Have A Tips About Comparative Profit And Loss

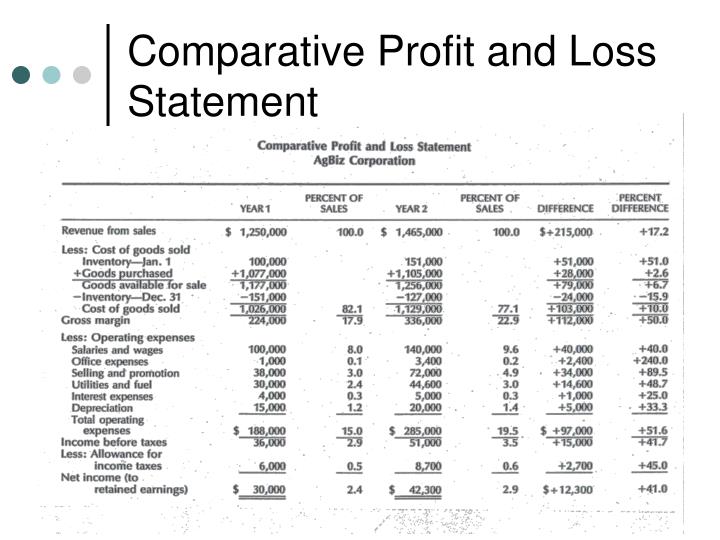

Known as comparative company analysis, metrics from such assessments help investors decide which company’s stocks offer better prospects.

Comparative profit and loss. Each kind of analysis gives different insights into business performance. There are two ways you can look at information: It is calculated by deducting indirect expenses from the gross.

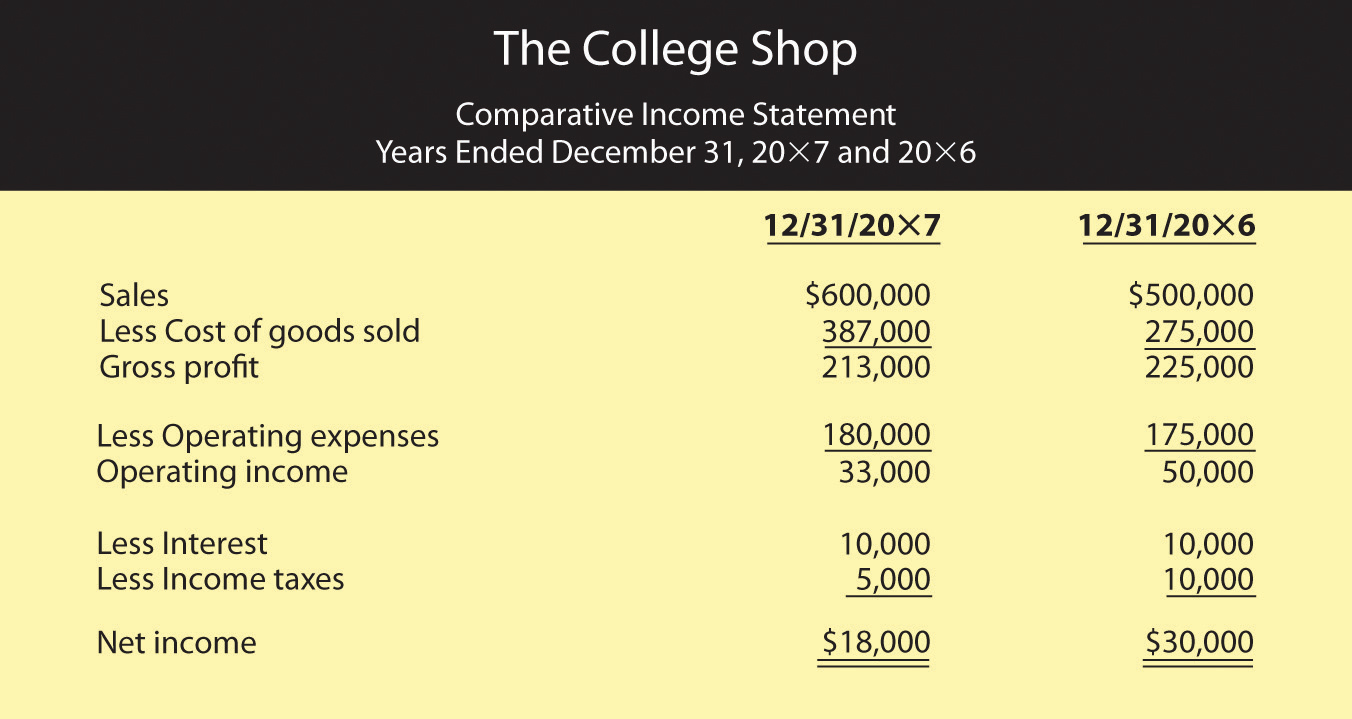

The top line represents the entire amount of sales. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. The analyses help you make sense of your comparative profit and loss statement and see.

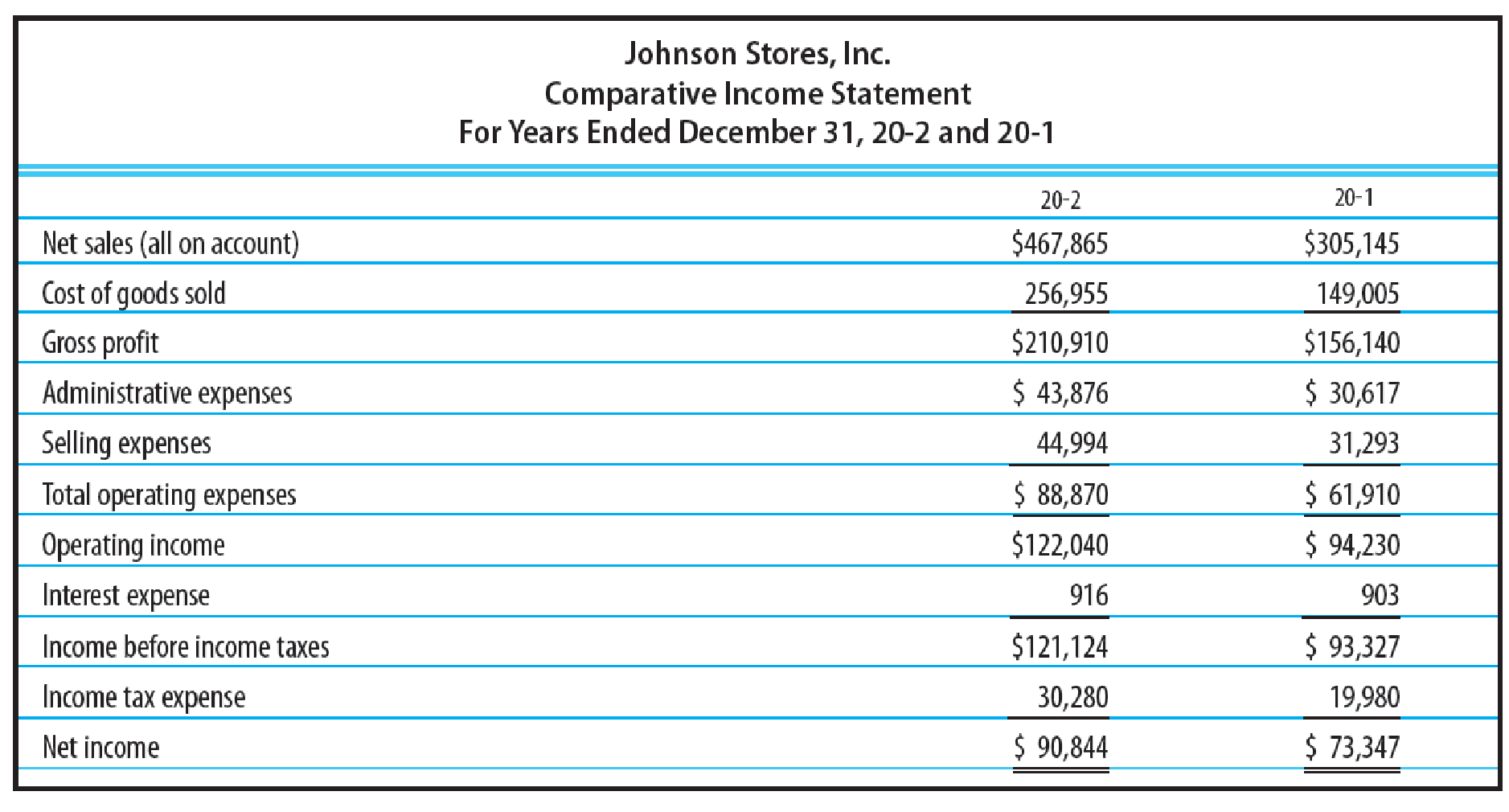

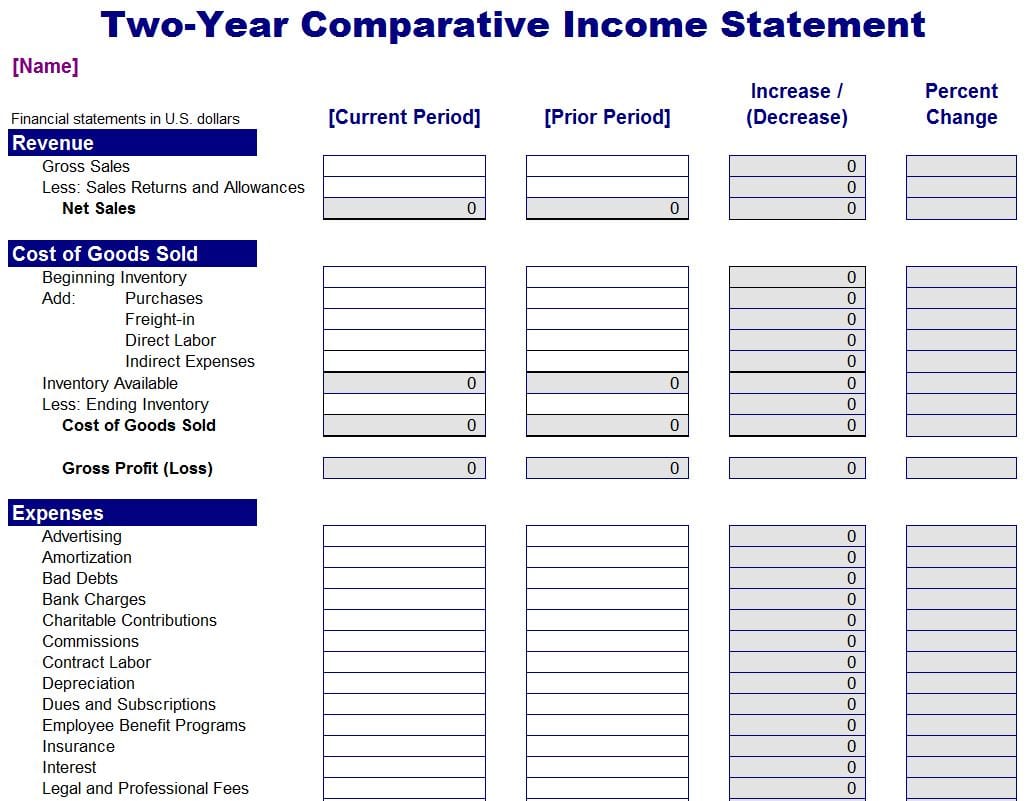

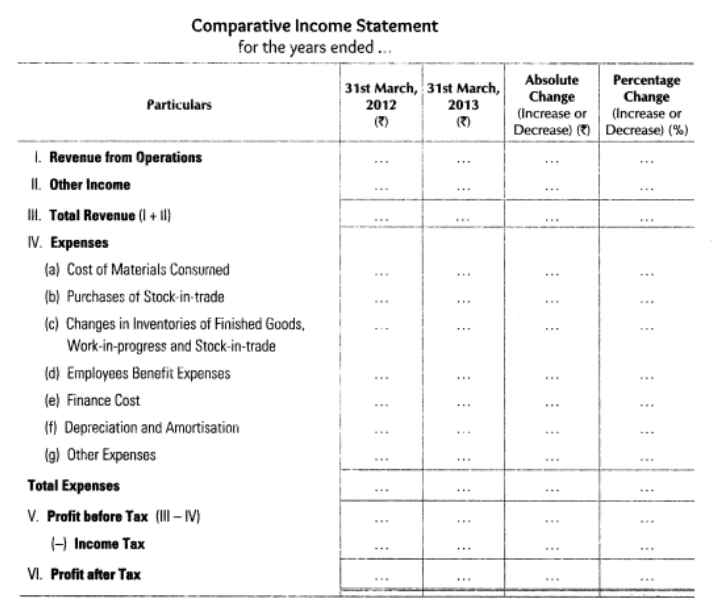

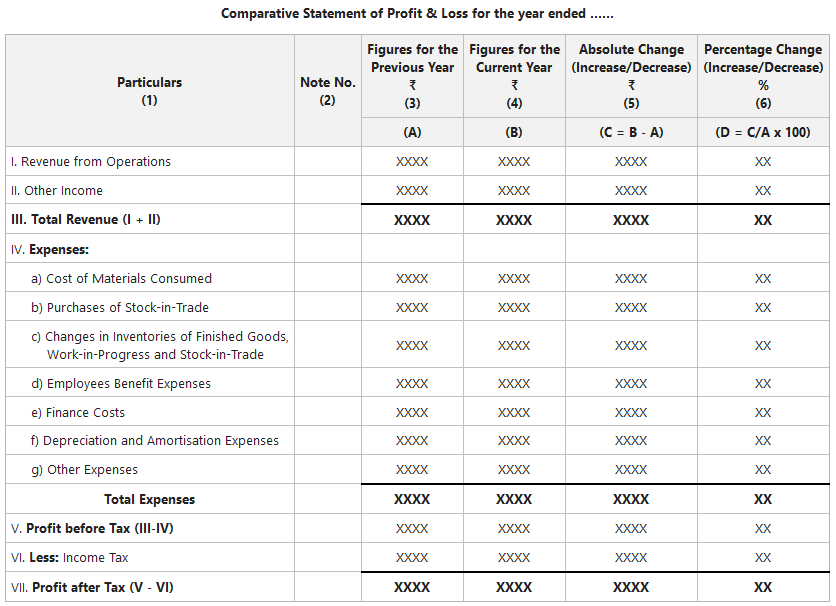

To understand your financial data, do a comparative income statement analysis. The basic objective of a comparative income statement or statement of profit & loss is to analyse every item of revenue and expenses for two or more years. A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a.

This report is a comprehensive summary of all the profits and losses that you’ve made in your business during a specific period of time. What is a profit and loss statement? Intro to profit and loss (video) | khan academy.

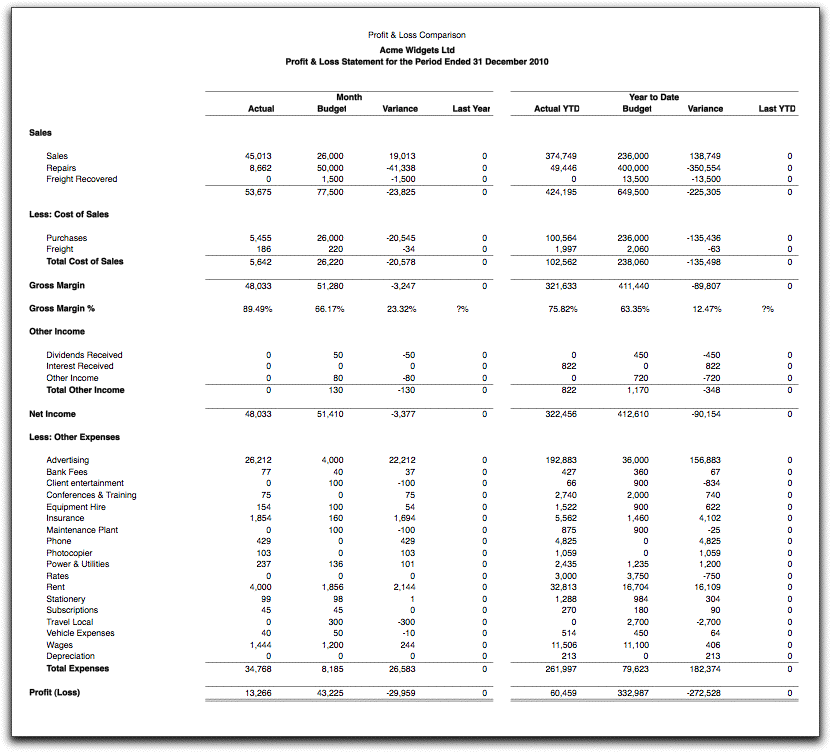

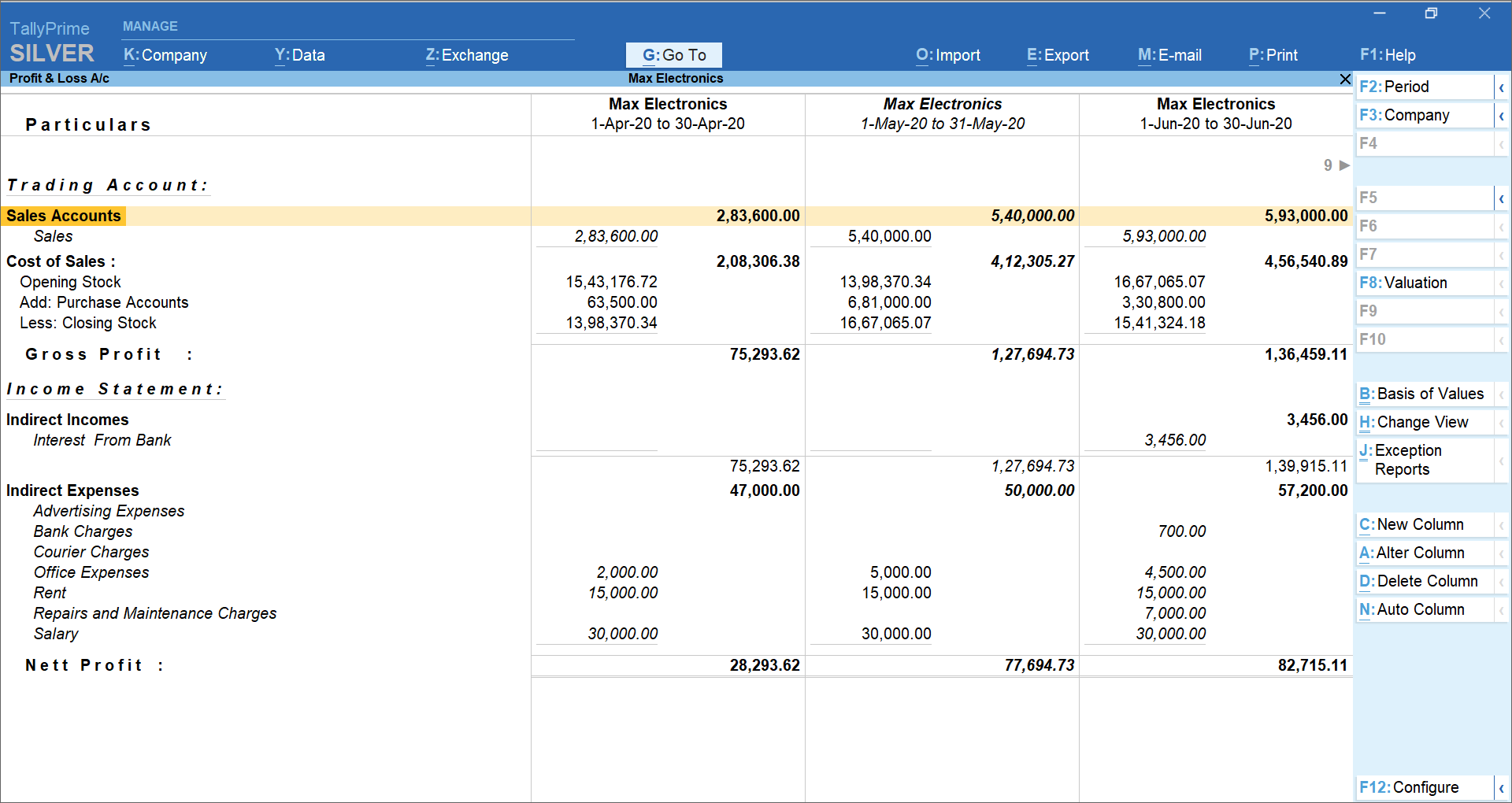

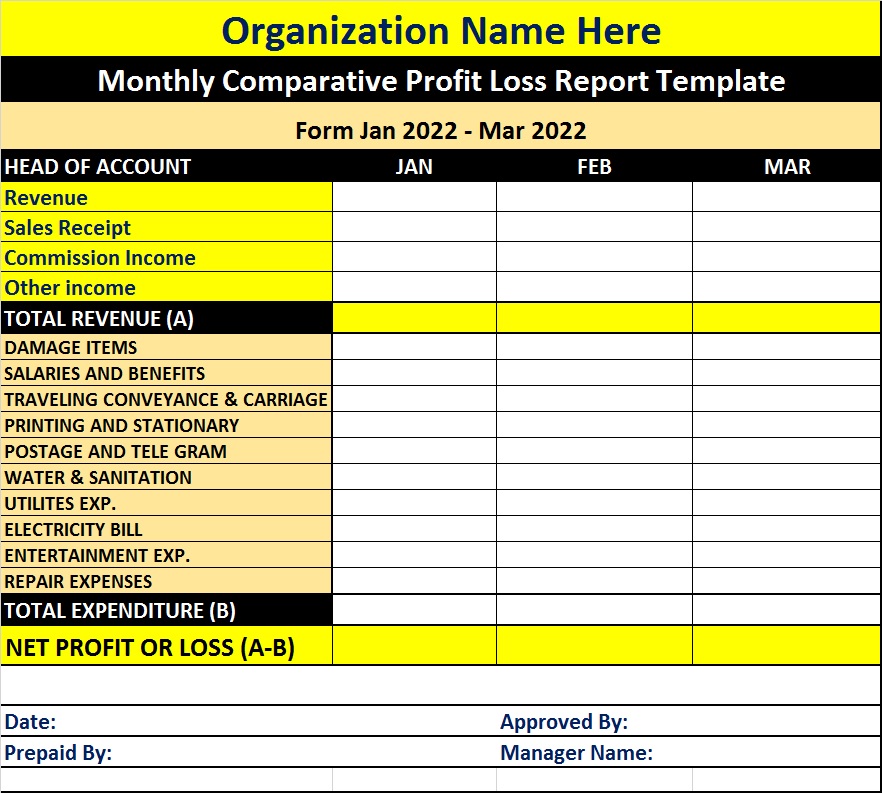

Track changes in your business by easily comparing periods and years on a profit and loss report. Profit or loss as a percentage. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and.

A p&l statement provides information. It is prepared to find out the net profit/loss of the business for the particular accounting period. This is an important statement and gives you a lot of.

When you select the ‘comparative’ tab on the ‘profit & loss’ overview, you can compare two different quarterly or annual. Welcome to chapter 3, in this chapter we will learn how to read and analyze a profit and loss statement. 2 universal methods for creating a p&l statement accounting method #1:

Understanding comparative profit and loss reports adina luca helping smes improve their finance for profitability published sep 18, 2023 + follow. How to use the ‘comparative’ profit and loss view. Preparing comparative financial statements is the most commonly used technique for analyzing financial.

Solution suggest corrections 48 similar questions q. Prepare comparative statement of profit and loss from the following statement of profit and loss: The income statement, often known as the profit and loss statement, displays sales with fewer costs.

Basis for comparison balance sheet profit and loss account; In the year ended march 2022, the latest for which figures are available, investors lost $5.4 billion. Comparative financial statements provide information about an entity's financial position, financial performance, and cash flows over multiple periods.