Beautiful Info About Statement For Retained Earnings

:max_bytes(150000):strip_icc()/statement-of-retained-earnings-final-8500839aff40433dba054ce0af9f9f42.png)

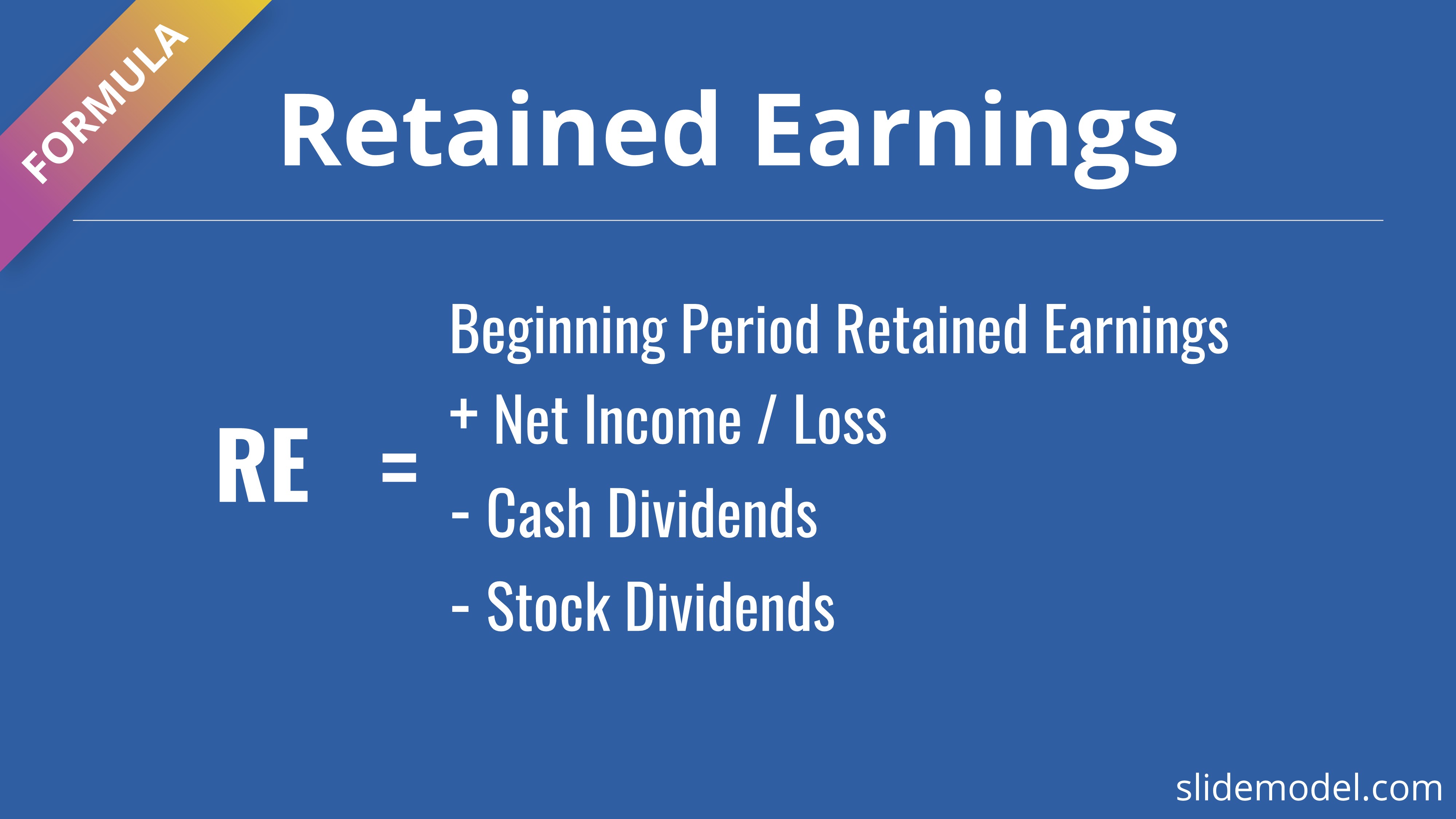

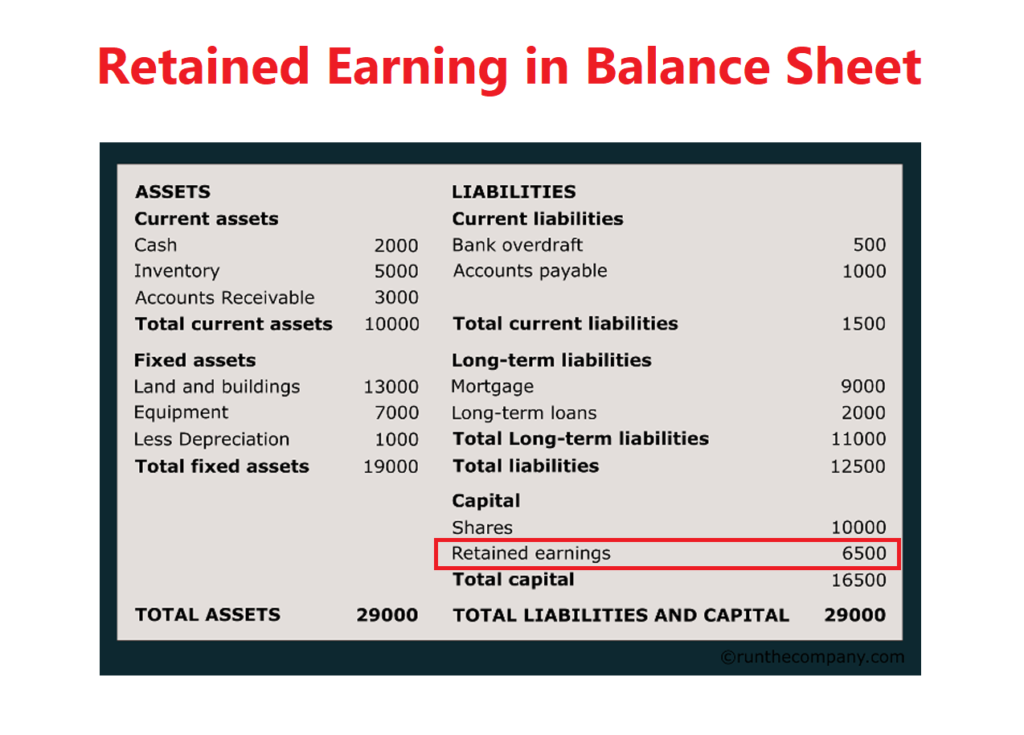

Retained earnings (re) are the amount of net income left over for the business after it has paid out dividends to its shareholders.

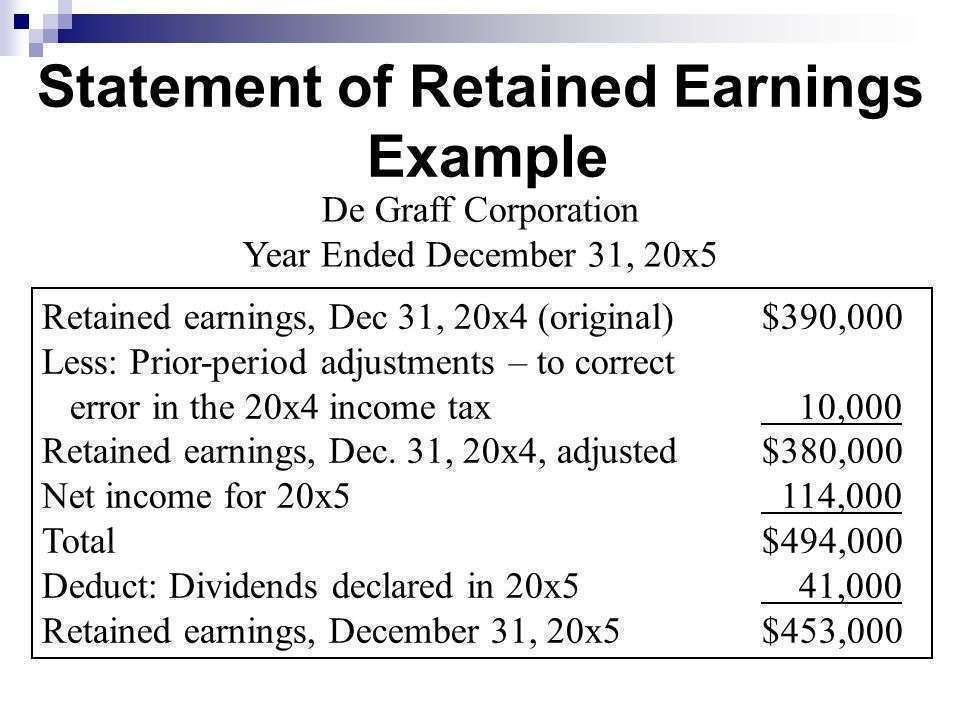

Statement for retained earnings. When preparing a statement of retained earnings, consider the following steps: The statement of retained earnings can be created as a standalone document or be appended to another financial statement, such as the balance sheet or income statement. The decision to retain the earnings or distribute them.

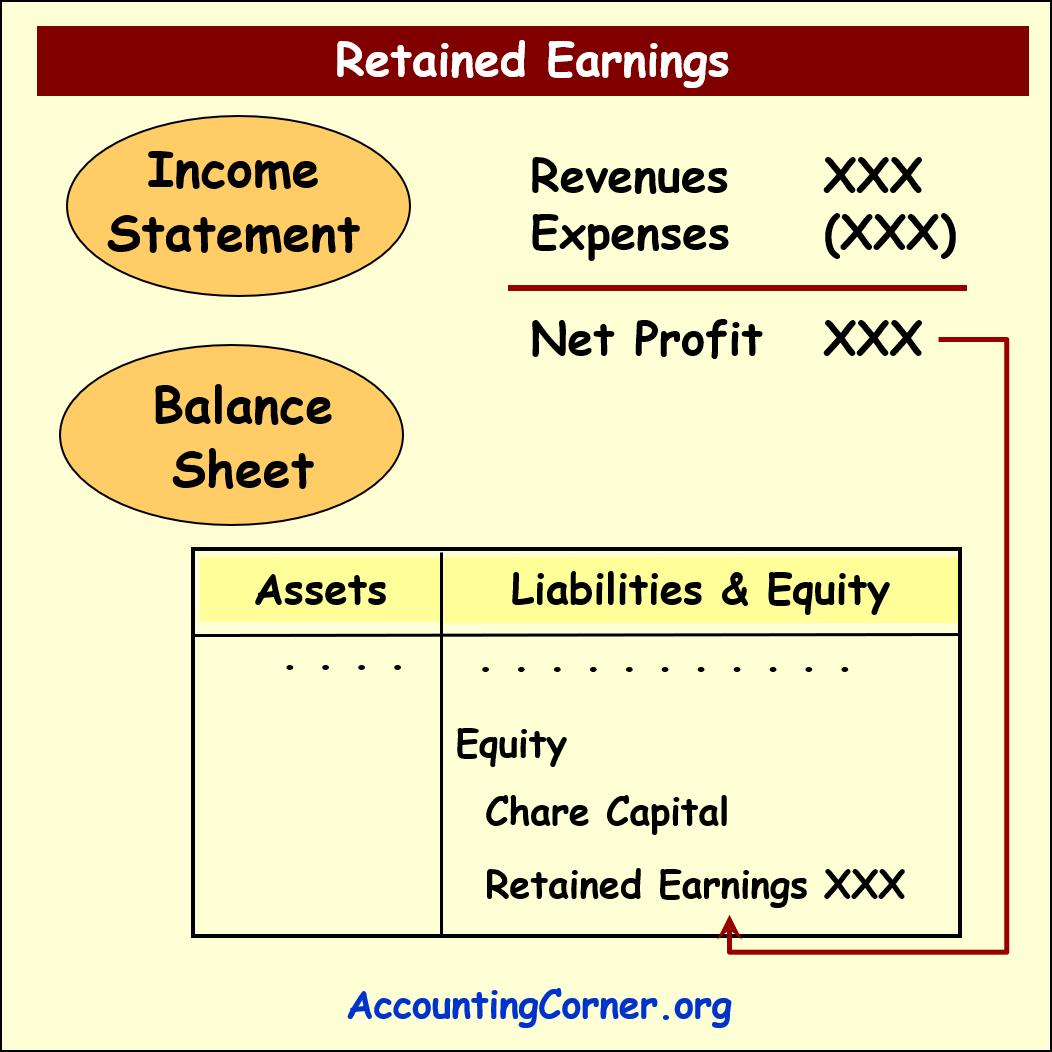

The statement of retained earnings is a key financial document that shows how much earnings a company has accumulated and kept in the company since inception. The numbers provide insight into a company’s financial position and the owner’s attitude toward reinvesting in and growing their business. This statement is primarily for the use of outside parties such as investors in the firm or the firm's creditors.

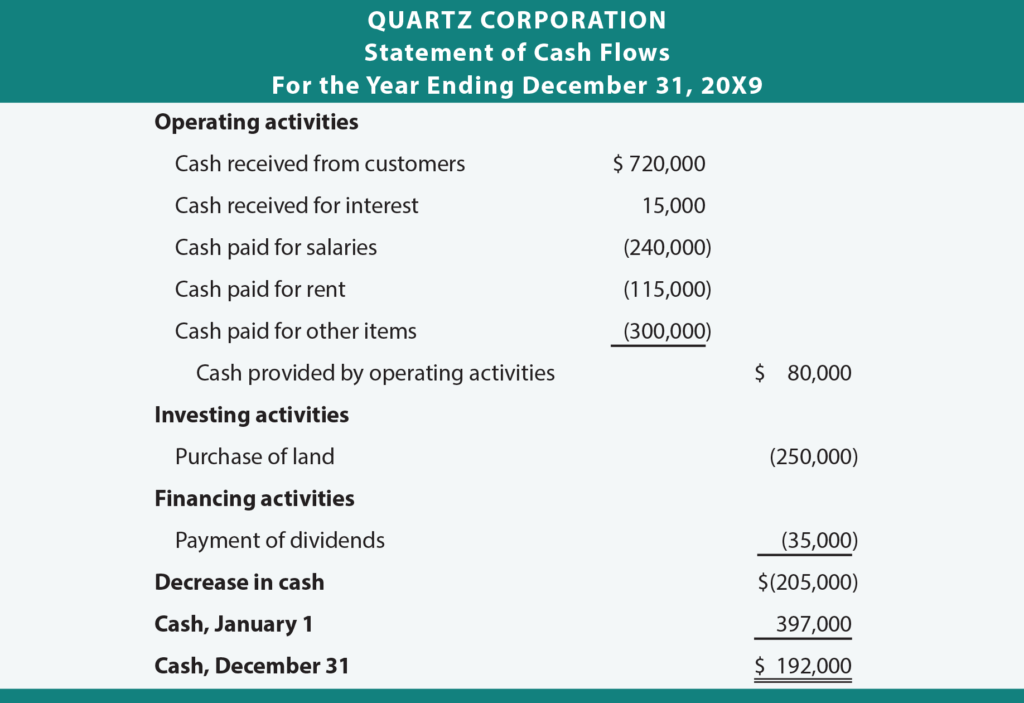

Since meow bots has $95,000 in retained earnings to date, herbert should hold off on hiring more than. Financial analysis cont… today’s session is emphasizing on ‘statement of change in equity & statement of cash flows’. Know your financials inside and out!

The retained earnings balance at the end of the previous reporting period is carried over as the balance at the beginning of the current reporting period. It is useful for understanding how management utilizes the profits generated by a business. The first line displays the company's name, and the second line gives the date of your statement.

Retained earnings represent the portion of the net income of your company that remains after dividends have been paid to your shareholders. For example, a constant increase in retained earnings may indicate the. To prepare your statement, you first can create a heading with two lines.

The retained earnings account on the balance sheet would be referenced as follows: Learn the components and complexities of the statement of retained earnings in this post, optimized for google and statement retained earnings. What is the statement of retained earnings?

By comparing retained earnings balances over time, investors can better predict future dividend payments and improvements to share price. If you are calculating your re for the company’s first year, your starting period re would be 0. The purpose of retaining these earnings can be varied and includes buying new equipment and machines, spending on research and development, or other activities that.

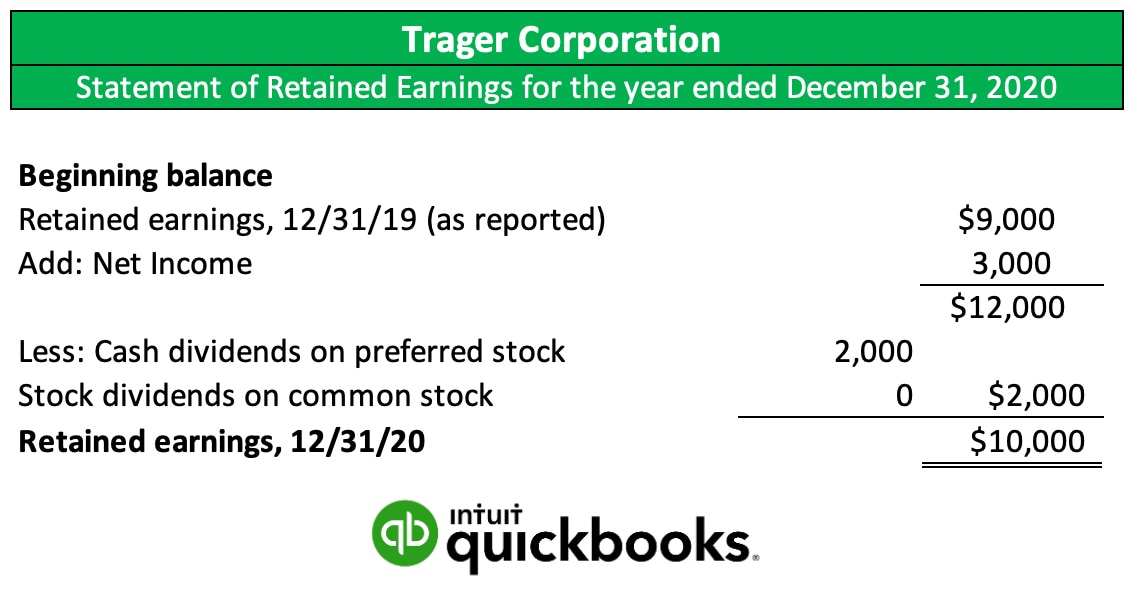

According to the provisions in the loan agreement, retained earnings available for dividends are limited to $20,000. The statement of retained earnings reconciles changes in the retained earnings account during a reporting period. A statement of retained earnings is a financial statement that shows the changes in a company’s retained earnings balance over a specific accounting period.

A statement of retained earnings details the changes in a company's retained earnings balance over a specific period, usually a year. The statement of retained earnings is a financial statement that is prepared to reconcile the beginning and ending retained earnings balances. The statement of retained earnings informs stakeholders about how a corporation manages its profits.

The date is often the end of the financial period, and. A retained earnings statement is one concrete way to determine if they’re getting their return on investment. Retained earnings are the profits or net income that a company chooses to keep rather than distribute it to the shareholders.