Looking Good Info About Cash Flow Statement Management Accounting

The cash flow statement is the combination of the income statement (balance sheet) and the balance sheet.

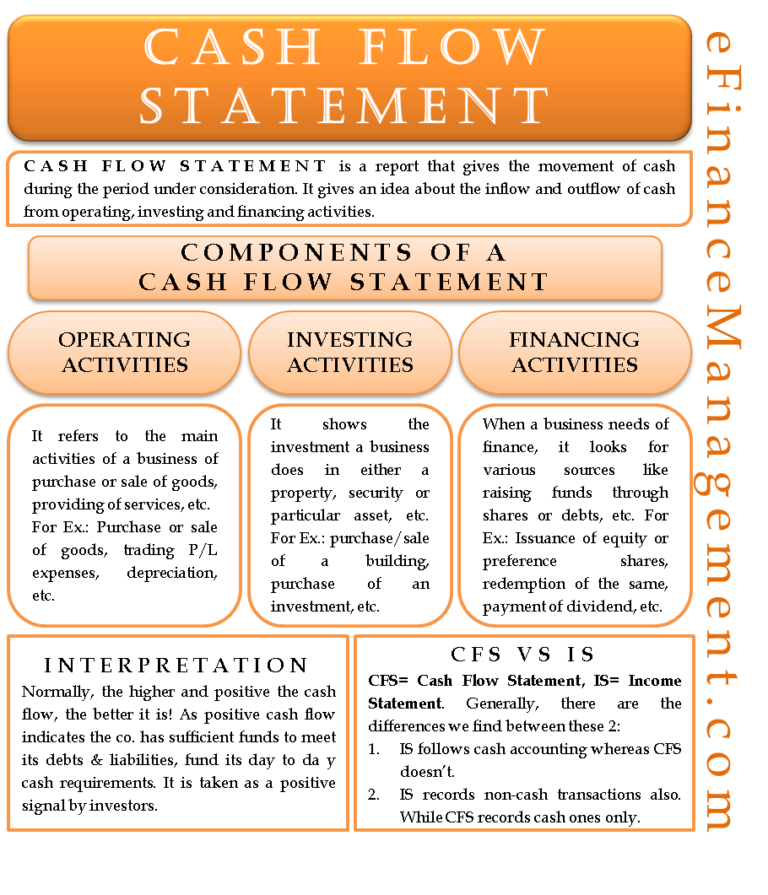

Cash flow statement management accounting. The cash flow statement (cfs), along with the income statement and balance sheet, represent the three core financial statements. A cash flow statement shows the net effect of various business transactions on cash and cash equivalents and consideration of receipts and payments of cash. An enterprise should prepare a cash flow statement and should present it for each period for which financial statements are presented.

Determine net cash flows from operating activities. Reviewing it can give you information about your cash flow as opposed to net income. Basically, the document it gives you (and your investors) key insights into whether or not your business.

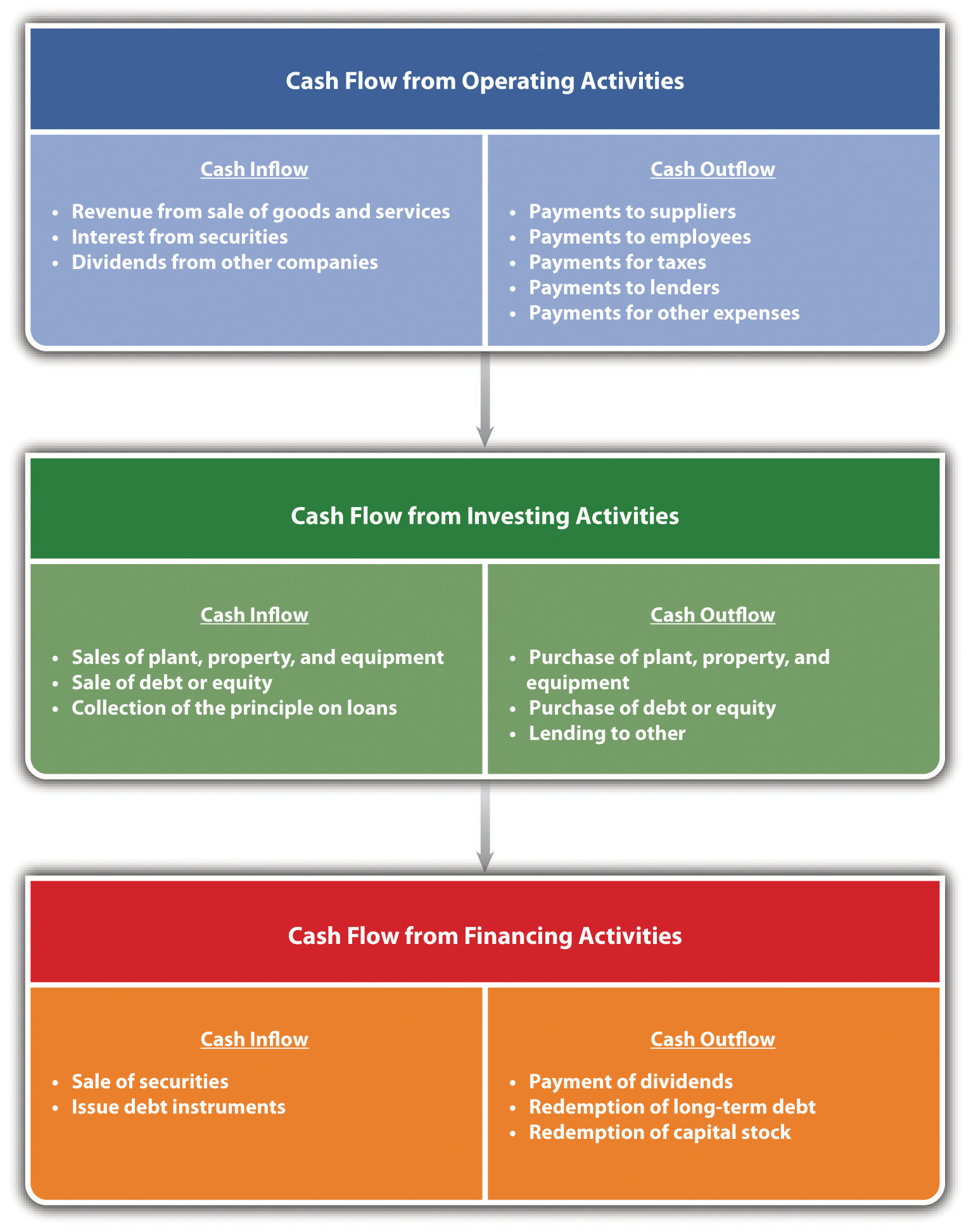

These statements are combined to make a cash flow statement. The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. Operating activities financing activities investing activities.

Moreover, a cash flow statement shows specifically where your spent cash has gone, and where your incoming cash is coming from. The cash flow statement is required for a complete set of financial statements. The cash flow statement in accounting is one of the four basic financial statements.

In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of. A cash flow statement is a document, typically generated monthly, quarterly, and/or annually, showing how much cash a business has on hand at a given moment in time. The important terms used in a cash flow statement are as.

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). Some businesses may simply wish to remove the guesswork out of calculating provisional tax under the other methods. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources.

Add back noncash expenses, such as depreciation, amortization, and depletion. Key takeaways a cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. Cash flow is a measurement of the amount of cash that comes into and out of your business in a particular period of time.

Cash flow statement resources & guides. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business. The statement of cash flows is prepared by following these steps:.

Using the indirect method, operating net cash flow is calculated as follows:. The statement of cash flows is one of the main financial statements produced by a business, alongside the the income statement and balance sheet. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

We will use these names interchangeably throughout our explanation, practice quiz, and other materials. When you have positive cash flow, you have more cash coming into your business than you have leaving it—so you can pay your bills and cover other expenses. Begin with net income from the income statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/Understanding-the-Cash-Flow-Statement-Color-fc25b41daf7d45e3a63fd5f916fbf9ee.png)