Out Of This World Tips About Financial Ratios For Service Companies

The simple answer?

Financial ratios for service companies. Financial ratios relevant to service companies. The p/b ratio compares the book value of a. However, they will not do a bit of good unless you analyse them to gain insights about your firm.

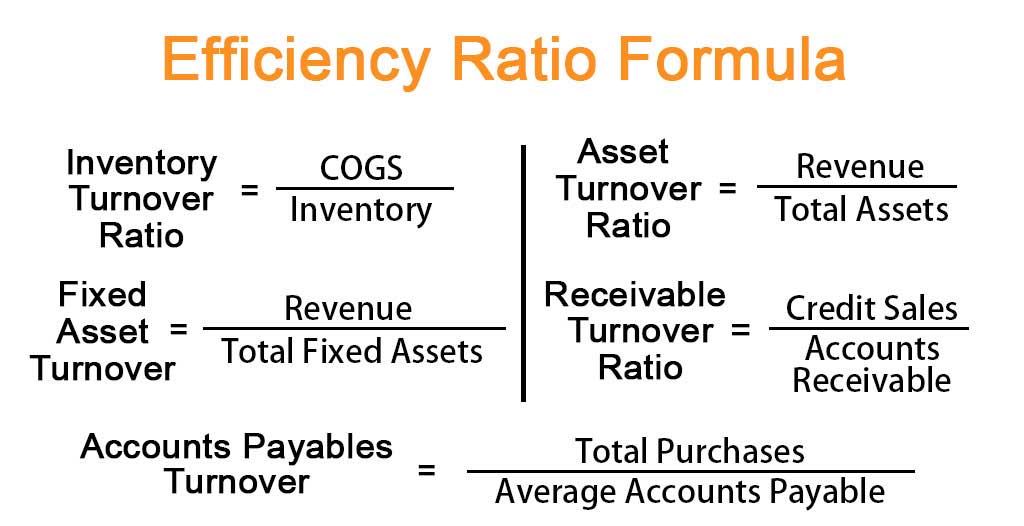

Different financial ratios indicate the company’s results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratios, stability ratios, etc. 19 key financial ratios to track. What are the five types of performance indicators?

The debt service coverage ratio reveals how easily a company can pay its debt obligations: Much of their cash is going towards debt repayment. Financial kpis can fit into 5 categories:

Liquidity, solvency, efficiency, profitability, market prospect, investment leverage, and coverage. We’ll look at 10 ratios across these four categories and provide a detailed walkthrough for each. Cash flow to debt (net income + depreciation) ÷ total debt = cash flow to debt ratio small businesses make money every month but still have cash flow problems.

Common kpis include profitability measures, such as gross and net profit, and liquidity measures, such as current and quick ratios. Below explaining each financial ratios: Financial ratios can provide insight into a company, in terms of things like valuation, revenues, and profitability.

The kpis a company chooses depends on its goals, industry, business model and other factors. Securities and exchange commission's electronic data gathering, analysis and retrieval (edgar) database provides free public access to corporate information including registration. For added confidence, a combination of ratios and tools can provide a more complete picture of potential investments.

Roe (return on equity), after tax : This comprehensive list of financial ratios by industry was gathered by public tax return data provided by the irs. Generally, we recommend assessing key performance indicators (kpis) at least once per week.

Provide more assurance for families and seniors, ultimately forging a stronger shared future. Long term level of debt used to generate profit. The suite of measures will:

2022 2021 2020 2019 2018 2017; Financial ratios are basic calculations using quantitative data from a company’s financial statements. Operating margin (return on sales) 9.7%:

Organizations always understudy the validity, liquidity, and profitability of existing investments, this effort advises management of its performance. For example, say you’re considering investing in the tech sector, and you are evaluating two potential companies. Efficiency ratios, also known as activity financial ratios, are used to measure how well a company is utilizing its assets and resources.