Spectacular Info About Importance Of Cash Flow From Operating Activities

Cash flow is the heartbeat of your small business, reflecting the movement of money in and out.

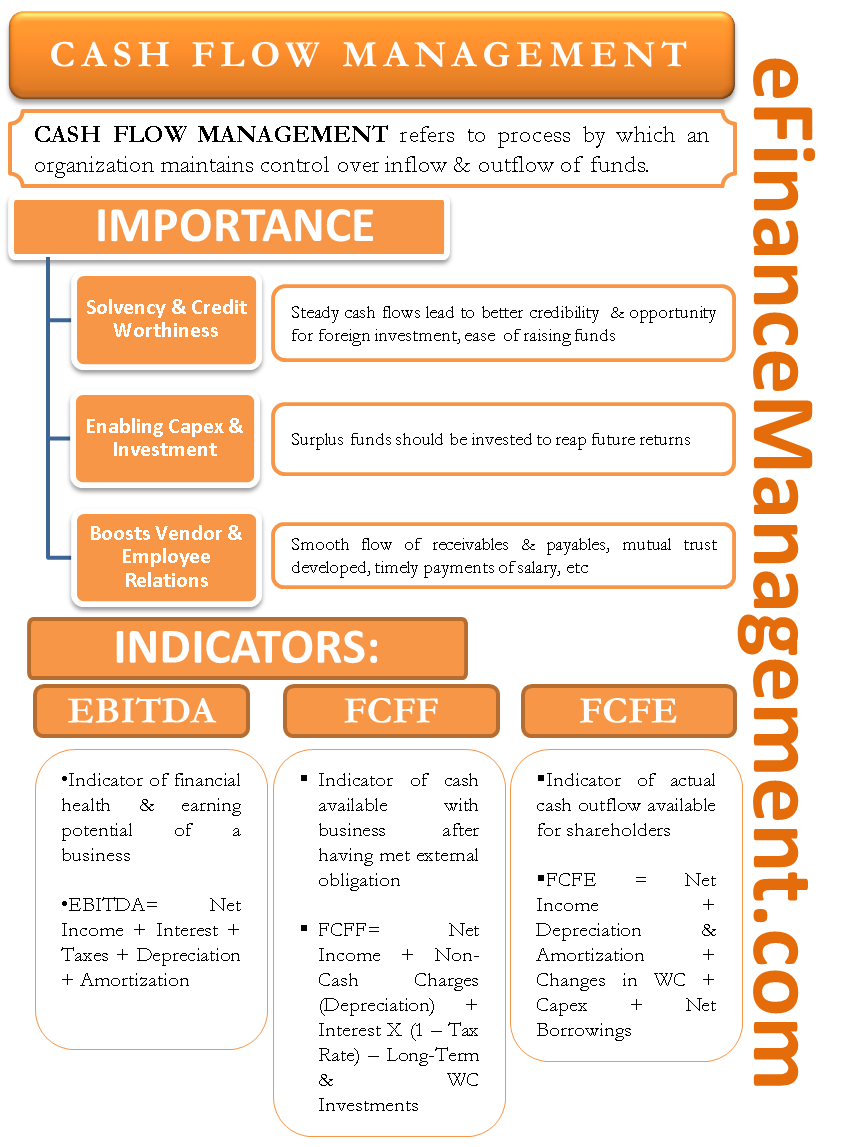

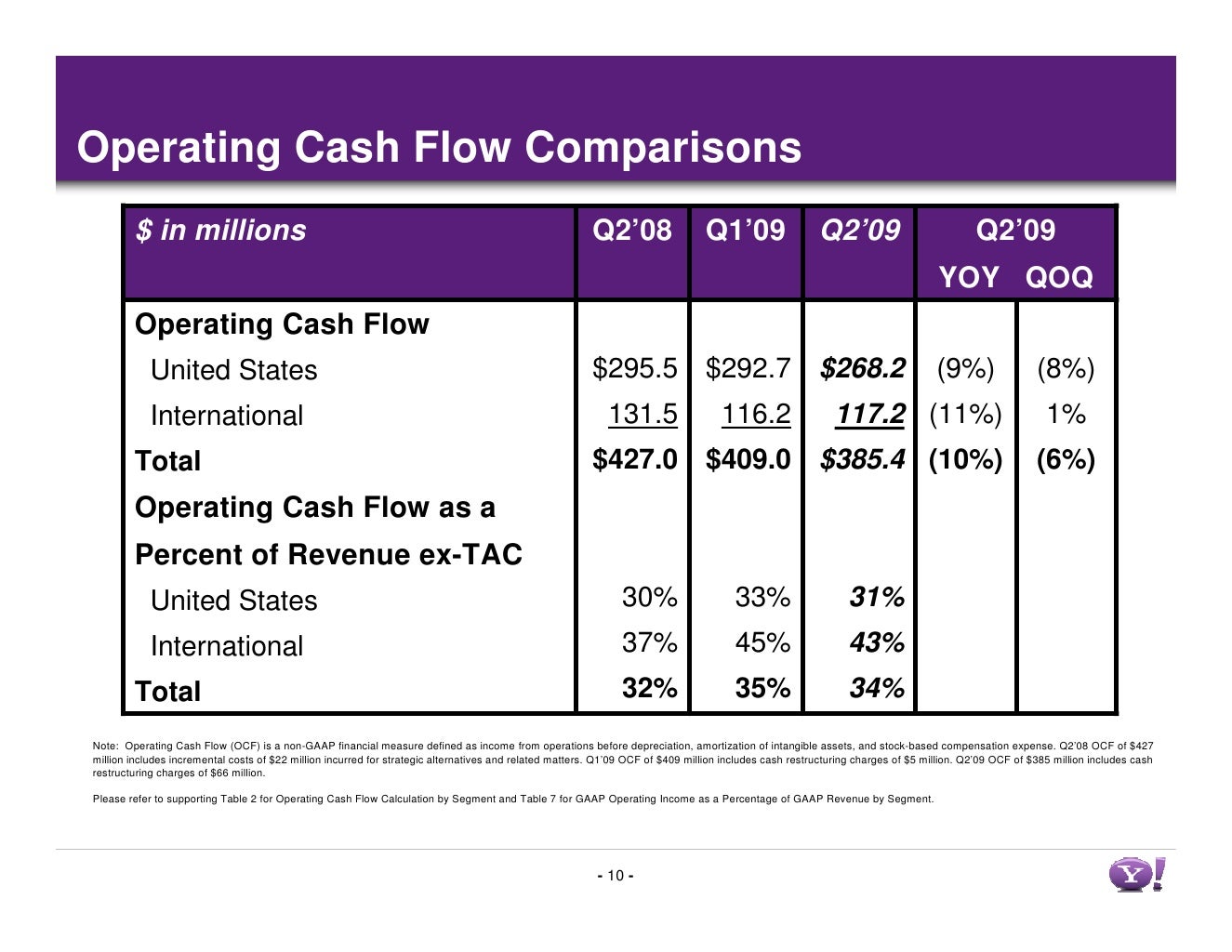

Importance of cash flow from operating activities. Cash flow from operating activities is an immediate health. Operating cash flow ratio = cash flow from operation / current liabilities. While there are three main areas of the cash.

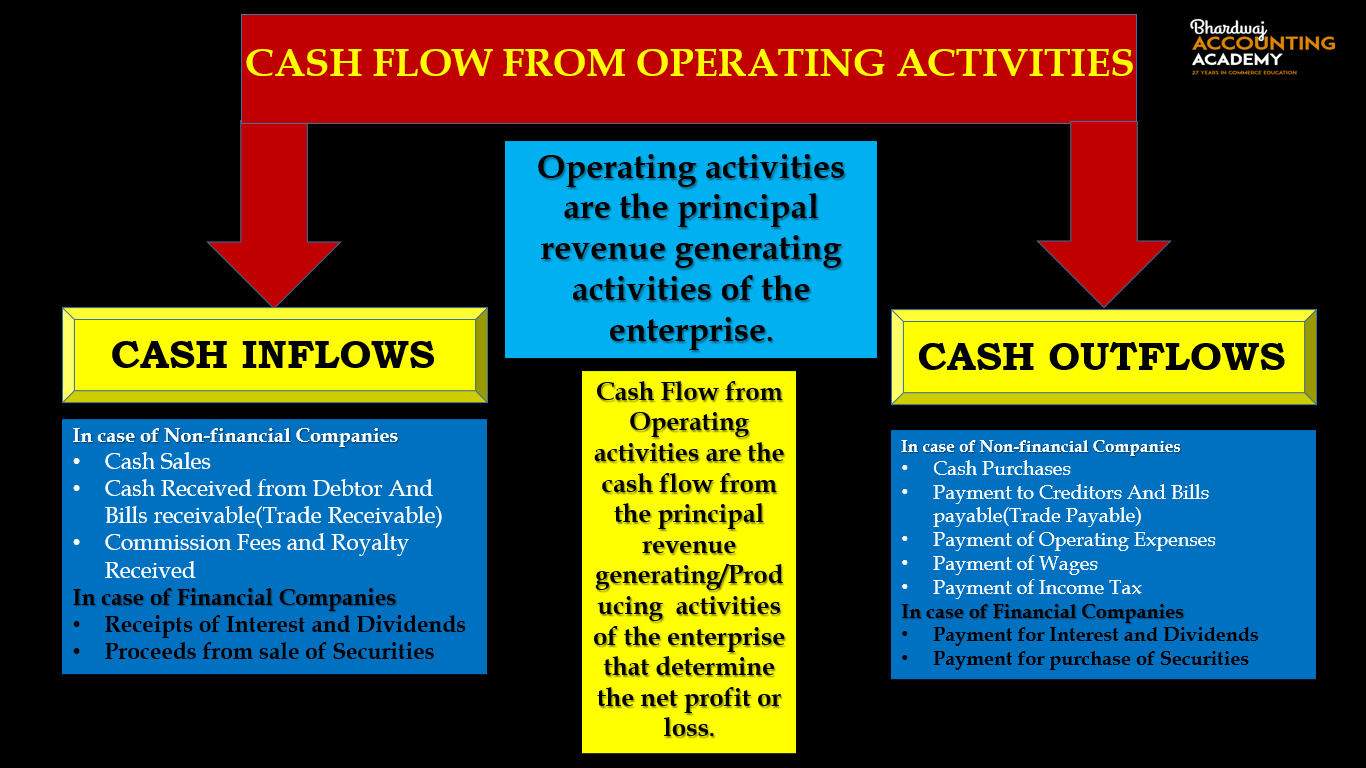

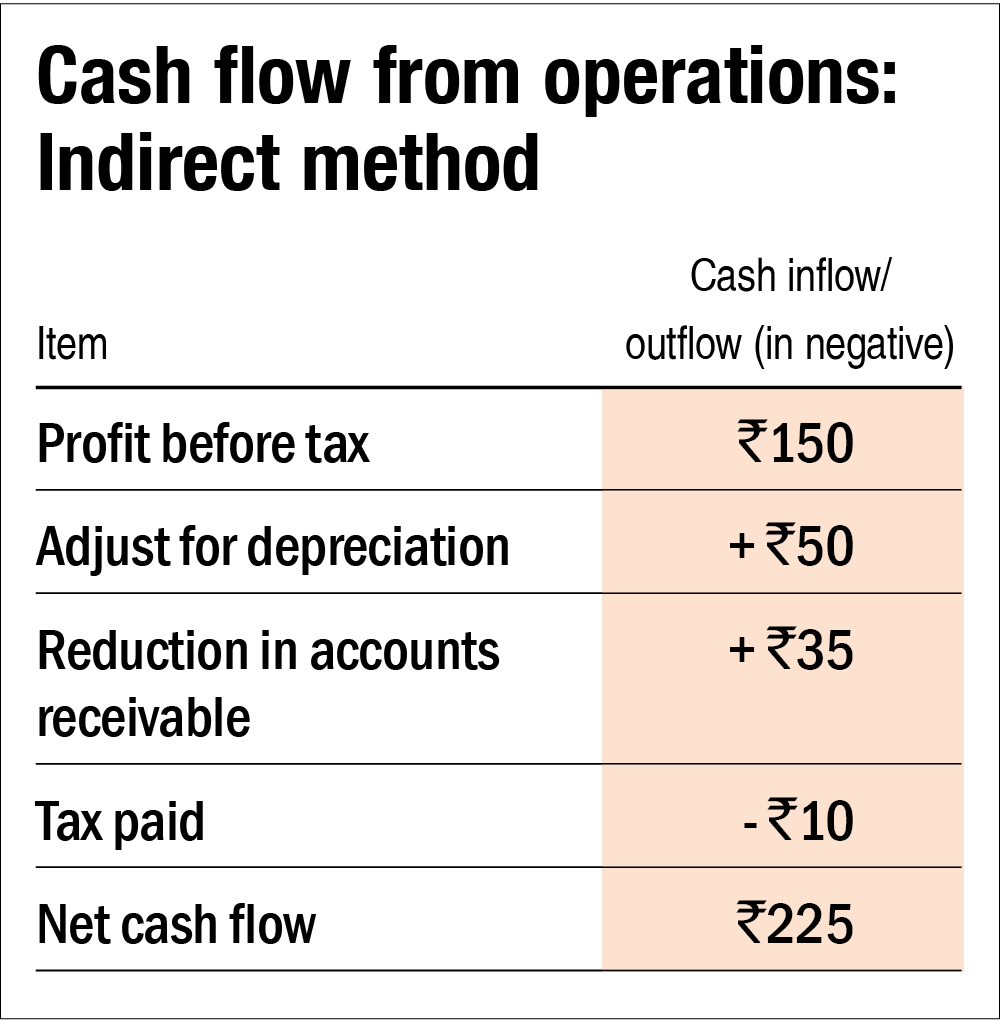

Importance of operating cash flow. For example, operating cash flows include cash sources from sales and. Read more on why is the indirect method of cash flow better.

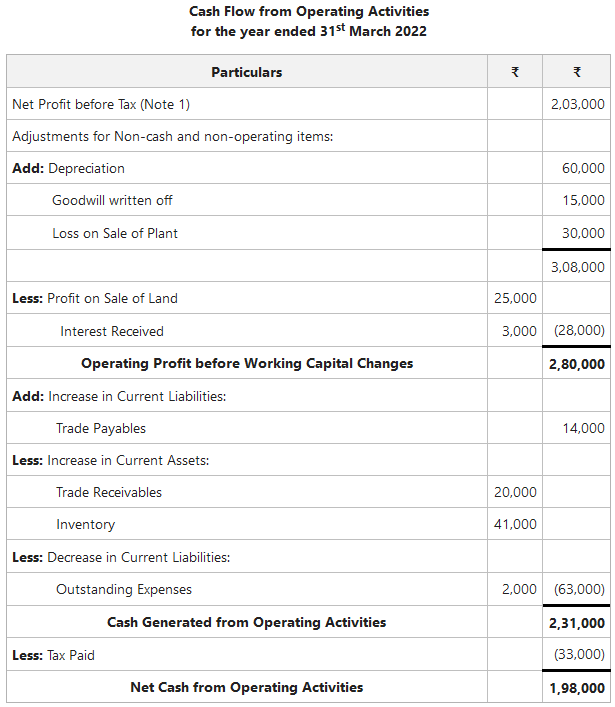

Last editednov 2020 — 2 min read. Future operating cash flows. Cash flows from operating activities arise from the activities a business uses to produce net income.

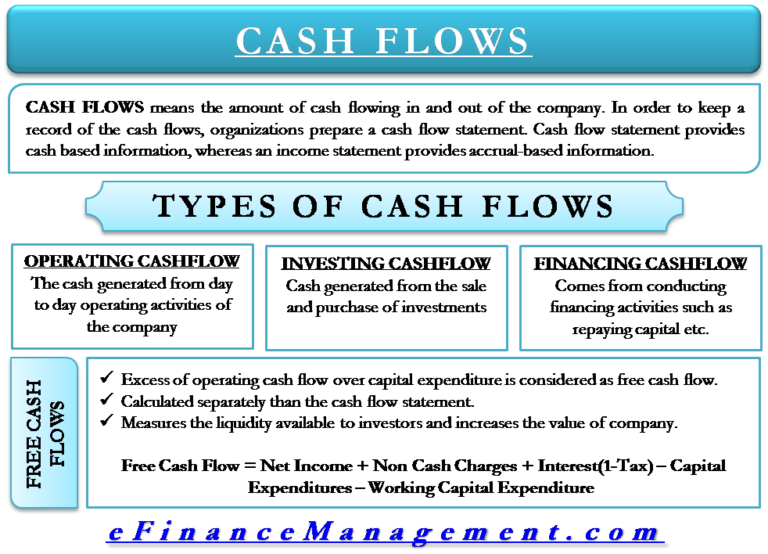

Cash inflows are the transactions that result in an increase in. It shows a periodical inflow and outflow. The movement of cash & cash equivalents or inflow and outflow of cash is known as cash flow.

Operating cash flow is an essential part of a cash flow statement as it gives a transparent financial view of the current business. Its examples include sales revenue, production. Importance of operating cash flow.

Cash flow from operating activities (cfo) is a measure that tells us the amount of cash a company generates through its everyday business operations and. Cash flow from operating activities is an essential part of your company’s cash flow statement. It helps measure how well (or how poorly) a company is able to manage its cash and pay off its financial obligations.

Cash flow from operating activities (cfo) shows the amount of cash generated from the regular operations of an enterprise to maintain its operational. Formula the operating cash flow ratio is calculated by the cash flow over its current liabilities. Also known as the statement of cash flows, the cfs helps its creditors determine how much cash is available (referred to as liquidity) for the company to fund.

Cash flow from operating activities is the incoming and outgoing money related to daily operation.

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)