Spectacular Tips About Calculate The Current Ratio For Each Year

You will have:

Calculate the current ratio for each year. Take the first year that you have any financial figures for. Use the current ratio calculator to calculate current ratio, historical financial ratios and year on year ratio changes. High yield cd and mma rates.

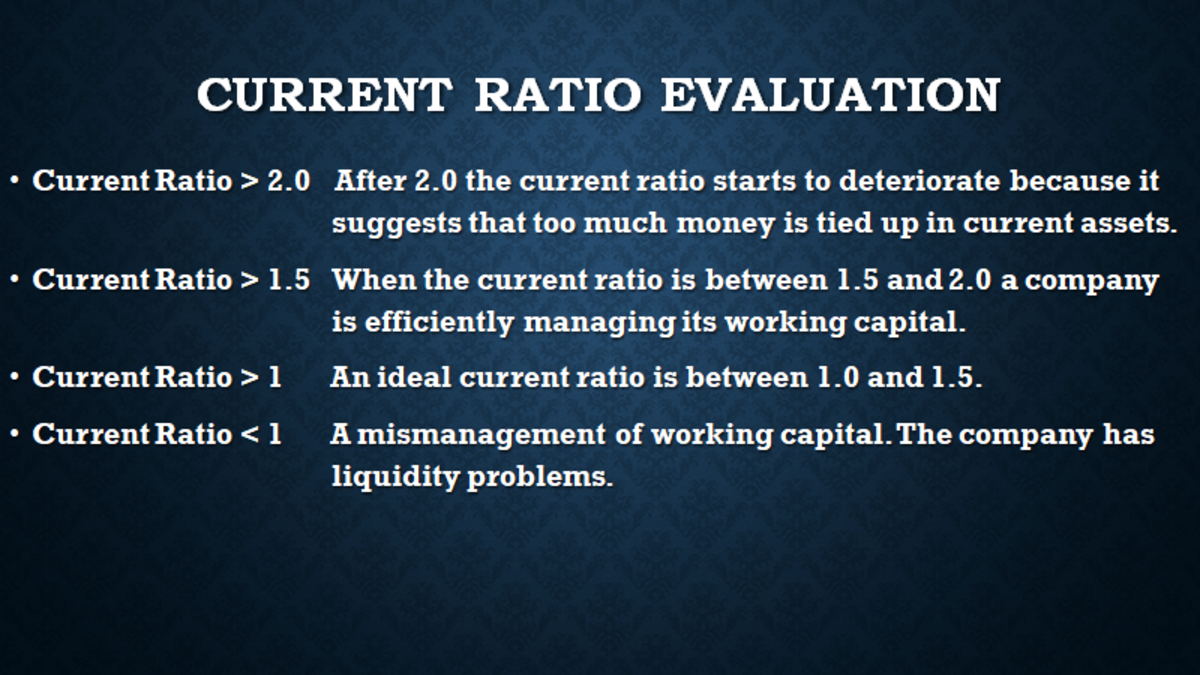

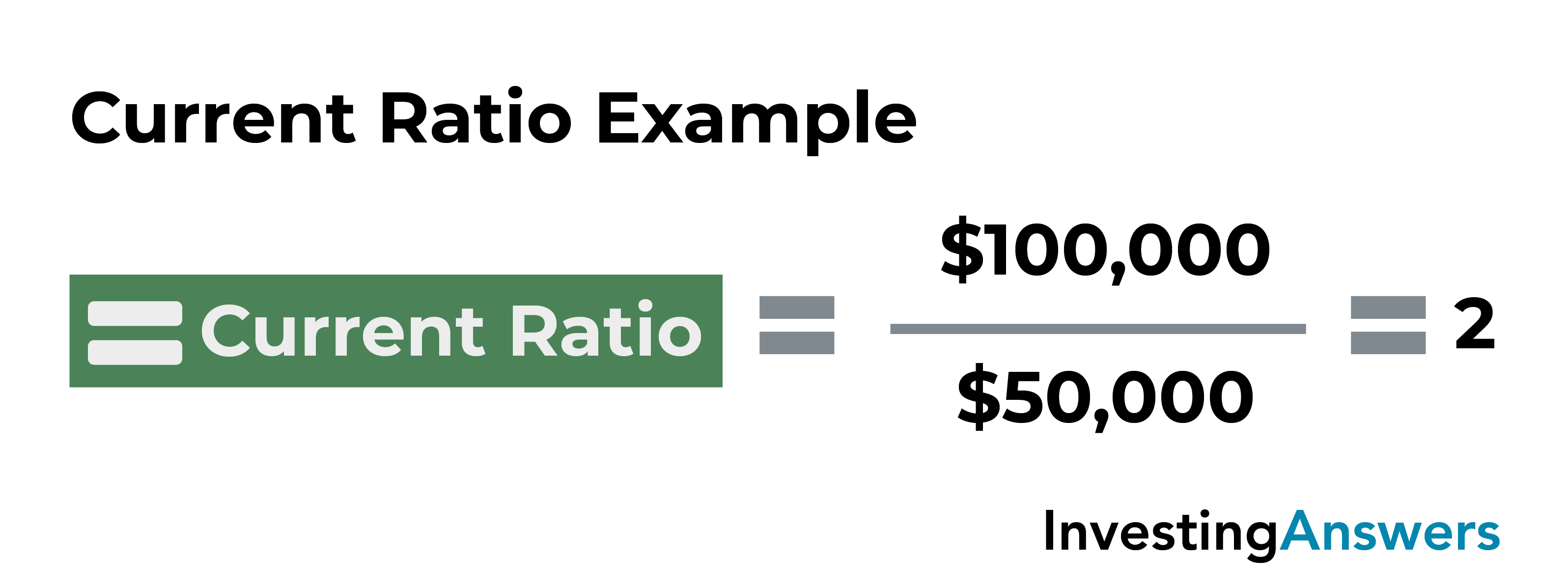

Calculate the quick ratio for each year. A current ratio of 1:1 or greater is generally considered good, as it indicates that a company has. A company with a current ratio of less than one doesn’t have enough current assets to cover its current financial obligations.

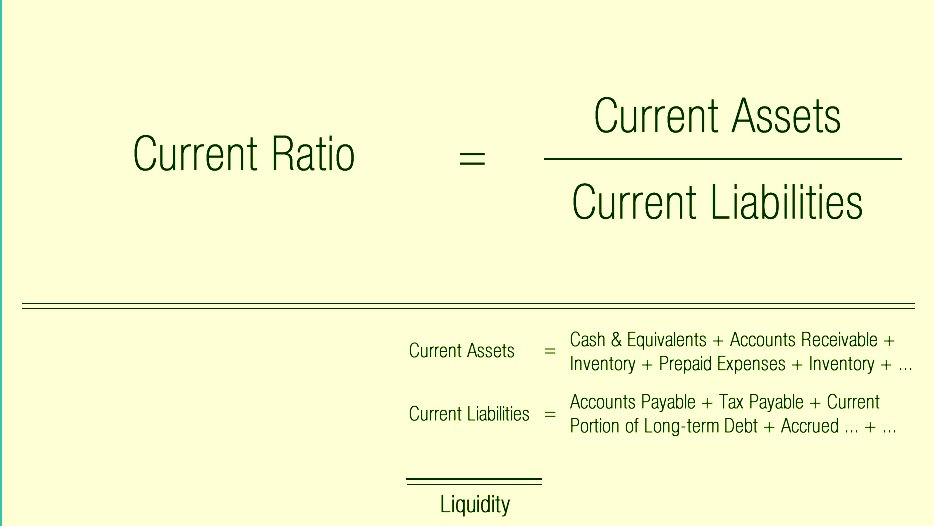

Acceptable current ratios depend on industry averages, and a low current ratio can cause liquidity problems. The current ratio, which is also called the working capital ratio, compares the assets a company can convert into cash within a year with the liabilities it must pay off within a year. Accounting accounting questions and answers 1.

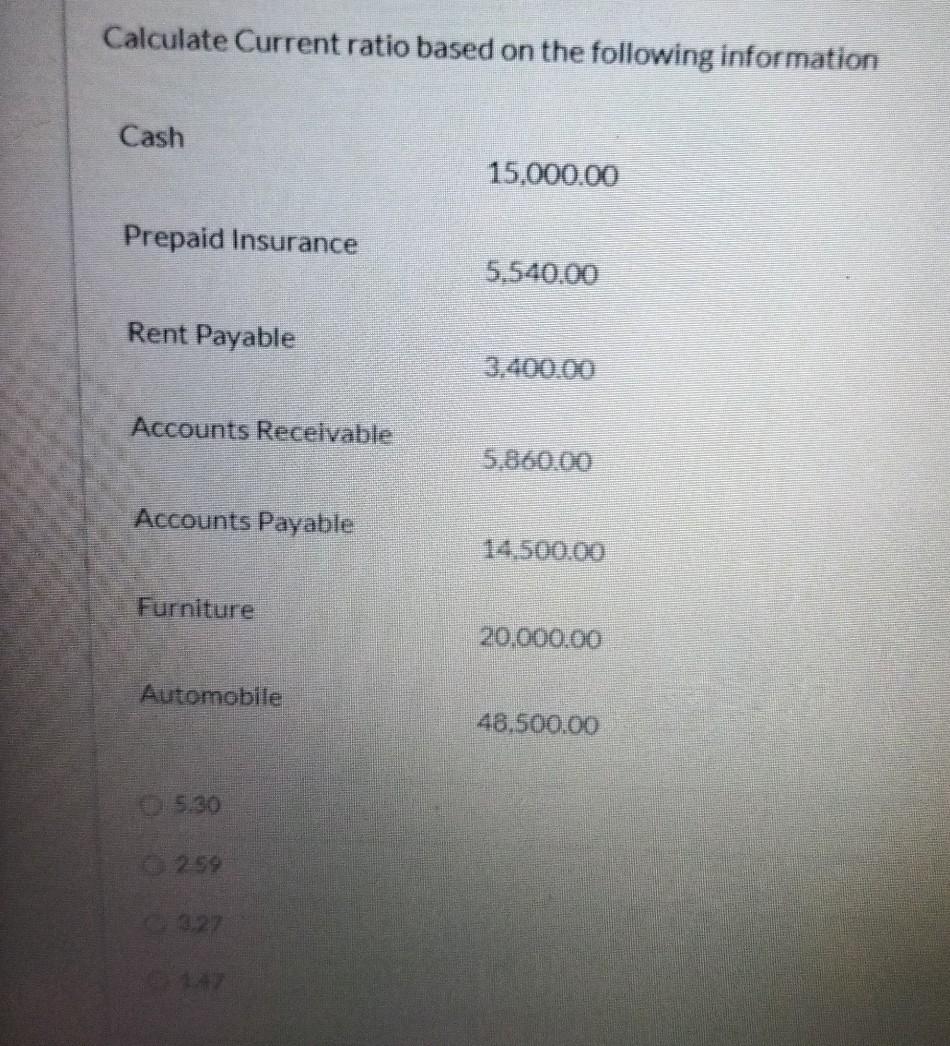

Working of current ratio calculator: (round your answers to 2 decimal places.) current ratio edison maxt chatter tru gleeson current current assets llabilities $ 84,000 $ 31,818 111,720 76,663 47,376 49,166 90,972 82,636 64,596 101,108 2. When you calculate a company's current ratio, the resulting number determines whether it's a good investment.

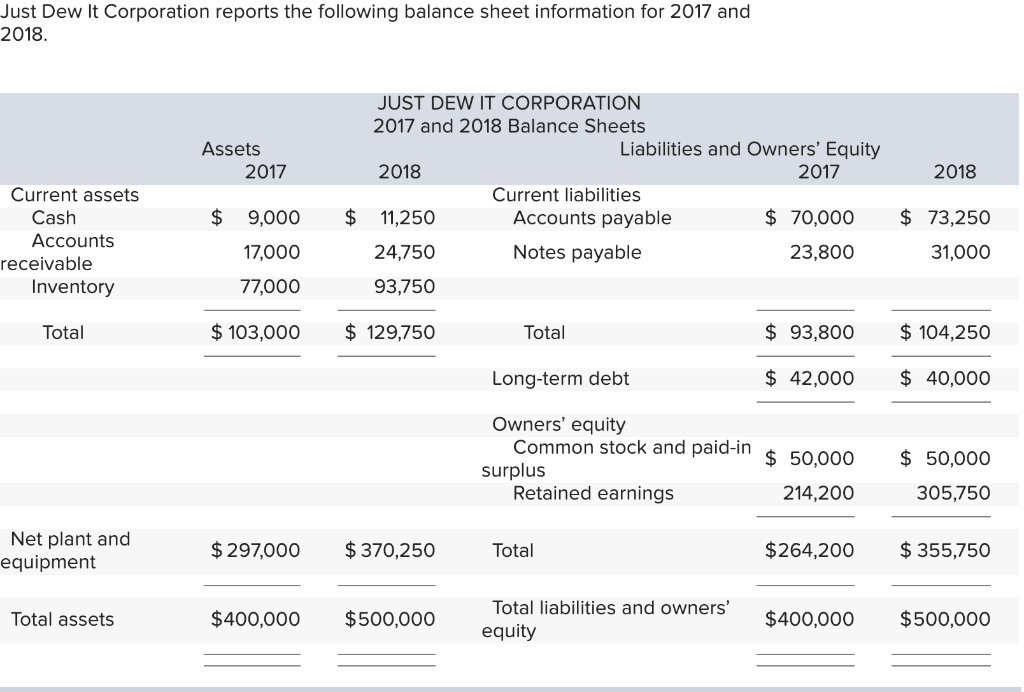

Add both the financial data for your assets as well as your liabilities for each year, entering your latest results at. From year 1 to year 4, the current ratio increases from 1.0x to 1.5x. Calculate the current ratio for each of the following competing companies.

Accounting questions and answers. Enter asset and liability value the current ratio calculator will calculate as you type a year on year ratio trend graph will build as you type how do i calculate the current ratio? Based on the balance sheets given tor just dew it:

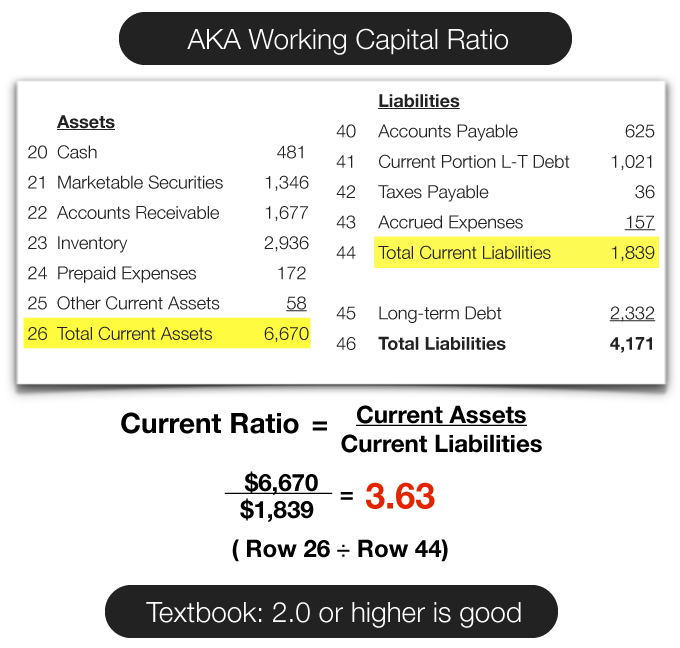

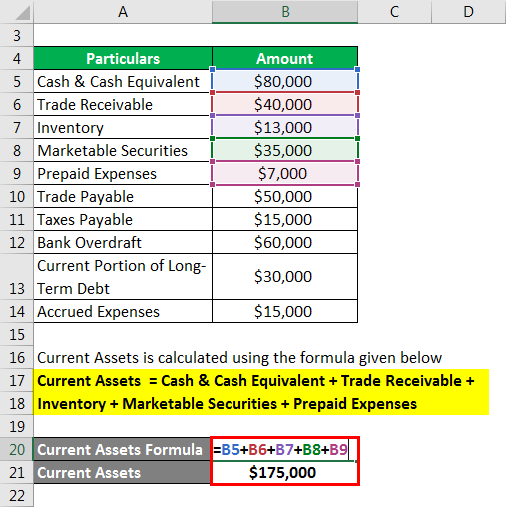

By dividing the current assets balance of the company by the current liabilities balance in the coinciding period, we can determine the current ratio for each year. (do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. In the balance sheet prepared in accordance with the ifrs ( international financial reporting standards ), in the part.

Again, current assets are resources that. The current ratio is calculated using the formula shown below. 5/1 arm (io) 30 year jumbo.

Walmart, inc., as of its fiscal year ending january 31, 2023. The current ratio is $140,000 divided by $50,000, or 2.8, meaning that outfield has $2.80 in current assets for every $1 of current liabilities. That means that the current ratio for your business would be 0.68.

Calculate your current ratio with bankrate's calculator. If current asset or current liability balances change, so too will the company’s current. The current ratio is calculated by dividing current assets by current liabilities.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)