One Of The Best Tips About Bad Debt Cash Flow Statement

Implicitly, the bad debts provision is viewed as a revenue deduction like sales discounts, returns, and allowances, rather than as a noncash expense;

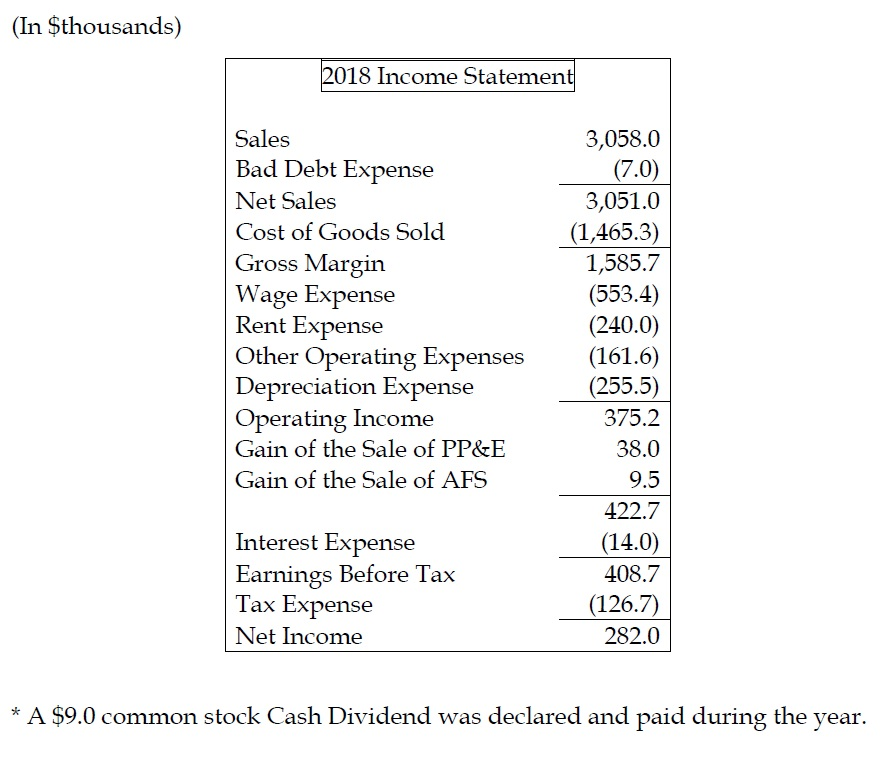

Bad debt cash flow statement. With this method, you record a debit of the bad debts account. The “bad debt expense” account appears on the income statement, reducing the reported revenue, and the “allowance for doubtful accounts” appears on. The cash flow statement looks at the inflow and outflow of cash within a company.

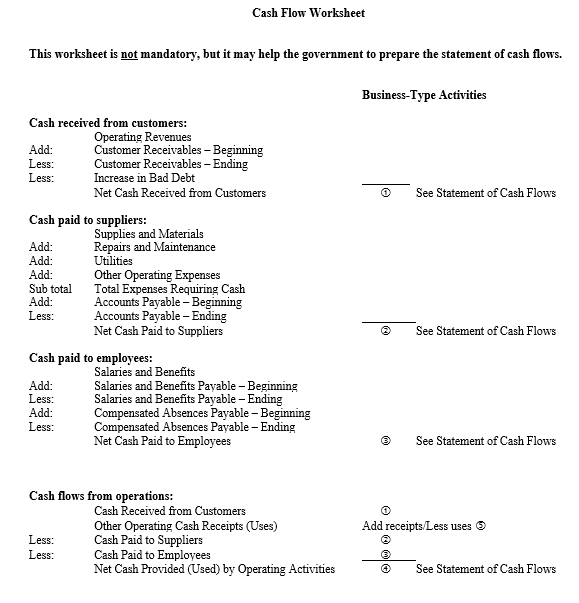

Misclassifying the three categories of cash flows all cash flows originate at one of these three categories: Having negative cash flow means your cash outflow is higher than your cash inflow during a period, but it doesn’t necessarily mean profit is. That gives you a more realistic picture of your business's.

Estimating your bad debts usually involves some form of the percentage of. It reflects certain captions required by asc 230 (bolded), and other common captions. Determine net cash flows from operating activities.

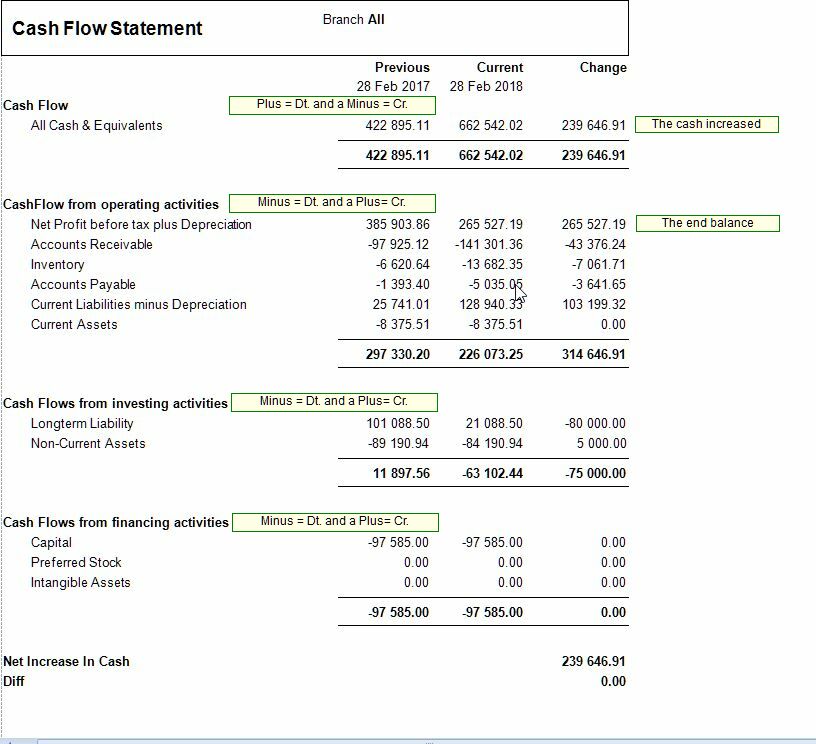

Statement of cash flows example. For example, if in 2021 i had receivables of £500,000 with bad debts of £10,000 and allowance for receivables of £50,000, then we are left with an end balance. The operating section of your cash flow statement records adjustments for bad debt.

In other words, it presents how much cash it spends and generates from various. Small businesses generally use the direct write off method when accounting for bad debt recovery. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and.

Hi katrien, that's kind of a trick question. Using the indirect method, operating net cash. Below is an example from amazon’s 2022 annual report, which breaks down the cash flow generated from operations, investing, and.

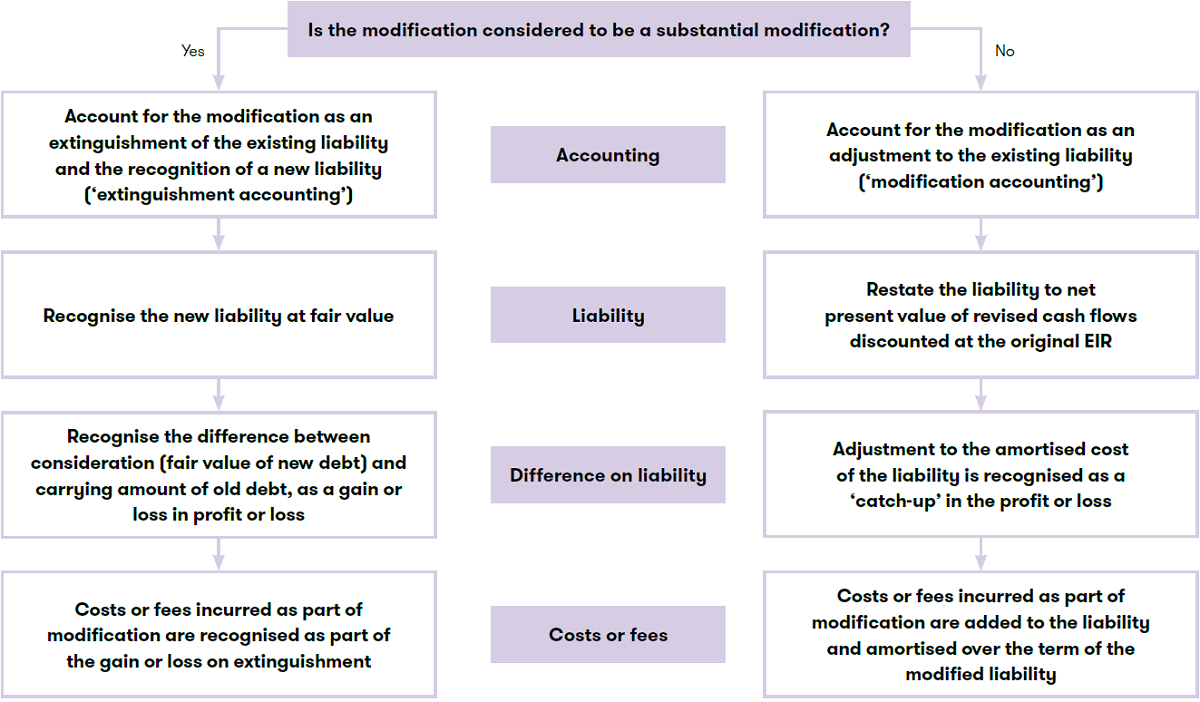

Solution here we can take the opening balance of ppe and reconcile it to the closing balance by adjusting it for the changes that have arisen in period that are not cash. While income statements are excellent for. How bad debt is accounted for depends on whether or not your company uses a bad debt reserve.

A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. Because you set it up ahead of time, your allowance for bad debts will always be an estimate. The statement of cash flows is prepared by following these steps:.

The bad debt provision reduces your accounts receivable to allow for customers who don't pay up. Once doubtful debt for a certain period is realized and becomes bad debt, the actual amount of bad debt is written off the balance sheet—often referred to as write.