Stunning Tips About Company Balance Sheet And Profit Loss Account

There are several key differences between the p&l and balance sheet, particularly the information presented and what it means.

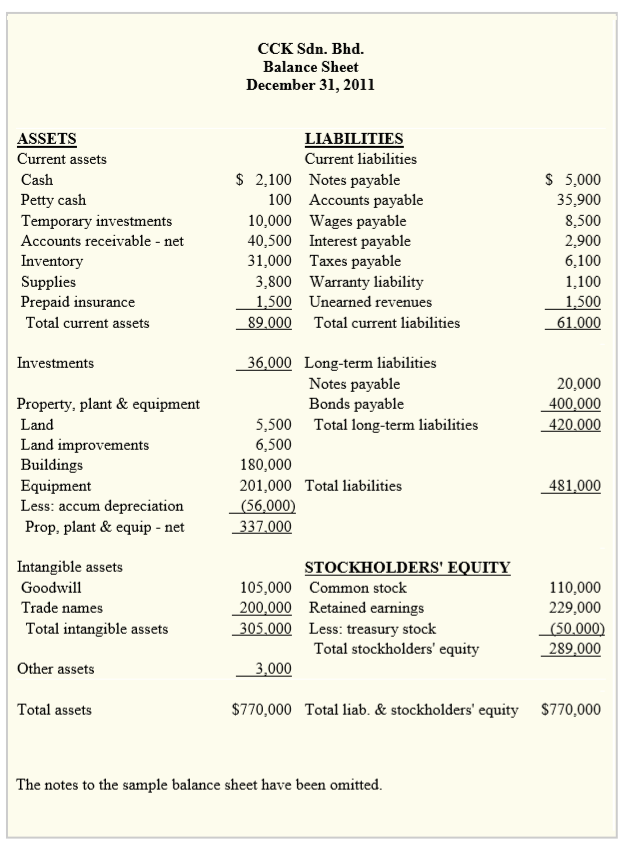

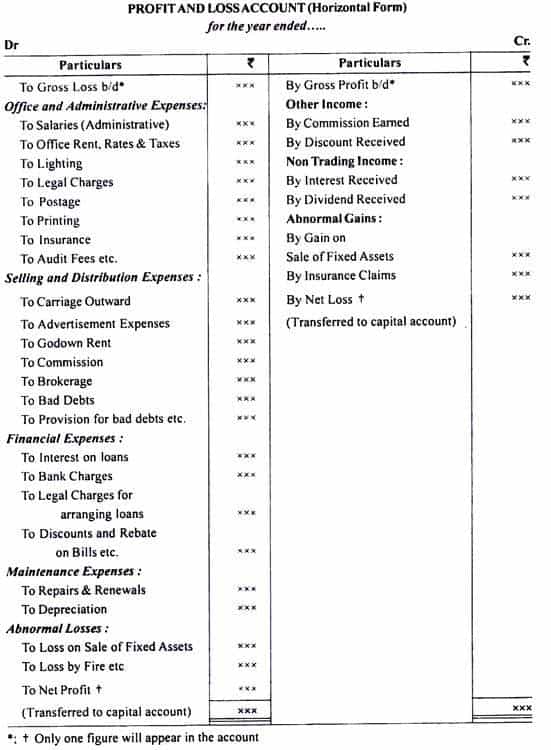

Company balance sheet and profit and loss account. Let us look at what these two terms mean and how these are different from one another. Here is an example of a typical balance sheet for a small limited company: Trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business while the profit and loss account is the second part of the account, which is used to determine the net profit of the business.

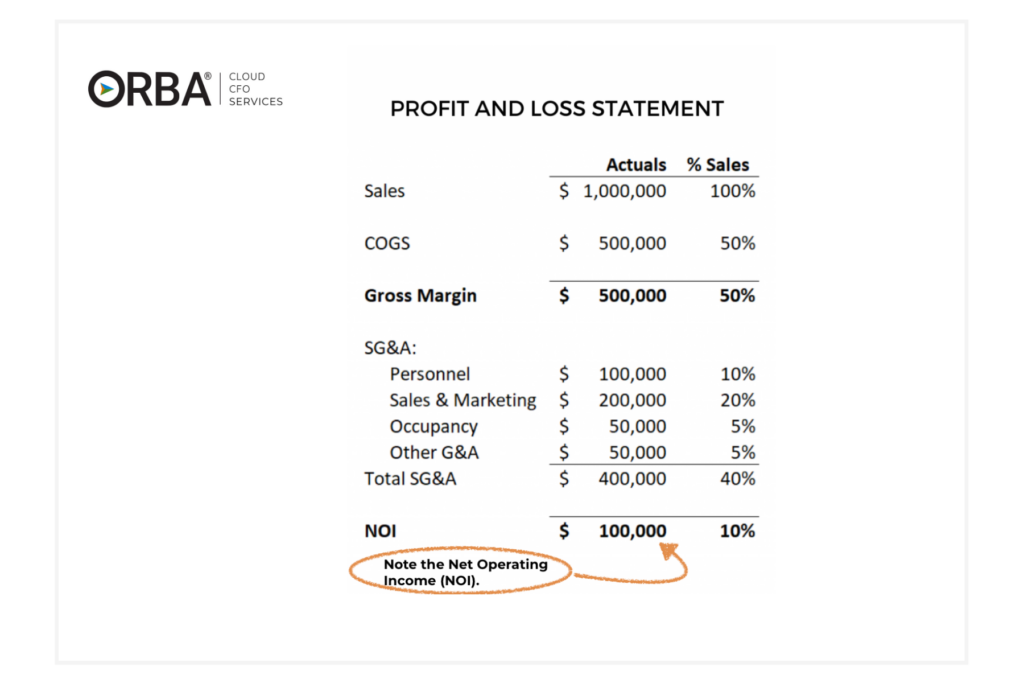

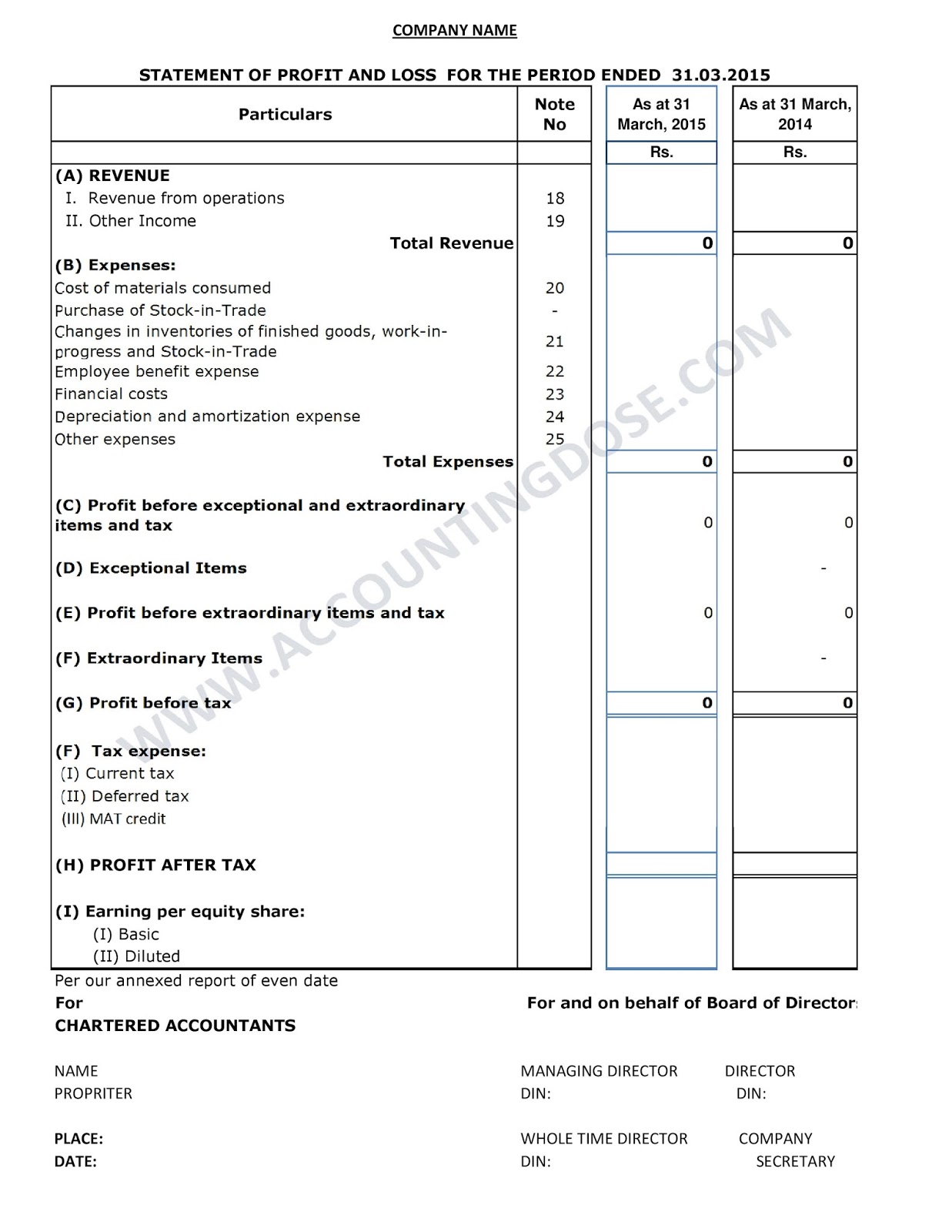

A profit and loss account is an account that shows the revenue and expenses of the firm from business operations during a financial year. That net income becomes a retained earnings line item on the balance sheet, which is used to locate the ending cash balance. It is important to prepare profit and loss statement because this information helps an organisation to take the right business decision like where should.

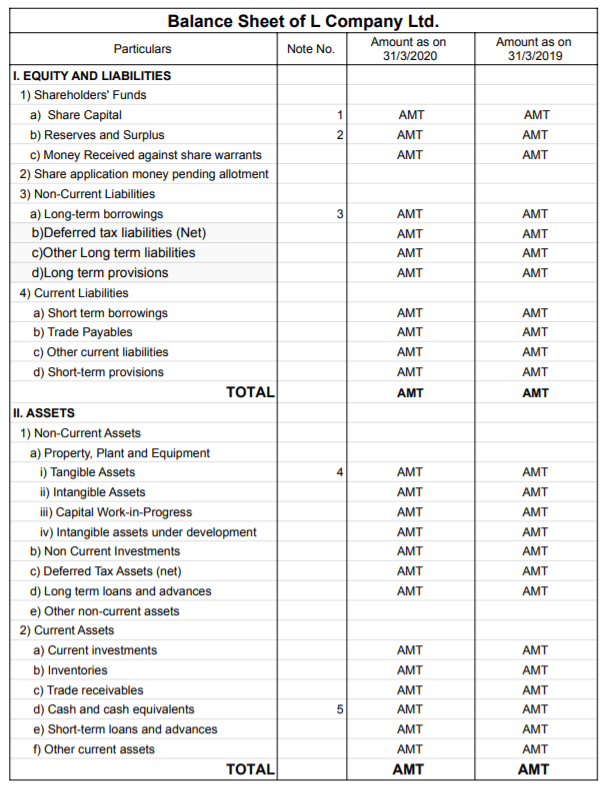

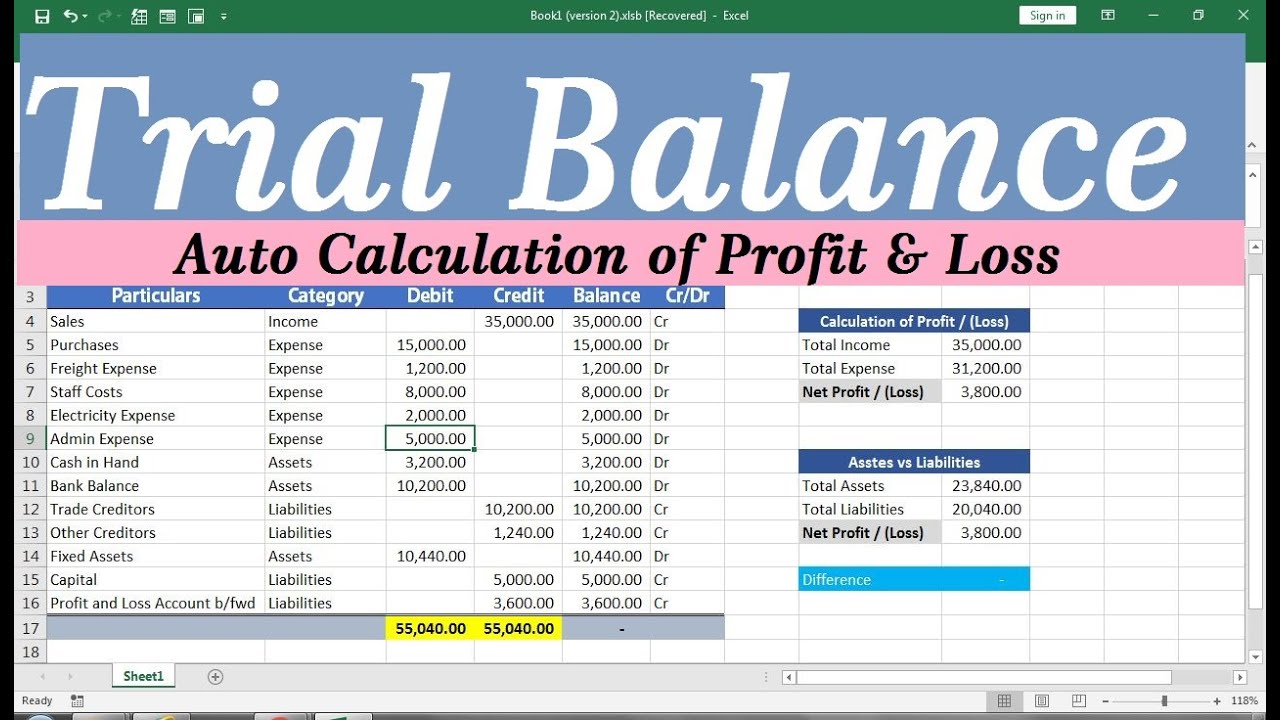

Balance sheet has the components like assets, liabilities, and equity of stakeholders. Every company prepares a profit and loss account/statement at the end of the year generally, to get the visibility of the income, earning, expenses and loss incurred in a specific range of period. In order to prepare the profit and loss account and the balance sheet, a business owner needs to set out the closing balances from the trial balance in the formats shown above in figs 7.1 and 7.2.

The company's financial standing as of a. Profit & loss account (income statement) purpose. Along with your balance sheet, your profit and loss statement (p&l) is the most significant financial document your business will produce.

These two totals are called the balance sheet total. The profit and loss statement: A balance sheet is a precise representation of the assets, equity and liabilities of the entity.

The p&l summarizes the company’s performance over a specific period, while the balance sheet reflects the company’s value at a specific date. The three main types of financial statements are the income statement (also known as the profit and loss statement), the balance sheet, and the cash flow statement. This is outlined by every enterprise, a partnership enterprise or sole proprietorship firm.

Represents the financial position at a specific point. It reveals the financial security of the enterprise. Profit and loss account and balance sheet are the same kinds of documents any organisation prepares to understand profit or loss earned by the company in a financial year.

The balance sheet is a snapshot of a company’s assets, liabilities, and equity at a specific point in time. The total of the bottom half of the balance sheet will equal the top half. This statement summarizes the revenue, cost of goods sold, gross profit, expenses, and net income for your company from the beginning of the year to the current date.

Summarizes revenues, expenses, and profits or losses over a specific period (e.g., a month, quarter, or year). The balance sheet, by comparison, provides a financial snapshot at a given moment. A balance sheet is a declaration that details a company's assets, liabilities, and equity as of a certain time.

Instead, you should submit abbreviated annual accounts to the registrar of companies, which include just a balance sheet and. A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date. The p&l account provides an overview of all the company’s revenues and expenses.