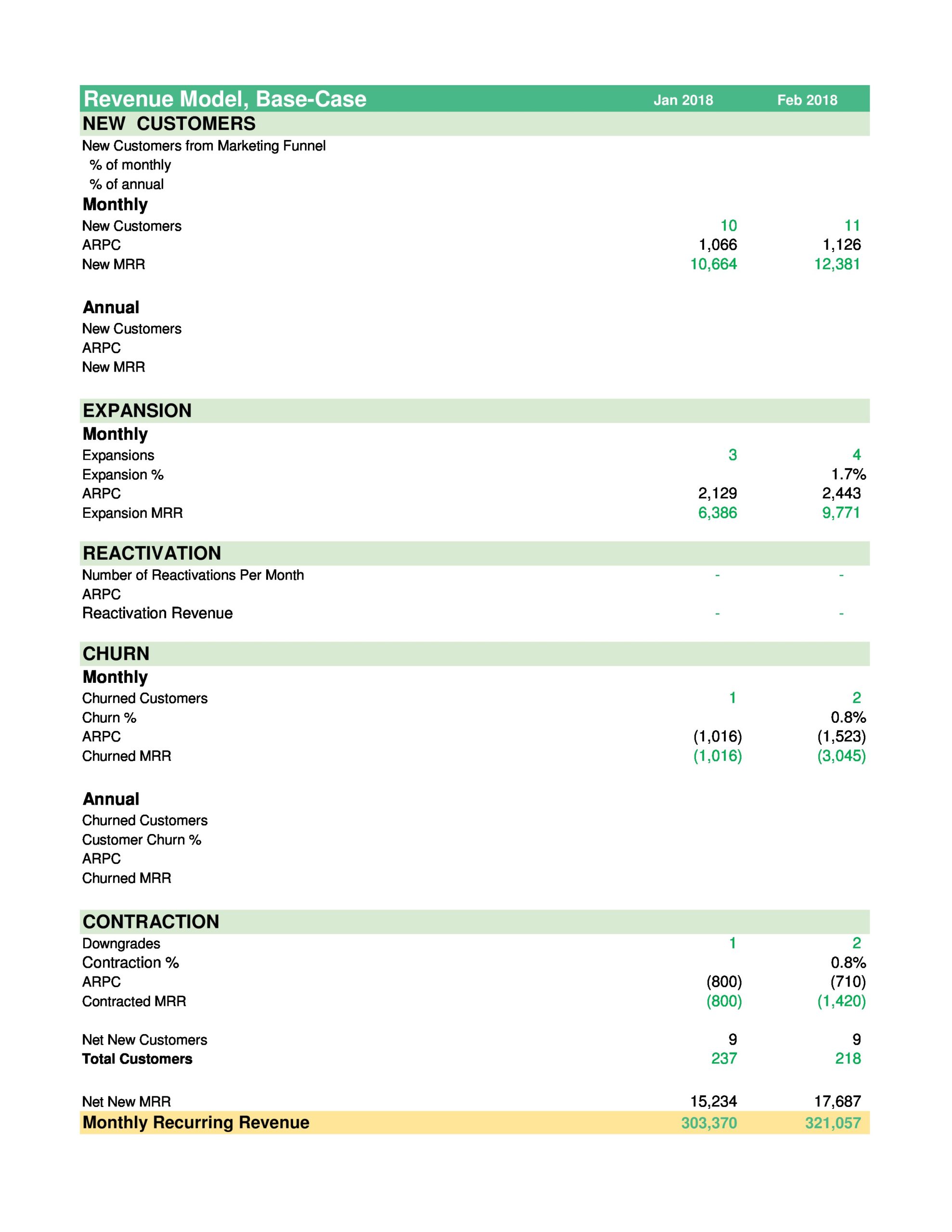

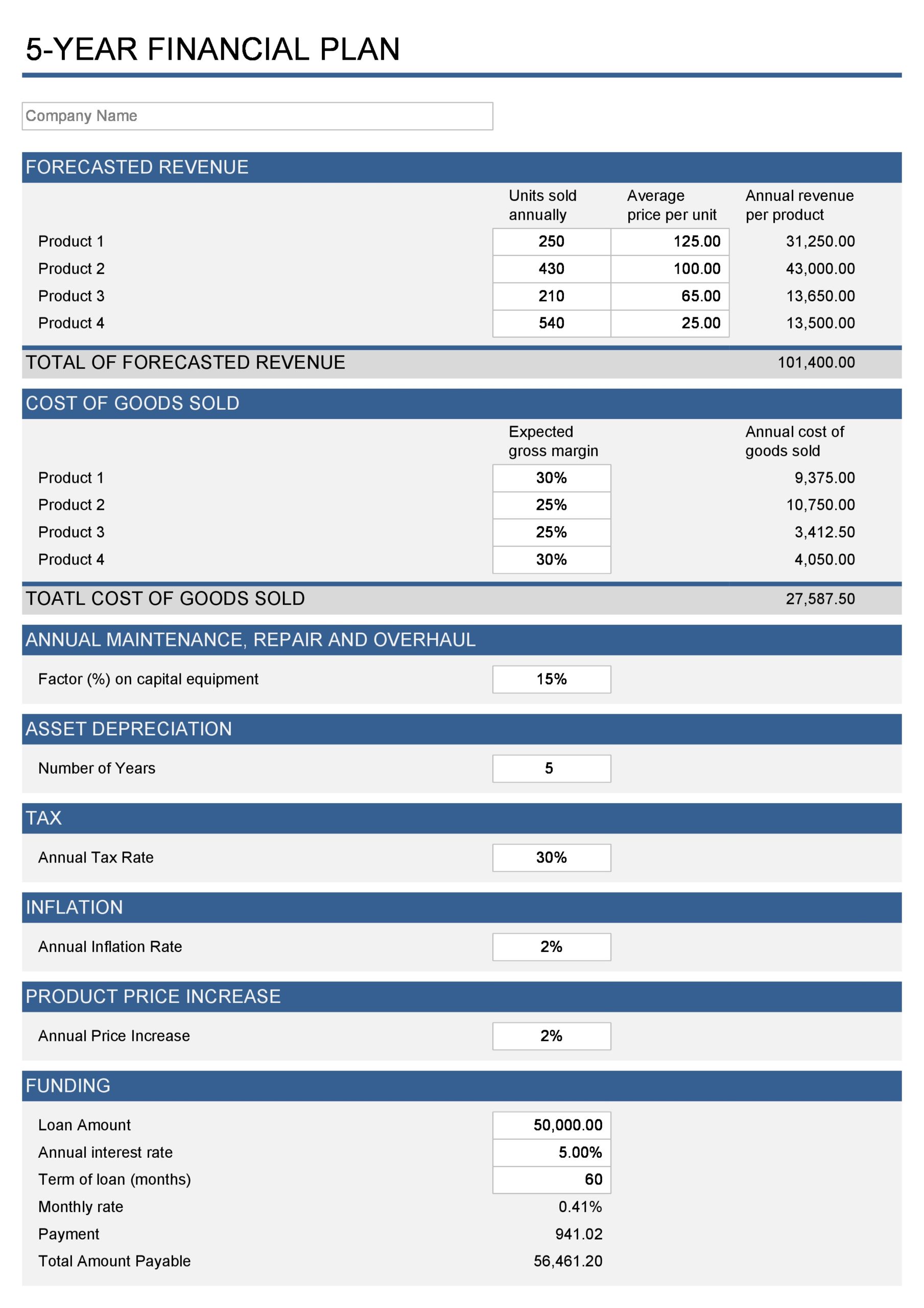

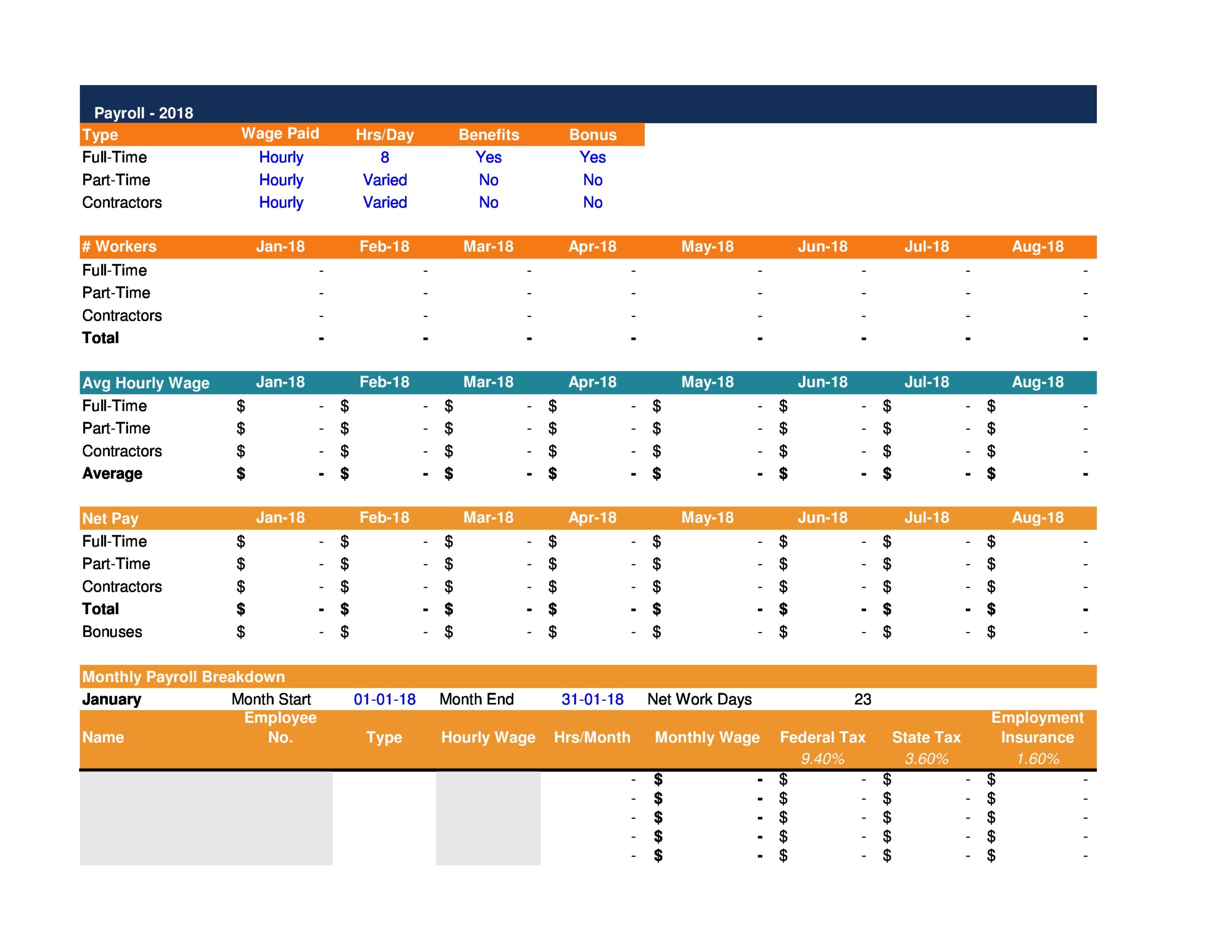

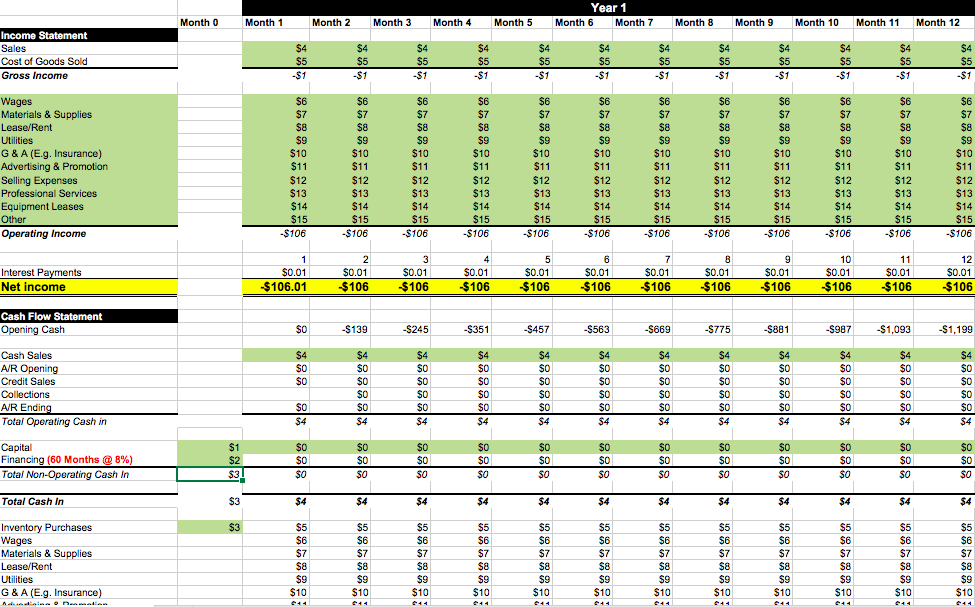

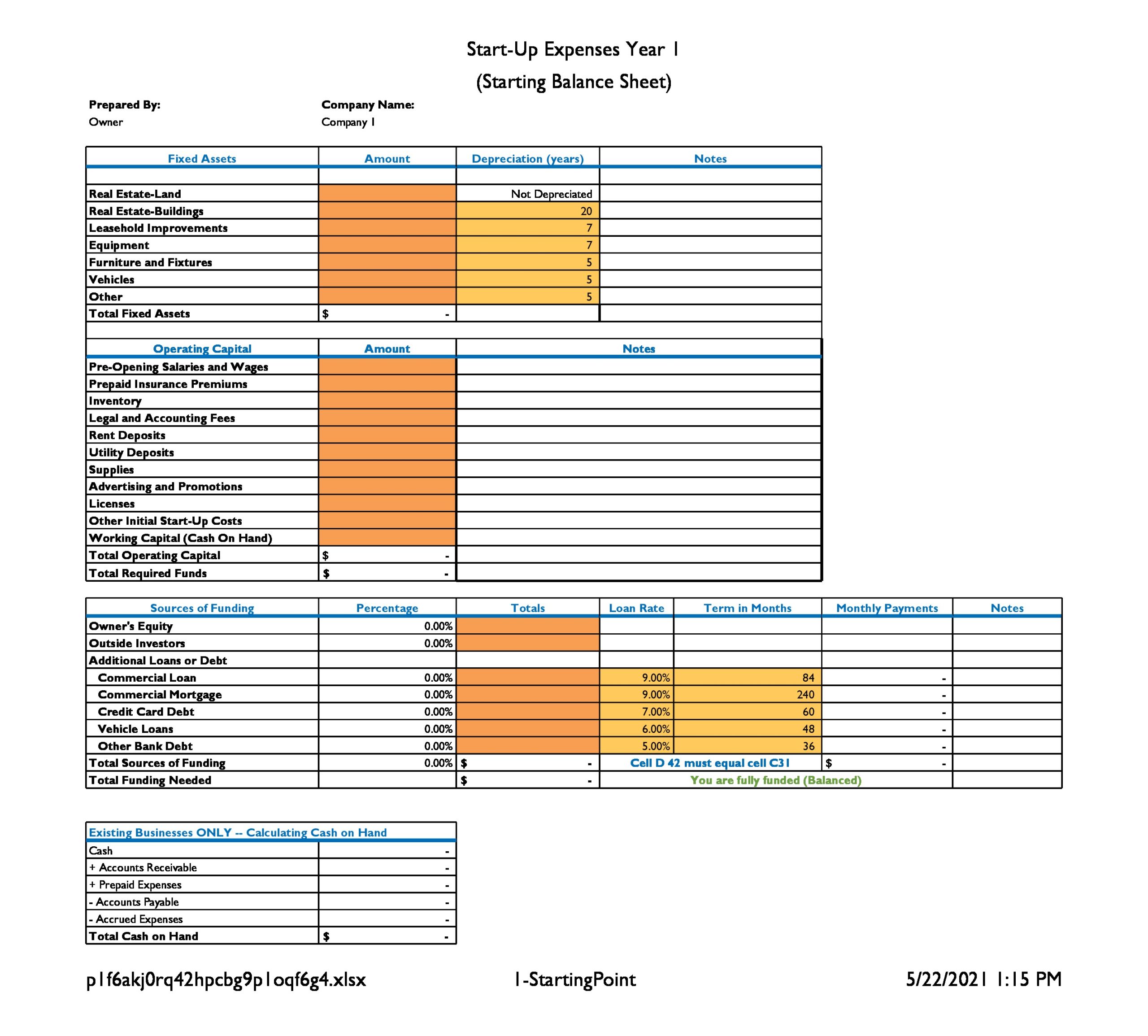

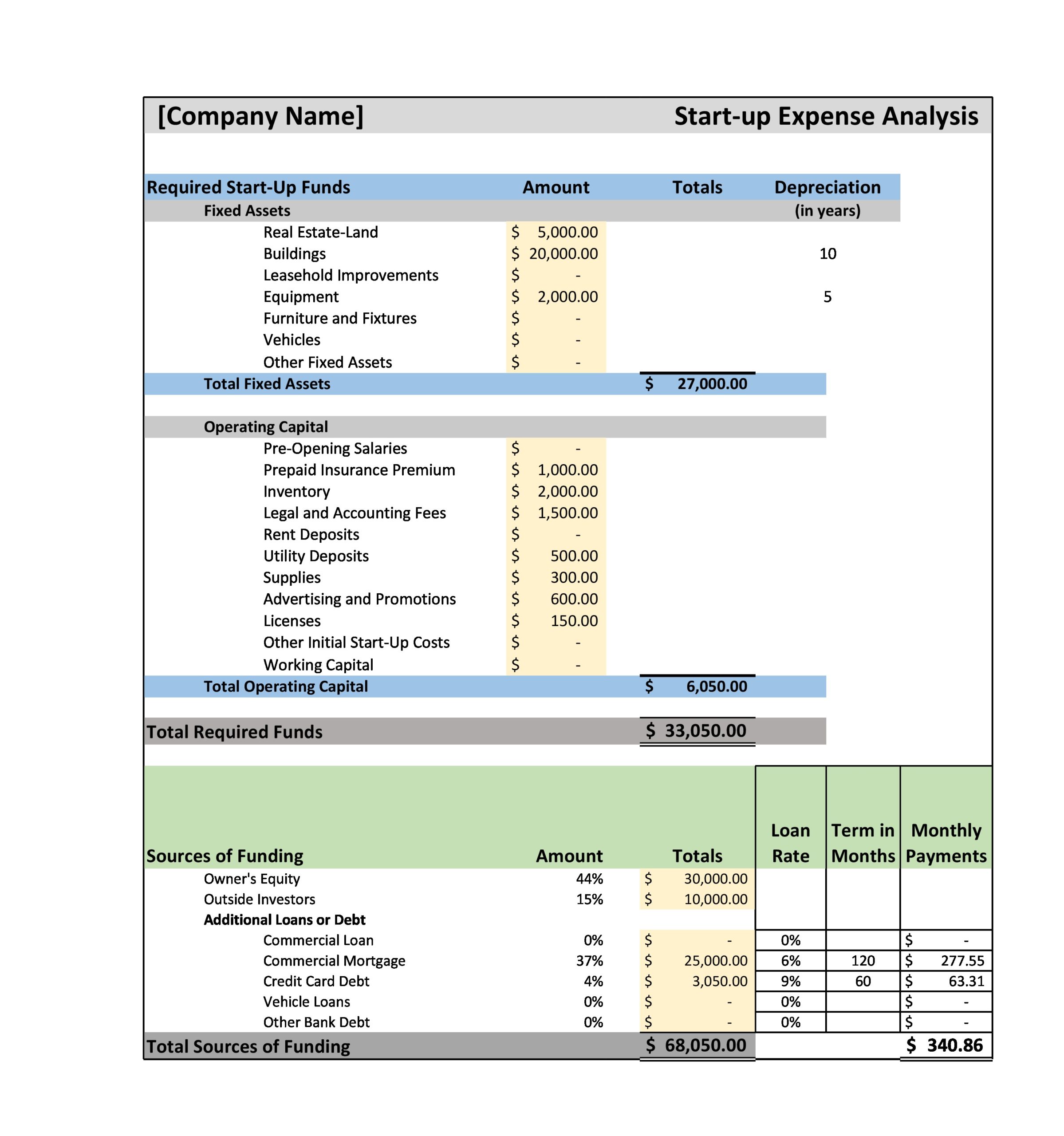

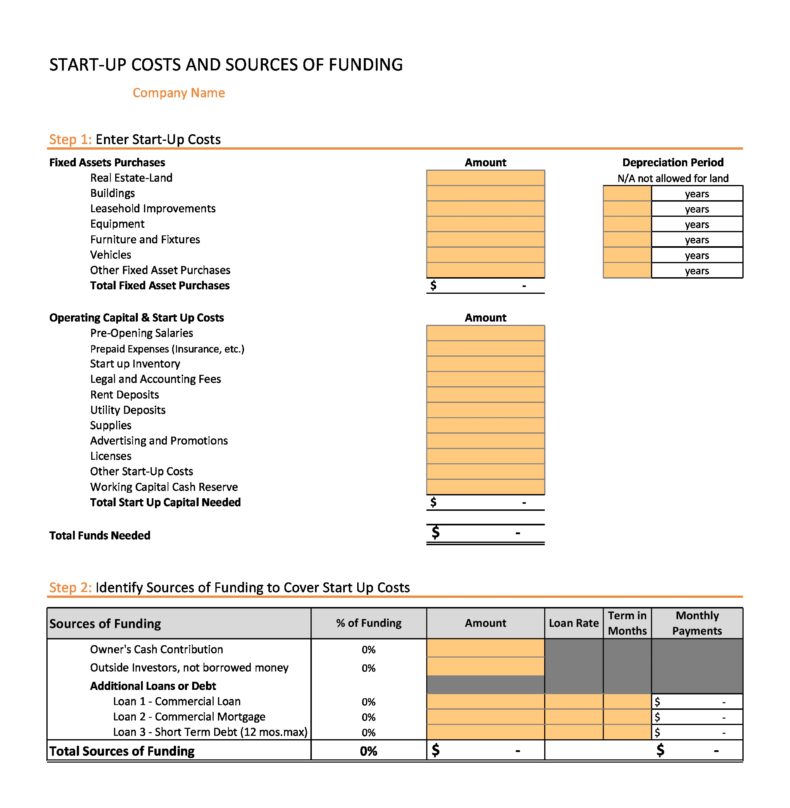

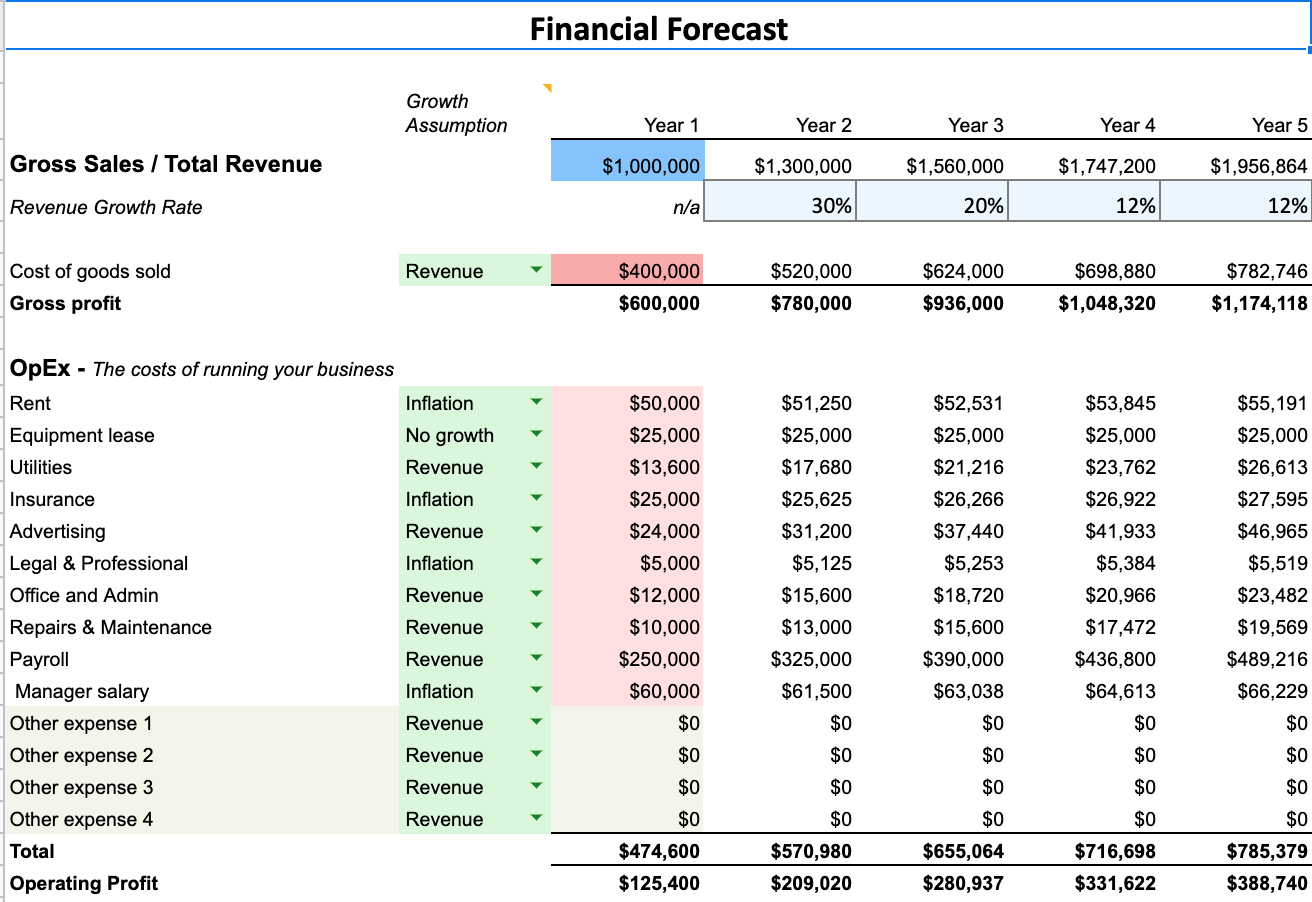

Financial plan and projections example. The plan projections template produces the three main financial statements, income statements, balance sheets, and cash flow statements for the next five years. Financial plan assumptions are the key variables, estimates, and predictions used to develop a company's financial projections and strategy. Plug your expenses and revenues into a cash flow projection that shows monthly inflows and outflows of money for the first 12 months of operations.

Key components of a financial plan. The primary method of projections is to project the various financial statements. Download and customize our financial projections template for startups to begin importing your financial data and build a road map for your investments and growth.

What are financial plan assumptions? A financial projections template usually includes a few financial statements that will help you achieve better financial performance for your business: Download this free financial plan template to project your revenues and expenses, track your progress and anticipate cash flows.

Financial plan templates. Creating financial projections can break down into 5 simple steps: It can be done, though, if you have a good understanding of the market you are entering and industry trends as a whole.

The growth of the company by analyzing the evolution of the turnover over several years; They often include different scenarios to see how changes to one aspect of your finances (such as higher sales or lower operating expenses) might affect your profitability. Finally, we use those projections for business planning.

They can also be used to make informed decisions about the business’s plans. Business plan financial projections are a company’s estimates, or forecasts, of its financial performance at some point in the future. Here is everything you need to include in your financial plan along with optional performance metrics, specifics for funding, and free templates.

How to write the financial section of a business plan: Need help creating a financial plan for your startup? To create the projections, you can use an excel spreadsheet or tools available in your accounting.

They serve as the foundation for forecasting revenues, costs, investments, and taxes, among other elements. The p&l statement the cash flow statement the balance sheet p&l statement the profit and loss statement enables you to assess: Sales forecast as a startup business, you do not have past results to review, which can make forecasting sales difficult.

Projections are based on financial modeling techniques and provide the answers to questions that may come from lenders, investors or other business stakeholders. Financial projections are important for a number of reasons. So, how do you create one?

Creating an accurate, adaptive financial projection for your business offers many benefits, including: Sales projections, expense projections, balance sheet projections, income statement projections, and cash flow projections. Examples of financial statements to include in your forecast your forecast will need to include 3 financial statements: