Can’t-Miss Takeaways Of Tips About Common Stock Income Statement

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

Revenue, expenses, gains, and losses.

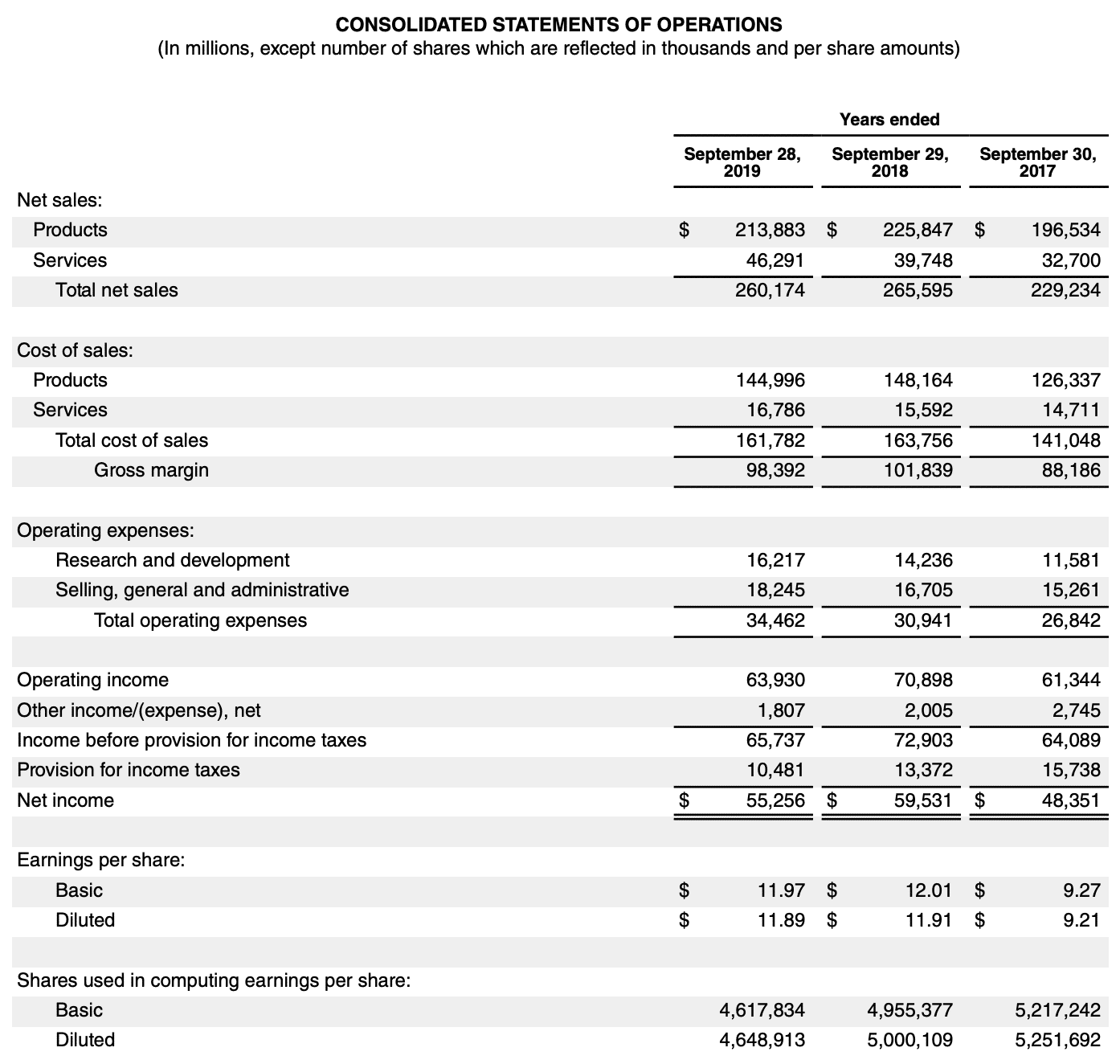

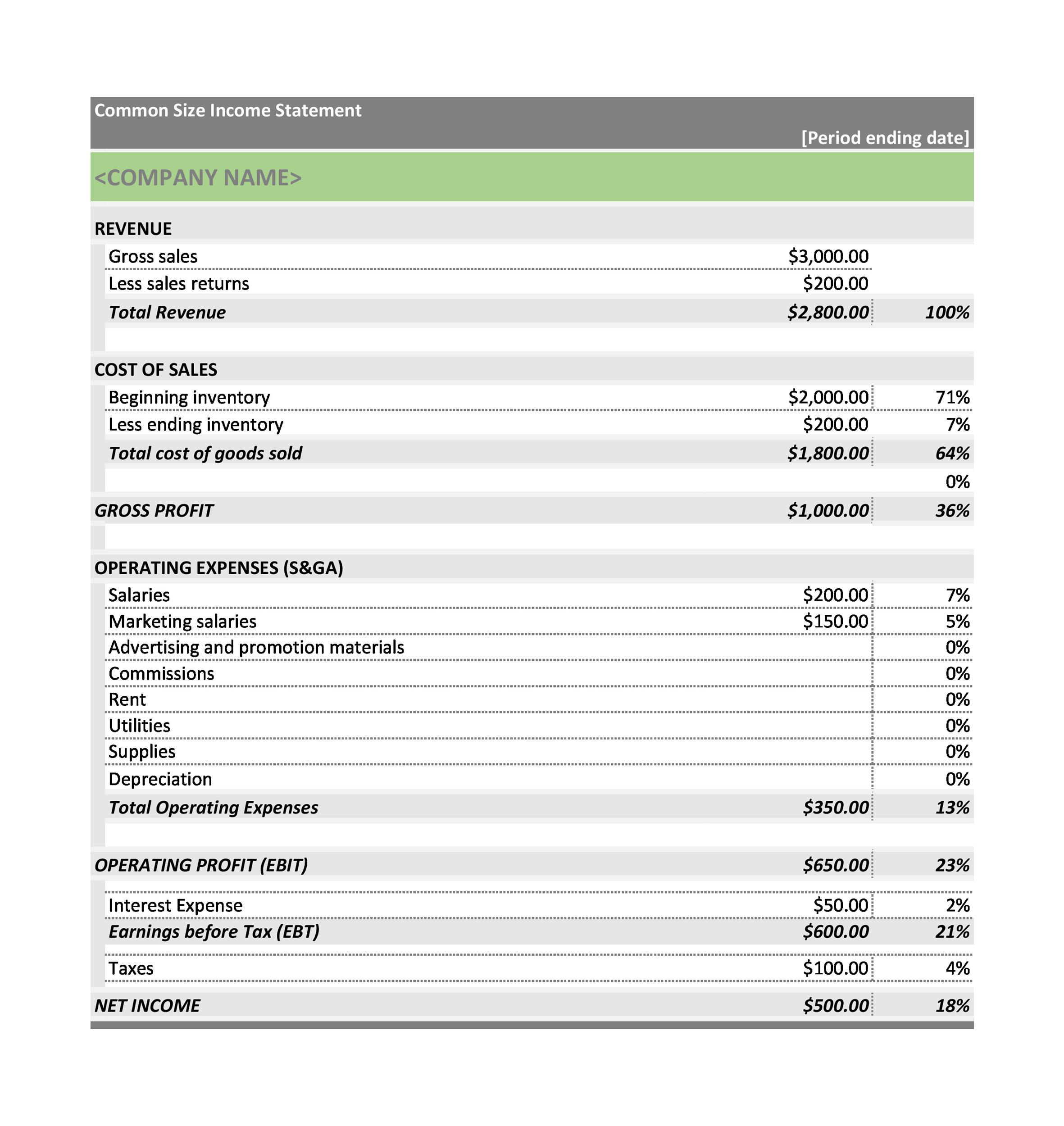

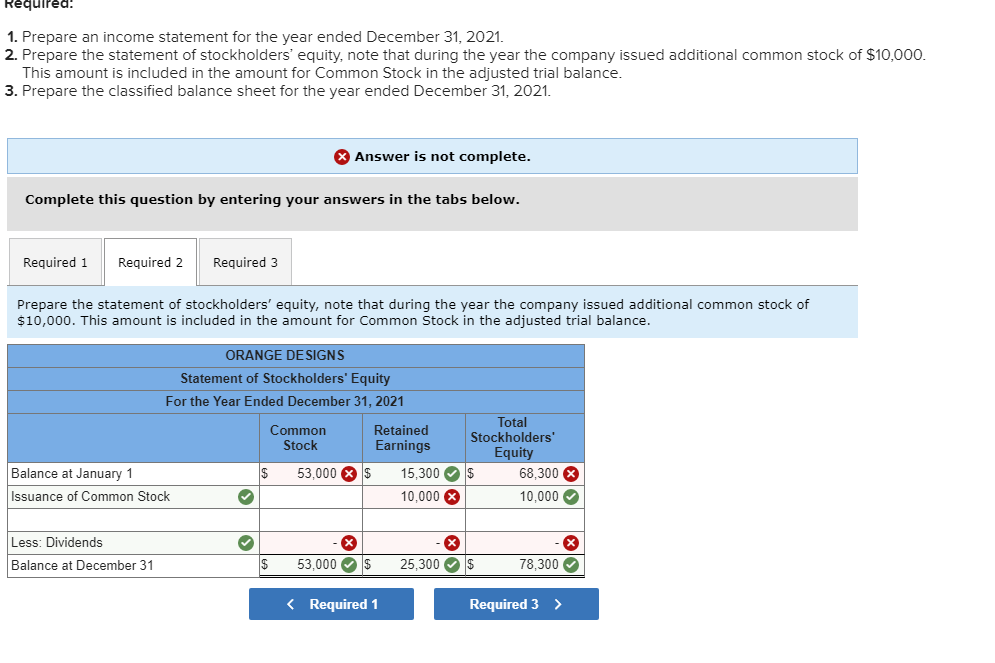

Common stock income statement. The income statement is the most common financial statement and shows a company's revenues and total expenses, including noncash accounting, such as depreciation over a period of time. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss. Where does common stock go on the income statement?

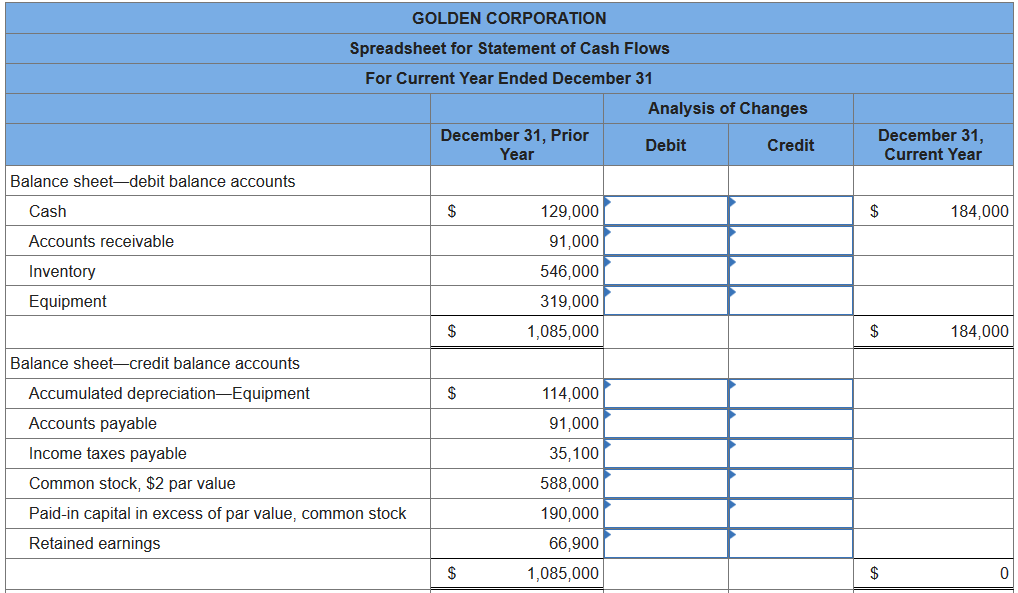

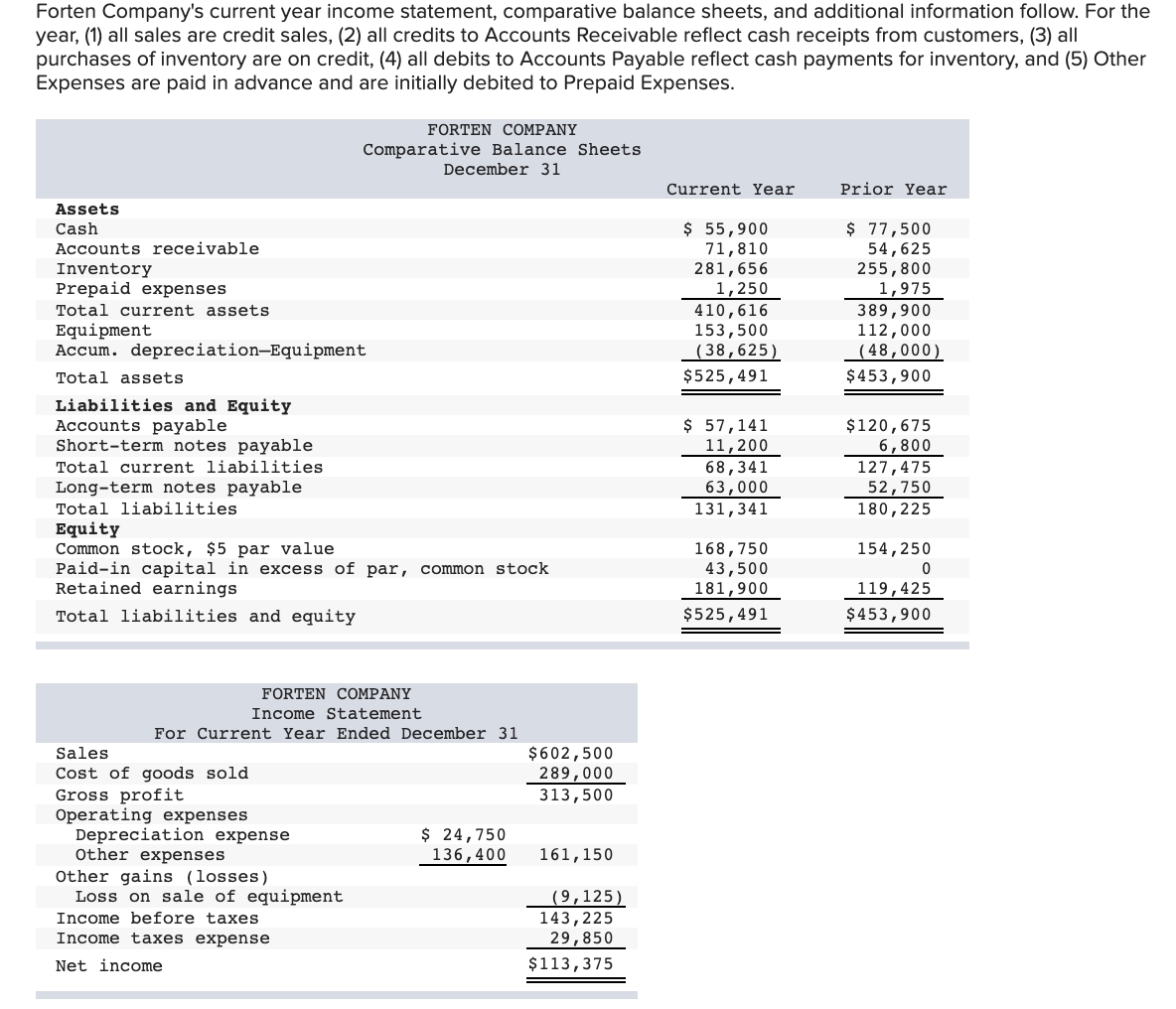

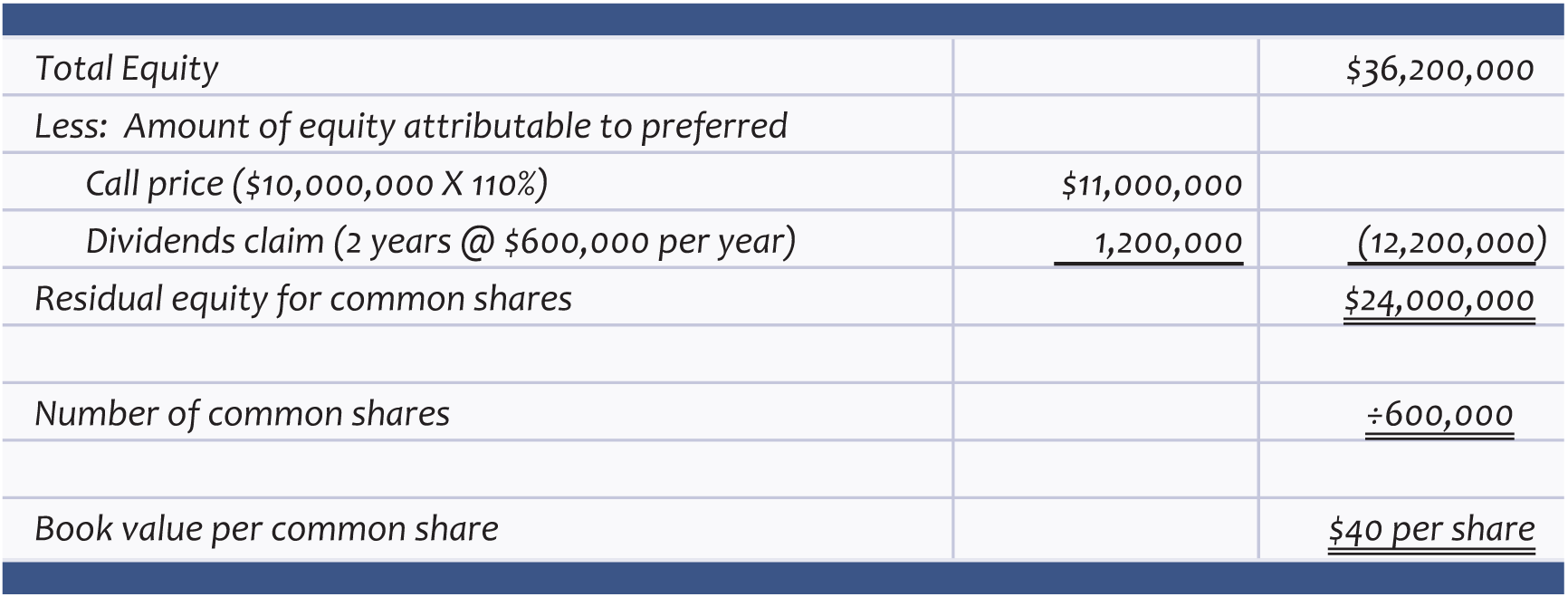

Financial statements often indicate the number of authorized shares (the maximum allowed), issued shares (the number that have been sold), and outstanding shares (those currently in the hands of owners). What is an income statement? There are four main financial statements.

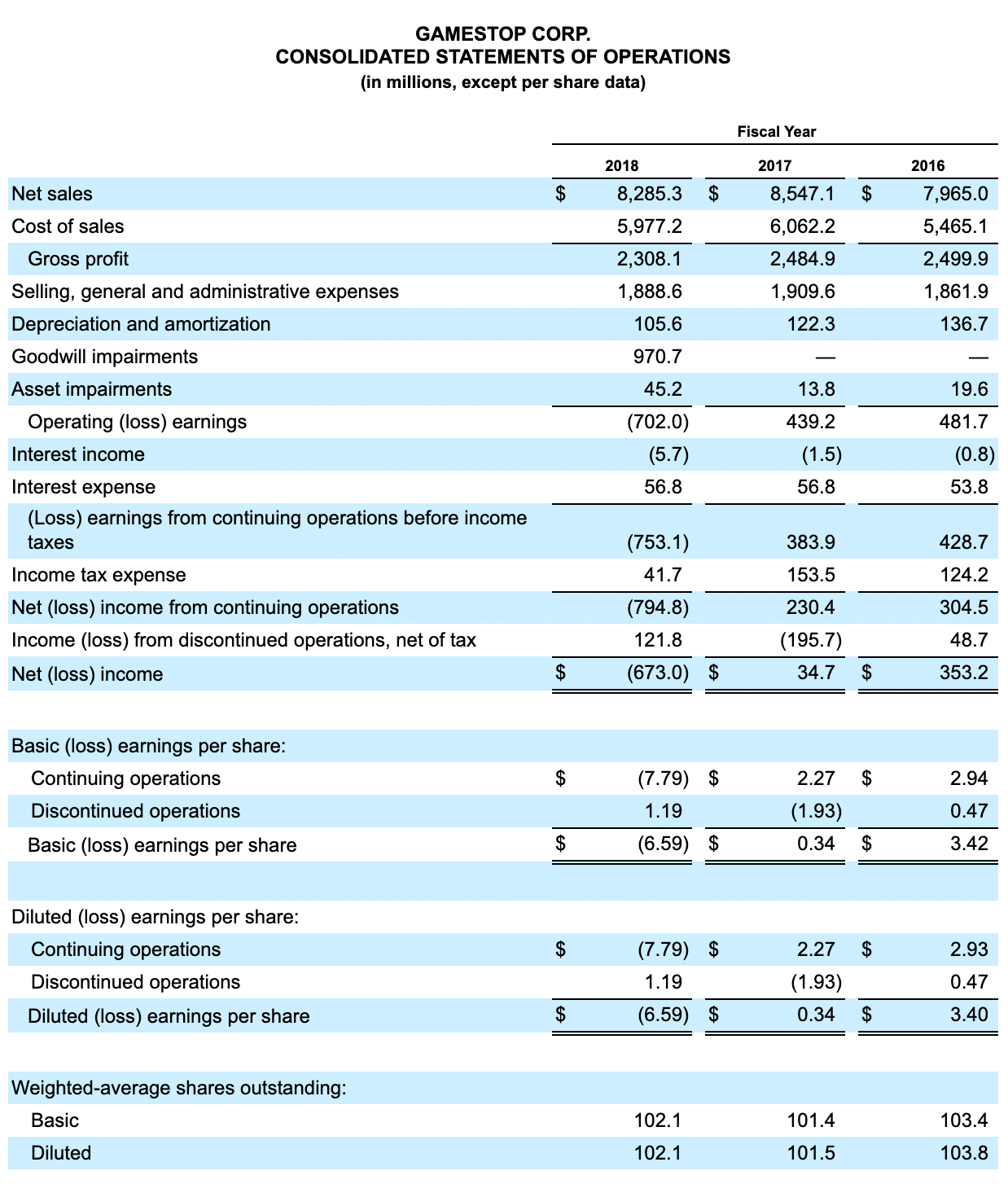

Fsr) (“fisker” or the “company”), driven by a mission to create the world’s most emotional and sustainable electric vehicles, announced that on february 15, 2024, it received notice from the new york stock exchange (the “nyse”) that it is. An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter. Special dividend of € 1.00 per share.

What is the income statement? An income statement shows you a company's profit or loss for a specific period. The net income applicable to common shares on an income statement is the income that could be given to common stockholders.

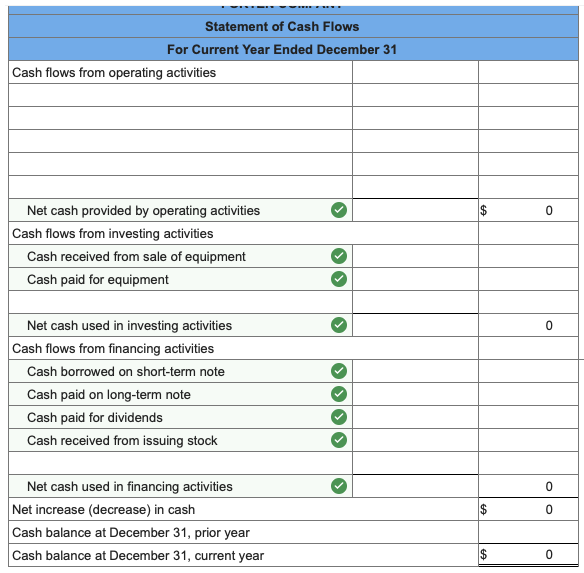

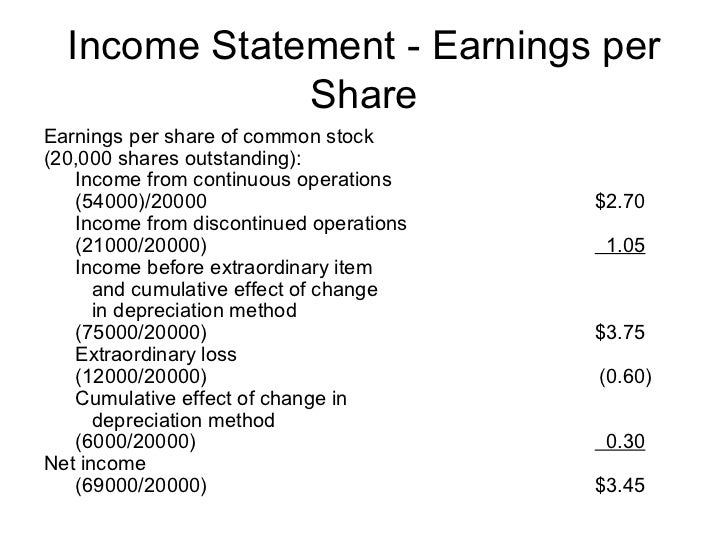

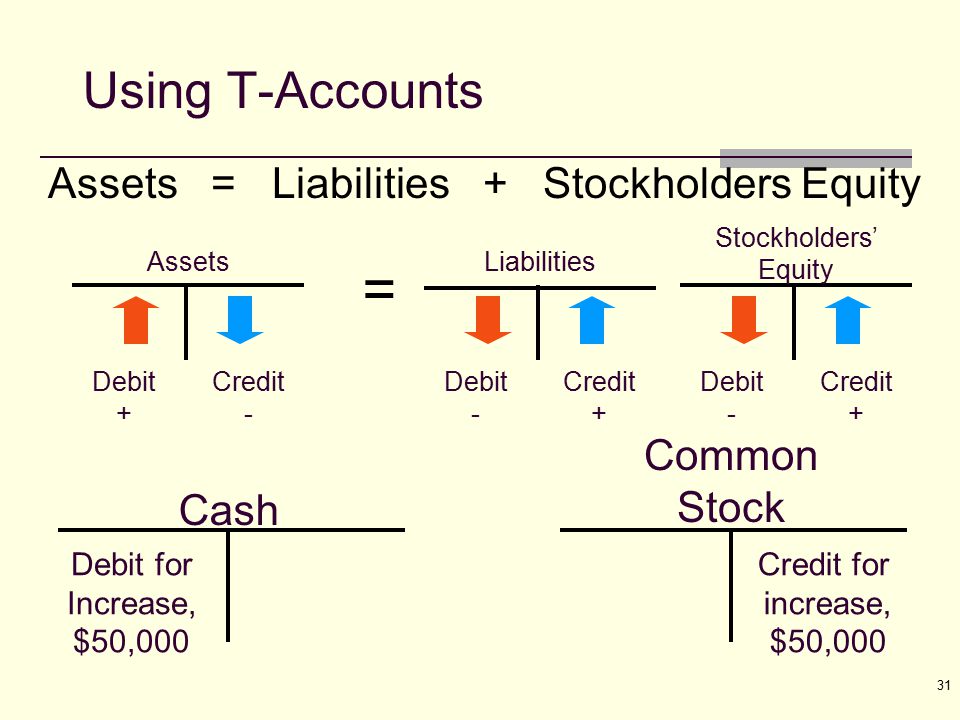

And (4) statements of shareholders’ equity. A common size income statement is an income statement in which each line item is expressed as a percentage of the value of sales, to make analysis easier. Net income applicable to common shares is the amount of capital left after subtracting expenses, taxes, and dividends to preferred shares from earnings for the year.

Common stock usually has a par value although the meaning of this number has faded in importance over the decades. Income statements show how much money a company made and spent over a period. The cash flow statement would show $9 million in dividends distributed.

Free cash flow before m&a and customer financing € 4.4 billion; Dividend of € 1.80 per share; Net cash € 10.7 billion.

The income statement focuses on four key items: Eps indicates how much money a company makes for each share of its stock and is a. Learn about the income statement, what it looks like, and how it can be used to assess an organization's current financial condition and future prospects.

The company’s common stock continues to trade on the nyse under symbol “fsr” fisker inc. Value of income statement to investors the income statement of a business includes the expenditures and general costs related to the company's revenues. Enbridge’s high yield, solid dividend payment and growth history, and growing dcf make it an attractive passive income investment.

Fourth quarter gaap net income (loss) of $ (39.4) million or $ (0.73) per diluted common share and distributable earnings(1) of $10.8 million or $0.20 per diluted common share. Common stock is a type of security that represents ownership of equity in a company. An income statement is a financial report detailing a company’s income and expenses over a reporting period.