Great Info About Differentiate Between Cash Flow Statement And Fund

Cash flow statements are primarily.

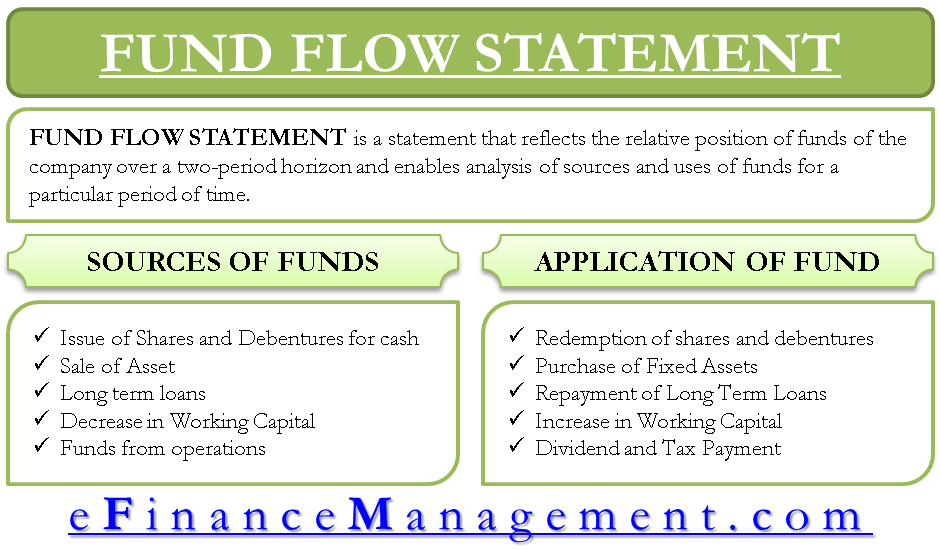

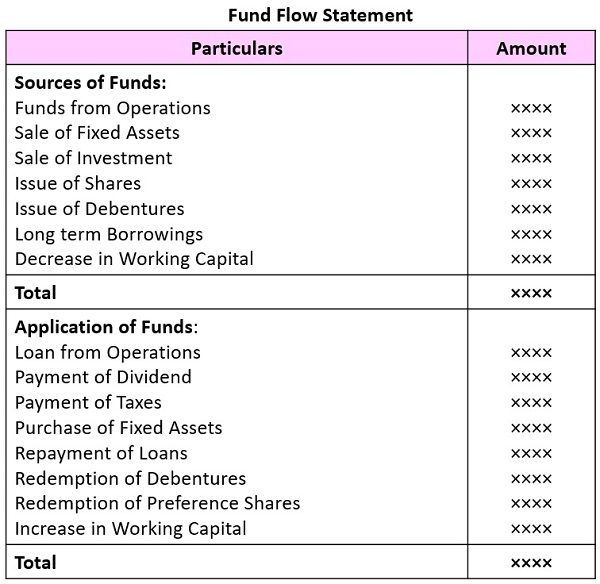

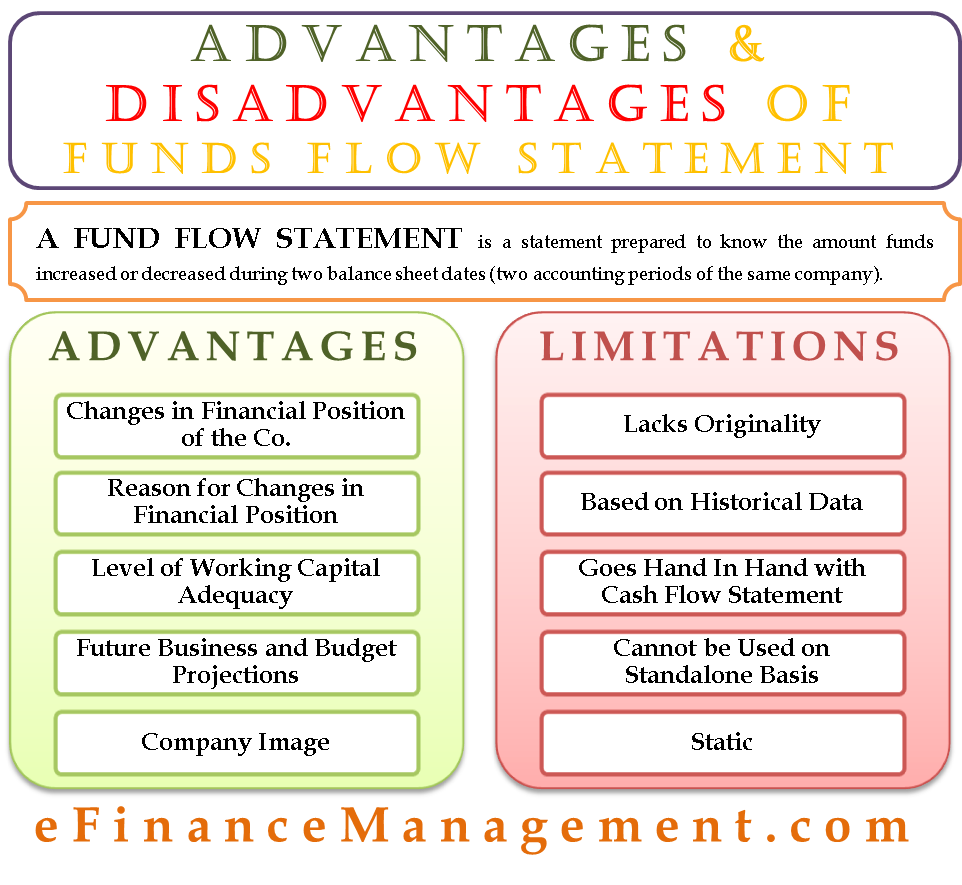

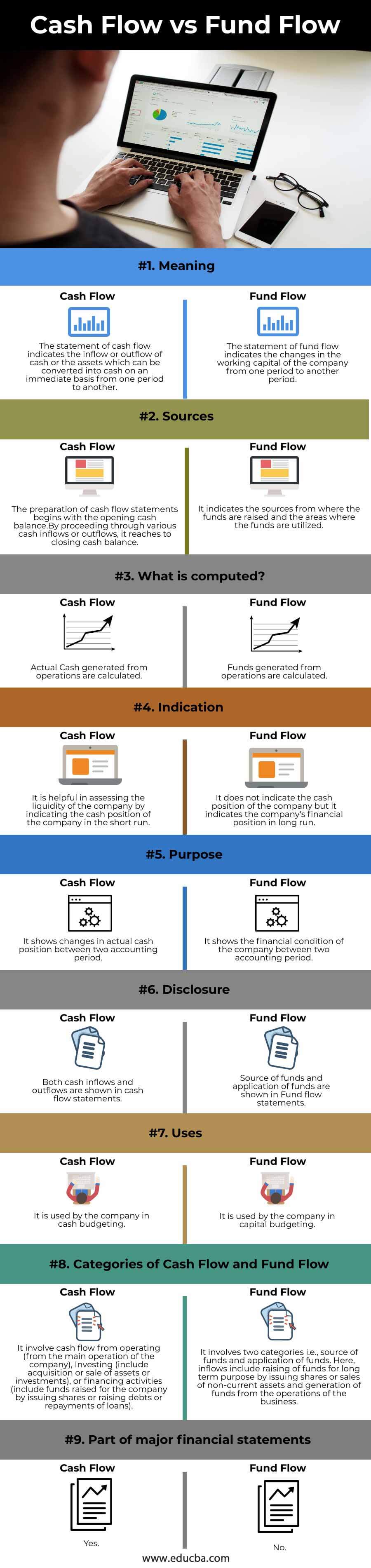

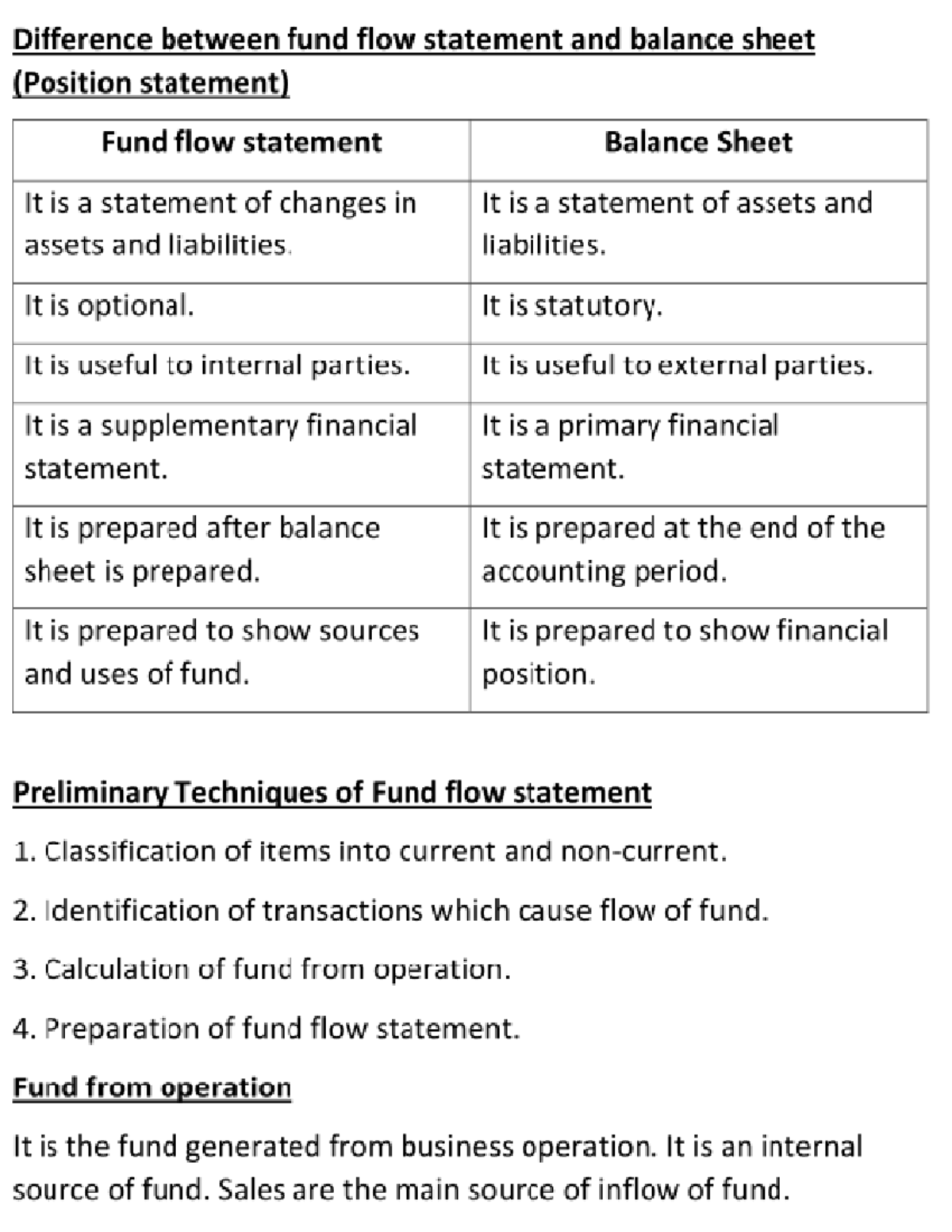

Differentiate between cash flow statement and fund flow statement. A fund flow statement is prepared to see the sources and uses of funds during a particular period and how that “change in the funds” affects the company’s working capital. Definition of cash flow and funds flow statements. On the other hand, a fund is a broader term that consists of the total financial resources available and is referred to as the working capital of a business.

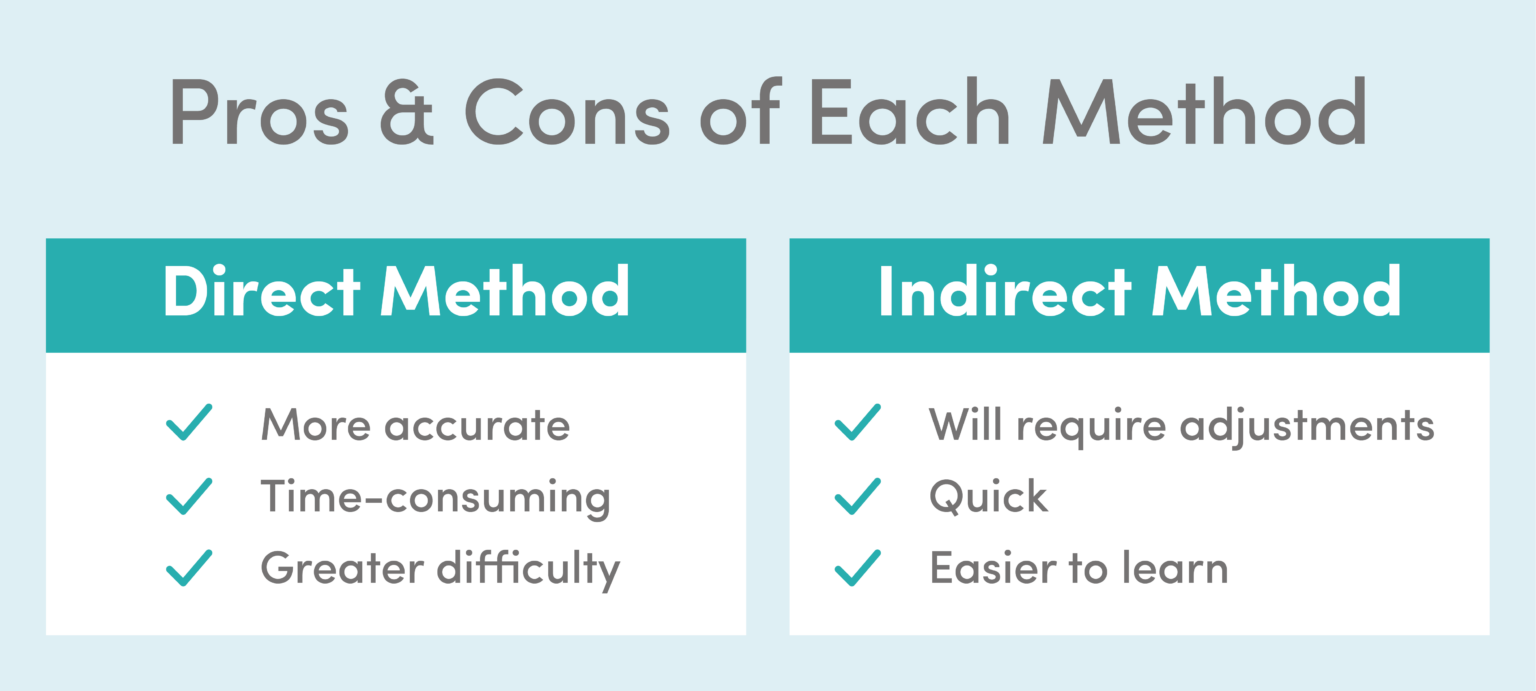

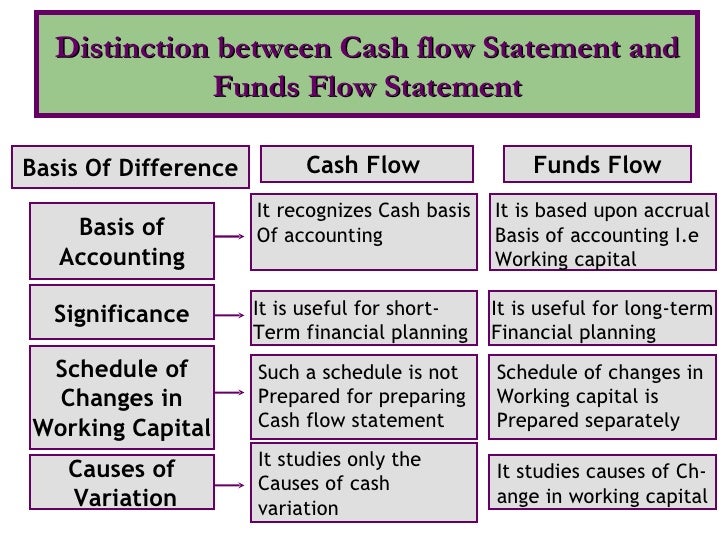

The difference between cash flow and fund flow is that the former is more concrete and current while the latter is more abstract and doesn’t only deal with recent data. The cash which flows in and out of a business, in a certain period of time. On the other hand, the fund flow statement is created by following the accrual basis of accounting.

The period of time can be monthly, quarterly or as required by the business. Both help provide investors and the market with a periodic picture of the company’s performance. The role of a financial analyst is indisputable in such matters.

A funds flow statement can be divided into two segments. Corporate finance accounting cash flow vs. A fund flow statement analyzes the financial position of a company by the inflow and outflow of funds.

Though both of them are closely related, their purposes are entirely different. Businesses account for the changes in the cash and. The fund flow statement and its new importance fund flow statement format simplified fluctuations in working capital earnings.

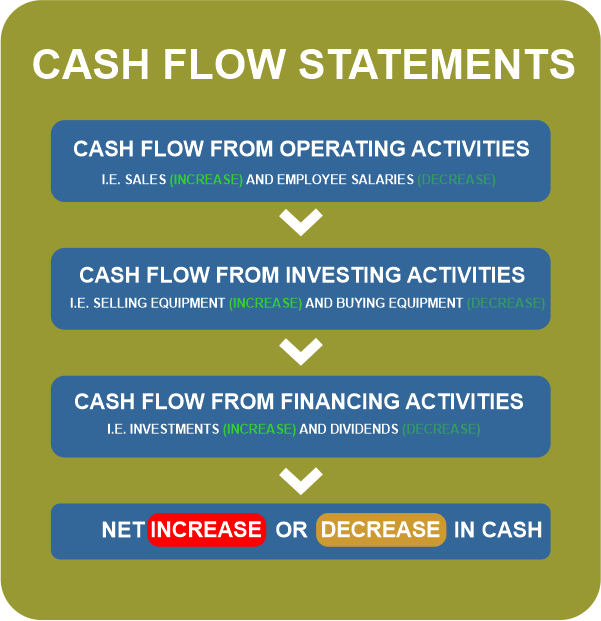

Thus, the difference between cash flow and fund flow highlights the conceptual limit of cash and a broader inclusion for funds. In conclusion, the main difference between the cash flow statement and the fund flow. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

The cfs measures how well a company. Both of these statements are vital tools for assessing a company's financial health. As funds flow statement shows the change in working capital it deals with all the components of.

Inflows and outflows of cash. By sean ross updated may 18, 2021 reviewed by andy smith cash flow vs. Cash flow refers to the outflow and inflow of cash or cash equivalents in an organization in a specific period.

Imarticus september 6, 2023 financial statements are necessary paradormirmejor.org for companies to keep track of their company’s economic health. The cash flow statement is created by following a cash basis of accounting. Cash flow is derived from the statement of cash flows.

Cash flow fund flow; Cash flow and fund flow are two completely different statements that are required for running a business and analyzing its shortcomings. Fund flow refers to the concept of financial changes in working capital over a period of time.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)