Lessons I Learned From Info About Cash Flow Statement For Startup

Cash flow is the lifeblood of any business, but it’s even more critical for startups.

Cash flow statement for startup. A cash flow statement is one of the three basic financial reports—the other two being the balance sheet and income statement (or profit and loss statement). There are a number of options available to you: Why is cash flow so important for startups?

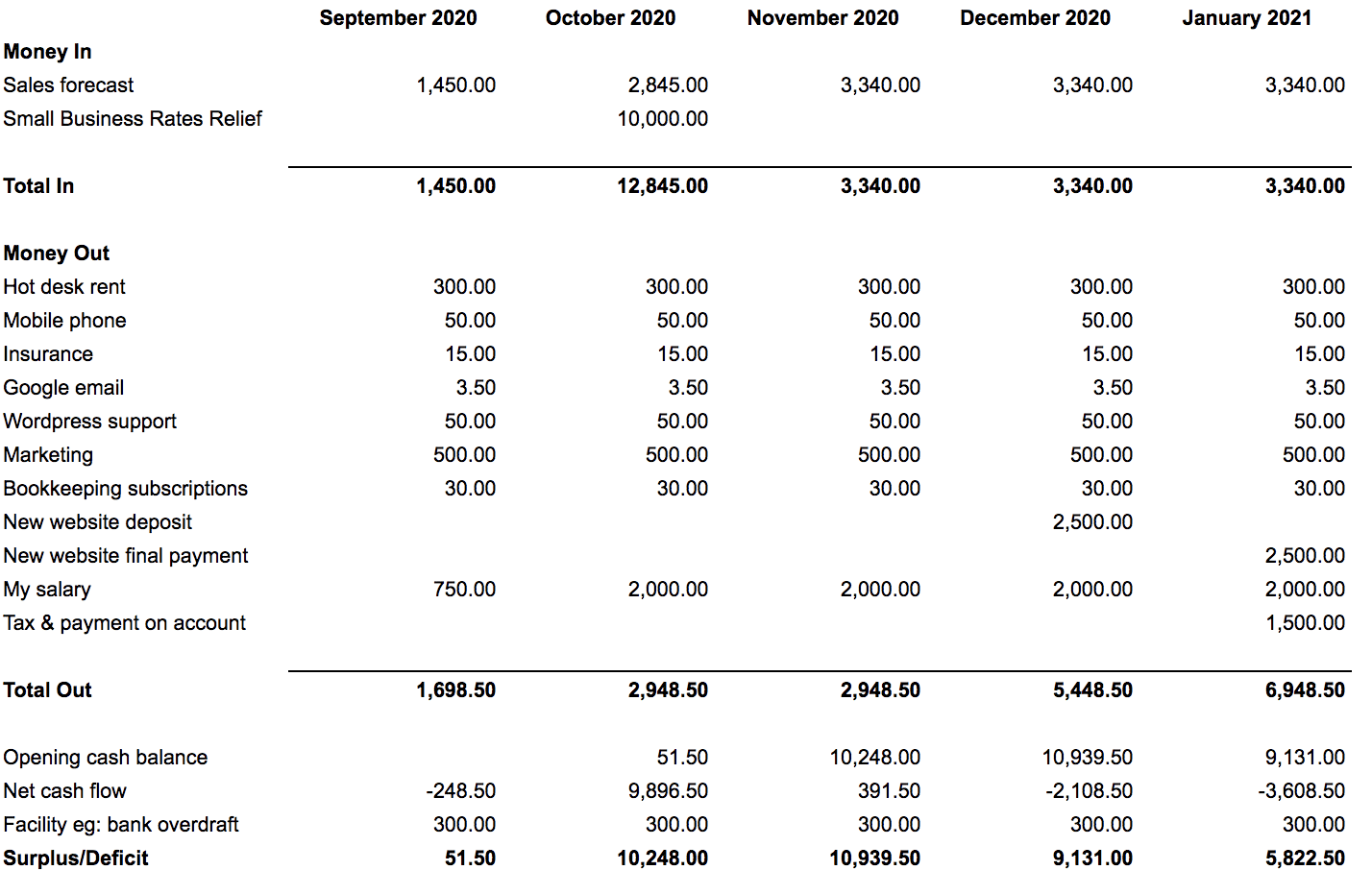

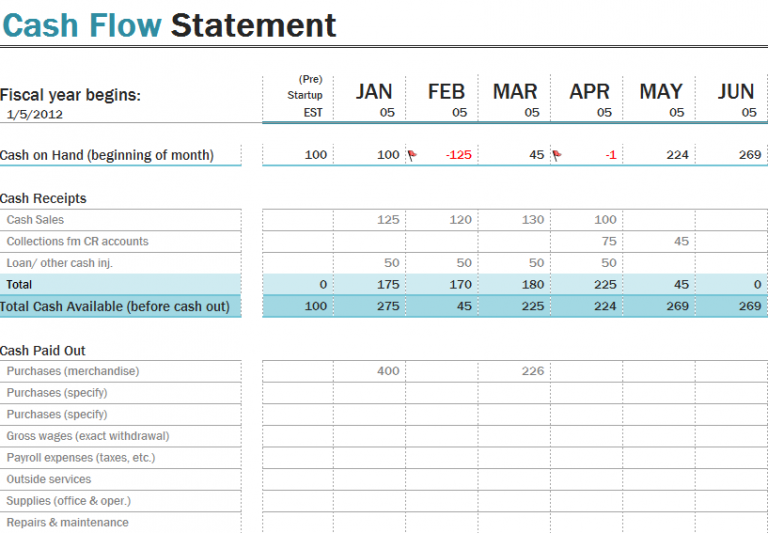

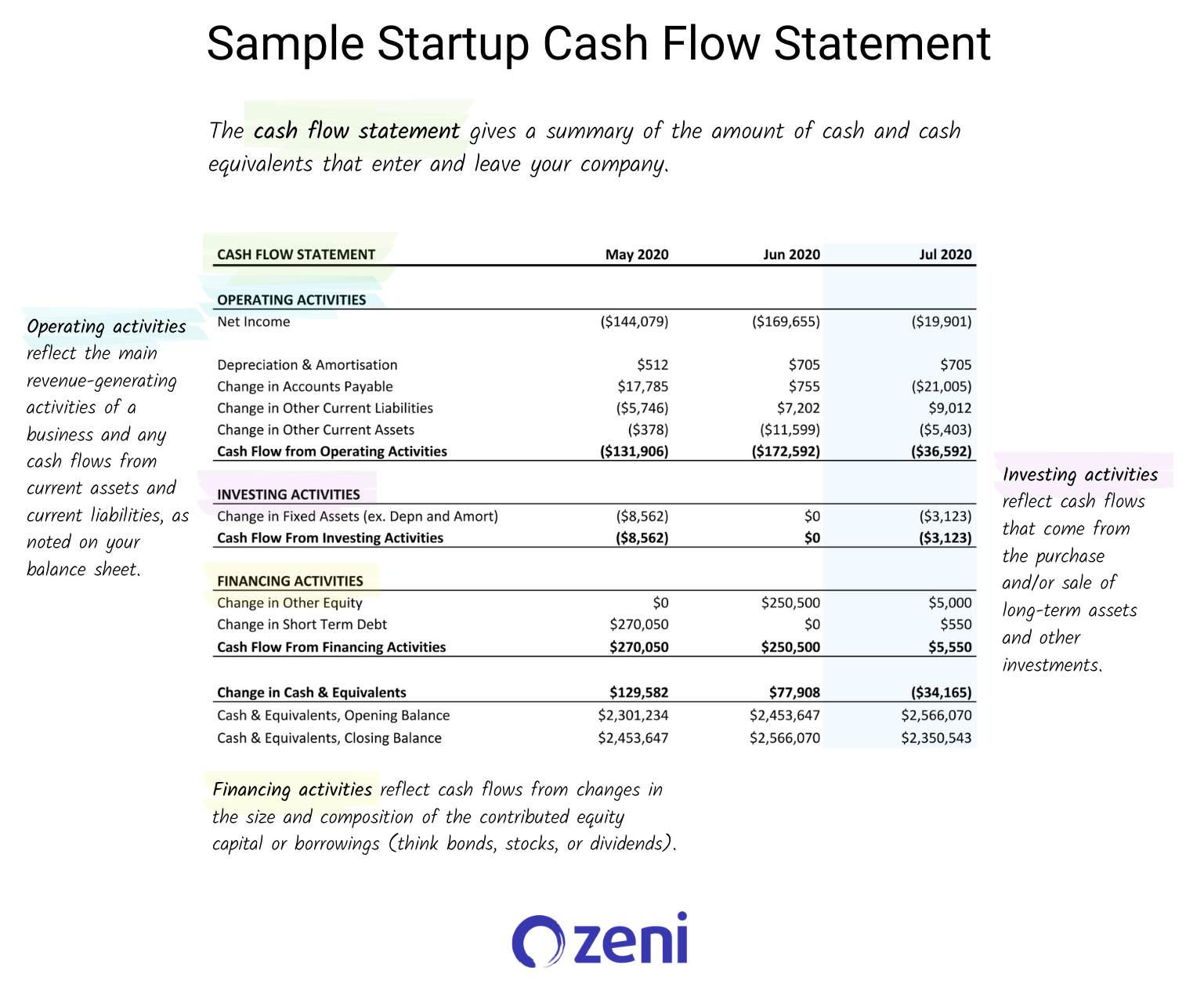

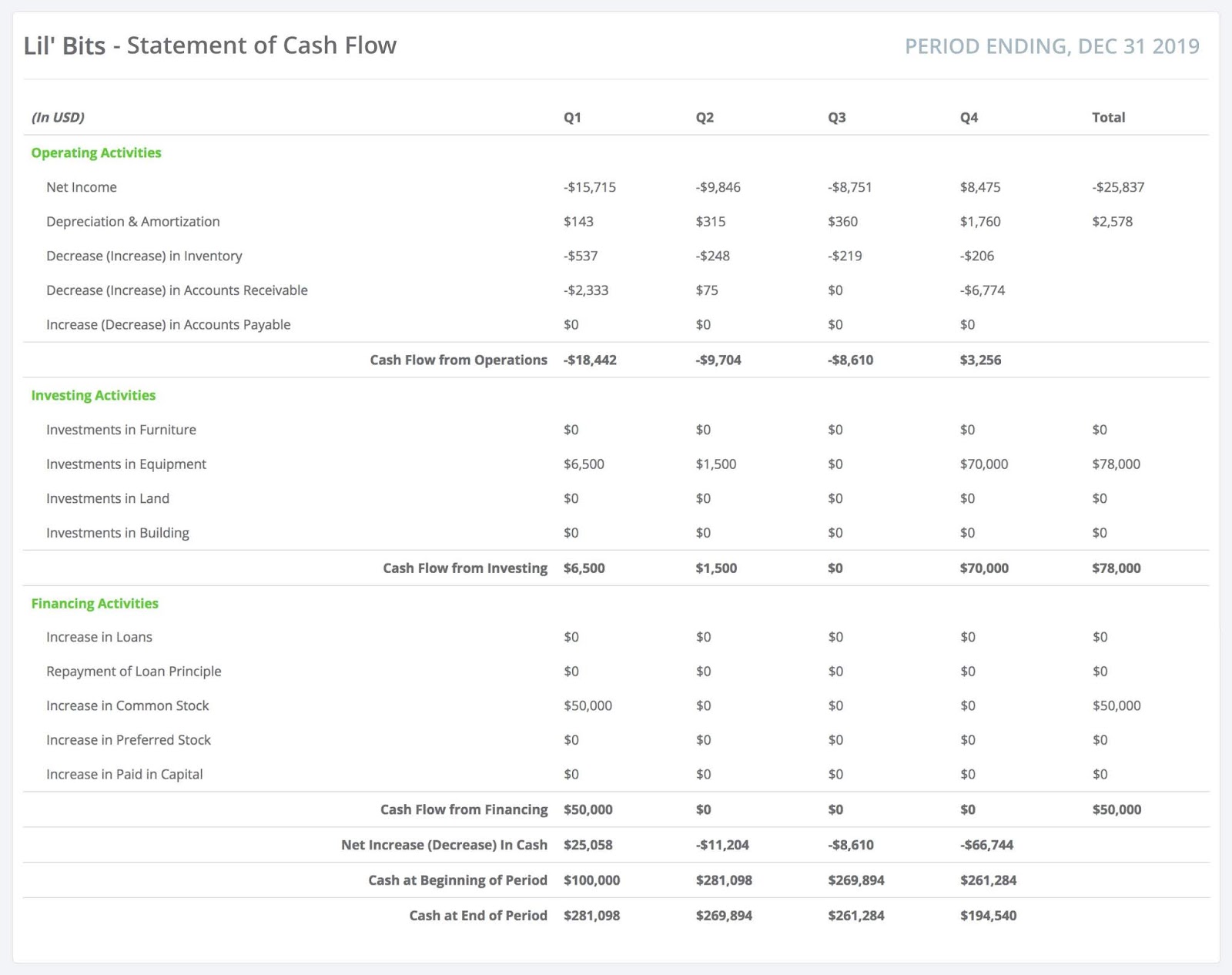

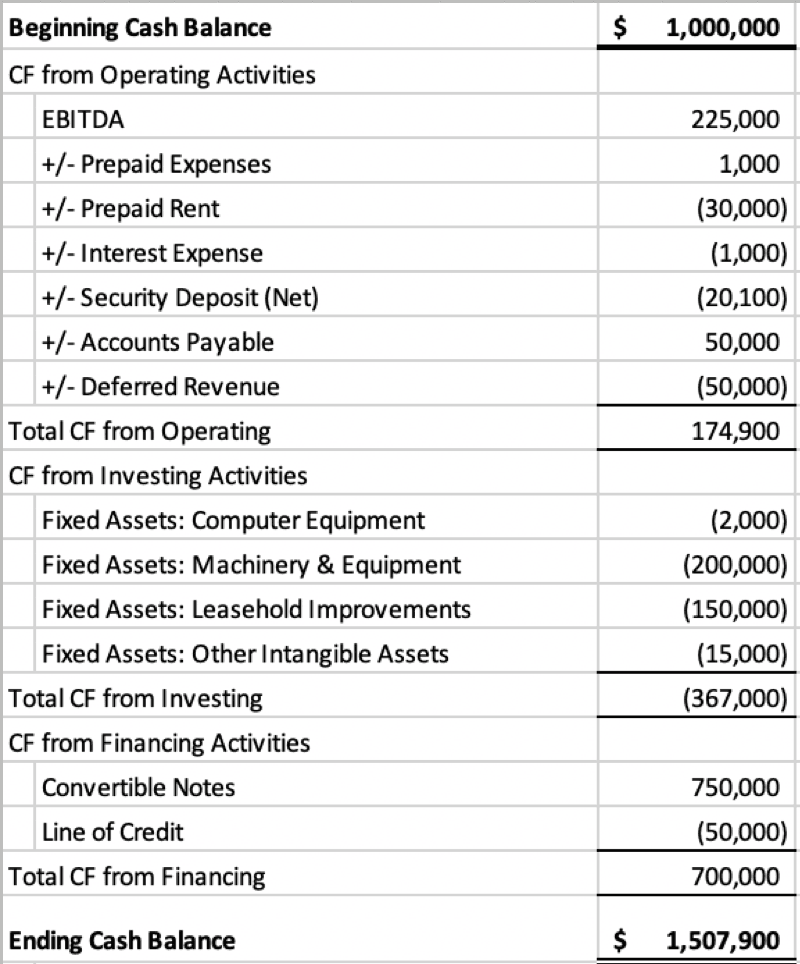

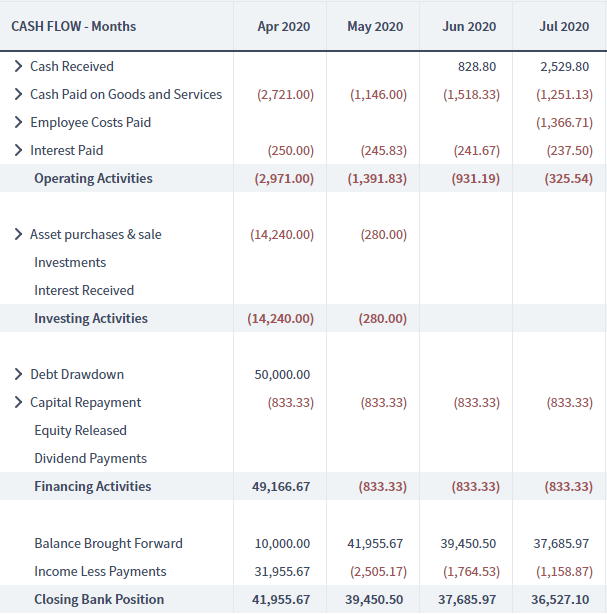

When you see in the statement of cash flows which activities generate (or consume) cash, the decisions you need to make become clearer. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements.

Why cash flow statement is important for startups how to make your cash flow figures more attractive to investors what is a cash flow statement? Operating activities, investing activities, and financing activities. A cash flow statement, or cfs, is a financial statement that accurately summarizes the total amount of cash that goes into and eventually leaves a startup business.

A cash flow statement for startups is an essential financial tool showing owners, investors, and creditors a company’s ability to generate cash inflows and its overall profitability. How is it calculated? A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period.

By understanding the cash flow statement, startups can easily track major cash flow trends, identify potential cash shortages, and plan accordingly. You calculate it by subtracting the starting cash balance for the time period from the ending cash balance (net cash flow). For startups, this is essential in several circumstances such as creating your pitch deck or doing a valuation of your company.

There are three ways to calculate startup cash flow: This value can be found on the income statement of the same accounting period. Remi november 17, 2023 forecast your business whether you want to understand what’s your breakeven, your valuation or simply create a budget for your business plan, preparing a cash flow forecast for your startup is key.

Cash of 24,954 was received from the issue of new debt by the business. Learn all the details with cash flow frog ️ start free What is a cash flow statement?

How to create a startup financial statement [free template] 1. It provides an overview of how much cash the business generates and where it’s being spent. A cash flow statement provides insights into the financial health of your startup.

The cash flow statement is the bedrock of your financial model and. A cash flow statement for a startup can help a startup better manage its finances. The company used cash of 29,722 to repurchase some of its common stock.

The cash flow statement gives a clear picture of how cash moves through your startup during the reporting period. You know where to focus your team’s effort and. A cash flow forecast is the precursor to a cash flow statement, serving as a measurement of what your business’s cash flow will be over a short or long period of time.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)