Outstanding Info About Expenses Payable In Balance Sheet

This is the number of days it takes a.

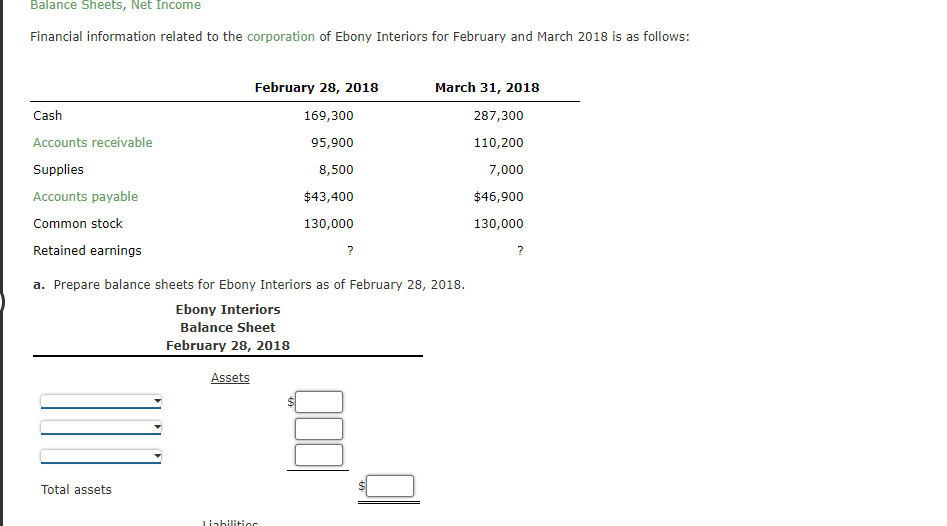

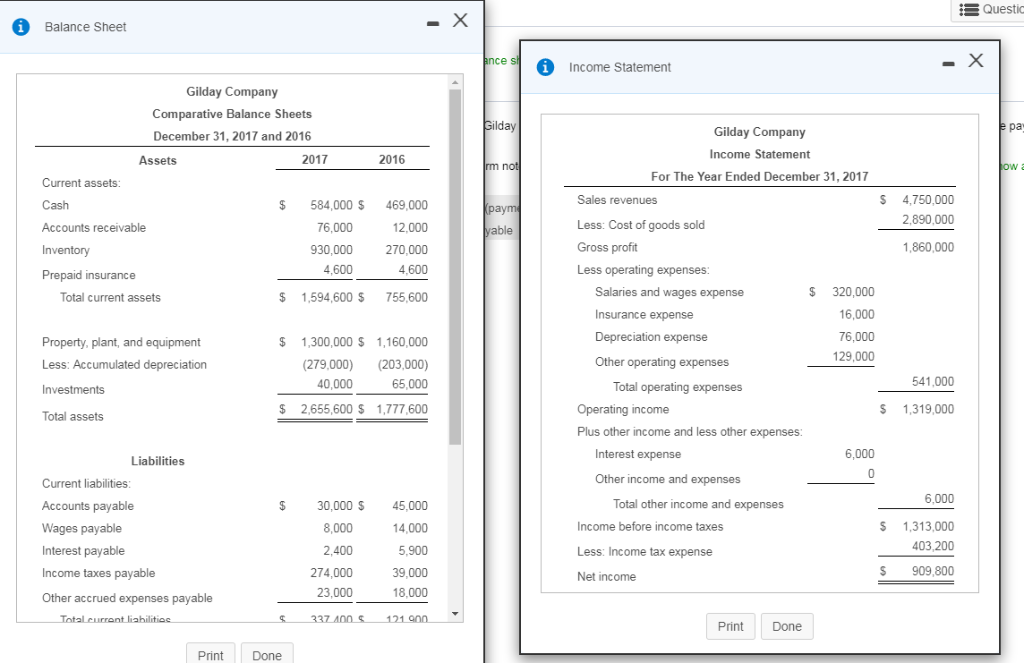

Expenses payable in balance sheet. A small company in the food industry is seeking persons to file the vacant post of accounts payab. It can also be referred to as a statement of net worth or a statement of financial position. Accounts payable (ap) is a liability, where a company owes money to one or more creditors.

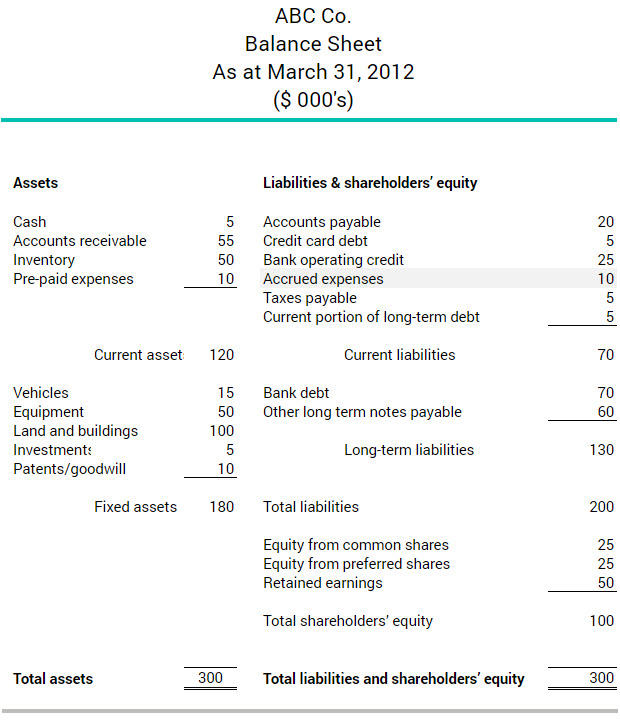

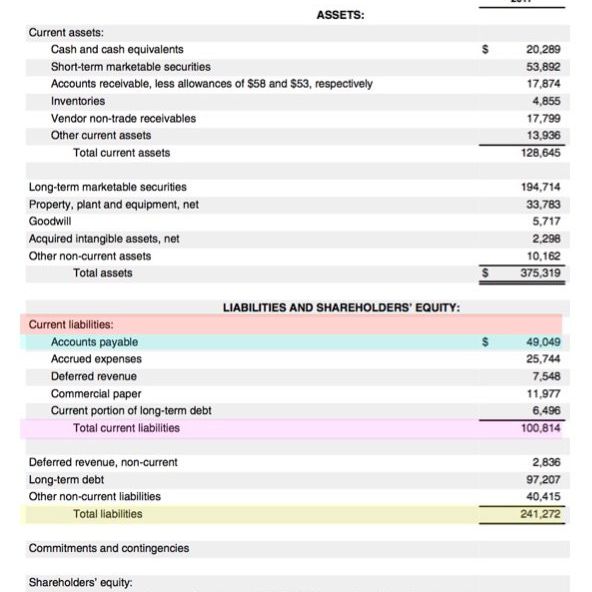

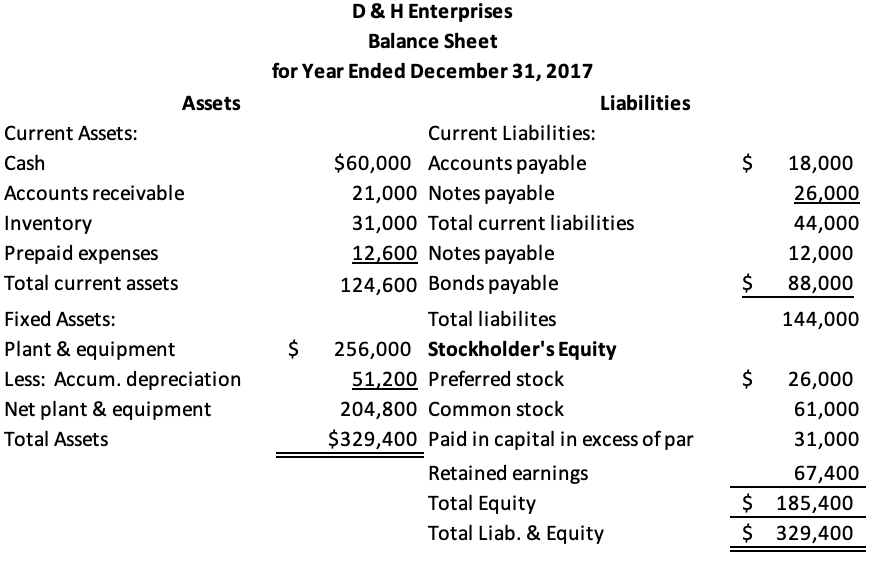

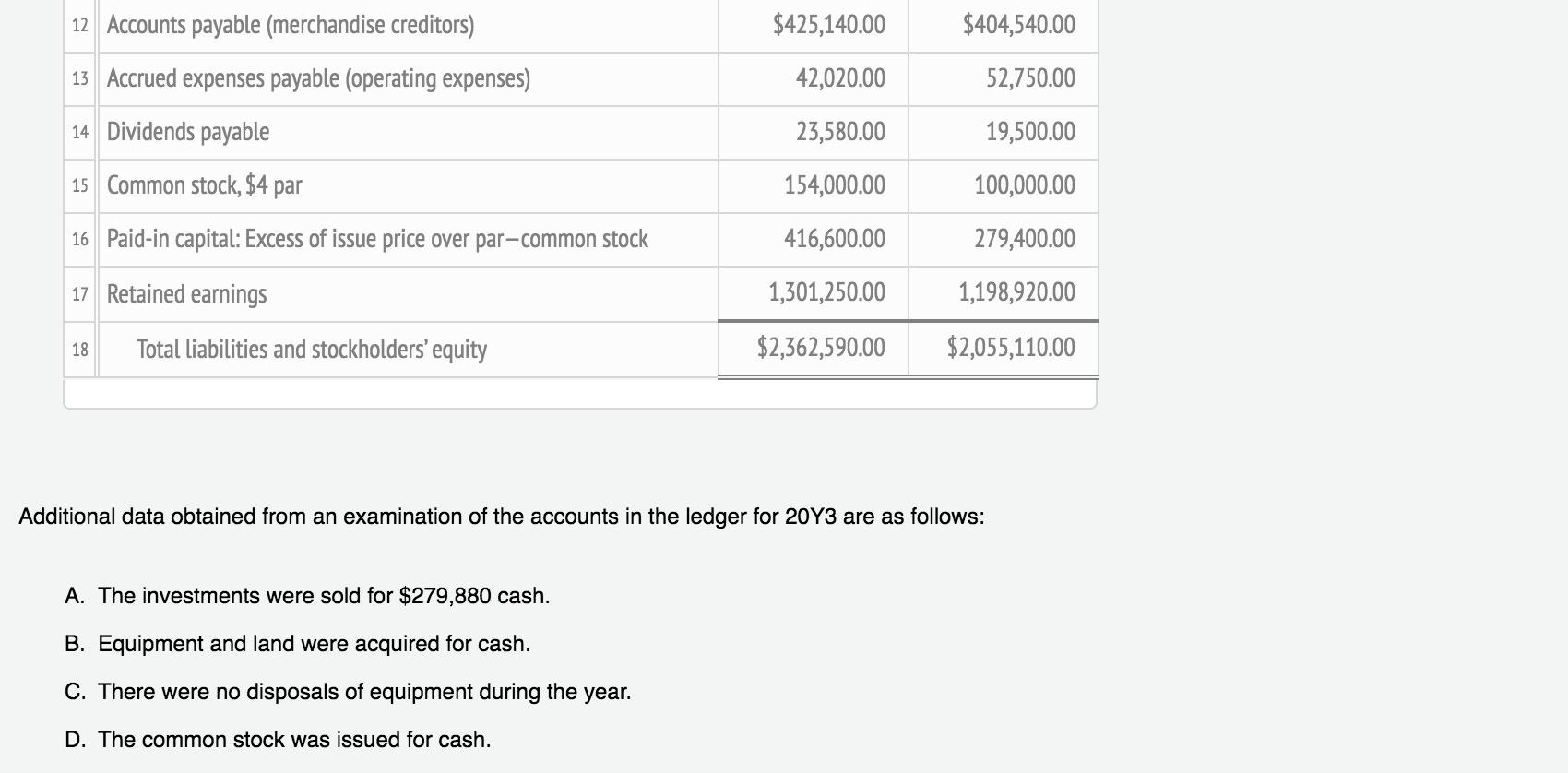

However, they affect the numbers on your balance sheet because you'll have more available in assets if your. However, labor expenses appear on the balance sheet as well, and in three notable ways: An example of different accounts on a balance sheet:

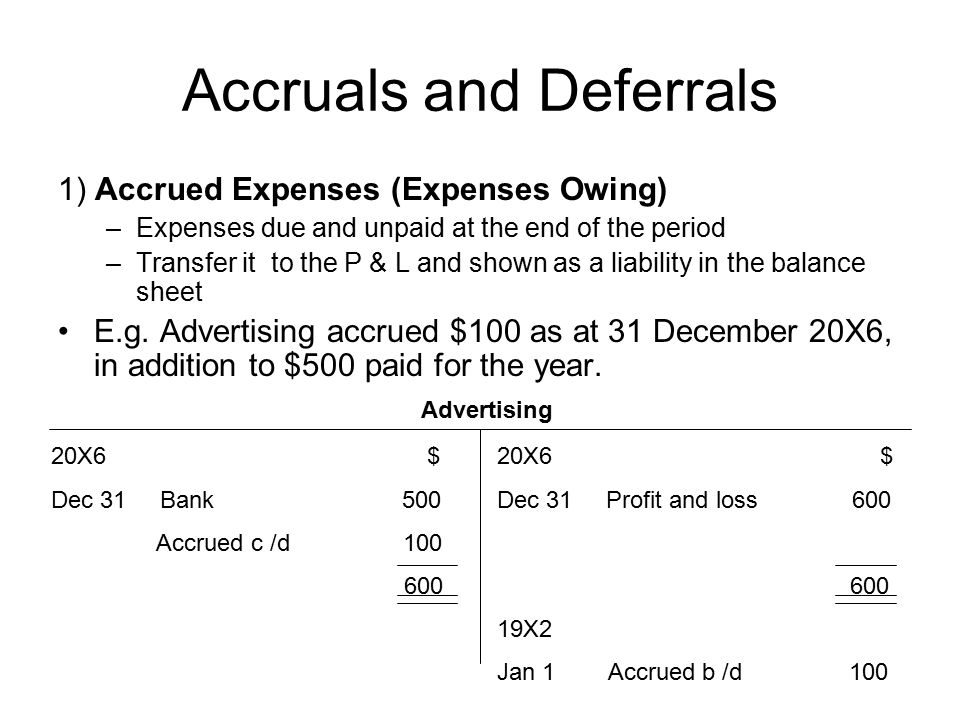

A balance sheet provides a snapshot of a company’s financial performance at a given point in time. An increase in the balance in the liability account accounts payable, or an increase in accrued expenses payable (including wages payable, interest payable, etc.) definition of expense an expense is a cost that has been used up, expired, or is directly related to the earning of revenues. Accounts payable is often mistaken for a company's core operational expenses.

Conceptually, the assets of a company (i.e. Accounts payable vs. Accounts payable is located on the balance sheet, and expenses are recorded on the income statement.

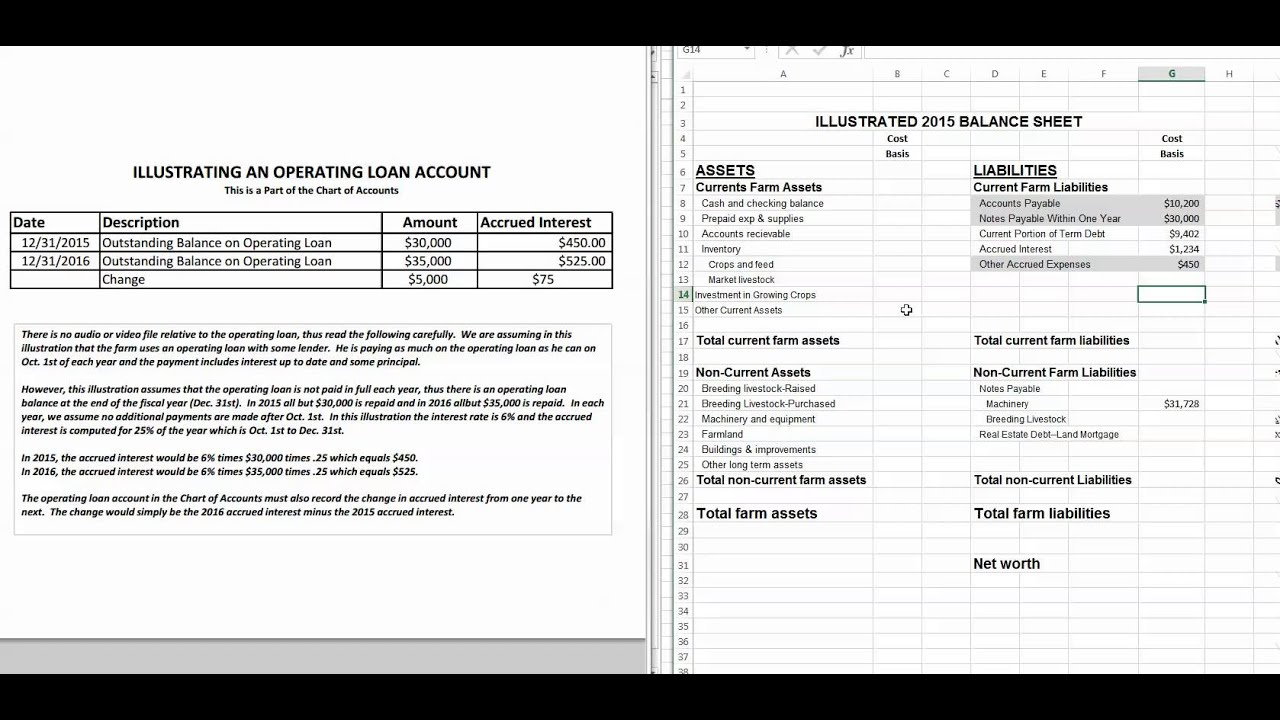

A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. Accounts payables turnover is a key metric used in calculating the liquidity of a company, as well as in analyzing and planning its cash cycle. It appears on the balance sheet under the current liabilities.

The balance sheet is one of the three core financial statements that are used to. Days payable outstanding (dpo) = (average accounts payable ÷ cost of goods sold) × 365 days In short, expenses appear directly in the income statement and indirectly in the balance sheet.

Examples of expenses on the balance sheet, such as cogs, depreciation and amortization, salary and wage expenses, and interest expenses, demonstrate the diverse ways in which expenses can influence the financial statements. In other words, the total amount outstanding that you owe to your suppliers or vendors comes under accounts payable. Interpreting these examples helps stakeholders gain insights into a company’s financial performance and.

As fixed assets age, they begin to lose their value. Accrued expenses are adjusted and recorded at the end of an accounting period while accounts payable appear on the balance sheet when goods and services are purchased. What are accounts payable on a balance sheet?

Accounts payable refers to the money your business owes to its vendors for providing goods or services to you on credit. The balance sheet is based on the fundamental equation: A related metric is ap days (accounts payable days).

The balance sheet shows the carrying values of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. It is a liability due within a specific time frame usually one year. Think of the balance sheet as being similar to a team’s overall win/loss record—to a certain extent a.