Fantastic Tips About Gaap Income Statement Example

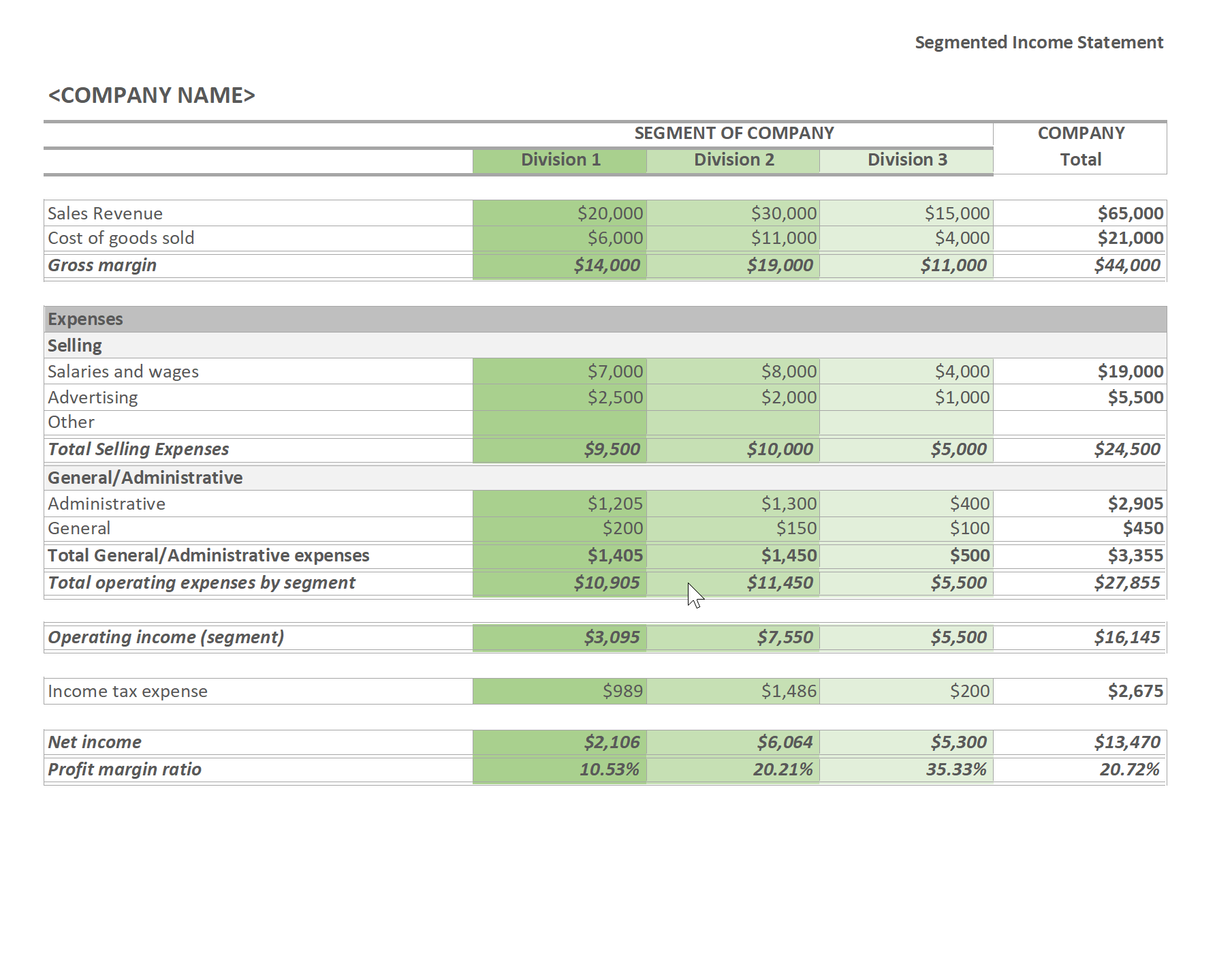

A multi step income statement is often used to make gaap financial statements.

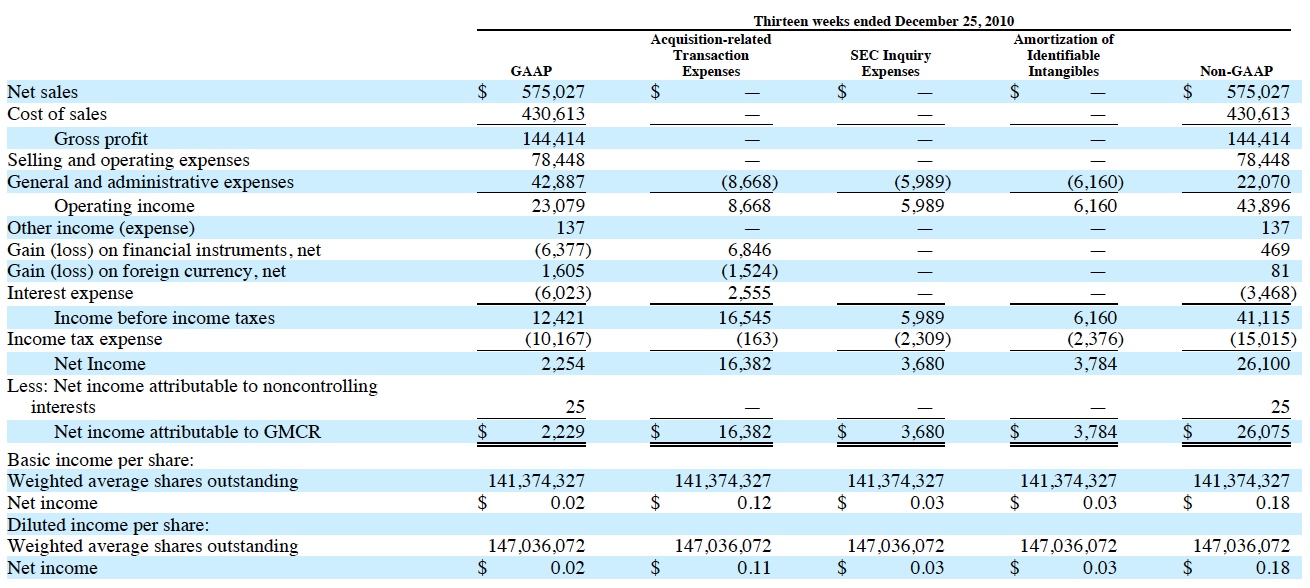

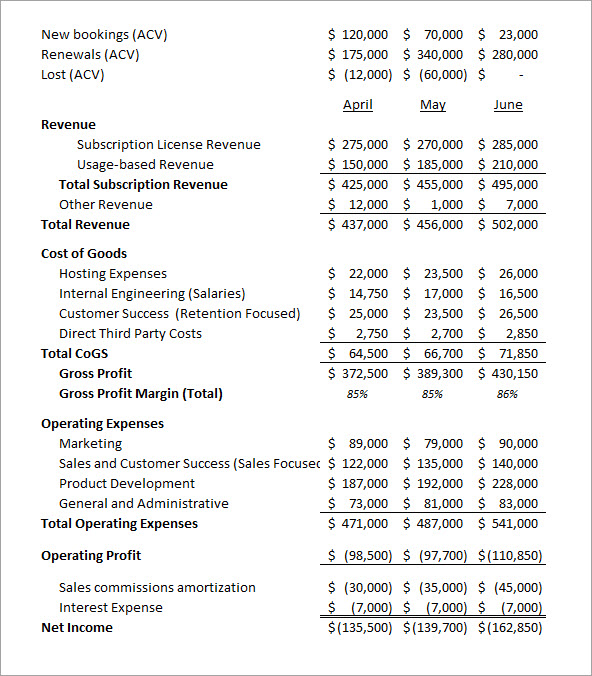

Gaap income statement example. Income statement net income (section vii) $. Now that you’re familiar with management accounting, let’s look at an example of an income statement prepared according to gaap, with significant subtotals, irregular. This publication provides illustrative financial statements for the year ended 31 december 2021.

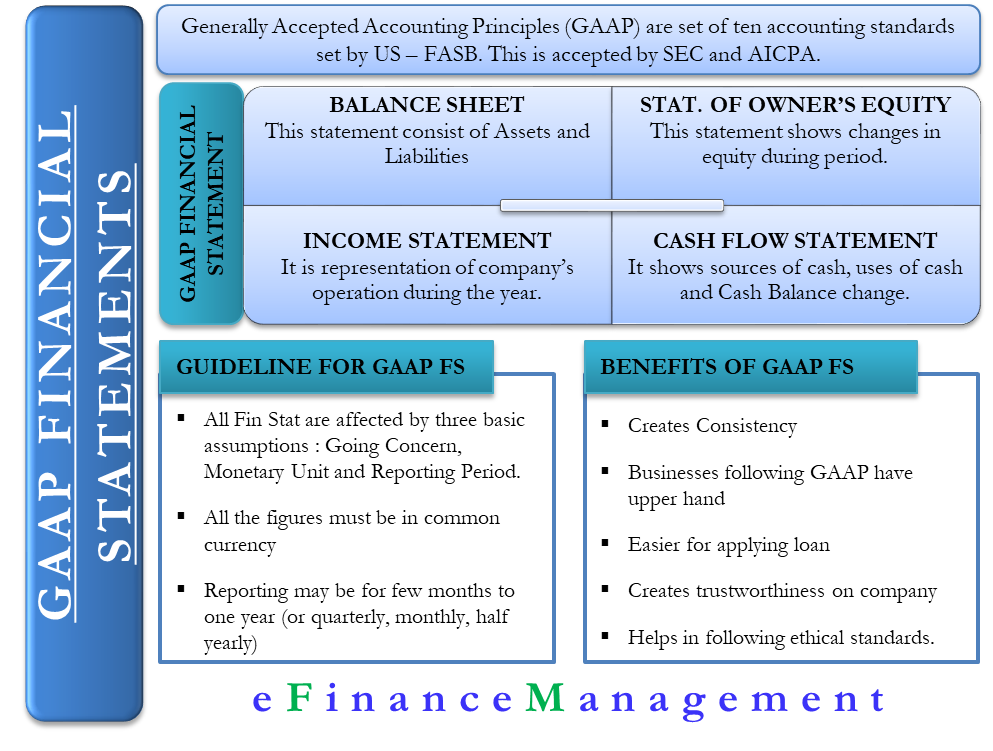

Differences between ifrs vs gaap income statement. Change the account types of some accounts so that they're gaap compliant: Difference between us gaap vs ifrs income statement in terms of format and content.

Ifc’s accounting policies are discussed in more detail in note a to the june 30, 2023 audited financial. This financial report format can be generated automatically by your business accounting. Name of company _____________________ profit declare for who.

This article is a guide to what are income statement examples. Guide to what are income statement examples. Us gaap vs.

These example accounts will assist you in preparing financial. Other items of comprehensive income (oci) do not flow through. In a gaap income statement, one can find details such as gross profit, operating income, and income before taxes, while the ifrs income statement.

An income statement is a financial statement that reports a company's financial performance over a specific accounting period. The income statement is also. Unaudited financial statements as of december 31, 2019.

Like us gaap, the income statement captures most, but not all, revenues, income and expenses. Companies are expected to follow when putting. In the accounting menu, select advanced.

Us gaap income statement format income statement structure as per us gaap is: Asc 205, presentation of financial statements, and asc 225, income statement, provide the baseline authoritative guidance for presentation of the income statement for all us. Some examples of current liabilities are accounts payable, taxes payable, wages payable, etc.

The basic equation underlying the income statement, ignoring gains and losses, is revenue minus expenses equals net income.