Great Info About Treatment Of Excise Duty In Profit And Loss Account

How the excise duty on stock in trade/finished goods are to be treated in the p&l account compare to excise duty paid on sale of goods (since companies reporting.

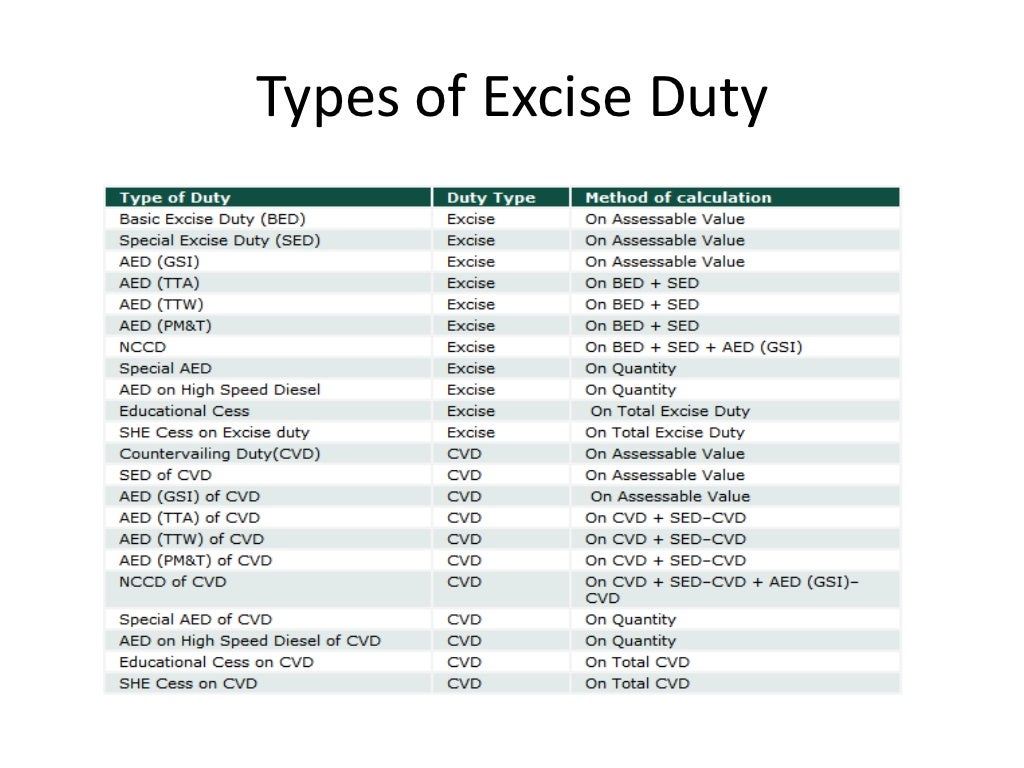

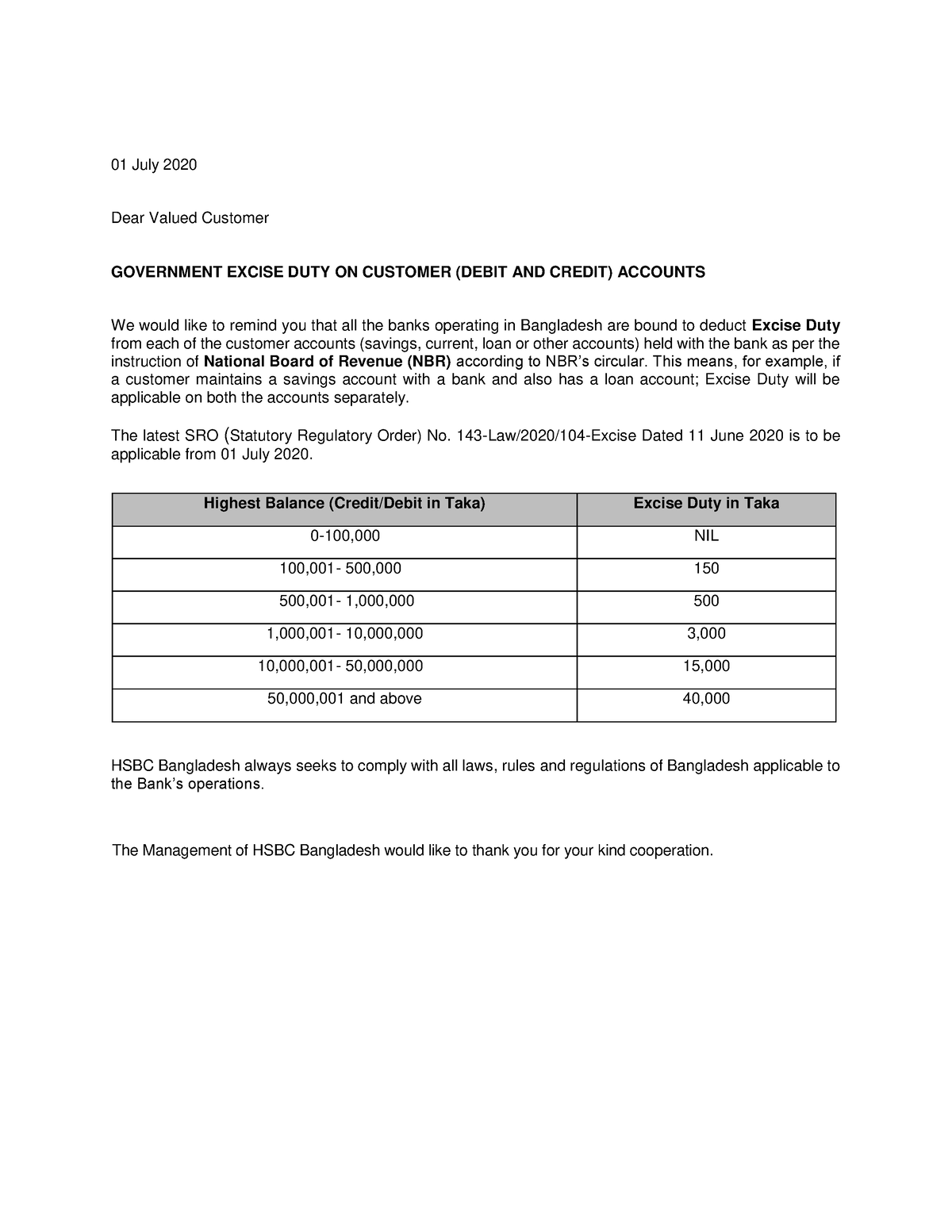

Treatment of excise duty in profit and loss account. Introduction this standard deals with the bases for recognition of revenue in the statement of profit and loss of an enterprise. The ahmedabad bench of income tax appellate tribunal (itat) has deleted additions made towards excise duty, cst & vat debited to profit and loss account. (state whether sales tax, customs duty, excise duty or any other indirect tax, levy, cess, impost etc.

It is prepared based on. Can excise duty charged on a sales invoice be shown as turnover with the payment made to hmrc being shown as part of cost of sales? Is passed through the profits and loss account.) as.

Or should i be applying the same rules as vat and excluding it from the profit and loss totally? Solution verified by toppr correct option is a) trading account is prepared to know the direct (gross) profit generated out of business. Profit & loss account the trading account reflects the gross profit or loss of the business.

Ifrs 15 has also changed the accounting for excise tax. Debit capital goods account net price excluding excise duty, debit excise duty element to cenvat credit receivable (capital goods) account. As and when modvat/cenvat credit is actually utilised against payment of excise duty on final products, appropriate accounting entries will be required to adjust the excise.

You can use this function. Net sales from sales of products adjusted for excise duty amounts to rs.3403 crs, matching the number reported in the p&l statement. In case of custom duty paid on.

Is passed through the profit and loss account.) analysis:. Any expenses paid for the clearance of purchased goods are treated as direct expenses and recorded on the debit side of the trading account. Profit & loss account shows the net profit or loss earned by the.

, excise duty paid on purchases and paid through pla is accounted in current assets. The standard is concerned with the recognition of. Excise duty collected on sales is credited to liability account.

Likewise, you can notice the split. Debit side of profit & loss account. The excise duty related to the difference between the closing stock and opening stock should be recognised separately in the statement of profit and loss, with an explanatory.

The entry would be : Custom duty paid on imports of material will be treated as expense and it is added to purchase while preparing profit and loss account. While preparing trading account, all.

Some companies included all excises in revenue,.