Fine Beautiful Info About Direct Cash Flow Forecasting

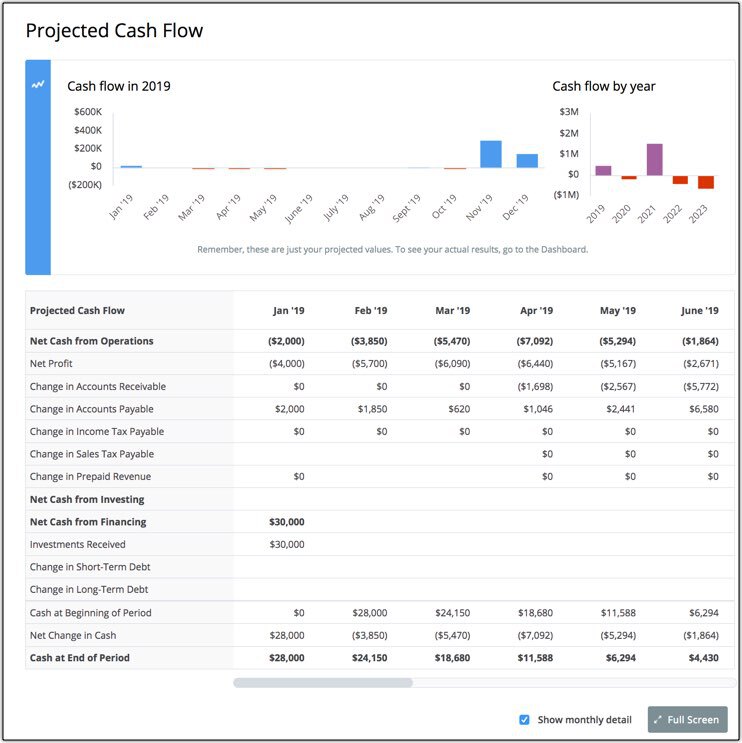

Cash flow forecasting is a financial management practice that involves estimating the future cash inflows and outflows of a business over a specified period.

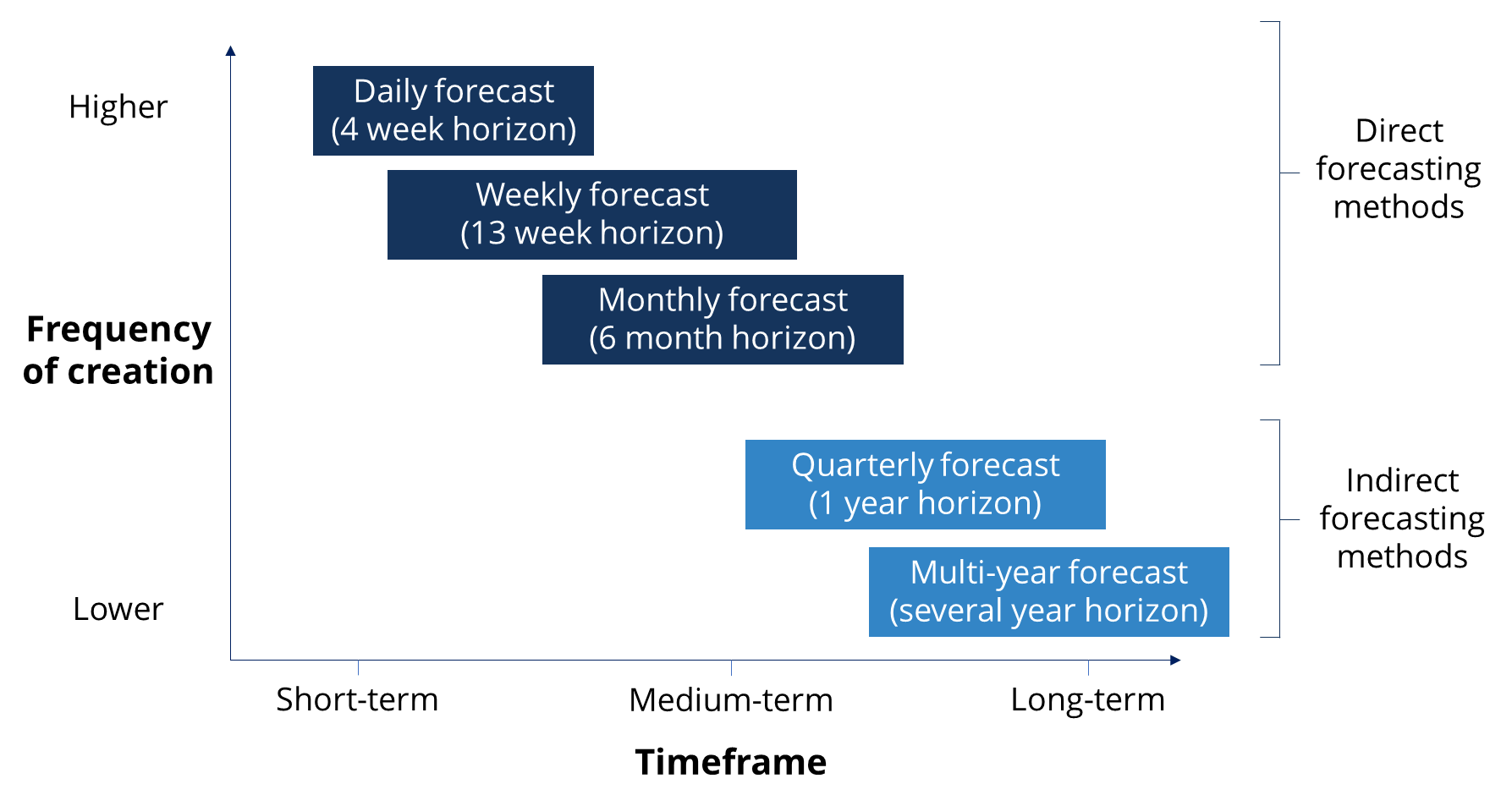

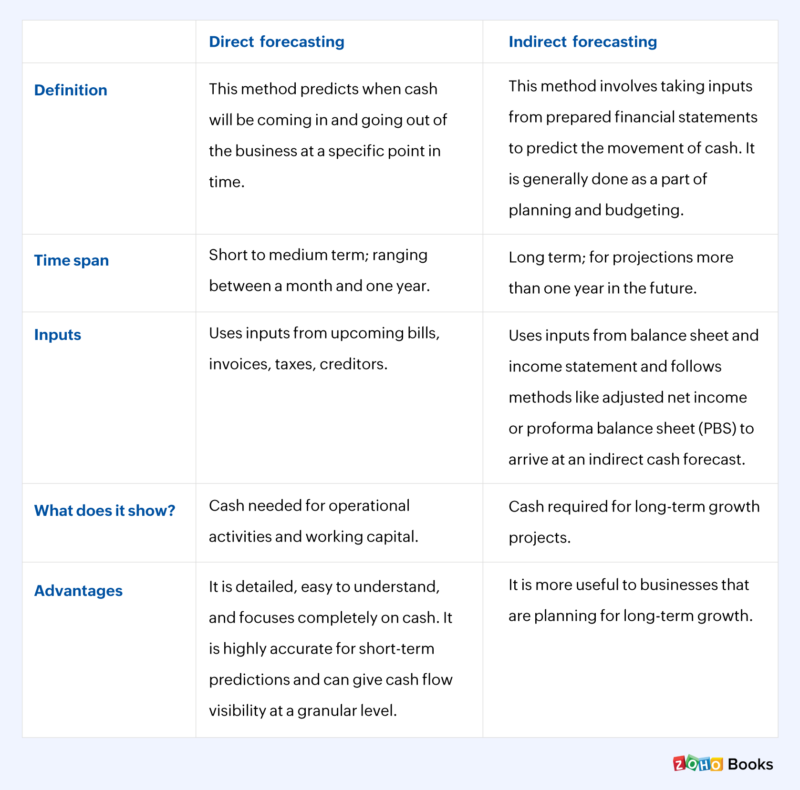

Direct cash flow forecasting. It relies on counting up all your expected. There are two different methods of cash flow forecasting: Direct cash flow forecasting method during your accounting period, and this can be set within cash flow frog using multiple perspectives, the direct method will.

The direct method of forecasting cash flow relies on this simple overall formula: Cash flow forecasting shows you if your business has enough cash to run normal operations and/or expand business by estimating the cash effect and timing of your. According to gill, direct cash flow forecasting offers two invaluable advantages.

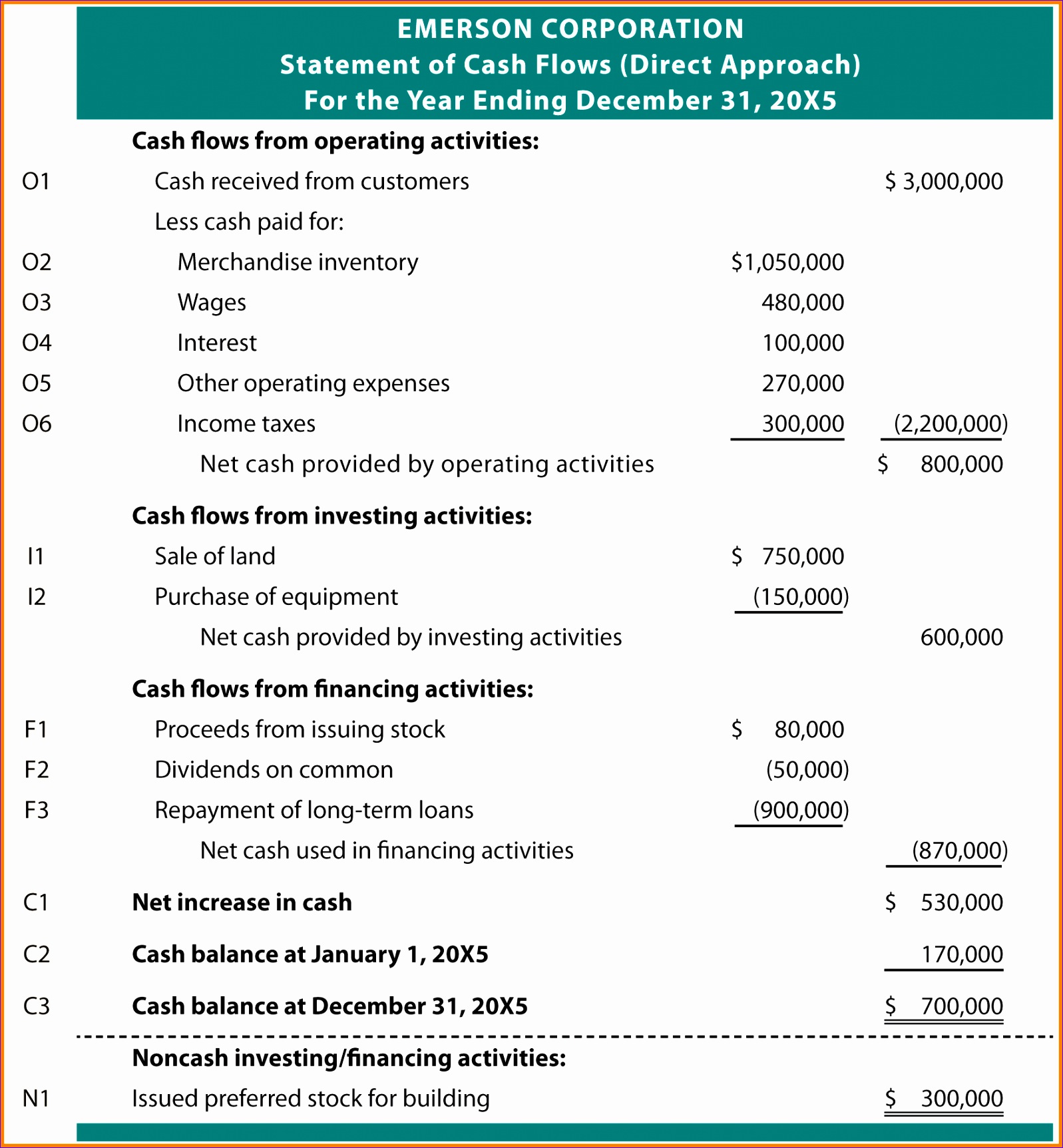

The first step in our cash flow forecast is to forecast cash flows from operating activities, which can be derived from the balance sheet and the income statement. Direct method cash flow forecasting: First, it instills greater confidence in the accuracy of cash forecasts.

Our results clearly indicate that, at least for cash flow forecasting, the direct method cash flow statements provide information that is more useful to investors,. The direct method, which deals with known income and. Cash flow forecasting is useful for more mundane applications.

This method involves forecasting cash inflows and outflows by directly estimating the amounts that will be received or. Cash flow forecasting is the process of predicting what the financial situation of your company will be in the future. How to create a direct cash forecast written by keegan chamberlin march 21, 2022 if you’ve never created a cash flow forecast, or are just looking for.

Many organizations have also expanded their cash flow forecasting process to include the direct method to provide enhanced insight over the more commonly used.