Recommendation Info About The Profit And Loss Account Is Also Called

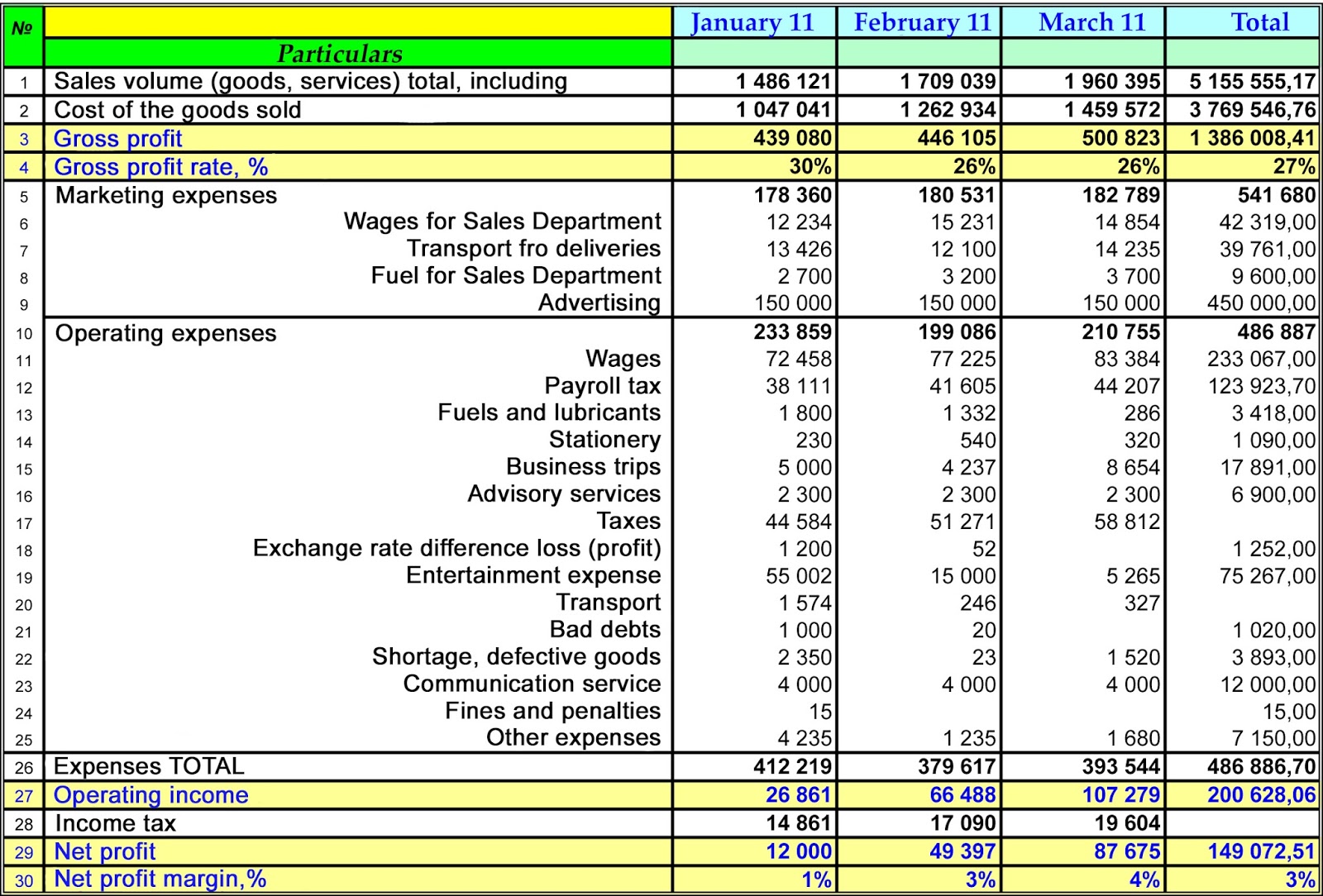

Timing trading account is prepared first and then profit and loss account is.

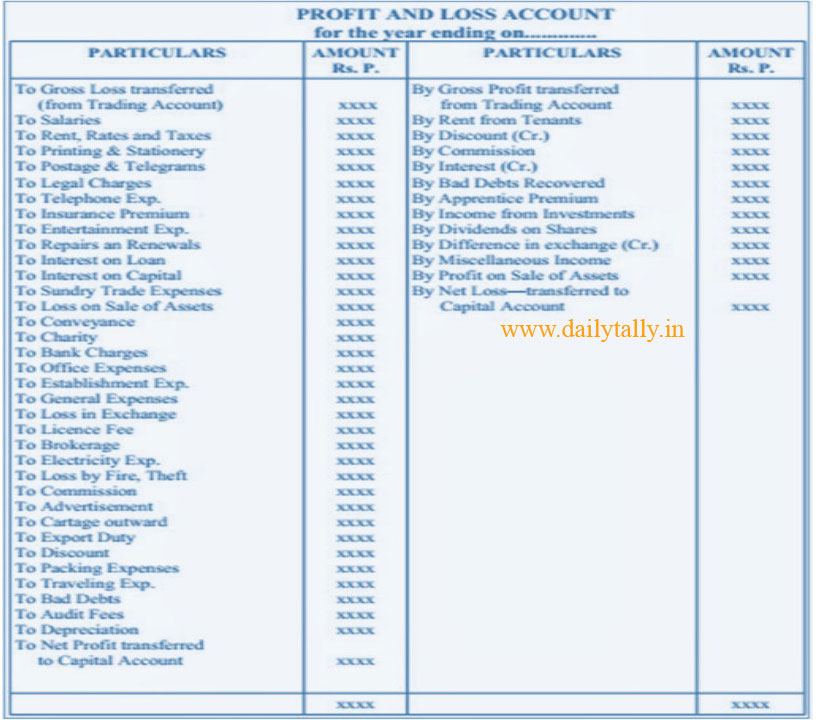

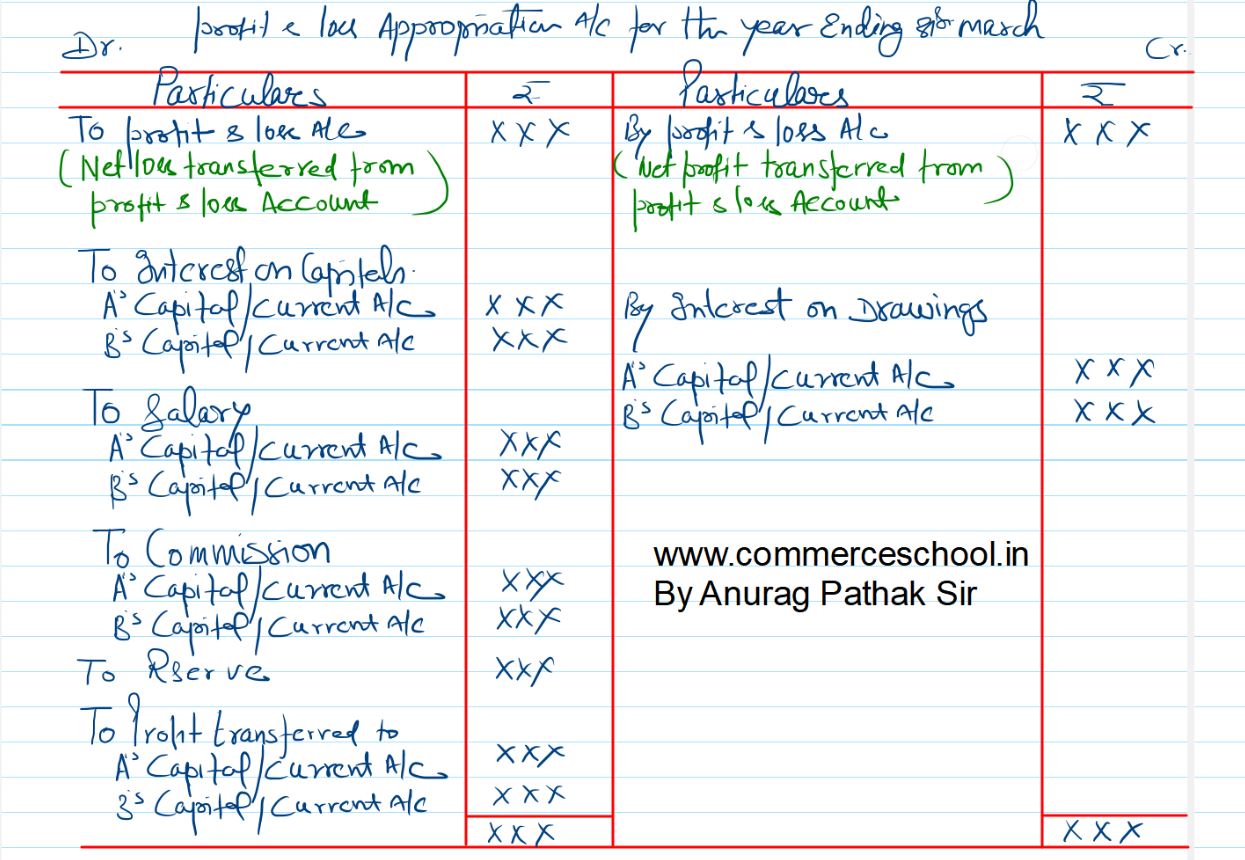

The profit and loss account is also called. A profit and loss account starts with the trading account and then takes into account all the other. The p&l account is a component of final accounts. The purpose of the profit and loss account is to:

On that basic level, profit and loss is derived from taking your costs away from your sales. A profit and loss statement, formally known as an income statement or simply as a p&l, tracks the amount of profit that remains after a business subtracts all of its costs from its revenue during a specific accounting period,. A profit and loss account is a financial statement showing a business's income, expenses, and net profit for a certain period.

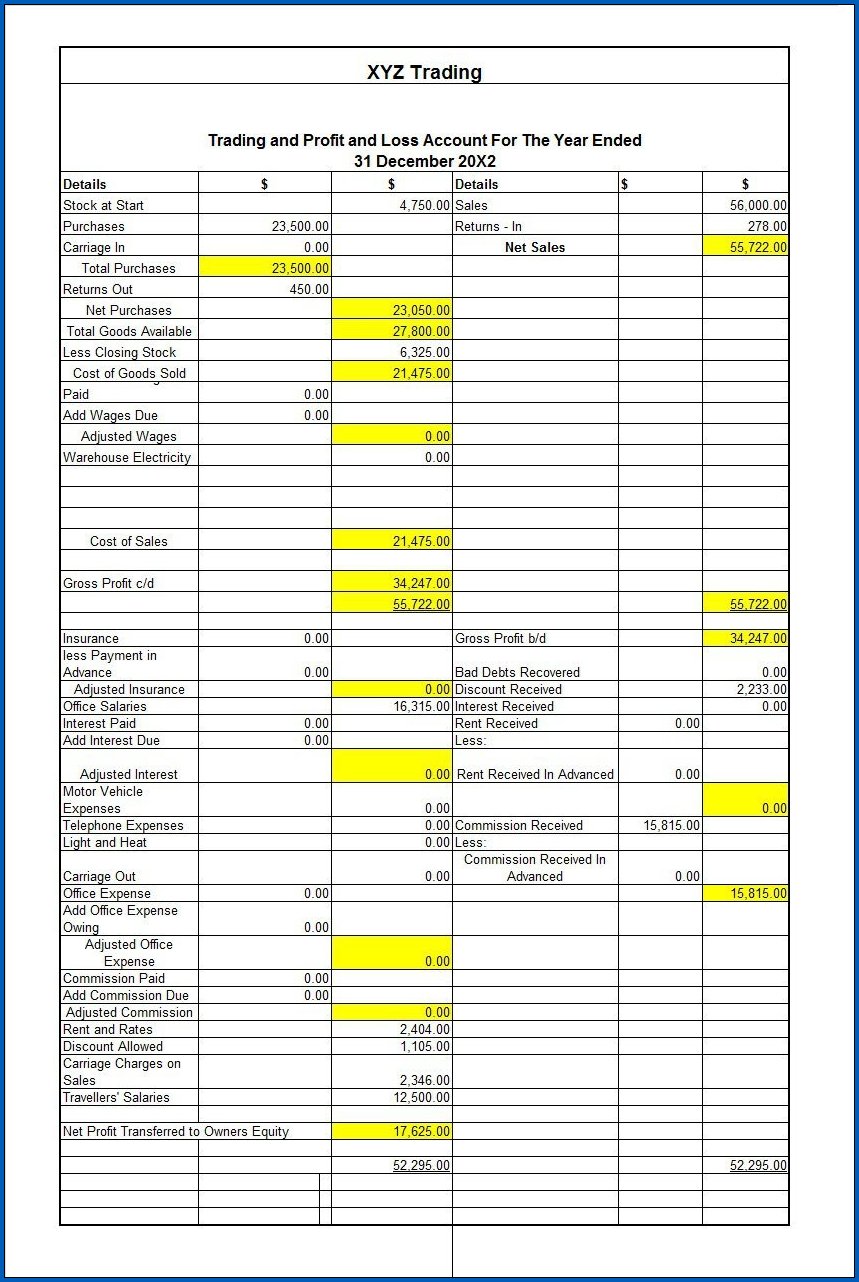

The income statement is one of three financial statements prepared by a company to report its financial performance. This account, also called the results account is a synthetic accounting document that measures company activity during a period of time. It is also called the profit and loss statement.

What is profit & loss statement? A profit and loss account is also known as the p&l statement, income statement, trading statement, or statement of financial performance. What is cash flow statement show a company's stability?

Trading account used to find the gross profit/loss of the business for an accounting period: A profit and loss (p&l) account shows the annual net profit or net loss of a business. Combined with the balance sheet and cash flow statement, the income statement assists you in understanding the financial health of your company.

Profit and loss accounting generates a profit and loss statement, also referred to as an income statement income statementthe income statement is one of the company's financial reports that summarizes all of the company's revenues and expenses over time in order to determine the company's profit or loss and measure its business activity over tim. What does a profit and loss account include? A profit and loss statement is also called an income statement, a statement of profit, or a profit and loss report.creating one is a.

In other words, the statement shows the profitable of a company for a time period. A profit and loss account will include your credits (which includes turnover and other income) and deduct your debits. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

The trading and profit and loss account is also called 1. The top section of the profit and loss account, up to and including the gross profit, is referred to as the trading account. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year.

A profit and loss statement is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year.it captures how money flows in and out of your business. Profit & loss account is also known as p&l a/c, profit & loss statement, income statement or income and expense statement. Therefore, b is the correct option.

Gross profit is a company's profits earned after subtracting the costs of producing and selling its products—called the cost of goods sold (cogs). Start networking and exchanging professional insights next question: It is prepared to determine the net profit or net loss of a trader.