Sensational Info About Net Profit Transferred To Capital Account Journal Entry

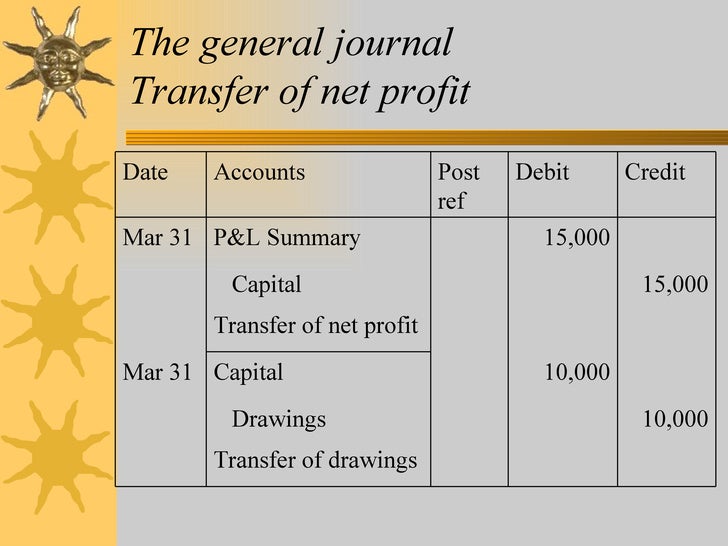

Transfer to capital a/c the net profit belongs to the ownership of the business which is represented by the capital account.

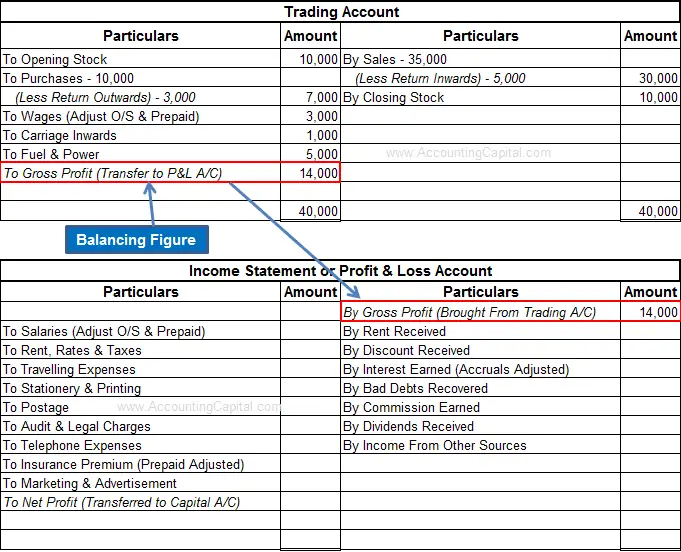

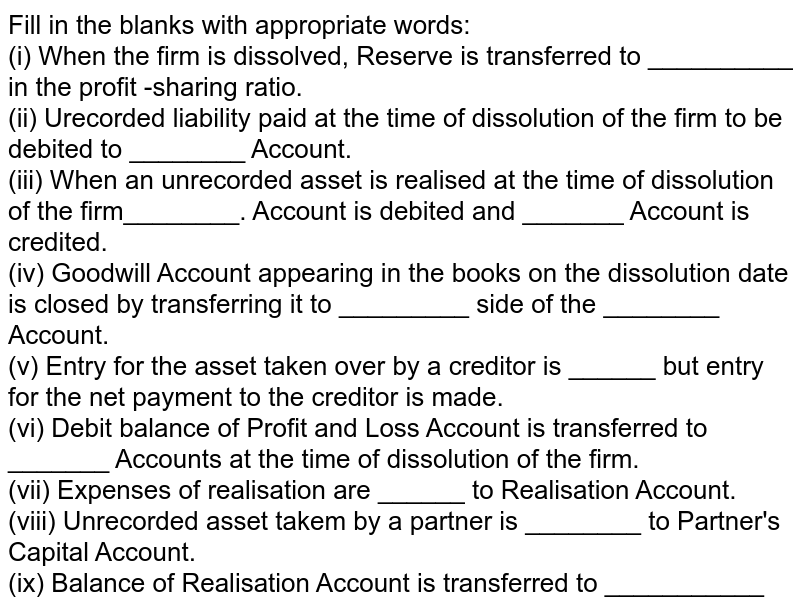

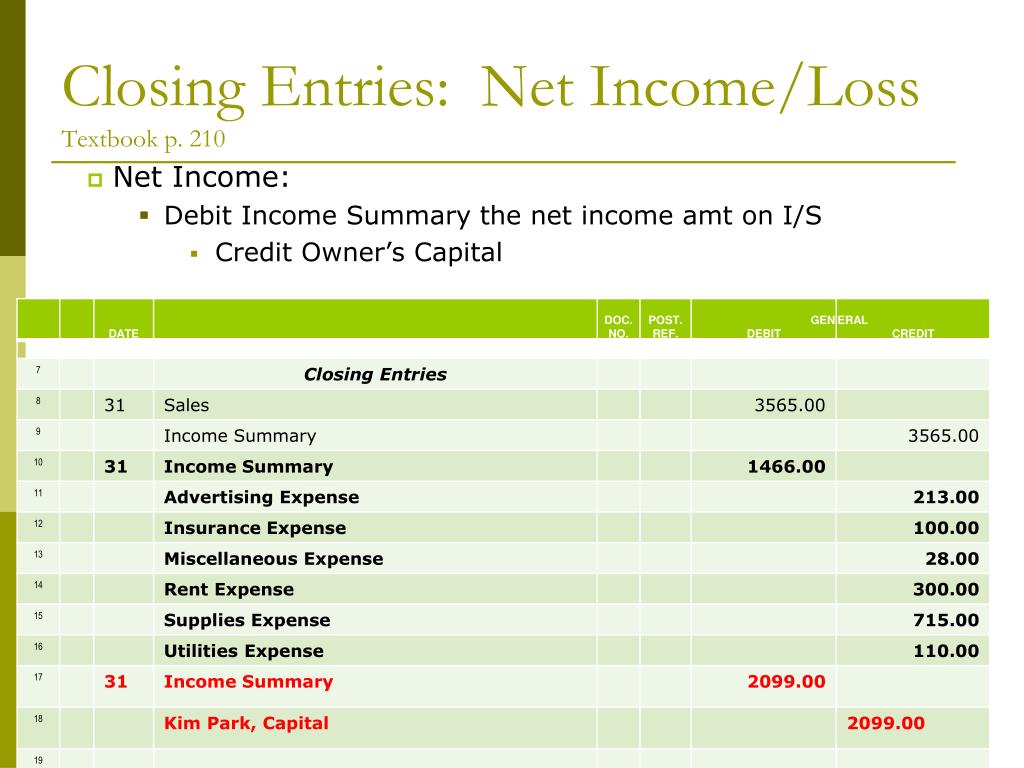

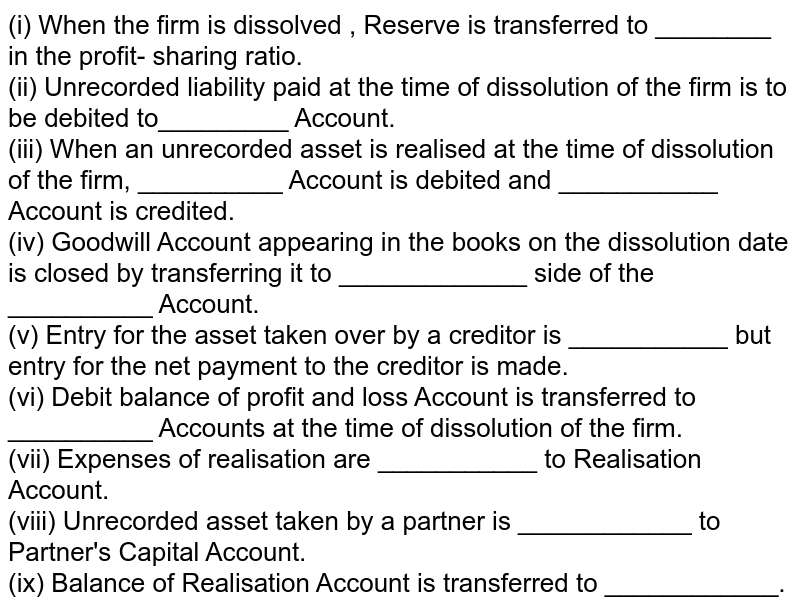

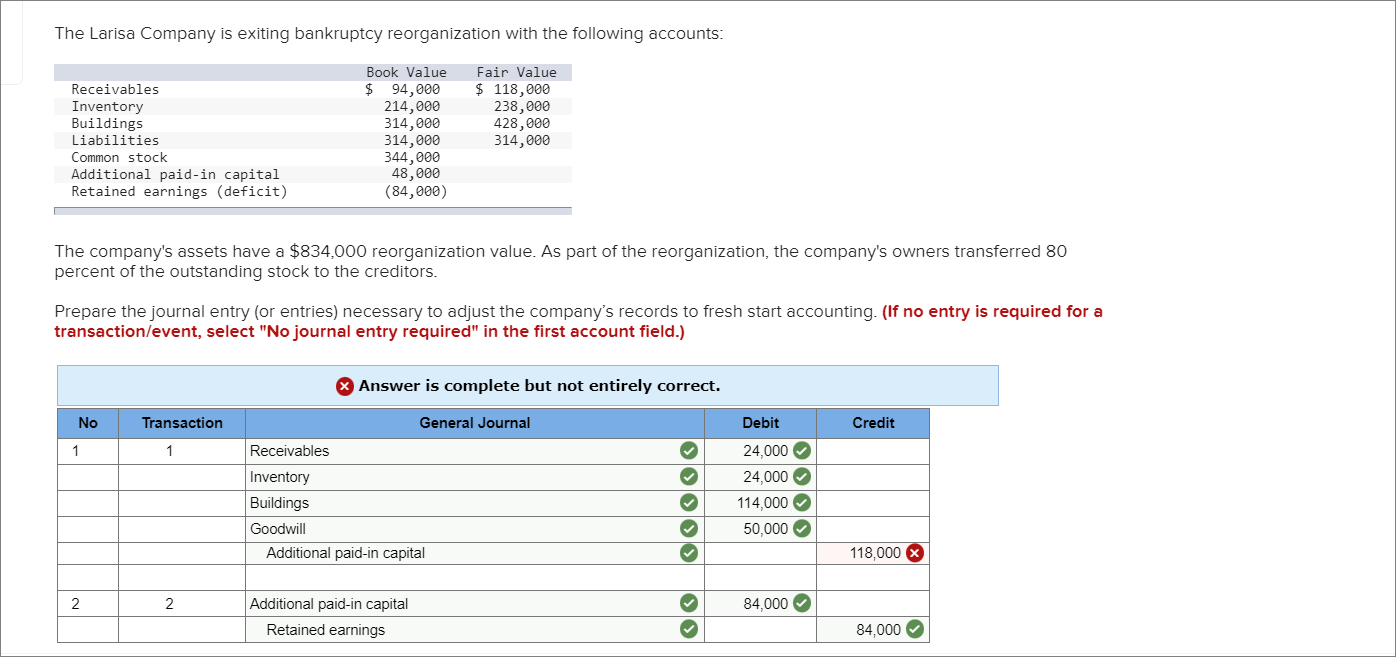

Net profit transferred to capital account journal entry. The net profit from profit and loss a/c is transferred to profit. Usually at the year, the net profit or loss is journalled to equity so that assets = liabilities + equity. Closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period, and transfer the balances to the.

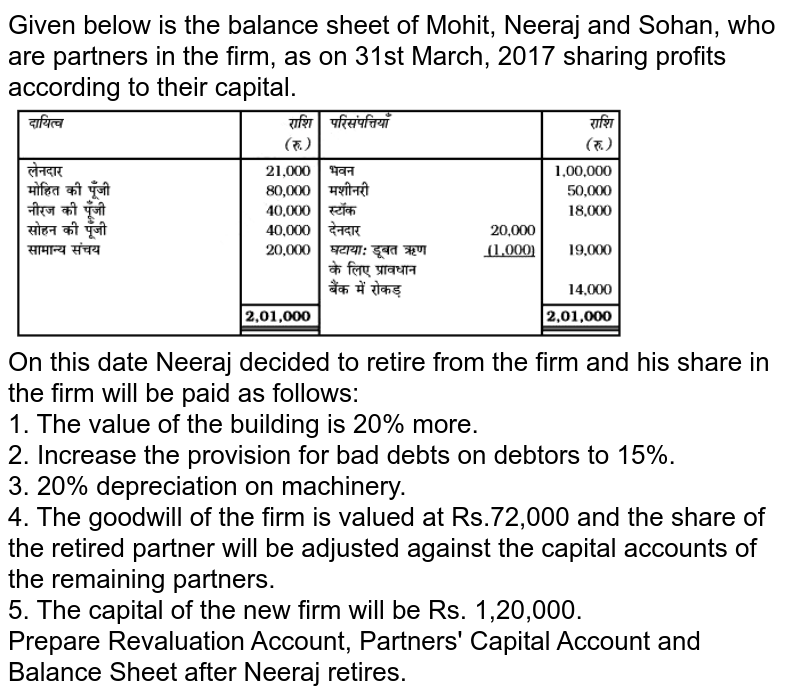

Therefore, the net profits or losses are ultimately transferred to the capital account. But in the partnership company, the profit will allocate to each partner. The private and corporate entities will record the net income in the retained earnings on the balance sheet.

Credit balance of profit & loss account is known as net profit. At the end of the period, the company will need to make the closing entry for net income by transferring all revenues and expenses to the income summary account. If instead the new partner.

3500 (net profit transferred to capital a/c) Note that the entry is a paper transfer—it is to move the balance in the capital account. When you roll over from one financial year to another in accentis enterprise, it is.

Just as in the previous example, the entries could also be combined into one entry with the credit to cash $23,000 ($8,000 from sam + $15,000. For transfer of net profit: We say that the profit and loss a/c is.

Any profit is transferred to capital because it is all related to capital value of firm like assets or any income. Net profit is transferred to the capital account and shown on the liability side of a balance sheet. There are the following types of entries in accounting :

(transfer of balances for closing the former accounts) profit and loss a/c: Browse more topics under admission. If instead the new partner.

The journal entries would be: Journal entry for the capital introduction the capital introduction transaction is shown in the accounting records with the following bookkeeping entries: Partner's profit or income the profit or income of the.

Journal entries relating to profit and loss appropriation account: The amount paid by remi to dale does not affect this entry. Note that the entry is a paper transfer—it is to move the balance in the capital account.

Treatment of reserves by definition, a reserve is that part of the profit that is not distributed among the partners but retained in the business.