Recommendation Tips About Section 26as Of Income Tax Act

Section 206cr of the income tax act 2020:

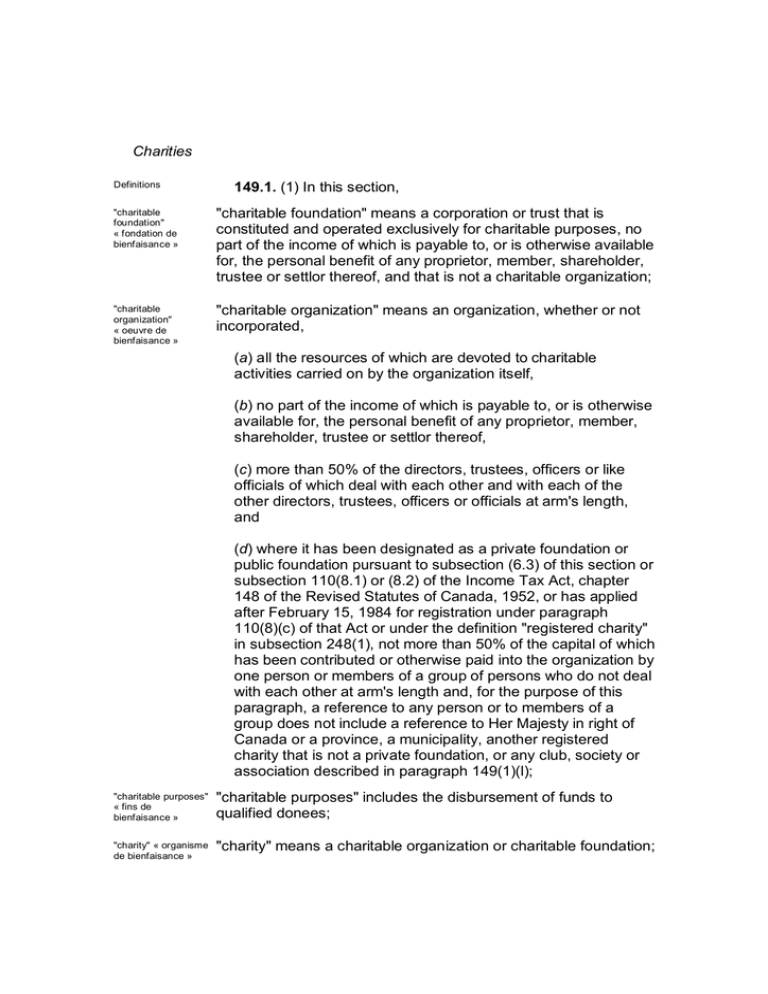

Section 26as of income tax act. Form 26as includes the information on all the deducted tax on the income of deducted. All the details of collected tax by the person who is collecting. Introduction of new section 285bb of the income tax act 1961 with.

Form 26as is a consolidated annual tax statement that shows the details of tax deducted at source, tax collected at source, advance tax paid by the assessee along. The great thing is that there is no such section 206 cq in the income tax act of 1961. Form 26as indicates details of tds, tcs, tax paid by an.

It is an annual information statement uploaded by the income tax department. However, the description about section 206cq in form 26as. Form 26as is an annual tax statement under section 203aa issued by the income tax department.

Section 206cr of the income tax act 2020 is a new provision that has been introduced to regulate the. Form 26as plays a pivotal role in the income tax filing process. The tax credit statement, also known as form 26as, is an annual statement that consolidates information about tax deducted at source (tds), advance tax paid by.

All the details of advance tax which is paid by the person who is paying the tax.