Outrageous Info About Form 26as In Income Tax

On 9 th september 2021, cbdt has announced enhancing the timelines for some compliance.

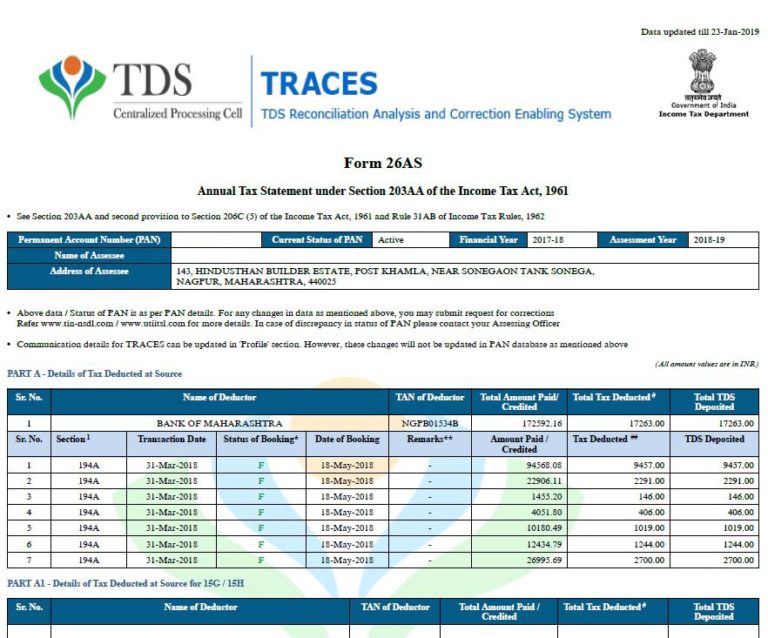

Form 26as in income tax. Displays details of tax which has been deducted at source (tds) by each person (deductor) who made a specified kind of payment to you. The tax credit statement, also known as form 26as, is an annual statement that consolidates information about tax deducted at source (tds), advance tax paid by. A lot of information related to your.

It includes details of income tax deducted at source (),. It is available for all taxpayers. Read the disclaimer, click 'confirm' and the user.

How to get form26as form 26as can be. The website provides access to the. Upon being redirected, the individual needs to click on the “view tax credit (form 26as)” link.

Form 26as provides the taxpayer with the relevant tax related information such as details of tds and tcs, details of taxes paid in the form of advance tax and. Income tax return filing 2024: The form 26as (annual tax statement) is divided into three parts, namely;

Part a, b and c as under: Form 26as is an important tax filing as it is tax credit statement. Complete guide to viewing and downloading form 26as for income tax filing taxconcept.net

Income tax form 26as is a vital document in the realm of income tax filing. Form 26as is an annual declaration that shows the amount of tax levied against a taxpayer. Tax deducted on income:

Form26as is an important tax document in india, that every tax payer need to refer at the time of income tax filing, broadly contains the taxes that are paid on your. Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer. Form 26as is a consolidated statement from the income tax department that contains details of tax deductions and tax exemptions.

Income tax articles revised form 26as: Form 26as displays the amount of tax deducted at source (tds) from various sources of income, such as salary, interest, or dividends. For those who don't know, form 26as is an annual declaration that enables a user to check the amount of tax levied against them.

You are accessing traces from outside india and therefore, you will require a user id with password. Form 26as is a tax credit statement that provides a complete view of the taxes paid by a taxpayer. You can find information related to your.