One Of The Best Tips About P&l Accounting Term

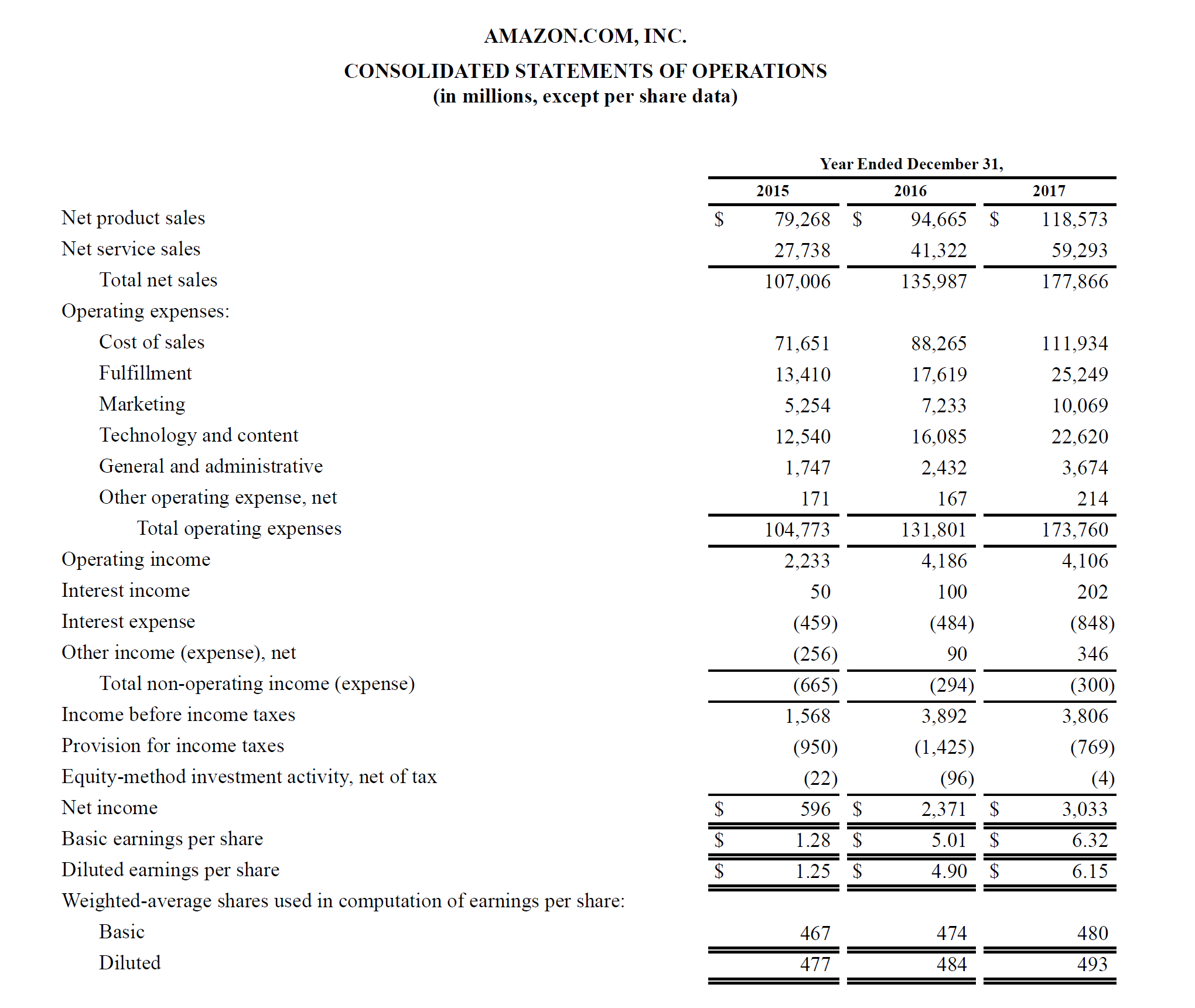

The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of a company, in a specified period.

P&l accounting term. Based on this information, the profit or loss is calculated during year ending to understand the profitability of the company. All organizations need to be able to assess whether they are making a profit or running at a loss. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year.

How to read a profit and loss statement A profit and loss statement (p&l), also known as an income statement, is a financial report that shows a company's revenues and expenses over a given period of time, usually a fiscal quarter or year. The profit and loss statement format is also called the income statement and it is used to show the details of revenue earned and expenses incurred during an accounting period.

These statements provide a clear picture of the company’s profits and losses incurred during a specific period. The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe. 18 may 2020 data insights blog understanding profit and loss terminology is key to successfully analyzing your p&l statements and getting a handle on your property’s performance.

It provides insight into several details of the entity, including efficiency of the management, underperforming and performing sectors, operations, and profitability status of. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. The profit and loss statement is an apt snapshot of a company's financial health during a specified time.

A profit and loss statement is defined as a financial statement that provides a record of the revenues, expenses, and profits/losses incurred by a business over a specified time frame, typically issued monthly, quarterly, and annually. The abbreviation for profit and loss statement. The two others are the balance sheet and the cash flow statement.

A balance sheet, on the other hand, focuses on and displays a firm’s financial performance in the context of its assets, liabilities, and equity. As this income statement is prepared based on accounting principles that include revenue recognition, matching and accruals, the records normally provide information that shows the ability of a. Also known as profit and loss statement, it is an overview of how a business is performing in a particular period.

Sometimes, finance professionals call p&l statements income statements since the term profit is. Cash accounting is when the business enters the figures for revenue or expenditure on the transaction date. This is done by producing a profit and loss account, sometimes known as the p&l.

It indicates the source of income and cost of running the business to arrive at the net profit and loss. It is one of four major statements in the financial reporting process, and it shows the organization's net. The income statement, often known as the balance sheet, is a window into the heart of a corporation, presenting revenues, costs, and expenses in a comprehensive style.

Accruals adjust the figures for when the transaction takes place. A p & l account or profit and loss account is a crucial financial document. P&l refers to a profit and loss statement in accounting.

P&l stands for profit and loss — a p&l statement details a company’s financial position for a given accounting period, such as a quarter, month, or year. A profit and loss statement, also called an income statement or p&l statement, is a financial document that summarizes the revenues, costs, and expenses incurred by a company during a specified period. P & l definition.