Recommendation Info About Significant Accounting Policies

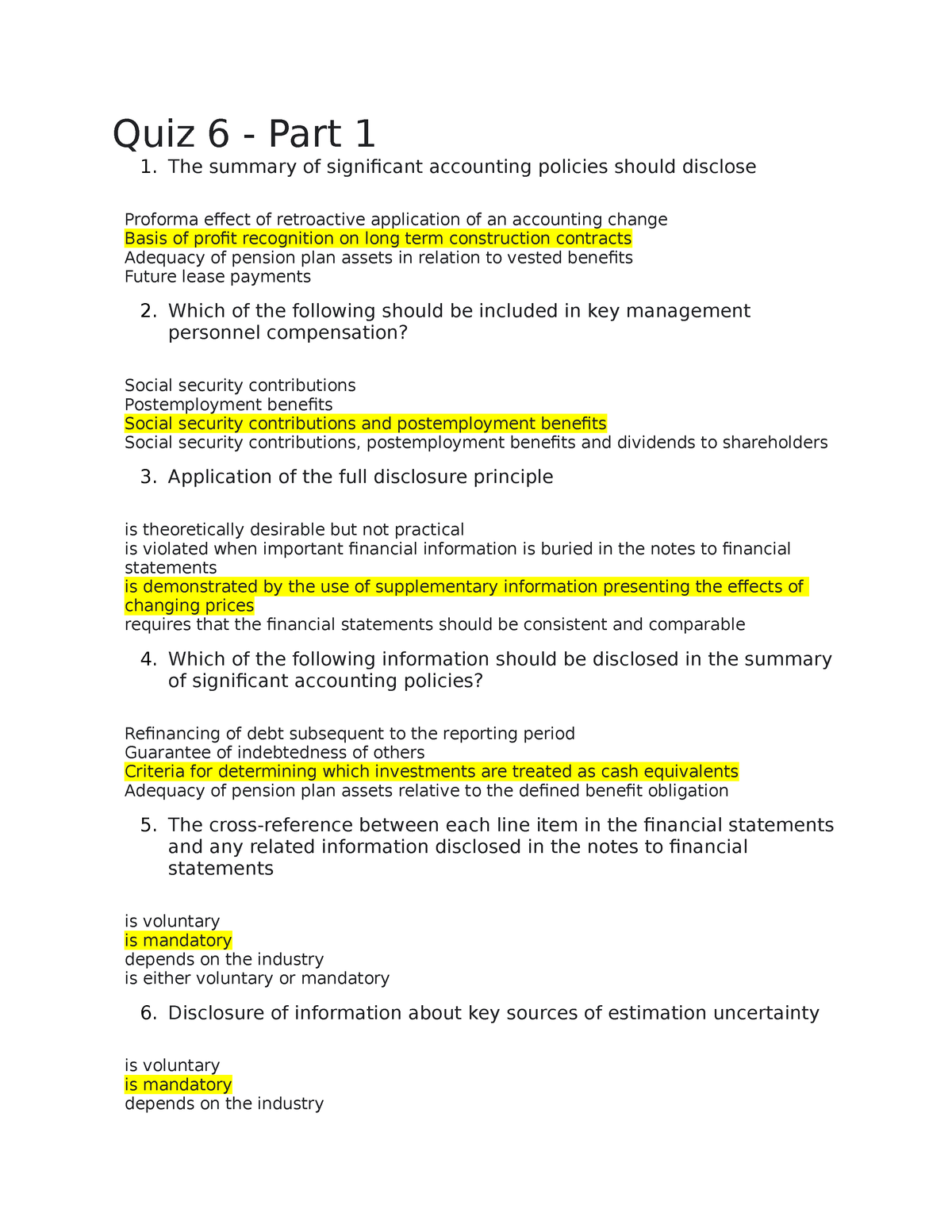

In deciding whether a particular accounting policy shall be disclosed, management considers whether.

Significant accounting policies. The accounting policies were unchanged during the year as compared. Accounting standards september 2023 kpmg.com/ifrs contents contents about this guide 2 references and abbreviations 5 independent auditors’ report 6 consolidated financial. Significant accounting policies disclosure of accounting policies 1.

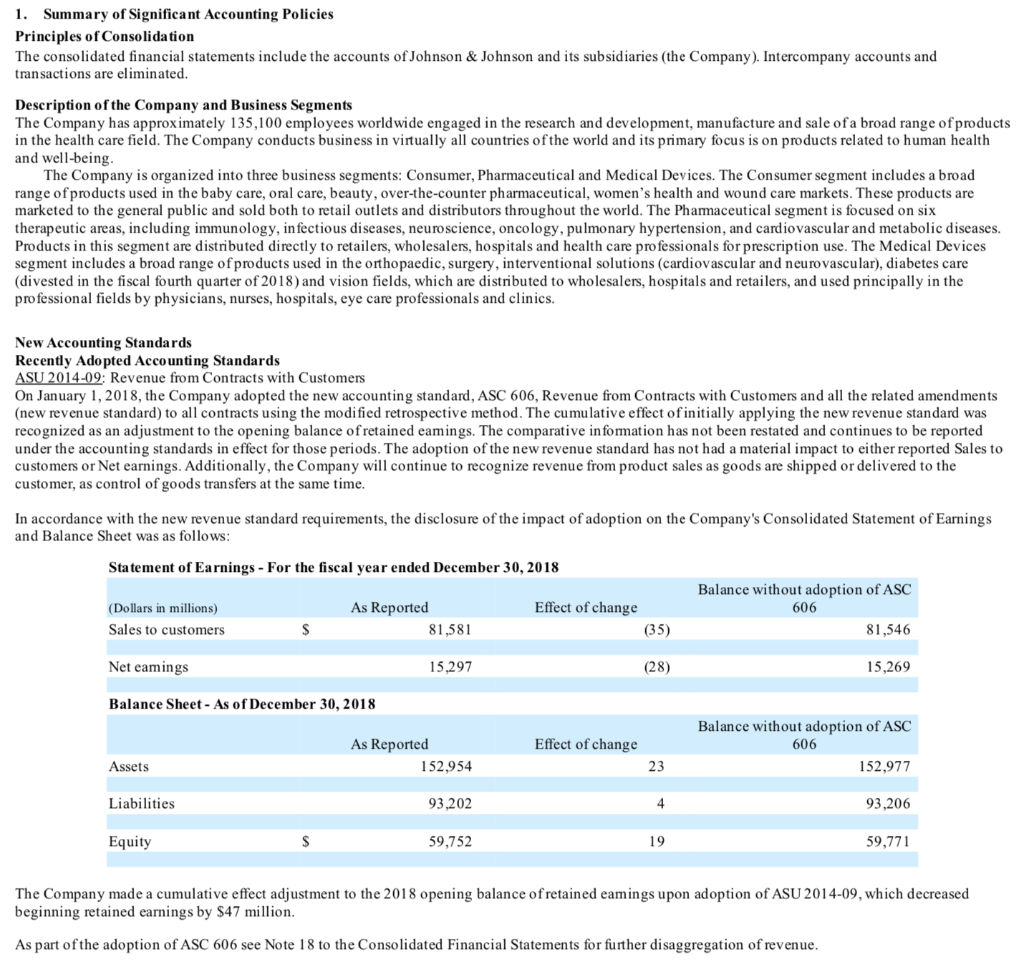

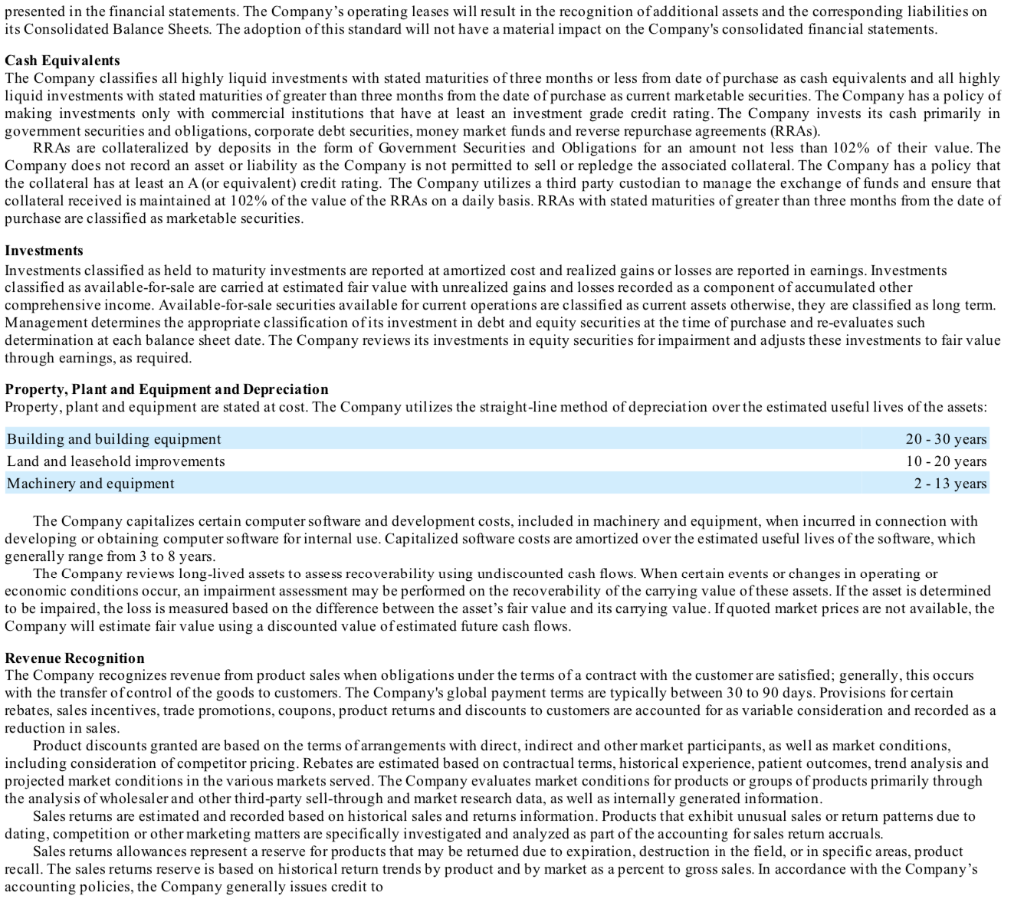

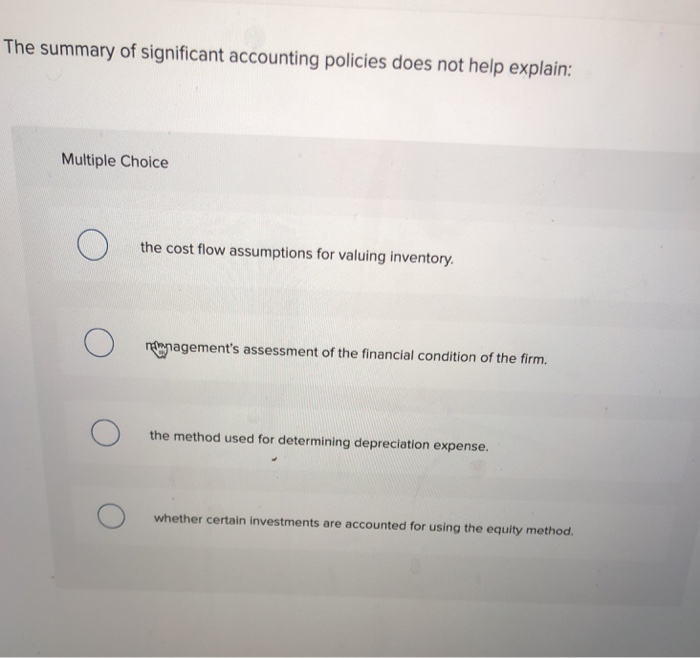

The summary of significant accounting policies is a section of the footnotes that accompany an entity's financial statements, describing the key policies being followed by the accounting department. On 12 february 2021, the iasb issued amendments to ias 1 and the ps to provide guidance on the application of materiality judgements to accounting policy disclosures. In february 2021 the board issued disclosure of accounting policies which amended ias 1 and ifrs practice statement 2 making materiality judgements.

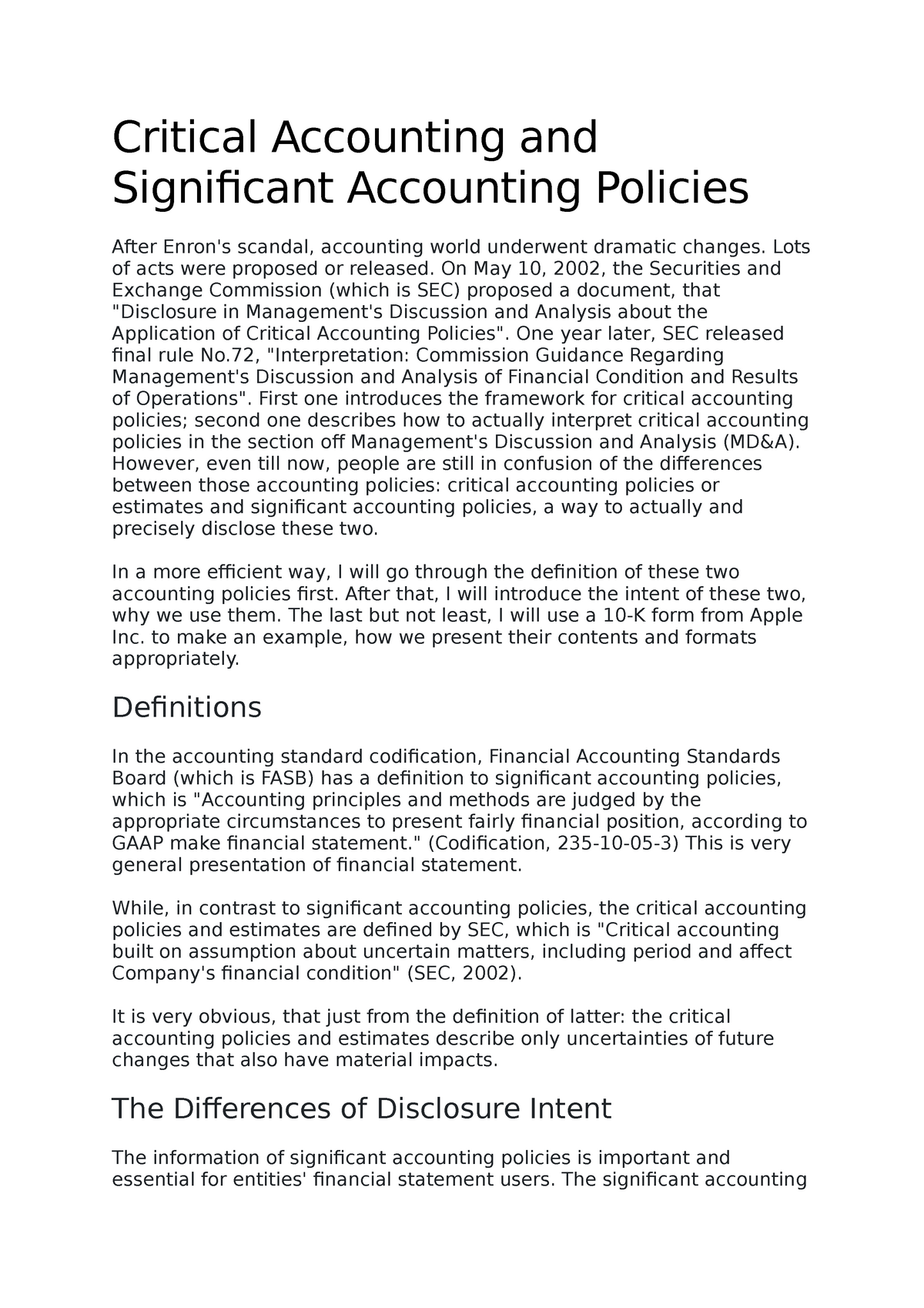

Standards issued but not yet effective 142. Learn what significant accounting policies are, why they are important to disclose, and how to describe them in financial statements. Disclosures of accounting policies on revenue recognition (continued) analysis entity g considers that:

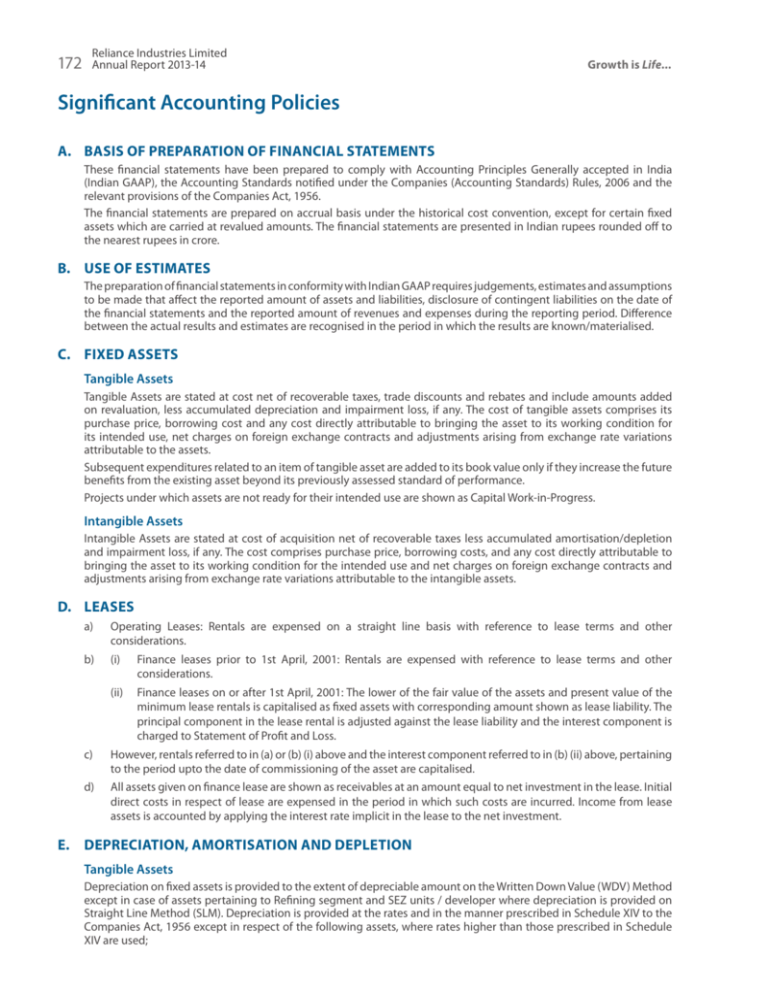

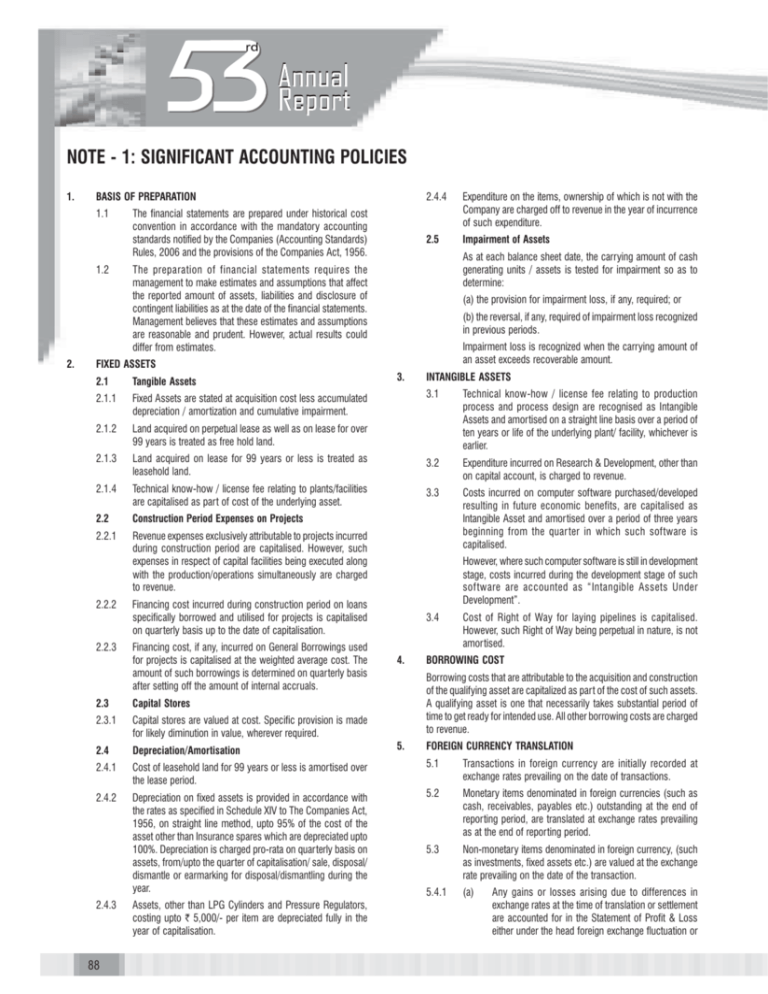

[ias 1.117] the measurement basis (or bases) used in preparing the financial statements; The board amended ias 1 presentation of financial statements to require companies to disclose their material accounting policy information rather than their. Beyond tackling immediate concerns, budget 2024 makes significant policy shifts to better position singapore for the future, said deputy prime minister lawrence.

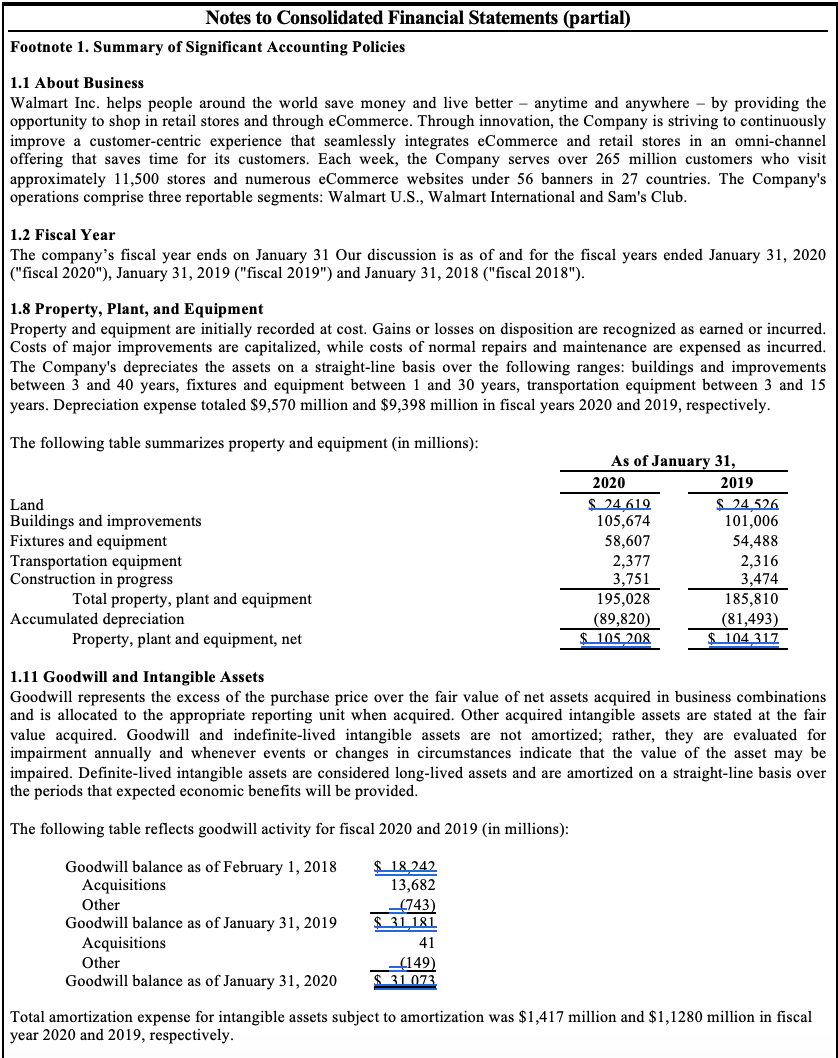

This note describes shell’s significant accounting policies, which are those relevant to an understanding of the consolidated financial statements. Correction of errors 125 44. Basis of measurement 124 43.

Applying the amendments, an entity discloses its material. The purpose of this standard is to promote better understanding of financial statements by establishing through an accounting standard the disclosure of significant accounting. And (c) aasb 1060, to require entities to disclose their material accounting.

(b) aasb 1054, to reflect the updated terminology used in aasb 101; Determining which accounting policies are considered “significant” is a matter of management judgment.

Accounting policies 124 42. For sec registrants, disclosure of the application of critical accounting policies and significant estimates is normally made in the management’s discussion and analysis. Significant accounting policies 126 45.

Following feedback that more guidance was needed to help companies decide what accounting policy information should be disclosed, the board has today. Introduction this standard deals with the disclosure of significant accounting policies followed in preparing and presenting financial statements. (significant accounting policies) to indicate that the paragraph relates to recognition and measurement requirements, as opposed to presentation

Management might consider materiality of the related account,. A summary of significant accounting policies applied, including: 4 significant accounting policies 16 5 acquisitions and disposals 37 6 interests in subsidiaries 41 7 investments accounted for using the 44 equity method 8 revenue 46 9.

:max_bytes(150000):strip_icc()/TermDefinitions_Adequatedisclosure_colorv1-cb6a29b7047f498db5299b0039fdf07b.png)