Casual Tips About Liquidation Financial Statements

Hong kong’s accounting and financial reporting council said.

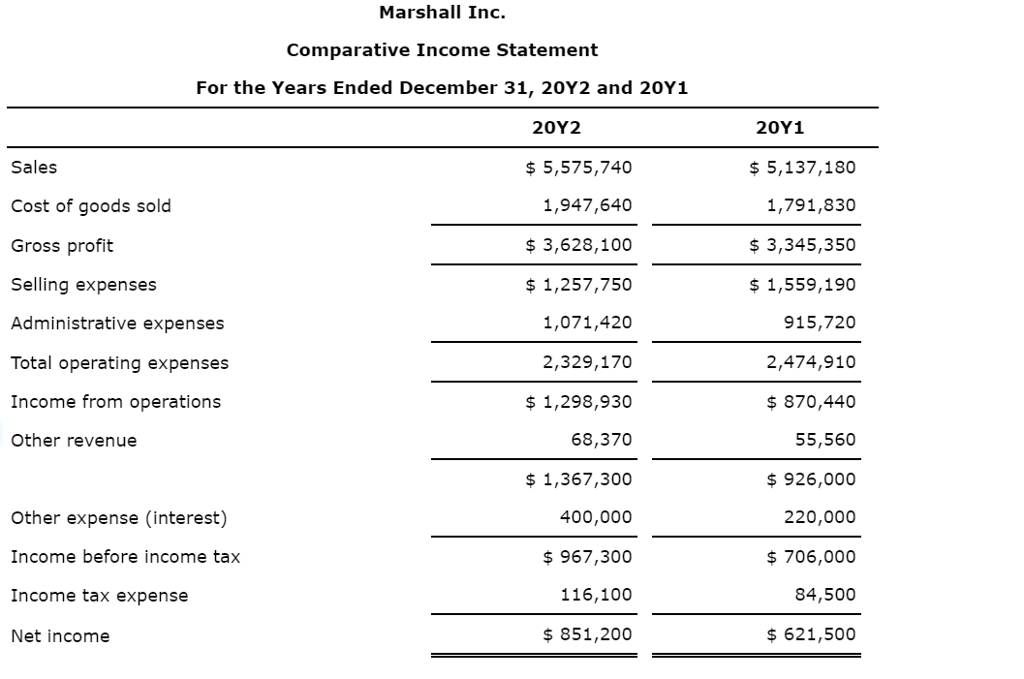

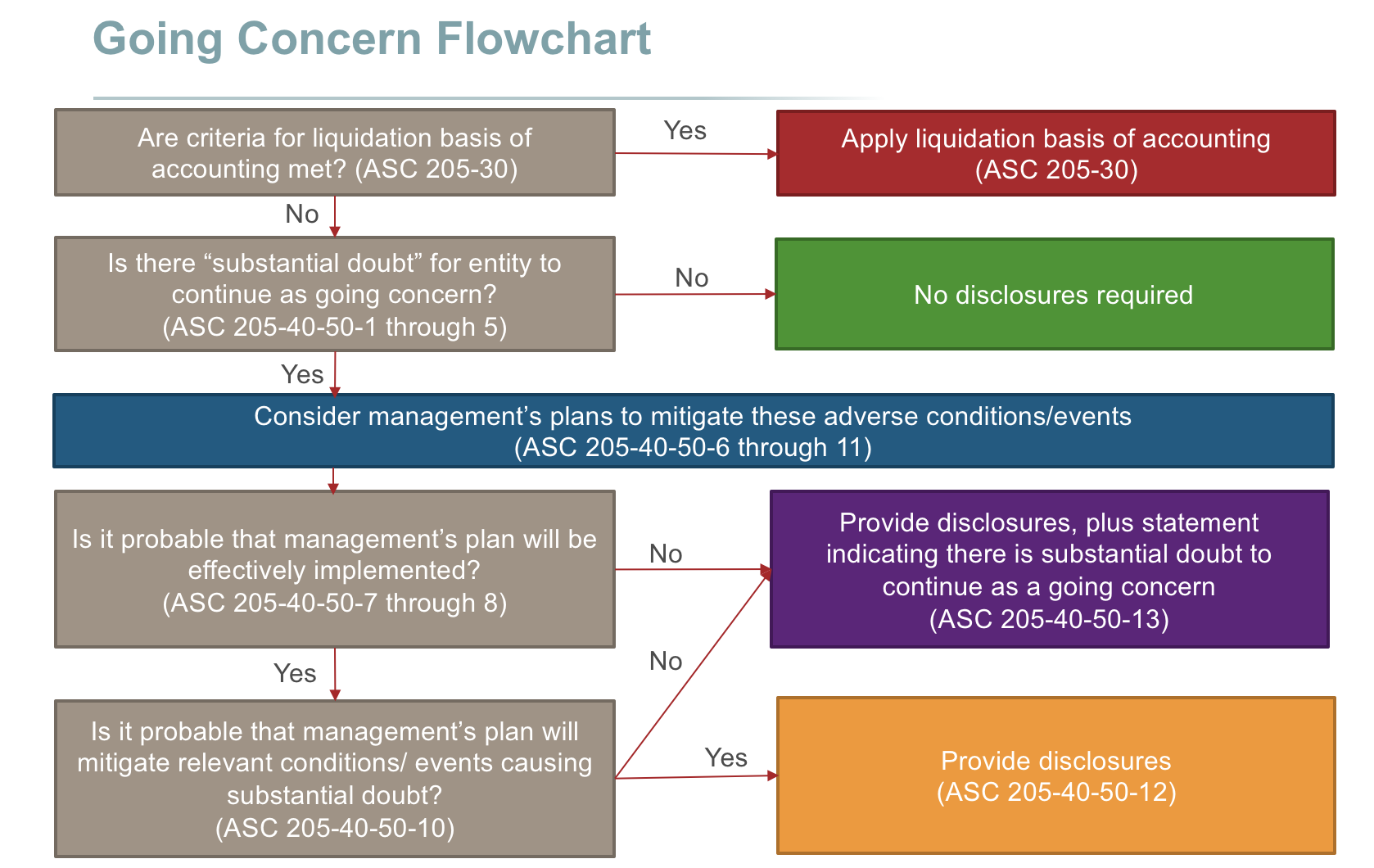

Liquidation financial statements. The proper application of liquidation basis of accounting (lboa) within financial statements can be quite challenging. (a) are intended to provide general information on the application of accounting principles generally accepted in the united states of america effective as of september 30, 2015, and do not include all possible disclosures that may be required for private investment companies; Liquidation will be considered “imminent” when (1) a liquidation plan has been approved by those with the authority to do so and the chance of the plan being blocked by other.

An indication that the financial statements are prepared using the liquidation basis of accounting, including the facts and circumstances surrounding the adoption of the liquidation basis and a description of how the reporting entity determined that its liquidation was imminent The financial statements of a reporting entity applying the liquidation basis should reflect the amount of cash or other consideration that an investor might reasonably expect to receive after the reporting entity's assets have. What is liquidation as defined in the fasb glossary?

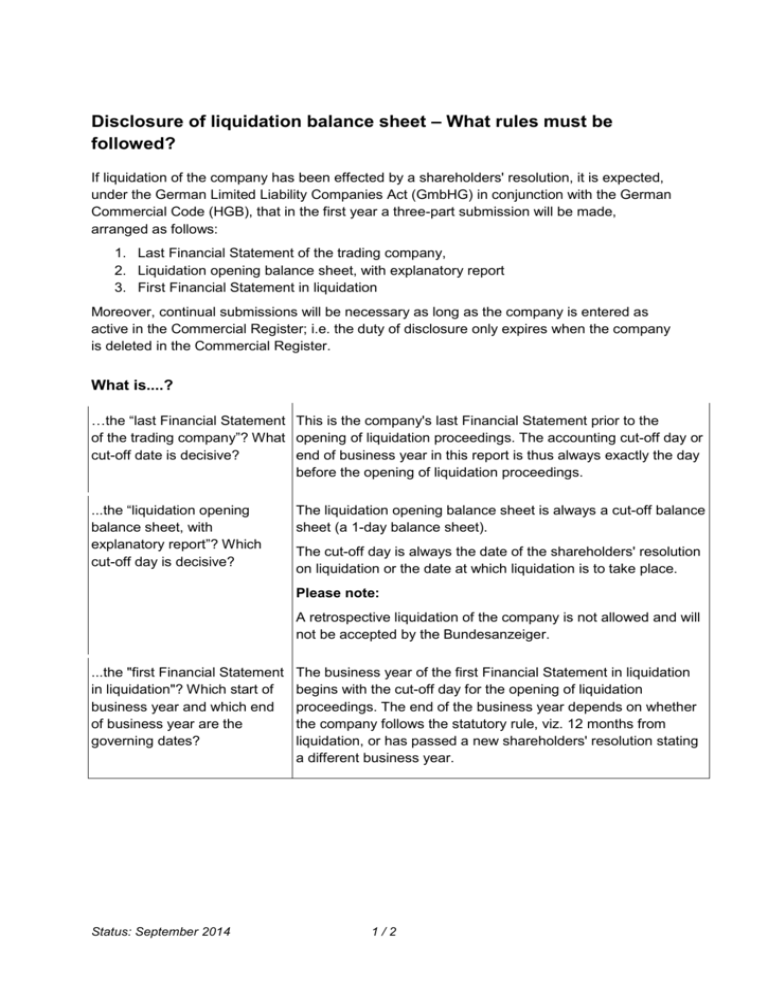

These illustrative financial statements: Financial statements should include at a minimum: Financial statements prepared using the liquidation basis of accounting are now required by gaap to include a statement of net assets in liquidation and a statement of changes in net assets in liquidation, as well as all disclosures necessary to present relevant information about an entity’s expected resources in liquidation.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position in liquidation of the foundation as of december 31, 2018, and the changes in its net assets in liquidation and its cash flows in liquidation for the year then ended, in accor. The difference between bankruptcy and liquidation, when to apply the liquidation basis of accounting, how to apply the liquidation basis of accounting, and. The liquidators were “taking steps to protect [their ability to bring] legal claims against auditors”, one of the people said.

The goal behind lboa is to report the amount that an investor may expect to receive after the. Statement of net assets in liquidation; Impacts on financial statements presentation and.

Under the liquidation basis of accounting, a business must issue two new statements, which are noted below. Under the asu, an entity is required to use the liquidation basis of accounting to present its financial statements when it determines that liquidation is imminent, unless the liquidation is the same as the plan specified in an entity’s governing documents created at its inception. Simon gauge, the rochdale chairman, says the club now require a cash injection of £2 million and a new investor in place by the end of march.

The statement of net assets in liquidation shows the net assets available for distribution at the end of the reporting period. Entities generally will be required to prepare financial statements on the liquidation basis of accounting if liquidation is “imminent.”. Ifrs accounting standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial health.

The companies law requires preparing financial statements at the end of each fiscal year of a company1 during the liquidation period. Gaap consolidation — identifying a controlling financial interest contingencies,. Entities must prepare financial statements using liquidation basis of accounting to present relevant information about the expected resources in liquidation;

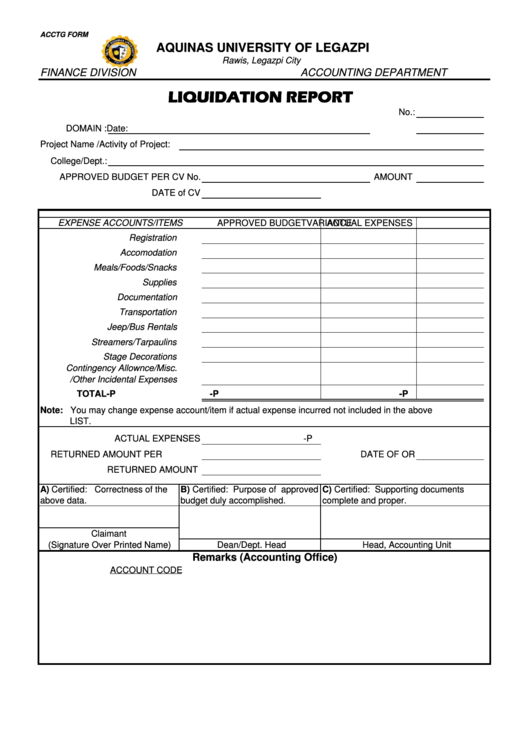

Liquidator’s final statement of account article shared by: Statement of changes in net assets in liquidation 31 aug 2021 (updated 30 jun 2023) us bankruptcy & liquidation guide.

Presentation of financial statements. The pronouncement requires that the financial statements of an entity in liquidation must be prepared using “the liquidation accounting base” to present relevant information about the expected resources and the resources that are committed when that situation arises. The liquidator’s task is to realise the assets and disburse the amounts among those who have a rightful claim to it;