Neat Info About Profit And Loss Statement Is Also Known As

A profit and loss statement is also called an income statement, a statement of profit, or a profit and loss report.

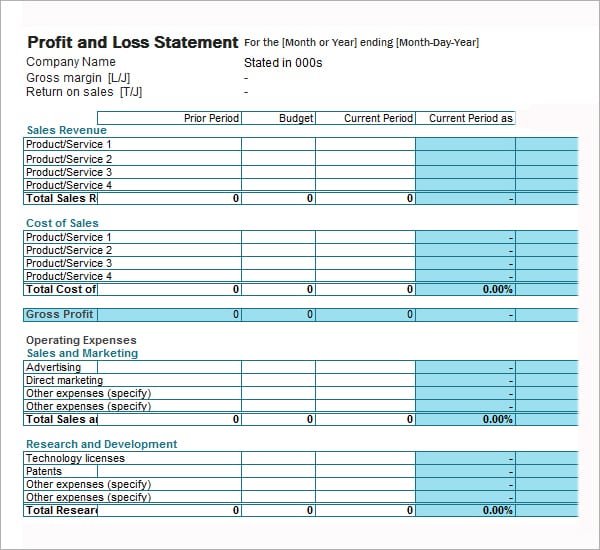

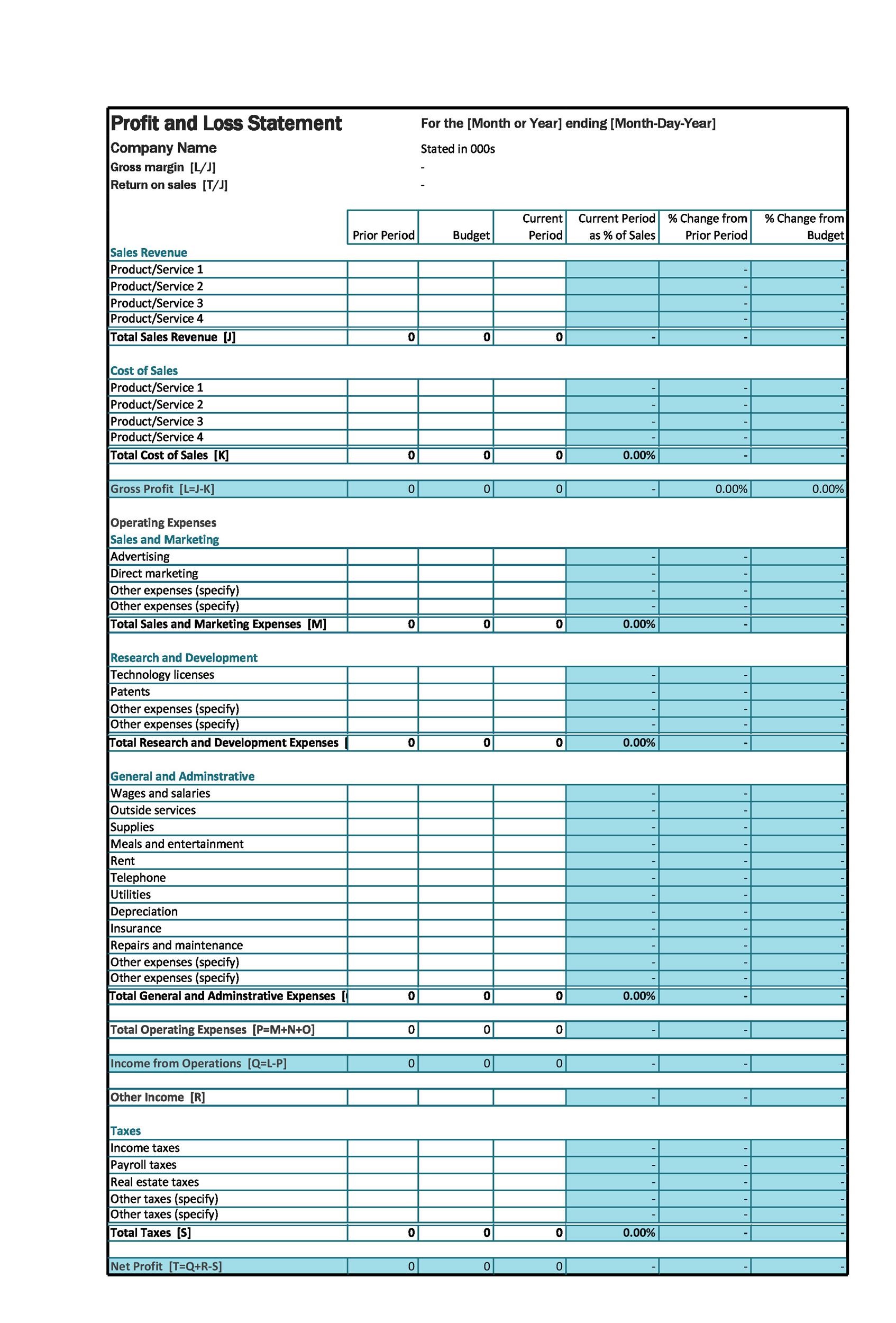

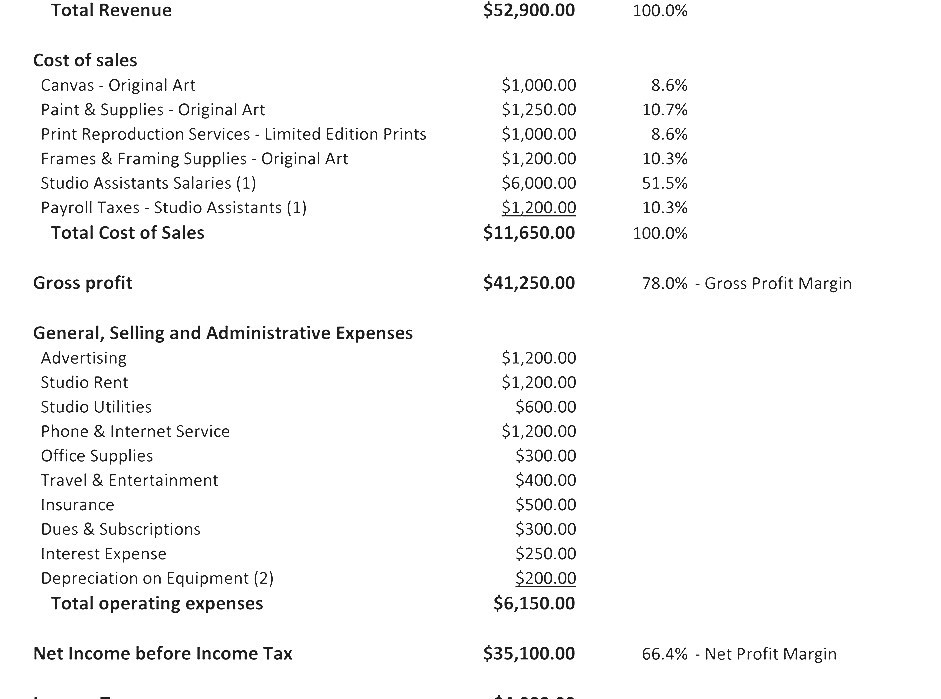

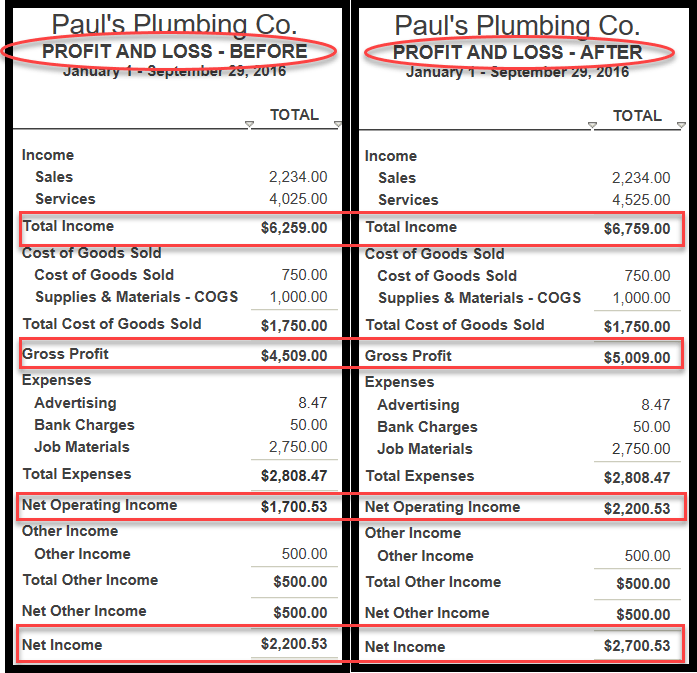

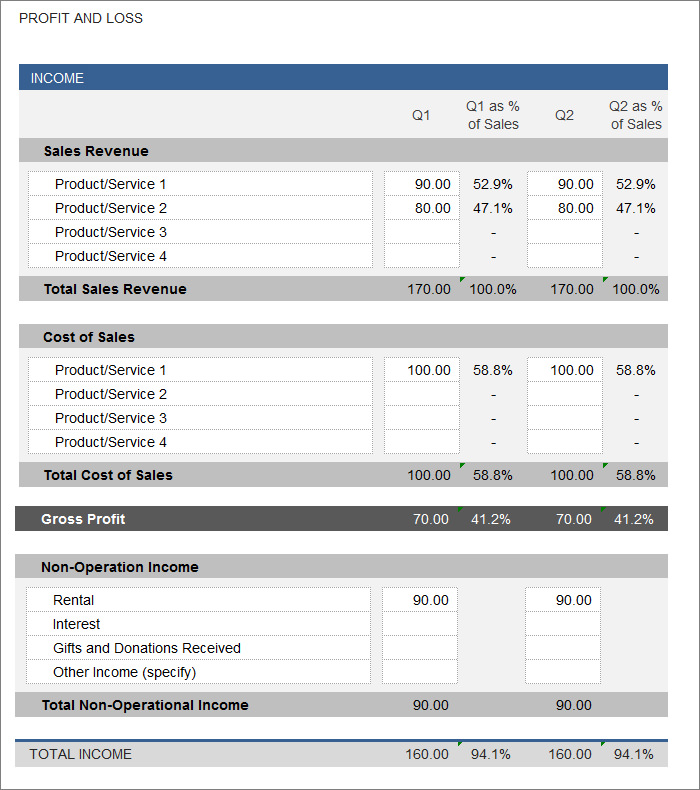

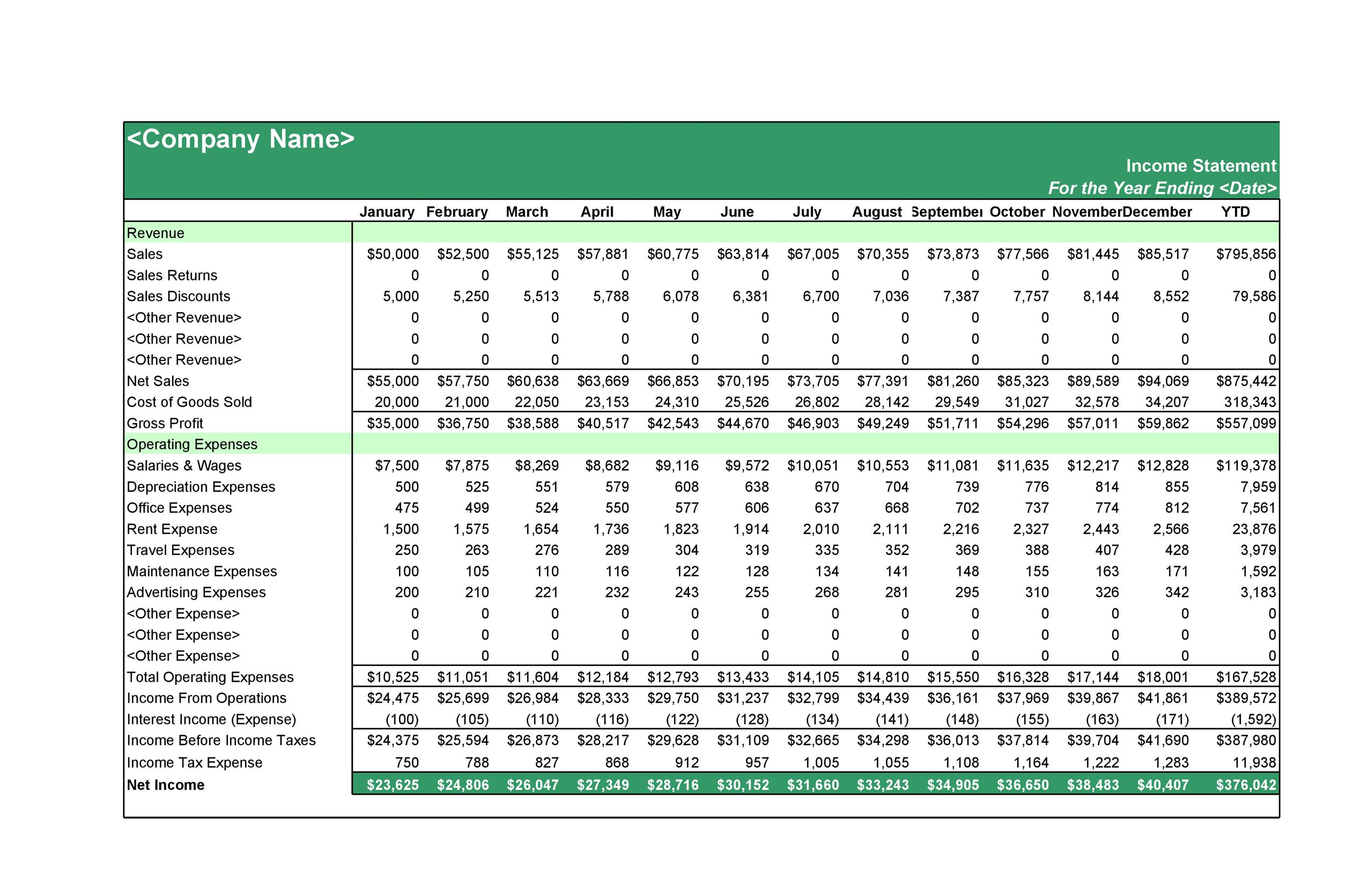

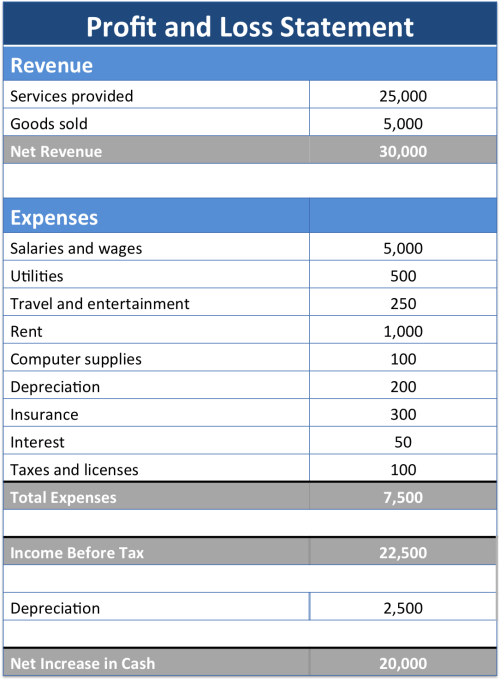

Profit and loss statement is also known as. The profit and loss (p&l) statement, also known as your income statement, shows your business’s revenues and expenses for a set time period. A profit and loss (p&l) statement, also known as the income statement, is one of the three financial statements that companies prepare. Gross profit refers to a company's profits after subtracting the costs of producing and distributing its products.

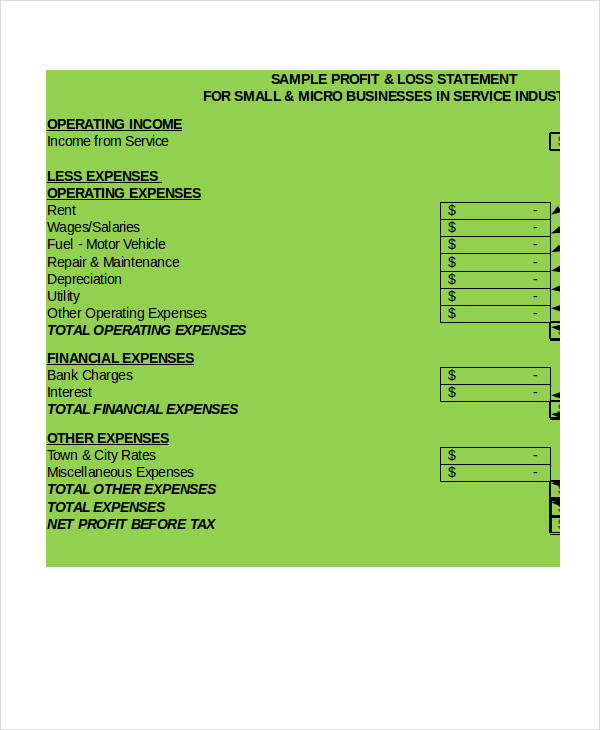

A profit and loss statement, formally known as an income statement or simply as a p&l, tracks the amount of profit that remains after a business subtracts all of its costs from its revenue during a specific accounting period,. An income statement is also known as a profit and loss account, statement of income or statement of operations. The profit and loss formula is:

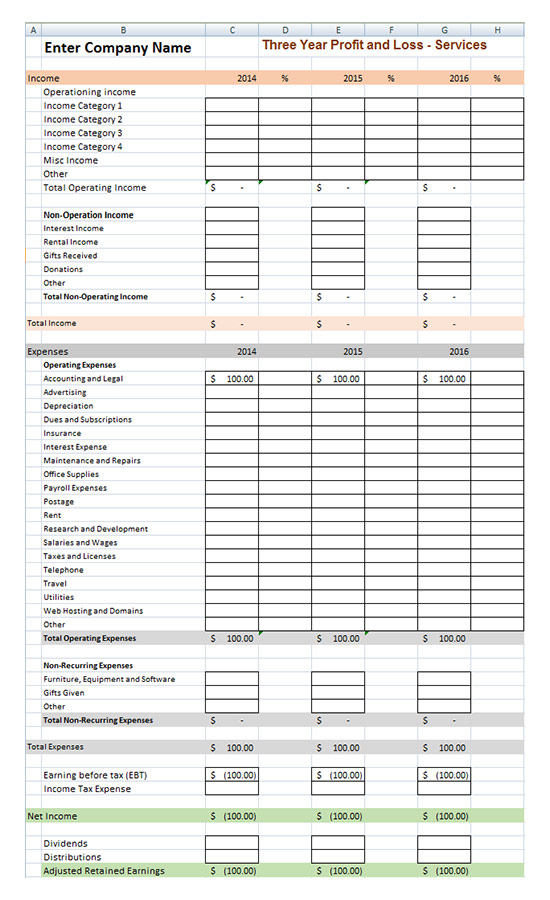

Generated both quarterly and annually, profit and loss. A profit and loss statement is a financial document that provides an overview of your business’s total income and total expenses in a set period of time. Why is the profit and loss statement important?

It shows company revenues, expenses, and net income over that period. A basic understanding and ability to analyze a company's profit and loss statement, also known as an income statement, is an essential skill for any investor. How does a company benefit from a profit and loss statement?

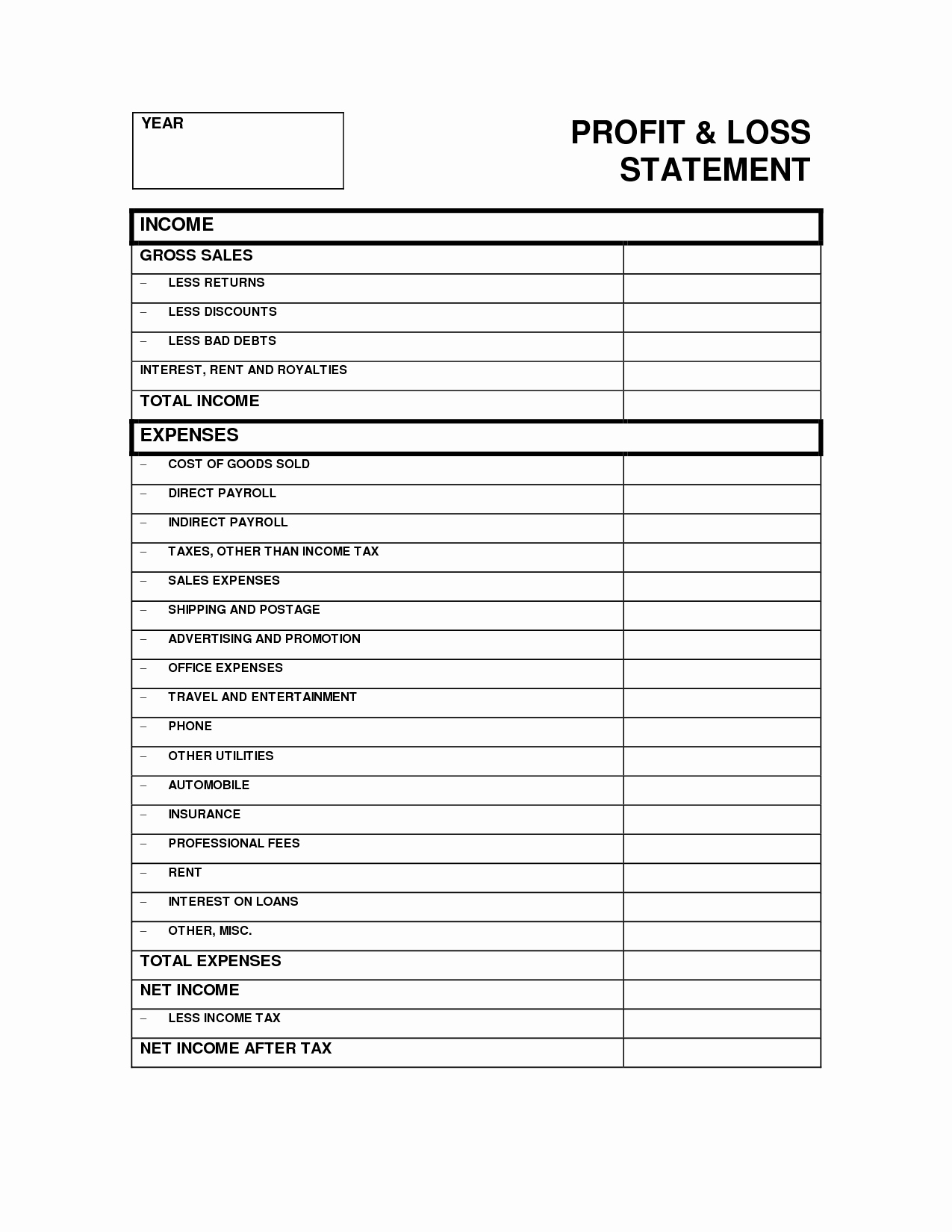

The bottom line on a p&l will be net income, also known as profit or loss. One of the essential financial statements that every business owner should understand is the profit and loss (p&l) statement, also known as an income statement. The three main types of financial statements are the income statement (also known as the profit and loss statement), the balance sheet, and the cash flow statement.

It captures how money flows in and out of your business. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. What is profit & loss statement?

It contains information pertaining to a company’s revenue. The p&l statement is a financial report containing a company’s costs, profits, and revenue.the report helps investors determine a company’s profitability.it also demonstrates the company’s ability to increase sales and profits by controlling its debts and costs. Then, it subtracts the costs of making those goods or providing those services, like.

In basic accounting , the p&l statement is always one of the first financial statements to be prepared. Income statement statement of earnings statement of operations statement of income. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services.

Creating one is a standard way to compile historical data for your business to tell its financial story over time. At its most basic, the p/l statement shows whether a company is making money or not. This guide will explain what a p&l statement is, what it includes, and why it's vital for your business's success.

A profit and loss statement is a snapshot of a company's sales and expenses over a period of time, such as one year. A p&l statement, also known as an “income statement,” is a financial statement that details income and expenses over a specific period. It typically includes information on assets, liabilities, revenues, expenses, gains, and losses, and provides an overview of the financial health of the entity.